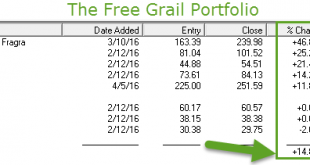

The free portfolio advanced 2.02% this week, but the S&P lost the small amount of 0.12%. Click to enlarge. The Ultima Plus portfolio became operational on 31 December 2015. Click to enlarge. Market Comment Up to Wednesday, the S&P 500 rose to a 10-month high of 2119.12 points, less than 1% below its all-time high of 2130.82 of 12 May last year. But stocks pulled back on Thursday and more decisively on...

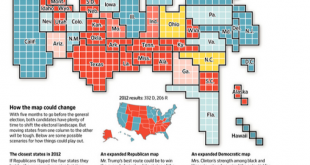

Read More »US Election Infographic

This infographic was in the Wall Street Journal on the US election. It is important to remember that the US does not elect the President by direct popular vote. This makes the national polls a bit misleading. There are 538 electoral college votes. To be elected a candidate must secure a majority or 270 electoral college votes. Obama received 332 elector votes and Romney 206. The WSJ cites four major...

Read More »FX Daily, June 13: Brexit Dominates

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. See the Dukascopy Video FX Rates The risk that the UK votes to leave the EU next week is the dominant force in the capital markets. It is a continuation of what was seen at...

Read More »Democratic Deficit: Is the UK Referendum the Tip of the Iceberg?

One of the most profound criticisms of the EU that it remains, even at this late date, primarily an elite project. The democratic deficit has grown, according to the latest Pew Research multi-country poll. The Pew Research survey covered ten countries that represent 80% of the EU28 population and 82% of the region’s GDP. The poll surveyed nearly 10.5k people between April 4 and May 12. It found that 2/3 of the both...

Read More »Brexit Paranoia Creeps Into the Markets

European Stocks Look Really Bad… Late last week stock markets around the world weakened and it seemed as though recent “Brexit” polls showing that the “leave” campaign has obtained a slight lead provided the trigger. The idea was supported by a notable surge in the British pound’s volatility. Battening down the hatches… Euro-Stoxx 50 Index On the other hand, if one looks at European stocks, one could just as well...

Read More »Is It Our Duty to Fight When the Deep State Asks?

Hero or Traitor? And it’s one, two, three, What are we fighting for? Don’t ask me, I don’t give a damn, Next stop is Vietnam; And it’s five, six, seven, Open up the pearly gates, Well there ain’t no time to wonder why, Whoopee! We’re all gonna die. Country Joe McDonald Robert McNamara, next to a map of Vietnam…in 1964 he participated in propagating the “Tonkin incident” lie, a false flag incident which drew the US...

Read More »Where Then Will Silver Go?

Silver gets the Saruman question…(see further below) Photo credit: New Line Cinema Precious Metals Surge The price of gold bumped up thirty bucks, and that of silver about one buck. Is this liftoff — when the dollar falls sharply, and the price of each metal in dollar terms skyrockets? Is this the denoument when the gold bug does not get rich, because although his net worth measured in dollar is massively up, the...

Read More »What Congress Really Thinks of Voters

Battle of Wits BALTIMORE – On Wednesday, the Dow rose over 18,000, for the first time since April. Hillary is riding high, too. She is a pro. She has the entire Deep State behind her – including almost every crony and zombie in the country – and a political machine that can turn out more claptrap than any in history. While her opponent rambles incoherently and mindlessly, every phrase from Hillary’s mouth is a...

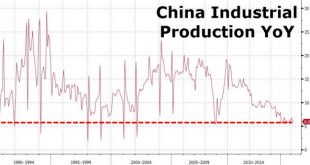

Read More »China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better. Economic Data from China Then Chinese data largely disappointed. A “meet” in Industrial Production – hovering at multi-year lows… *CHINA MAY INDUSTRIAL OUTPUT RISES 6.0% FROM YEAR EARLIER...

Read More »Central Banks & Governments and their gold coin holdings

Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves. These...

Read More » SNB & CHF

SNB & CHF