Stock Markets EM FX was mixed last week, with political optimism driving the big winners ZAR and CLP. We remain cautious, as the Fed has signaled its intent to continue tightening in 2018. Stock Markets Emerging Markets, December 18 Source: economist.com - Click to enlarge Brazil Brazil reports October monthly GDP proxy Monday, which is expected to rise 2.8% y/y vs. 1.3% in September. Brazil then reports November current account and FDI data Wednesday. It then reports mid-December IPCA inflation Thursday, which is expected to rise 2.95% y/y vs. 2.77% in mid-November. The central bank releases its quarterly inflation report that same day. Last COPOM statement suggested a 25 bp cut to 6.75% could be seen at

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Stock MarketsEM FX was mixed last week, with political optimism driving the big winners ZAR and CLP. We remain cautious, as the Fed has signaled its intent to continue tightening in 2018. |

Stock Markets Emerging Markets, December 18 Source: economist.com - Click to enlarge |

BrazilBrazil reports October monthly GDP proxy Monday, which is expected to rise 2.8% y/y vs. 1.3% in September. Brazil then reports November current account and FDI data Wednesday. It then reports mid-December IPCA inflation Thursday, which is expected to rise 2.95% y/y vs. 2.77% in mid-November. The central bank releases its quarterly inflation report that same day. Last COPOM statement suggested a 25 bp cut to 6.75% could be seen at the February 7 meeting, but rising price pressures may make that difficult. HungaryNational Bank of Hungary meets Tuesday and is expected to keep rates steady at 0.90%. However, it may ease again via unconventional measures. CPI rose 2.5% y/y in November, shy of the 3% target and in the bottom half of the 2-4% target range. PolandPoland reports November retail sales, industrial and construction output, and PPI Tuesday. While some slowing is expected, the economy remains robust. Central bank minutes will be released Thursday. We believe it will not be able to hold rates steady through 2018, and instead look for the first hike by mid-year. MalaysiaMalaysia reports November CPI Wednesday, which is expected to rise 3.4% y/y vs. 3.7% in October. Bank Negara does not have an explicit inflation target. However, falling inflation should allow it to remain on hold for now. Next policy meeting is January 25, no change is expected. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 1.0% y/y in November, shy of the 2.5% target and right at the bottom of the 1-4% target range. We believe BOT will remain on hold until well into 2018. TaiwanTaiwan reports November export orders Wednesday, which are expected to rise 8% y/y vs. 9.2% in October. The central bank meets Thursday and is expected to keep rates steady at 1.375%. CPI rose 0.4% y/y in November. The central bank does not have an explicit inflation target, but low price pressures should allow it to remain on hold well into 2018. Taiwan reports November IP Friday. KoreaKorea reports trade data for the first 20 days of December Thursday. Regional trade data is robust so far in Q4, and so markets will be looking for a continuation of this going into 2018. Czech RepublicCzech National Bank meets Thursday and is expected to keep rates steady at 0.50%. However, about a third of the analysts polled look for a 25 bp hike to 0.75%. CPI rose 2.6% y/y in November, above the 2% target and in the top half of the 1-3% target range. We lean towards a hike, but it will be a close call. MexicoMexico reports mid-December CPI Thursday, which is expected to rise 6.65% y/y. If so, it would be well above the 3% target as well as the 2-4% target range. Banco de Mexico just hiked 25 bp to 7.25% last week. If price pressures top out, it may be able to stand pat in early 2018. South AfricaSouth Africa reports November budget data Friday. The fiscal outlook remains poor, and we continue to believe that Moody’s will downgrade the nation after the next fiscal year budget is released in February. |

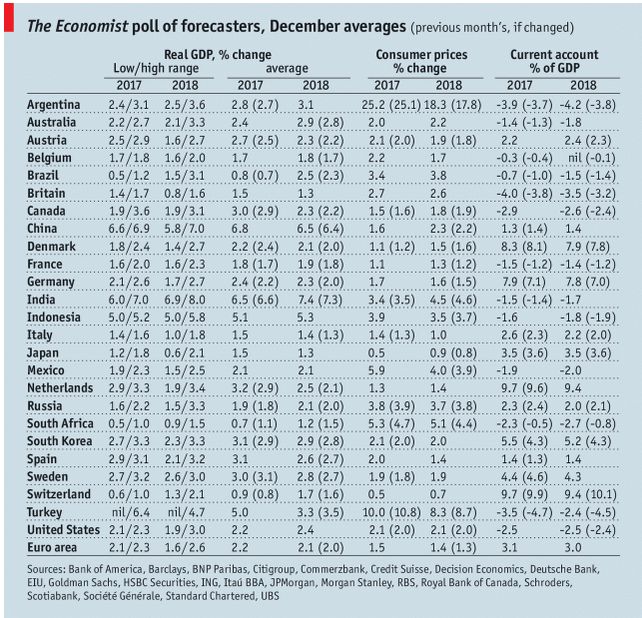

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, December 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent,win-thin