The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »FX Daily, May 01: May Day Calm

Swiss Franc Switzerland Retail Sales YoY, March 2017(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge FX Rates Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed. The yen is the weakest of the majors, off about 0.3% as the...

Read More »FX Weekly Preview: Looking Through the FOMC Meeting as it Looks Past Poor Q1 GDP

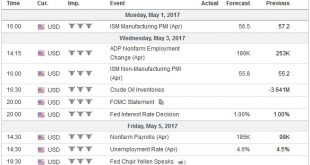

Summary: US jobs and auto sales data may be more important than the FOMC meeting. Norway and Australia’s central bank meets. Neither is expected to change policy. All three large countries that reported Q1 GDP figures last week – US, UK, France – disappointed expectations. A Federal Reserve meeting always draws market interest, as investors are on guard for policy signals. However, the statement from this...

Read More »FX Weekly Review, April 24 – 29: Dollar Remains the Fulcrum

Swiss Franc Currency Index Trade-weighted index Swiss Franc, April 29(see more posts on Swiss Franc Index, ) Source: markets.fx.xom - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended last week on a mixed note. Indeed, the week and the month were also very much mixed for EM, reflecting a variety of global and country-specific drivers impacting these countries. This week’s US jobs data could bring Fed tightening back as a major driver for EM. We will also get the first snapshots of trade in April from Korea and Brazil, as well as Caixin PMI readings for China. Official...

Read More »Gold Bullion Imports Into China via Hong Kong More Than Doubles in March

Gold bullion imports into China via main conduit Hong Kong more than doubled month-on-month in March, data showed on Tuesday as reported by Reuters. Net-gold imports by the world’s top gold consumer through the port of Hong Kong rose to 111.647 tonnes in March from 47.931 tonnes in February, according to data emailed to Reuters by the Hong Kong Census and Statistics Department. China’s net-gold imports rose to its best...

Read More »Swiss have never moved as much as they did in 2015

© Totalpics | Dreamstime.com 20 Minutes. In Switzerland, more than a million people moved house in 2015, 12.1% of the population. The figure has never be higher, according to a report called Immo-Monitoring published by Wüest Partner. The home moving covered around 490,000 dwellings. Of those who moved, 344,000 stayed in the same commune (Gemeinde) while the other 659,000 changed municipality. One quarter of the total...

Read More »NAFTA Trade Update

Summary: The trade tensions between the US and Canada set the Canadian dollar to lows for the year. The dollar’s downside momentum against the Mexican peso has eased. The Canadian dollar looks attractive not against the US dollar but against the peso. The Trump Administration has switched gears. During the campaign through the inauguration, Trump picked on Mexico. The rhetoric and threats drove the peso to...

Read More »Housing’s Echo Bubble Now Exceeds the 2006-07 Bubble Peak

If you need some evidence that the echo-bubble in housing is global, take a look at this chart of Sweden’s housing bubble. A funny thing often occurs after a mania-fueled asset bubble pops: an echo-bubble inflates a few years later, as monetary authorities and all the institutions that depend on rising asset valuations go all-in to reflate the crushed asset class. Take a quick look at the Case-Shiller Home Price Index...

Read More »New 50 Swiss franc note wins international beauty contest

A Swiss 50. What a beauty – © Hai Huy Ton That | Dreamstime.com The new 50 franc note, launched last year, was voted the best new bank note in 2016 by the International Bank Note Society, a society founded in 1961. Nearly 120 new banknotes were released worldwide in 2016. The Swiss 50 only narrowly beat the Maldive Islands 1000 Rufiyaa bill, Argentina’s 500 Peso jaguar, and the Royal Bank of Scotland’s 5 Pound first...

Read More » SNB & CHF

SNB & CHF