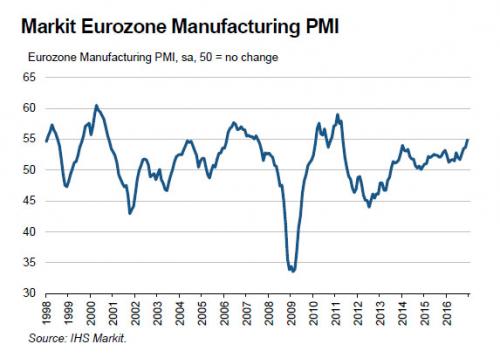

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011. “Euro-zone manufacturers are entering 2017 on a strong footing, having ended 2016 with a surge in production,” said Chris Williamson, chief business economist at IHS Markit. “Policy makers will be doubly-pleased to see the manufacturing sector’s improved outlook being accompanied by rising price pressures.” Markit Eurozone Manufacturing PMI - Click to enlarge Some details from today’s PMI report: The eurozone manufacturing sector ended 2016 on a high note. At 54.9 in December, up from 53.7 in November, the final Markit Eurozone Manufacturing PMI® posted its best reading since April 2011 and was unchanged from the earlier flash estimate. The average for the final quarter (54.0) was solidly above that for the third quarter (52.1) and signalled the fastest growth since the second quarter of 2011. Moreover, the average PMI reading over 2016 as a whole (52.

Topics:

Tyler Durden considers the following as important: 2015–16 Chinese stock market turbulence, Bond, Business, CAC 40, currency, DAX 30, DJ Euro Stoxx 50, economic indicators, economy, Economy of the European Union, Euro, Eurozone, Featured, flash, France, FTSE MIB, FX Trends, Germany, Greece, Index numbers, Italy, Markit, Netherlands, newslettersent, PMI, Purchasing Managers' Index, STOXX, Stoxx 600, Switzerland, Turkey, Turkish lira, Volatility, Yen, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

“Euro-zone manufacturers are entering 2017 on a strong footing, having ended 2016 with a surge in production,” said Chris Williamson, chief business economist at IHS Markit. “Policy makers will be doubly-pleased to see the manufacturing sector’s improved outlook being accompanied by rising price pressures.” |

Markit Eurozone Manufacturing PMI |

Some details from today’s PMI report:

|

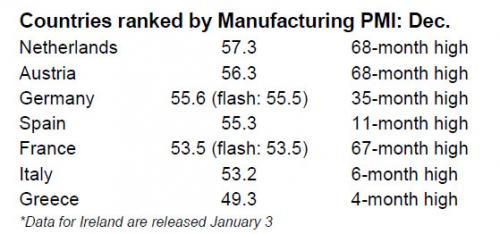

Countries Ranked by Manufacturing PMI, December 2016 |

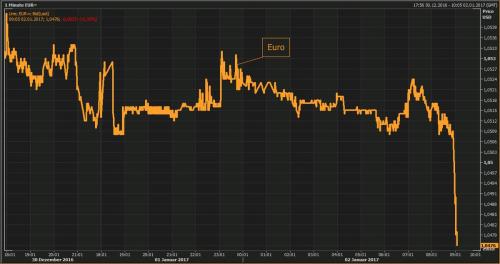

| Perhaps as a result of another rogue algo operating in thin markets, today it was the Euro’s turn to tumble, and instead of rejoicing at this manufacturing strength, the European currency took no comfort from the figures, and suddenly dipped by 40 pips, sliding 0.3% back below $1.05 after climbing to as high as $1.07 during a flash surge in low trading volumes in Asia on Friday. |

Euro, Daily |

| The weakness in the currency, however, was ignored by stocks and in early trading the euro zone’s blue-chip Euro STOXX 50 index as well as the broader STOXX 600 rose by 0.5% to its highest since December 2015 after the purchasing managers’ index (PMI) for factories in the currency bloc came in at 54.9 – well above the 50 mark that separates growth from contraction.

Italy’s stock index hit its highest level since January last year, outperforming other major European stock indexes, with a rally in its banks and a strong manufacturing report improving sentiment. Italy’s FTSE MIB index was up 1.3% by 1000 GMT after rising to its highest since January 15 of 2016. Germany’s DAX was up 0.9% at its highest in nearly 17 months, while France’s CAC was up 0.3 percent after hitting a 13-month peak earlier in the day. Meanwhile, as European stocks climbed, a full blown rally across all assets also pushed down the yields on lower-rated government bonds in the euro zone to multi-week lows. Italian, Spanish and Portuguese 10-year bond yields were down roughly 8 basis points each on the day. It wasn’t just lower rated bonds, as yields on 10Y Bunds dropped to 0.157%, the lowest since the Trump election, and suggesting that the Trumpflation rally, at least in Europe, has largely fizzled at least based on long-end inflation expectations in Europe’s benchmark bond security. |

Germany 10 Year Yields, Daily |

The dollar index, which flash crashed on the last trading session of 2016 during thin, illiquid conditions in Asia, climbed 0.4 percent, and traded at 102.36 as of this posting. The Japanese yen – traditionally used as a safe haven – falling 0.3 against the dollar, close to an 11-month low.

“In the last days of 2016 we saw the dollar retreat somewhat, and there might be some sense of a correction from Europe this morning. I don’t see any fundamental drivers for the moves,” said Commerzbank currency strategist Esther Reichelt, in Frankfurt.

Despite yet another terrorist shooting in Turkey, one which the Islamic State took responsibility for the murder of 39 people in an Istanbul nightclub, most markets remained unfazed by ongoing political disturbances. “After all the big political shocks last year and muted market reaction, it is tempting to argue that the markets are very resilient,” said Finland-based Nordea chief market strategist Jan Von Gerich. “I would say this is too optimistic an assumption and I think we will see more volatility this year.”

“The problem is that this once again stresses the increasing instability and the security issues, and we’re seeing tourist numbers going down, which will have a lasting negative impact on the Turkish economy…and that’s Turkish lira-negative,” said Commerzbank’s Reichelt.

The Turkish lira slipped 0.4 percent after the attack to 3.5384 per dollar, close to a record low of 3.5840 lira touched in December.

Data released over the weekend showed China’s manufacturing sector expanded for a fifth month in December, though growth slowed a touch more than expected in a sign that government measures to rein in soaring asset prices are starting to have a knock-on effect on the broader economy. The Chinese yuan suffered its biggest annual loss in more than 20 years in 2016, with an almost 7 percent fall making it the worst-performing currency in Asia.

Tags: 2015–16 Chinese stock market turbulence,Bond,Business,CAC 40,Currency,DAX 30,DJ Euro Stoxx 50,economic indicators,economy,Economy of the European Union,Euro,Eurozone,Featured,flash,France,FTSE MIB,Germany,Greece,Index numbers,Italy,Markit,Netherlands,newslettersent,PMI,Purchasing Managers' Index,STOXX,Stoxx 600,Switzerland,Turkey,Turkish lira,Volatility,Yen,yuan