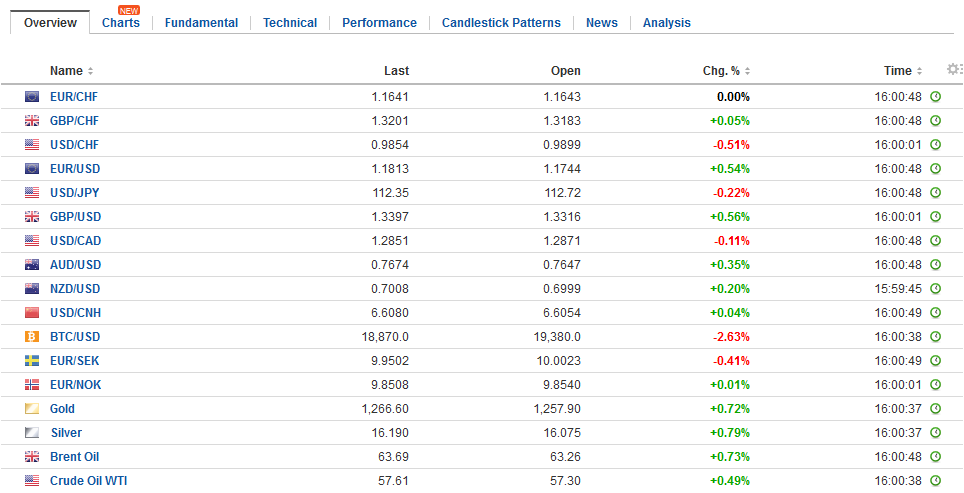

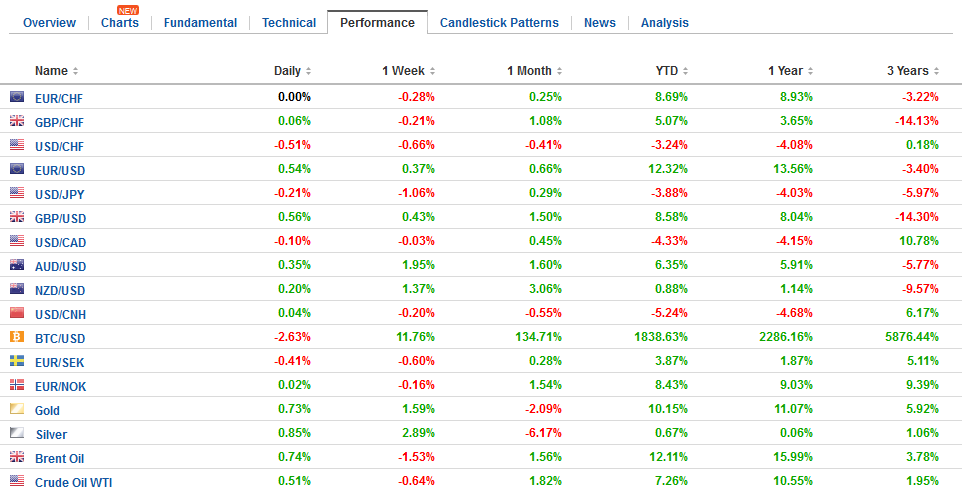

Swiss Franc The Euro has risen by 0.10% to 1.165 CHF. EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure initiative is likely to be unveiled as early as next month. Before that, the US is poised to ratchet up the tension on China. Despite the unilateral thrust of the Trump Administration, in its confrontation with China, it has been wise to coordinate efforts with the EU and Japan. Last week, the three

Topics:

Marc Chandler considers the following as important: $CNY, China, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, FX Trends, Japan Exports, Japan Imports, Japan Trade Balance, newslettersent, trade, USD/CHF, WTO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.10% to 1.165 CHF. |

EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX TrendsThe two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure initiative is likely to be unveiled as early as next month. Before that, the US is poised to ratchet up the tension on China. Despite the unilateral thrust of the Trump Administration, in its confrontation with China, it has been wise to coordinate efforts with the EU and Japan. Last week, the three issued a joint statement, a thinly veiled criticism of China for its policies and funding that led to excess capacity in numerous sectors. They agreed to target market-distorting subsidies. |

FX Daily Rates, December 18 |

| The US recently formally supported the EU in a WTO case whose crux was whether China should be classified as a market economy. The US, EU, and Japan say no. If China were to be declared a market economy, it would be more difficult for countries to resist unfair trade practices, like dumping (selling a good cheaper in a foreign market than in the domestic market). The US, Japan, and the EU protest a range of China’s policies, from market-distorting subsidies to forces technology transfers and infringement of intellectual property rights.

