If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it. In an interview with Charles Schwab, the former Fed Chairman says not to worry: Dr. Bernanke noted that corporate earnings have risen at the same...

Read More »FX Daily, May 02: Dollar and Yen Heavy, Equities Trade Higher and Bonds Lower

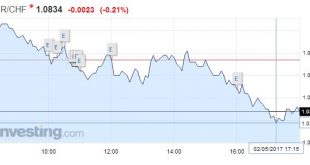

Swiss Franc EUR/CHF - Euro Swiss Franc, May 02(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is sporting a softer profile against most of the major and emerging market currencies. The Japanese yen is the main exception. The greenback is rising against the yen for the fourth session and the sixth of the past seven. The dollar’s gains against the yen coincide with the 10-12 bp recovery...

Read More »New Swiss company tax reform plan well received in Brussels

© Miriam Doerr | Dreamstime.com The Swiss government’s company tax reform plans have been reborn after the last plan met with defeat in a popular vote on 12 February 2017. The new plan, dubbed “Tax proposal 17”, aims to avoid issues that bedeviled the last project. Last time many were concerned by the potential financial impact of lower company tax rates, and the proposal was rejected by 59.1% of voters. This time the...

Read More »Why Good Economics Matters Now More Than Ever

In a newsletter published in 1970, economist Murray Rothbard wrote, “It is no crime to be ignorant of economics, which is, after all, a specialized discipline and one that most people consider to be a ‘dismal science.’ But it is totally irresponsible to have a loud and vociferous opinion on economic subjects while remaining in this state of ignorance.” This is an oft-quoted platitude within circles of libertarian...

Read More »Defining Labor Economics

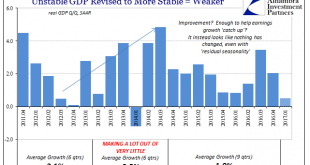

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to...

Read More »The Fed Will Blink

Honest Profession GUALFIN, ARGENTINA – The Dow rose 174 points on Thursday. And Treasury Secretary Steve Mnuchin said we’d have a new tax system by the end of the year. Animal spirits were restless. But which animals? Dumb oxes? Or wily foxes? Probably both. But what caught our attention were the central bankers strutting across the yard and crowing with such numbskull cackles that even barnyard animals would be...

Read More »Swiss or Tamil? Caught in the middle.

Tama Vakeesan was born in Switzerland – to Tamil parents from Sri Lanka. Sometimes she doesn’t know where she belongs. But then she also feels like this makes her more open-minded. In her quirky, fun and thoughtful video series, we meet Tama’s family and friends – and find out what it’s like to be caught between two worlds. Join the journey! (SRF Kulturplatz/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on...

Read More »Insect eating goes legal in Switzerland

Mealworms, crickets and grasshoppers can now be served up in restaurants and sold in supermarkets, thanks to new laws. (Julie Hunt/SRF) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Ueli Steck knew he was dicing with death

The Swiss are mourning the loss of one of their greatest sports heroes, speed climber Ueli Steck, who died on Sunday in the Himalayas. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Weekly Speculative Positions (as of April 25): Bulls Take Charge of 10-year Note Futures, while Sterling Bears Hang On

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More » SNB & CHF

SNB & CHF