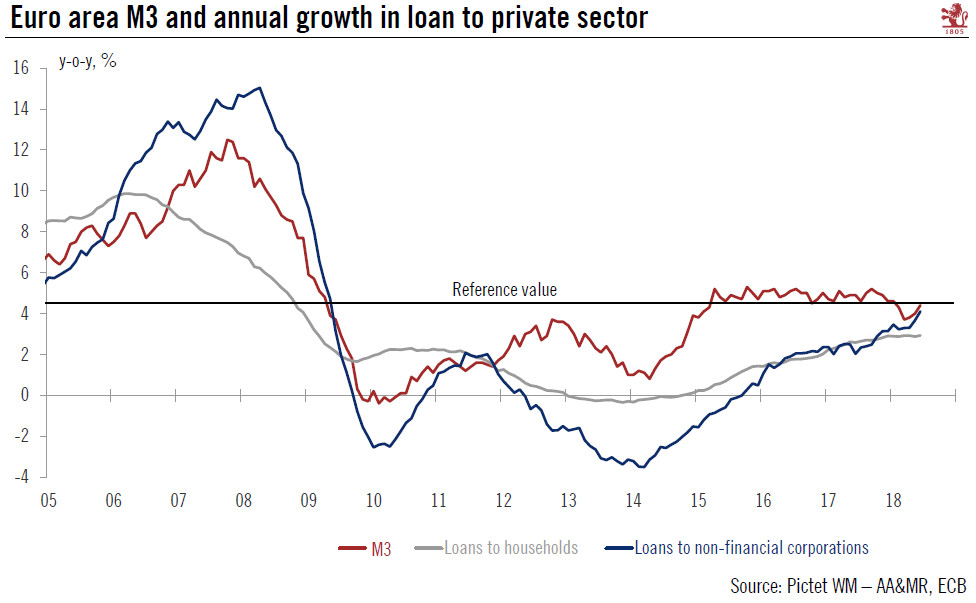

Rising bank credit flows confirm that domestic fundamentals remain solid across most of the euro area.The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May. Corporate-sector lending increased 4.1% year-over-year in June, its fastest rate since May 2009. On a country-by-country basis, flows were positive in Germany, France and Spain, but negative in Italy. Bank credit flows to euro area households rose strongly again in June, extending their upward trend. Forward-looking indicators suggest that credit growth should continue

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Rising bank credit flows confirm that domestic fundamentals remain solid across most of the euro area.

The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May. Corporate-sector lending increased 4.1% year-over-year in June, its fastest rate since May 2009. On a country-by-country basis, flows were positive in Germany, France and Spain, but negative in Italy. Bank credit flows to euro area households rose strongly again in June, extending their upward trend. Forward-looking indicators suggest that credit growth should continue over the coming months.

Separately, the ECB’s latest Bank Lending Survey showed further strong improvement in credit demand across most countries and sectors. Demand accelerated in Q2 and is expected to rise further in Q3. Low interest rates were again cited as one of the main factors driving higher demand for corporate credit and mortgages.

All in all, financial conditions remain supportive in the euro area and are not expected to tighten too much. In a context of increasing downside risks, the ECB is likely to remain cautious when it comes to policy normalisation and will try to avoid any unwarranted tightening in financial conditions in the coming months.