One way that China projects its power is by co-opting local elites with lucrative sinecures and consultancy contracts. Consider the recent news that former UK Prime Minister Cameron has taken a post with head up a GBP750 mln fund that is to help finance China’s One Belt One Road initiative. The fund is supported by the UK government though no taxpayers’ money will be invested. |

FX Performance, December 18 |

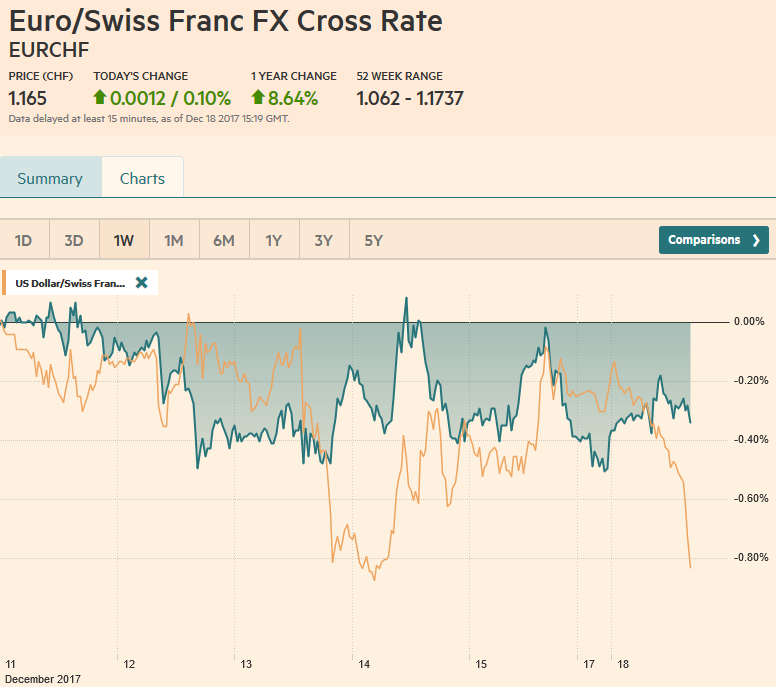

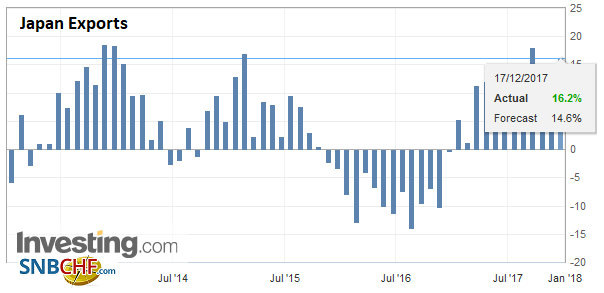

Japan |

Japan Exports YoY, Nov 2017(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

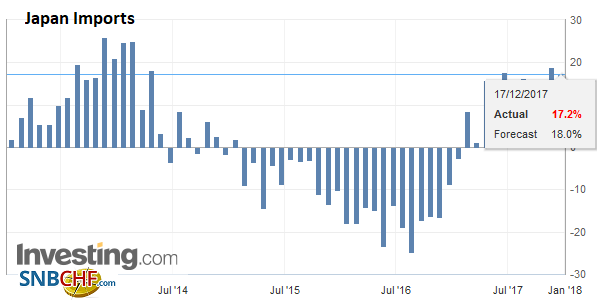

Japan Imports YoY, Nov 2017(see more posts on Japan Imports, ) Source: Investing.com - Click to enlarge |

