The prospects that the Republican-controlled legislative branch would find a compromise to tax cuts were enhanced when a few senators appeared to capitulate without much to show for it may have helped lift US stocks and dollar ahead of the weekend. Each chamber must now approve the reconciliation measure, which does not look particularly like either the House or Senate bills, though the regressive thrust was maintained. Passage will be relatively easy in the former, but it will be a close call in the Senate. There are a few Republican Senators that do not face re-election, like McCain and Flake from Arizona and are not subject to party retaliation. Still, despite “maverick” rhetoric, and others professing concern

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Trends, GBP, JPY, newsletter, SEK, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The prospects that the Republican-controlled legislative branch would find a compromise to tax cuts were enhanced when a few senators appeared to capitulate without much to show for it may have helped lift US stocks and dollar ahead of the weekend. Each chamber must now approve the reconciliation measure, which does not look particularly like either the House or Senate bills, though the regressive thrust was maintained.

Passage will be relatively easy in the former, but it will be a close call in the Senate. There are a few Republican Senators that do not face re-election, like McCain and Flake from Arizona and are not subject to party retaliation. Still, despite “maverick” rhetoric, and others professing concern about the resulting deficit, the odds of passage have improved.

At the same time, the Federal Reserve raised interest rates and the median Fed forecast was for three more hikes next year. This combination of expanding fiscal policy and tighter monetary policy is associated with an appreciating currency. As we have pointed out before, the two “textbook” examples are the Reagan-Volcker mix of the early 1980s and the terms of the reunification of Germany in the early 1990s. A year ago, many investors were led to believe the fiscal expansion was going to be delivered in 2017.

The failure to deliver this stimulus in this year and recovery of the anxiety over European politics since the Dutch and French elections in the spring are reasonable factors behind the poor dollar performance and that the euro was the strongest of the major currencies this year. It appears that early 2018, attention will turn to the other leg of the fiscal stimulus–an infrastructure initiative. A public-private partnership is consistent with the signals from the White House, which could see around $200 bln from the federal government, though it may be cannibalized from some current programs.

We agree with those that do not expect the tax adjustment on overseas profits by American companies to boost the dollar directly or fuel much investment. The direct impact on the dollar is limited by the fact that most of the estimated $2 trillion overbooked abroad is kept in dollar-based investments.

The jaundiced eye toward the prospect of an investment spree is derived from experience. Research of the 2004 tax holiday, for example, cited by the Wall Street Journal, found that for every dollar repatriated, 79 cents went for repurchasing shares, and another 15 cents went to dividends. The research found no increase in domestic dividends. Also, as reported ahead of the weekend, US industry is operating at a little more than 77% of capacity. The last cyclical expansion saw capacity utilization rates exceed 80%.

There may be an indirect impact on the dollar from the changed tax regime for internationally book profits. It may come through the current account narrowing as investment income is repatriated. Traditional models of valuation in the foreign exchange market emphasize the basic balance as a key driver of movement in the foreign exchange market.

The recent string of economic data suggests that the synchronized economic expansion in the US, Europe, and Japan is strengthening as the year winds down. The stronger than expected US retail sales report points to a strong personal consumption report this week and prompted economists to revise up estimates for Q4 US GDP. The Atlanta Fed sees it tracking 3.3%, while the New York Fed sees 4.0%. The NY Fed also projects Q1 18 growth of a little more than 3%.

