December 13, 2017 (Eagle, Idaho) — A national precious metals dealer has selected four outstanding students to receive tuition assistance from America’s first gold-backed scholarship fund. Beginning last year, Money Metals Exchange, a national precious metals dealer recently ranked “Best in the USA,” teamed up with the Sound Money Defense League and well known members of academia and freedom-minded non-profits to offer...

Read More »Switzerland’s Economic Recovery gains momentum

Economic forecasts by the Federal Government’s Expert Group – Winter 2017/2018* The Federal Government’s Expert Group expects the Swiss economy to make a speedy recovery over the next few quarters. While only moderate GDP growth of 1.0% is anticipated in 2017 due to a weak first half of the year, the forecast for GDP growth in 2018 is strong at 2.3% in the course of the global economic upturn. A solid 1.9% growth is...

Read More »FX Daily, December 18: Trade Tensions with China Set to Escalate

Swiss Franc The Euro has risen by 0.10% to 1.165 CHF. EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX was mixed last week, with political optimism driving the big winners ZAR and CLP. We remain cautious, as the Fed has signaled its intent to continue tightening in 2018. Stock Markets Emerging Markets, December 18 Source: economist.com - Click to enlarge Brazil Brazil reports October monthly GDP proxy Monday, which is expected to rise 2.8% y/y vs. 1.3% in September. Brazil then reports...

Read More »Swiss Perfectionism

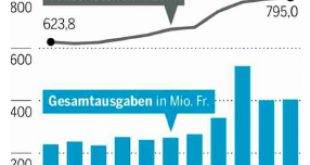

In Der Bund, Adrian Sulc comments on the Swiss National Bank’s perfectionism. Keine andere Schweizer Organisation kommuniziert so professionell wie die SNB, keine andere Organisation kann so gut dichthalten. Perfectionism is costly. Der Personalbestand ist in den letzten fünf Jahren um 18 Prozent auf 795 Vollzeitstellen gestiegen. … Die durchschnittlichen Lohnkosten pro Mitarbeiter betragen mittlerweile 155 000 Franken...

Read More »FX Weekly Preview: Policy Mix Underlines Positive Fundamental Backdrop for the Dollar

The prospects that the Republican-controlled legislative branch would find a compromise to tax cuts were enhanced when a few senators appeared to capitulate without much to show for it may have helped lift US stocks and dollar ahead of the weekend. Each chamber must now approve the reconciliation measure, which does not look particularly like either the House or Senate bills, though the regressive thrust was...

Read More »Direct Investments in 2016

Swiss direct investment abroad In 2016, companies domiciled in Switzerland invested CHF 71 billion abroad. Swiss direct investment abroad thus fell short of the CHF 90 billion recorded in 2015, due primarily to lower investment activity by finance and holding companies. All other industry categories combined actually exceeded the level of the previous year with investment abroad of CHF 62 billion (2015: CHF 46...

Read More »UBS chairman warns of ‘bitcoin bubble’

Bitcoin is increasingly being accepted into the mainstream, but many remain sceptical (Keystone) - Click to enlarge Axel Weber, the board chairman of big bank UBS, has warned of a possible Bitcoin currency crash. With increasing numbers of small investors jumping on the cryptocurrency bandwagon, it is time for regulators to intervene, he says. Bitcoin has surged from $1,000 (CHF9,900) at the start of the...

Read More »GoldSeek Radio – Dec 15, 2017 [CHARLES HUGH SMITH & JOHN EMBRY] weekly

GoldSeek Radio's Chris Waltzek talks to Charles Hugh Smith from Of Two Minds http://www.oftwominds.com/blog.html and to John Embry, Chief Investment Strategist at Sprott Asset Management. http://sprott.com/ http://www.goldseek.com/ http://radio.goldseek.com/

Read More »Slow wage growth to keep Fed on prudent normalisation track

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December)....

Read More » SNB & CHF

SNB & CHF