Swiss Franc The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar. Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again. FOMC The FOMC meeting later today,...

Read More »Fed Softens Stance Slightly

The Federal Reserve anticipated a more gradual tightening path going forward. This weighed on the dollar and lifted equities. August Fed funds futures implies less of a chance of a hike next month. It is now consistent with an 8% chance of a hike, which is less than half the probability assigned at the end of last week.The immediate reaction was driven by the Fed’s dot plots. Although the median continues to...

Read More »Kuroda and the BOJ

Following today’s FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow. The SNB will keep its powder dry to be able to respond to the results of the UK referendum if needed. The Bank of England is also on hold. The outlook for the BOJ is more in dispute. The strength of the yen and deflationary pressures encourage some to look for Governor Kuroda to ease policy. In fact, a little more than...

Read More »IIF Chief Warns “Brexit Bigger Threat To Global Economy Than Lehman”

As Brexit appears to gathering pace among British voters, Bloomberg Briefs interviews Hung Tan, executive managing director at the Institute of International Finance in Washington, DC., to understand the global impact of a decision by Britain to leave The EU… Q: What would happen if Britain voted to leave the EU? A: It is not Lehman in the short term in terms of markets being in a panic or chaotic mood, because the...

Read More »Claudio Grass Talks to Godfrey Bloom

Godfrey Bloom, back in his days as UKIP whip Photo credit: Reuters Introductory Remarks – About Godfrey Bloom [ed note by PT: Readers may recall our previous presentation of “Godfrey Bloom the Anti-Politician”, which inter alia contains a selection of videos of speeches he gave in the European parliament. Both erudite and entertaining, Mr. Bloom constantly kept the etatistes of the EU on their toes.] Before becoming...

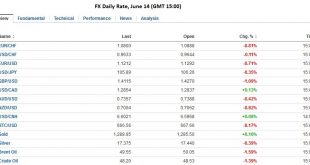

Read More »FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

“The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%”. A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain. Core bond yields are 4-5 bp lower, which...

Read More »The VIX Breaks Out – Market Risk Continues to Surge

The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock index. “Brexit” fears continue to grow, which has apparently been the driving force behind this move. The “Brexiteers” are gaining support as the referendum date draws...

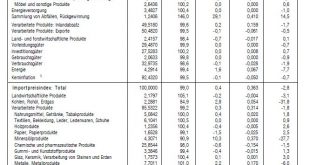

Read More »Producer and Import Price Index in May 2016: 0.4 percent rise in Producer and Import Price Index

14.06.2016 09:15 – FSO, Prices (0353-1606-10) Producer and Import Price Index in May 2016 0.4% rise in Producer and Import Price Index Neuchâtel, 14.06.2016 (FSO) – The Producer and Import Price Index rose in May 2016 by 0.4% compared with the previous month, reaching 99.7 points (base December 2015 = 100). This was primarily attributable to higher prices for scrap and petroleum products. Compared with May 2015,...

Read More »Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. DJIA, daily Fed chief Janet Yellen has made it clear she won’t do anything to disturb investors’ sleep. But that doesn’t mean they won’t have nightmares. Our research department...

Read More »Great Graphic: Oil Flirts with Four-Month Uptrend

Oil prices reached their highest level in eleven months in the middle of last week. The front-month futures contract did not post a key reversal on June 9, but the continuation contract did. Since reaching almost $51.70 then, prices have pushed lower, with lower highs and lower lows. As this Great Graphic created on Bloomberg shows, a trendline drawn off the mid-February cyclical low, and hitting the early and...

Read More » SNB & CHF

SNB & CHF