Resentment toward the EU hit a new high yesterday when the upper house of the Swiss parliament on Wednesday followed in the footsteps of Iceland, and voted to invalidate its 1992 application to join the European Union, backing an earlier decision by the lower house. The vote comes just a week before Britain decides whether to leave the EU in a referendum. Twenty-seven members of the upper house, the Council of States,...

Read More »Switzerland’s special EU deal

Brexit – yes or no? If the United Kingdom were to leave the European Union, would it work out a series of bilateral agreements, similar to the ones between the EU and Switzerland? Some Brits believe Switzerland has benefited from the bilateral approach. The Swiss-EU treaties give Switzerland direct access to the best parts of the EU: trade, transport and science projects – plus visa-less travel around Europe. One thing the UK has in common with Switzerland since Brexit is coming to a vote:...

Read More »Luggage robot could make flying even easier

Geneva Airport now boasts what it says is the first ever robot that both checks in and carries luggage: the prototype “Leo”. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal and political tragedy. Her needless death provided an inflection point. The suspension of the referendum campaigns and a steady stream of reports and speeches has the emotionalism of contest freeze. Investors quickly understood that the Cox’s death injected a new unknown into the forces that seemed to build toward a decision to leave the EU....

Read More »How Germany Could Upset Europe before UK Referendum

The assassination of the Jo Cox has broken the powerful momentum in the markets. Investors recognize that the tragedy potentially injects a new element into consideration for the outcome of next week’s referendum. The campaigns will be resume over the weekend, and new polls will be available. Investors will place more weight on polls conducted after the assassination. The UK referendum is the big event next week. ...

Read More »News conference Swiss National Bank 2016, Fritz Zurbrügg

Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 16.06.2016 Complete text: PDF(74 KB) Major Points: UBS and Credit Suisse: Capital Situation improved further: fully compliant with the requirements of the current Swiss ‘too big to fail’ regulations (TBTF1) for 2019.The regulation until 2019, however is only temporary. From 2020...

Read More »News conference Swiss National Bank, Thomas Jordan

Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 16.06.2016 Complete text: PDF (96 KB) Major points: SNB rate remains –0.75% and the target range for the three-month Libor unchanged at between –1.25% and –0.25%. Negative interest helps to maintain the interest rate differential between the Swiss franc and other currencies, hence...

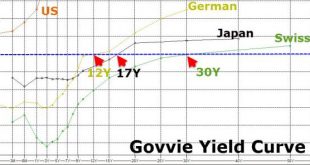

Read More »US Negative Interest Rate Bets Surge To Record Highs

As the “deflationary supernova” sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the ‘cheapness’ of Treasury bonds lures the world’s yield-hunters dragging it ever closer to the negative rate realities of Switzerland, Japan, and Germany. As rate-hike odds collapse, along with The Fed’s credibility, so investors are...

Read More »FX Daily, June 16: Markets are Anxious, Yen Soars

FX Rates The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The Kiwi was helped by better than expected Q1 GDP. The euro and sterling are within yesterday’s ranges. The euro has been able to resurface above $1.13 since Monday. Bids have...

Read More »Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely appropriateness of a rate hike this summer. Although the Fed did not rule out a...

Read More » SNB & CHF

SNB & CHF