The Swiss chocolate industry is increasingly supporting fair trade practices, which give cocoa farmers in West Africa and South America the chance of a decent wage. A Swiss start-up leads the way. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube...

Read More »Milking robots improve cows’ lives

A farmer in canton Aargau extolls the virtues of his new milking robot, which also feeds his cows and cleans up after them. (RTS/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Alberto Giacometti’s atelier opens

Alberto Giacometti was one of the major sculptors of the 20th century. He regularly spent time in his native village of Stampa in the Bregaglia Valley in canton Graubünden, and now his studio has now been opened to the general public. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit...

Read More »Post-Brexit relief rally fading – Swiss quality stocks as safe haven

Investec Switzerland. Facebook and Twitter.

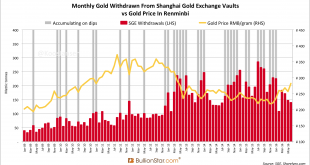

Read More »Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE...

Read More »The Gold Standard: Friend of the Middle Class

A Morally and Economically Superior Monetary System It has been theoretically demonstrated and seen in general practice that a monetary system of 100% metallic money devoid of central banking checks monetary inflation, prevents a general rise in the price level, and eliminates the dreaded business cycle while making all sorts of monetary mischief nearly impossible. A gold standard is not only economically superior...

Read More »Great Graphic: More Thoughts on Banks

Summary Italian banks have done worse that European banks. Italian banks outperformed Germany banks from end of H1 12 through H1 15. US banks and financials more broadly have outperformed Europe. Italian banks were struggling before the UK referendum. The result drove down interest rate, which keeps margins under pressure. The prospects of weaker growth as a result of Brexit means that demand for credit...

Read More »European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored. This actually worked for a...

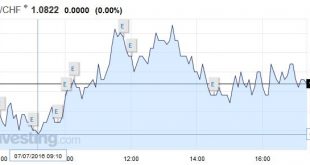

Read More »FX Daily, July 07: Sterling Bounces Two Cents, but Does not Appear Sustainable

Swiss Franc Click to enlarge. Brexit Amid a better if not strong risk appetite, sterling has rallied two cents from yesterday’s lows near $1.28 to poke through the $1.30 level in the European morning. Click to enlarge. United Kingdom It was helped by an industrial production report that was better than expected. Industrial and manufacturing output fell 0.5% in May. This was around half of the expected decline...

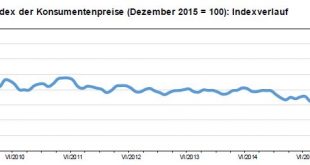

Read More »Swiss Consumer Price Index in June 2016: Consumer prices increase by 0.1 percent

07.07.2016 09:15 – FSO, Prices (0353-1606-90) Swiss Consumer Price Index in June 2016 Consumer prices increase by 0.1% Neuchâtel, 07.07.2016 (FSO) – The Swiss Consumer Price Index (CPI) increased by 0.1% in June 2016 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was -0.4% in comparison with the same month in the previous year. These are the findings of the Federal Statistical...

Read More » SNB & CHF

SNB & CHF