In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging Markets crisis. The last one culminated in the Russia crisis and the end of the peg in January 2015. At the CFA Society in summer 2014, I predicted the end of the EUR/CHF peg. This time, however, I foresee a weaker Swiss franc. U.S. Recessions and the Joseph Cycle Official NBER Recessions and Joseph Cycles The graph shows the years of the “official NBER recessions” in the United States:2008, 2000/2001, 1990, 1982/1983,1973/1974 and 1967. A pattern of a bit more than seven years can be identified. We should not follow the data of the United States too much; the U.S. economy tends more strongly to boom-bust cycles, often caused by weak savings, Fed interventions that ends the cycles too early. Recessions in other countries happened less often. According to the Handelsblatt, a recession in Germany took place in 1967, in 1975, in 1982, in 1993, in 2001/2002 and 2009. Simon Sim clearly identified the Joseph cycles in Singapore.

Topics:

George Dorgan considers the following as important: CHF, Featured, Genesis 41, Joseph cycle, newsletter, private debt, public debt, Recession, savings rate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging Markets crisis. The last one culminated in the Russia crisis and the end of the peg in January 2015. At the CFA Society in summer 2014, I predicted the end of the EUR/CHF peg. This time, however, I foresee a weaker Swiss franc.

U.S. Recessions and the Joseph Cycle

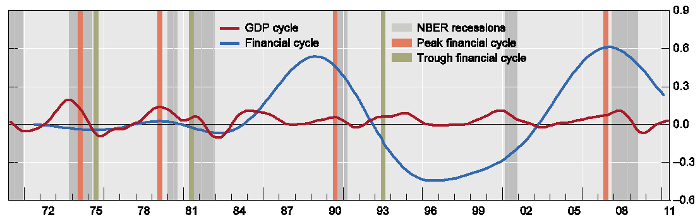

The graph shows the years of the “official NBER recessions” in the United States:

2008, 2000/2001, 1990, 1982/1983,1973/1974 and 1967.

A pattern of a bit more than seven years can be identified.

We should not follow the data of the United States too much; the U.S. economy tends more strongly to boom-bust cycles, often caused by weak savings, Fed interventions that ends the cycles too early.

Recessions in other countries happened less often. According to the Handelsblatt, a recession in Germany took place in 1967, in 1975, in 1982, in 1993, in 2001/2002 and 2009. Simon Sim clearly identified the Joseph cycles in Singapore.

In China, recessions did not happen at all. During the crisis years 2008 and 2009, for example, Chinese retail sales rose by 12% per year.

The Biblical Joseph Cycle

In Genesis 41, we read the following:

One day, the Pharaoh of Egypt had disturbing dreams in 2 consecutive days. In the first, he dreamt about 7 fat cows grazing the grass and thereafter, 7 lean cows devoured the 7 fat cows. In the second, he dreamt about 7 full ears of corn and later, 7 thin ears of corn swallowed the full ones. Joseph interpreted, “…there will be seven years of plenty in all the land of Egypt. After that there will be seven years of famine…”.

Under Joseph as minister, Egypt prepared itself and saved more in provision for the seven lean years.

Still today, Joseph cycles arise because the people’s behaviour change over the years. This can be translated in standard economic laws:

Two Phases of the Joseph Cycle translated in Behavioral Macro

-

Phase 1: Seven lean years

The seven leans years start with a recession and rapidly increasing unemployment and then a slow recovery. Compared to the fat years, they have

- higher unemployment

- slower rises in wage

- lower inflation

- good performance of bond and stock markets

- reduction of household debt1

-

Phase 2: The seven fat years

are characterized by

- lower unemployment

- stronger rises in wages

- higher inflation

- weak performance of bond markets

- bad performance of stock markets, in particular, during the last years

- increase of household debt

With reduction of the saving rate in the United States since the 1960s (see below) and central bank distortion, the second phase often ended earlier than it should have. Very often the Fed kept rates too low and, during early phase2, they hiked them suddenly. Consequently investment and GDP slumped. The economy moved back to Phase 1 more quickly than it was necessary according to the full 14 years Joseph cycle.

Moreover, we also have delays per country. The United States entered the recent lean years, the debt reduction years, already in 2007, but many Emerging Markets only in 2011 or later (see more here).