EurozoneThe flash December PMI for the eurozone suggests another quarter of strong growth. The expansion is broadening, and recent high frequency data shows regional laggards, like France and Italy, are also participating. It may not be a coincidence that as the economy has strengthened, Macron’s public support has risen. Italian elections look likely to be held in the first part of March next year, and, perhaps the better economic performance will ease the attraction of extreme policies. Sweden’s Riksbank meets in the week ahead. The upside surprise in the November CPI and strong growth will discourage it from extending its asset purchase program. On a trade-weighted basis, the krona is largely flat on the year, which is helping keep financial conditions easy. The euro is trading near seven-year highs against the krona. If the currency weakness persists, it may give the central bank the latitude to consider a rate hike around the middle of next year. The immediate political focus in Europe is on the German attempt to put together a new government three months after the election. In Germany’s way, there will be exploratory talks first. These can talk several weeks. Merkel does not want to lead a minority government. The SPD does not want to lose its identity in another coalition government. Both blocs do not want to return to the polls. In the September election, both saw their public support fall to post-WWII lows. A type of arrangement where the SPD and CDU/CSU agree on several broad programs and then fight for the rest of the agenda in the Bundestag seems like a minority government but may be the basis of a compromise. It allows the SPD to still be the main opposition party (rather than the AfD) and draw the parliamentary privileges associated with it. Catalonia goes to the polls next weekend. The polls suggest a tight race between the secessionists and federalists. However, many secessionists have moderated their message. Still, regardless of the results, whatever political uncertainty that lingers for a bit, it is unlikely to return to levels seen in earlier in Q4. Before the weekend, Fitch upgraded Portugal’s sovereign rating to BBB from BB+. It is the first mover, as S&P sees Portugal as a BBB- credit and Moody’s is a step below at Ba1. Investors may be ahead of the rating agencies as Portugal has outperformed. Consider that over the past three months, Portugal’s benchmark 10-year bond yield has fallen 99 bp compared with a 13 bp decline in Spain’s comparable yields and a 26 bp decline in Italy. |

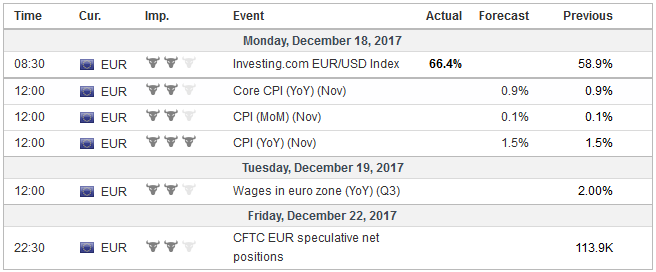

Economic Events: Eurozone, Week December 18 |

United KingdomThe UK government’s belated success in getting the EU’s approval to start talks about the post-exit was tarnished by the loss of having the last word on Brexit. In a narrow vote, Parliament secured the right to grant final approval. Another confrontation and possible defeat could be avoided in the week ahead if the specific date of 31 March 2019 can be removed from withdrawal bill. Given that Q1 18 will be spent discussing the transition period, a hard date may make that period more difficult. It is in the EU’s interest to argue for a standstill agreement; this is one that keeps the UK firmly in the EU’s rules and regulations, while the UK would be technically out of the EU. It also seems widely recognized that the Irish border issue has not been resolved in any meaningful way, implying that it could emerge again as a formidable challenge. |

