We expect core inflation to rise gradually later this year.The final reading for headline inflation in the euro area (HICP) was confirmed at 2.0% y-o-y in June (up from 1.9% in May), reflecting higher energy price inflation. This is the highest rate of inflation since February 2017.However, core inflation (HICP ex-energy, food, alcohol and tobacco) was revised down to 0.95% y-o-y, (rounded down to 0.9%) from a flash estimate of 0.97%. By comparison, core inflation in May was 1.13% y-o-y. The fall in core inflation was mainly due to distortions in service prices caused by the timing of Easter.That being said, we expect headline inflation to remain close to 2% for most of the rest of the year while we expect core inflation to hover around 1% before stronger base effects and a narrowing of

Topics:

Nadia Gharbi considers the following as important: euro area core inflation, Euro area inflation, Europe chart of the week, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

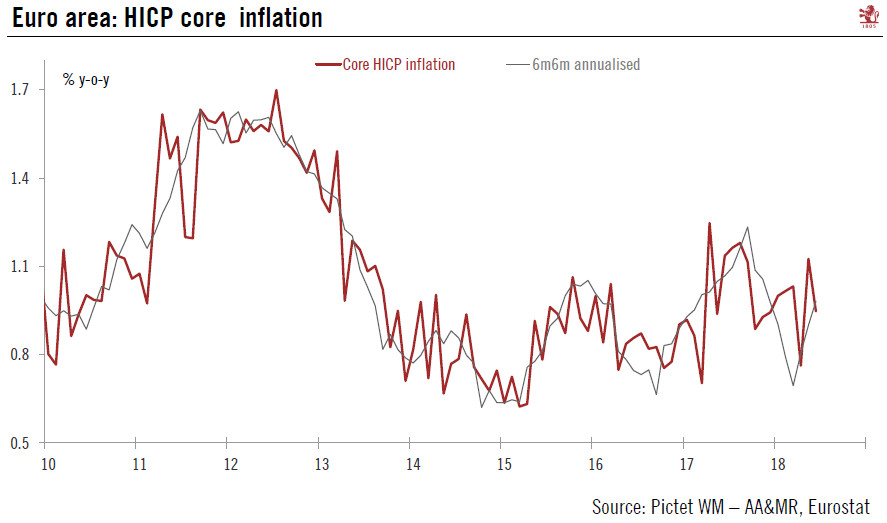

We expect core inflation to rise gradually later this year.

The final reading for headline inflation in the euro area (HICP) was confirmed at 2.0% y-o-y in June (up from 1.9% in May), reflecting higher energy price inflation. This is the highest rate of inflation since February 2017.

However, core inflation (HICP ex-energy, food, alcohol and tobacco) was revised down to 0.95% y-o-y, (rounded down to 0.9%) from a flash estimate of 0.97%. By comparison, core inflation in May was 1.13% y-o-y. The fall in core inflation was mainly due to distortions in service prices caused by the timing of Easter.

That being said, we expect headline inflation to remain close to 2% for most of the rest of the year while we expect core inflation to hover around 1% before stronger base effects and a narrowing of the output gap provide another push higher in Q4 2018, to around 1.3-1.4%.

The latest data on core inflation provide support for the ECB’s dovish line on interest rates. In June, the ECB strengthened its forward guidance by committing to maintaining policy rates at their present levels “at least through the summer of 2019” (effectively ruling out a rate hike in H1 2019). We do not expect any changes in interest rates or in the ECB’s enhanced forward guidance at its Governing Council meeting next week. A key focus of that meeting will be the ECB’s assessment of the economic outlook in light of global trade tensions.