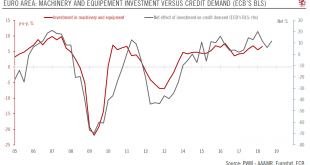

We are sticking to our forecast of 2.0% euro area GDP growth for 2018, but with risks tilted to the downside.Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for 48%, 32%, 18% and 2% of total investment. Machinery and equipment spending...

Read More »Rewarding excellence

IMD and Pictet join forces to celebrate and reward leading family enterprises.IMD Lausanne is a world-leading business school based in the Lausanne region. Its Global Family Business Centre, which has operated for more than 30 years, was the first institute to focus on family businesses, their values, the principles they champion and their particular characteristics.In October 2018, Pictet joined forces with IMD to the IMD Global Family Business Award, a prestigious annual prize presented to...

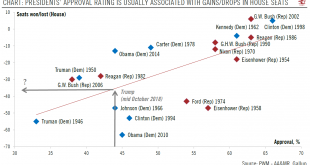

Read More »Republicans face uphill battle in retaining their House majority

But this may say little about Trump’s 2020 prospects.Most opinion polls suggest that the Democrats will win a majority in the House in the 6 November midterms, while the Republicans will retain their majority in the Senate.The historical relationship between the president’s approval rating and seats lost by his party in the midterms further corroborates the likelihood of a loss of House seats for the Republicans. The incumbent president’s party tends to face an erosion of seats, with a few...

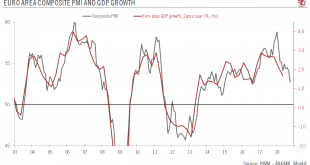

Read More »Gloomy signals for euro area manufacturing

Weakness in the sector signals continuing downward trend.The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in the car industry, but trade tensions, uncertainty over Brexit and...

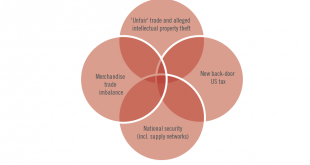

Read More »US-China Relations: A ‘politics bull trend’ creates a fertile ground for trade tensions

As the US vies to maintain world leadership beyond commerce, its policies will continue to create waves for markets.Today we are witnessing a redefinition of international relations and a new, although likely unstable, global equilibrium. The trade dispute unfolding today between the US and China should be seen in light of shifting structural trends that have developed over the last few decades. We expect rationality will eventually prevail, but the outlook is muddled by the Trump...

Read More »Emerging market currencies show encouraging signs for investors

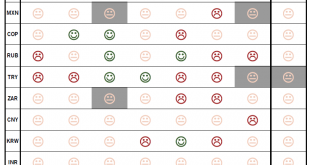

Up to now, emerging market (EM) currencies have been resilient in the face of market turmoil.Our EM FX scorecard, which ranks 10 EM currencies according to key criteria (such as growth and vulnerability to external shocks) saw few changes over the past month. The Fed’s current hawkish attitude remains a headwind for EM currencies, at it increases funding costs. That being said, the weakest EM currencies have seen some stabilisation, particularly for the Turkish lira and the Argentinian peso....

Read More »Weekly View – Moody’s to the rescue

The CIO office’s view of the week ahead.Italian bond prices regained some ground after Moody’s cut Italy’s credit rating by one notch on Friday, keeping it within investment grade, while upgrading its outlook from negative to stable. Investors welcomed this as positive news while they anticipate Italy’s response to Brussels’ criticism of its proposed 2019 budget due later today. This could prove an eventful week for peripheral bonds driven by news around Italy, with rating agency S&P...

Read More »In conversation with Claus Kjeldsen

[embedded content] Consumers have today what Claus Kjeldsen, CEO of the Copenhagen Institute for Future Studies (Cifs), calls a “liquid identity.” This means trying to classify consumers by age and gender is no longer effective, and so Cifs studies future trends and scenarios through the lens of social and behavioural science, economics and technology. At the fifth Entrepreneur Summit in Geneva, Claus discussed how so-called strategic adaptation can be applied to inform guests on...

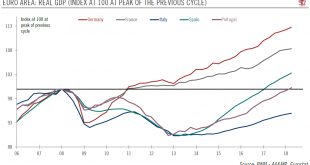

Read More »Portugal’s growth rate surpasses pre-crisis level

September growth and unemployment rates show how far it has come.In two decades, Portugal has gone through a boom (1996-2001), a slump (2002-2007), a deep recession (2008-2013), a timid recovery (2014-2016) and now a robust economic expansion. In 2017, real GDP grew by 2.8%, its fastest pace since 2000. This is even more remarkable when considering that the country exited its bailout programme only in mid-2014. Investment and robust exports were the main growth drivers in 2017.Starting in...

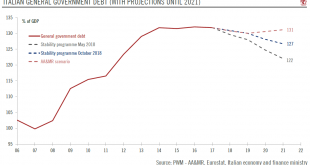

Read More »Bumpy road ahead for Italian budget

Rome’s budget plans put it on a collision course with the European Commission.The Italian government has submitted its 2019 draft budget plan (DBP) to the European Commission. The proposed DBP is not in line with European Union rules and sets the government on a collision course with the European authorities.Several elements within the Italian government’s budget plan have been raising eyebrows. First, the plans’ economic assumptions seem too optimistic to us, and there is a risk that the...

Read More » Perspectives Pictet

Perspectives Pictet