Summary People have become used to the idea that the State is their sugar daddy. Many apparently believe that it has some undisclosed, infinite stash of resources at its disposal which it can shower them with at will. The reality is unfortunately different. Hollande Threatens to Ban Protests Brexit has diverted attention from another little drama playing out in Europe. As of the time of writing, if you Google...

Read More »Down Go the Hopes and Dreams of Three Generations

Summary On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this? If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three...

Read More »FX Weekly Preview: It is All about Europe

Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out...

Read More »Weekly Speculative Postion: After Jo Cox Speculators Bought Sterling Futures with Both Hands

Sterling In the days ahead of the murder of Jo Cox, a UK member of parliament, apparently for her support for remaining in the EU, speculators in the futures market scooped up sterling. They added 25.4k sterling contracts to lift the gross long position to 61.7k contracts. This is the second largest long speculative position after the mid-March holdings of 62.9k long contracts. In the previous CFTC reporting...

Read More »FX Review Week till June 17: Jo Cox’s death supports Sterling, negative for CHF

EUR/CHF The EUR/CHF was finished nearly without change after it had fallen to 1.0775 on Thursday. The rise of GBP and EUR on Thursday can be explained with speculation that the death of Jo Cox will help the anti-Brexit camp. We reported that FX speculators bought Sterling with two hands. FX Rates June 13 to June 17, 2016 click to enlarge USD/CHF Speculators have finally positioned themselves long CHF against...

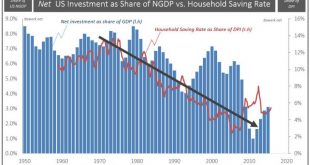

Read More »Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

We have seen several explanations for the financial crisis and its lingering effects depressing our global economy in its aftermath. Some are plain stupid, such as greed for some reason suddenly overwhelmed people working within finance, as if people in finance were not greedy before 2007. Others try to explain it through “liberalisation” which is almost just as nonsensical as government regulators never liberalised...

Read More »When Switzerland opened its arms to POWs

One town has been marking the time 100 years ago when Switzerland welcomed tens of thousands of prisoners of war. Revisiting the place has been an emotional experience for some of their descendants. Based on agreements with the belligerent nations, who paid the costs, 68000 sick and wounded British, French, German, Belgian, Canadian and Indian prisoners were interned for several months in sanatoria and hotels. These were mainly located in Alpine tourist resorts, thus supporting an industry...

Read More »SNB’s Maechler on Negative Rates and our Critique

At the news conference of the Swiss National Bank, Andréa Maechler discusses the current situation of financial markets and the negative interest environment. She explains the recent Swiss experience with negative interest rates. Negative rates have the desired effect: It makes holding money on Swiss bank accounts less attractive. We see different issues with this explanation: Negative rates make only holding money on...

Read More »Switzerland Withdraws Application To Join EU: Only “Lunatics May Want To Join Now”

Resentment toward the EU hit a new high yesterday when the upper house of the Swiss parliament on Wednesday followed in the footsteps of Iceland, and voted to invalidate its 1992 application to join the European Union, backing an earlier decision by the lower house. The vote comes just a week before Britain decides whether to leave the EU in a referendum. Twenty-seven members of the upper house, the Council of States,...

Read More »Switzerland’s special EU deal

Brexit – yes or no? If the United Kingdom were to leave the European Union, would it work out a series of bilateral agreements, similar to the ones between the EU and Switzerland? Some Brits believe Switzerland has benefited from the bilateral approach. The Swiss-EU treaties give Switzerland direct access to the best parts of the EU: trade, transport and science projects – plus visa-less travel around Europe. One thing the UK has in common with Switzerland since Brexit is coming to a vote:...

Read More » SNB & CHF

SNB & CHF