Behavioral global macro and savings

In a post on the Net National Savings Rate, we divided countries in two categories: the countries that are rather consumption-oriented and the ones that are savings-oriented. The graph below shows how consumption-oriented countries in the advanced economies reduced their savings rate from 25% in the 1960s to about 10% today, while Asia rapidly increased the savings.

Savings Rate Emerging vs. Advanced Economies 1980-2011, source2

Consumption-oriented Countries

A typical consumption-oriented nation is the United States: Americans have a very weak household savings-rate of 4%. When oil and gas get cheaper then Americans spend more on cars or other consumer goods. The total U.S. savings rate remains at very low levels. The UK, Southern Europe, New Zealand and Australia, Southern America and Africa belong to this category. In Italy the household savings rate has even fallen from 20% in 1991 (at time of high rates) to 4% (with the ECB keeping rates artificially low).

Savings-oriented Countries

People in Switzerland, Germany and many Asian countries are rather savings-oriented, they are far more risk-averse. They behave as Joseph told the Pharaoh to do:

You shall save during the seven fat years for the upcoming famine.

They often set themselves a fixed savings target. When salaries rise then savings rises, too. According to a recent German GFT survey, a rise of 2.8% in salaries let to 1.4% higher spending, the rest was saved. Four of the five biggest German fears are related to inflation and not having enough money during the pension.

After years of high Chinese wage increases, they do not rise as they did before. As Michael Pettis emphasizes in his book The Great Rebalancing, many Chinese keep their saving targets. Given that interest rates are lower now, they must save “more quantities”. The combination of slower rises in Chinese salaries and the habit to maintain high savings, are for us, the two major reasons of weaker Chinese GDP growth.

The new Balanced Global Economy

Nowadays we have three country blocks with the following GDP $ valued in purchasing power (PPP):

- China with 19.5 billion GDP in $(PPP)

- Europe with 19.2 bln.

- The United States with 18 bln.

The global economy is far less dependent on the U.S. than it was before and – therefore – less dependent on the Fed. We have a slight bias towards savings-oriented countries, given that Europeans are becoming more and more pre-cautious for the pension age.

In Europe, we expect the full length of seven fat years to start in 2016 and to end versus 2022/2023. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging Markets crisis – during the lean years. The last one culminated in the Russia crisis and the end of the EUR/CHF peg in January 2015.

The refugee crisis in Europe will clearly not represent an economic crisis that could be part of the lean years. It leads to higher debt in Europe and in the short term to higher economic growth, to fat years.

The Swiss franc should weaken between 2016 and 2020, during the early fat years

Since End January Eurozone inflation has been rising again. Further ECB easing measures cannot be expected. Therefore speculators position themselves against the Swiss Franc again. This resulted in a considerable weakening of CHF in particular against the euro. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators.

Switzerland is one of the countries with traditionally higher savings rates. When we look at the patterns of the Swiss franc, then we see phases of overvaluation during most of the lean years and undervaluation during the first years of the fat years. Finally at the end of the fat years, the monetarist argument trumps:

High inflation rates in the U.S. and in Europe compared to low inflation in Switzerland, leads to a strong CHF appreciation.

The fat years of the Joseph cycle are based on higher household debt in the consumption-oriented countries.

A lot of it will be denominated in cheap CHF, on money that the Swiss savers nation lend to foreign countries. These outflows in form of debt – i.e. direct lending or Swiss buying European bonds – will finally be able to neutralize the strong Swiss trade surplus. Investors will be in search of yield, hence the low yielding CHF will slowly depreciate against the euro, the carry trade will be back on vogue.

When inflation gets too high and a recession looms, then the CHF debt is suddenly paid and flows invert again. Some months during next global recession around the year 2022, the franc should appreciate strongly again. We gave our number of EUR/CHF 0.90 in 2022 and explained why.

There is a second argument that speaks for a weaker franc: Weaker growth rates in China are negative for the Swiss franc. See CHF is no safe haven but a safe proxy for global growth.

Further References

Strangely two major writers on business cycles have the first name Joseph.

Joseph Schumpeter compared all four different types of business cycles

and Joseph Kitchin with his decision making cycle (short business cycles) of around 40 months.

References- Be aware that in particular with today’s countercyclical measures, public debt moves in the opposite of private debt. Public debt shall increase during the lean years to oppose weak private spending. But public debt often decreases during the fat years. [↩]

- Danthine, Jean-Pierre. 2012. ‘A world of low interest rates’ Swiss National Bank. Online, March 2012 [↩]