|

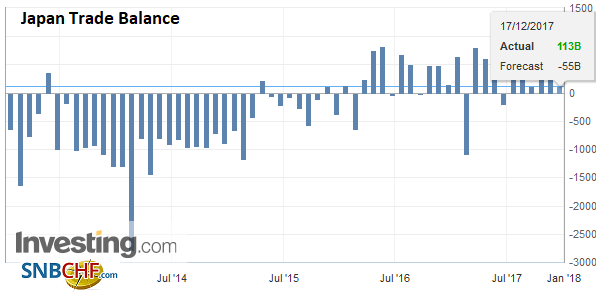

Japan Trade Balance, Nov 2017(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

|

Eurozone |

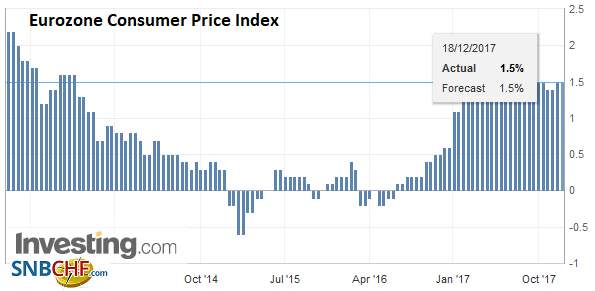

Eurozone Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

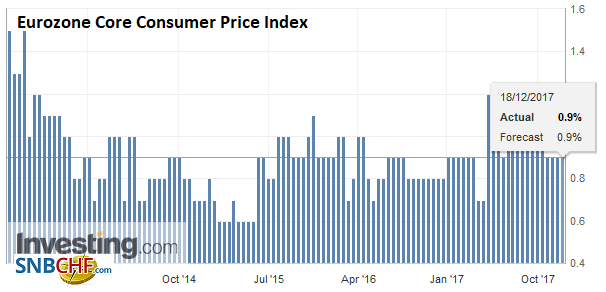

Eurozone Core Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

In 2015, when Cameron was Prime Minister a Shanghai-London stock connect initiative was announced. It has yet to be implemented. A bond-connect type of facility has been announced more recently, though it too may not be implemented quickly. Recall Cameron also led the UK to break what up until that time was unified front by Europe, the US, Japan, and others not to participate in China-sponsored Asia Infrastructure Investment Bank.

President Trump is expected to unveil his national security strategy on Monday. Press reports indicate that it will accuse China of “economic aggression.” The document will reportedly upgrade China from a competitor on every element and dimension of power to a threat. The broad thrust of getting tougher on China will enjoy bipartisan support.

Still, one might think reasonable wonder if the bark is not worse than the bite. As a candidate, Trump promised to cite China as a currency manipulator. He hasn’t. Trump promised to slap 25% tariff on imports from China. He hasn’t. The Administration talked tough on sanctioning Chinese banks who facilitate trade with North Korea. Only one bank has been cited, and it is was one of the country’s smallest banks.

The administration launched investigations on national security grounds into steel and aluminum imports. Nothing has come from these, and a new charge on intellectual property rights has been made. Many countries, including the US, have become more selective of direct investment by Chinese companies, especially from those that are state-owned. Australia’s Prime Minister Turnbull crackdown on China’s interference with its domestic politics has led to a Labour Senator’s resignation over links to a Chinese billionaire connected to the Chinese Communist Party.

Even through the summer, it appeared US Administration officials were kept in check by the President’s need for China’s cooperation in dealing with the threat posed by North Korea. China has stepped up pressure on North Korea and has voted in favor of US initiatives in the UN Security Council. However, China has stopped short committing itself to measures that have not be sanctioned by the UN, and Trump officials seem to believe China could do more but is unwilling.

The Trump Administration pays little notice to the fact that this year through October, China bought $130 bln of US Treasuries (bills, notes, and bonds). It sold almost $190 bln of Treasuries in 2016. Instead, the fact that the US calculates that this year’s bilateral trade deficit with China is set to grow over last year’s $347 bln has been a thorn in its side. Through October, the bilateral deficit stood at $310 bln.

The US tax bill provides an opening for China. Chinese and European officials have expressed concerns about some features of the proposed tax reform. Some features may not stand up to WTO scrutiny. Other features, like the tax treatment of intrafirm loans, may put some subsidiaries of foreign companies, including financial firms, as a distinct disadvantage.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: $CNY,China,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,Japan Exports,Japan Imports,Japan Trade Balance,newslettersent,Trade,USD/CHF,WTO