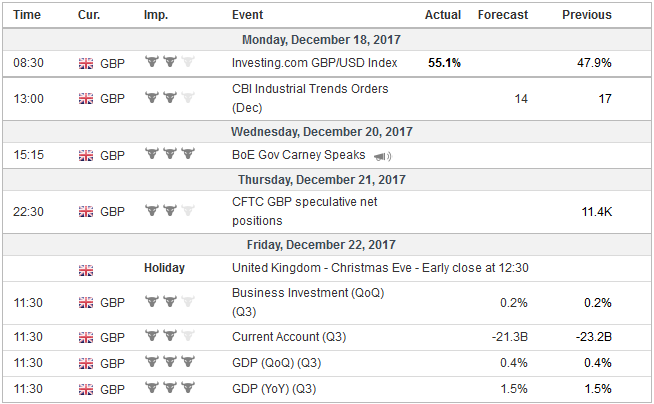

Economic Events: United Kingdom, Week December 18 |

United StatesThe US two-year premium over the UK appears to be the widest in at least a quarter century and sterling its flirting with a downtrend line drawn off the 2014 and 2016 highs. Speculative positions are relatively extreme still. Sterling seems particularly vulnerable. We do not think the widening of the cross-currency basis swap in the dollar’s favor is much more than a particularly intense bout of year-end funding needs. It is particularly pronounced in Europe. Australian dollars, for example, can be swapped for dollars for three months at a premium to US dollars. The dollar premium over the yen is in the area it was at the end of last year. The dollar premium for euro swaps is at its most extreme since 2012, while the dollar premium for sterling swaps appears to be at a record extreme. EONIA jumped at the end of November, and it has spent the first half of December gradually returning to its longer-term averages near -36 bp. When the debt ceiling is lifted, the adjustment of the US Treasury cash holdings will drain around $400 bln of liquidity via mostly bill sales, and this may raise dollar premium on cross currency swaps next year. Regulatory incentives may also influence the availability of dollar funding. |

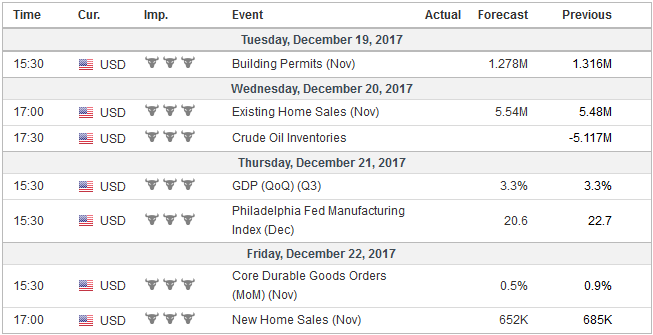

Economic Events: United States, Week December 18 |

JapanThe Bank of Japan meets in the week ahead. It is most unlikely to change policy. It may also be a little early to seriously discuss a more flexible approach to the 10-year yield target. Also, there is nothing quite like have critics on the governing board that may want take new action to reach the 2% inflation target to make Kuroda appear cautious. Less appreciated is Abe’s tax initiative. At the end of last week, the government announced a targeted corporate tax cut and progressive changes individual taxes. The corporate tax cut was for companies that “sharply increased wages.” If businesses follow the government’s tax incentives, the statutory rate could fall to 20% from 29.7% presently. The basic income allowance will be increased. This tax break will be funded by raising the income tax on incomes above JPY8.5 mln (~$75.5k). Taxes are also likely to increase for pensioners with incomes greater than JPY10 mln. |

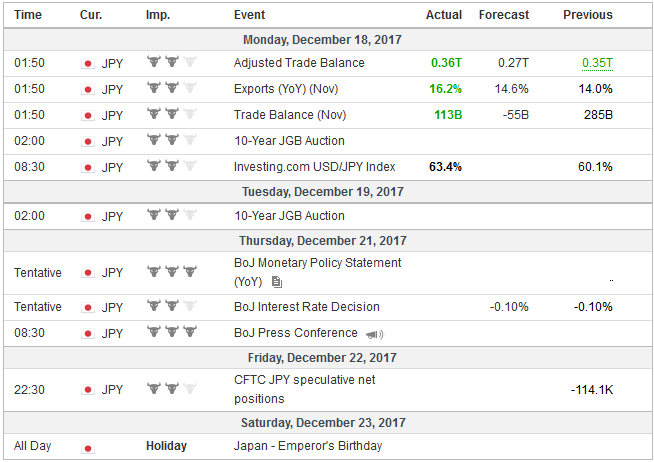

Economic Events: Japan, Week December 18 |

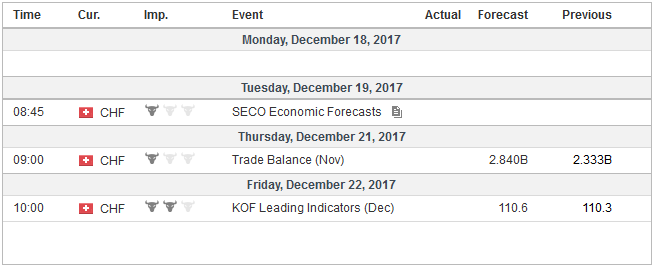

Switzerland |

Economic Events: Switzerland, Week December 18 |

Tags: #GBP,#USD,$EUR,$JPY,Featured,newsletter,SEK