When to Sell? The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s...

Read More »Mark O’Byrne–Time For Hard Assets Nearly At Hand #3866

Mark believes that fundamentals do not justify the massive gains in US stocks in recent years (rise of over 300% in the S&P 500 since 2009). Does the U.S. have a perfect 'Goldilocks economy' or a vulnerable 'Food stamp economy'? Are we in a ultra low interest rate, liquidity driven "everything bubble"? Is margin debt one of the factors driving speculation in stocks and a stock market bubble? Is there 'irrational exuberance' and overly bullish sentiment as seen in the...

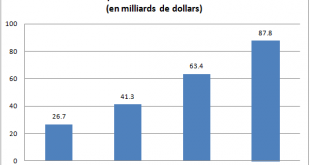

Read More »Favoritisme délibéré ou perte de contrôle ? La politique d’investissement chaotique de la Banque nationale suisse

Favoritisme délibéré ou perte de contrôle ? La politique d’investissement chaotique de la Banque nationale suisse « Je peux vous assurer que nos spécialistes en investissement connaissent parfaitement leur métier » (Fritz Zurbrügg) « La BNS n’a aucun spécialiste qui peut dire ‘il faut prendre le titre A plutôt que le titre B’ » (Jean-Pierre Danthine) « Nous décidons de nos placements avec le concours d’un...

Read More »FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Swiss Franc The Euro has risen by 0.19% to 1.1622 CHF. EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past...

Read More »Shrinkflation Intensifies – Stealth Inflation As Thousands of Food Products Shrink In Size, Not Price

– Shrinkflation continues to take hold across UK, Ireland and US for sixth year running– Shrinkflation sees consumers gets less product, but at the same or increased price– 2,500 products have shrunk according to Office of National Statistics in UK– Reported inflation is between 1.7% and 3% but actually much higher– Shrinkflation is financial fraud, unreported inflation in stealth mode– Gold is hedging inflation and...

Read More »The secret life of a bunker

There is a place, in the Graubünden mountains, which remained top secret until 1994... Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit...

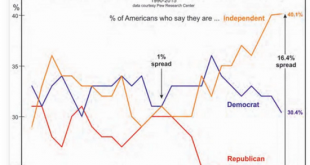

Read More »Is Congress Finally Pushing Back Against Security Agencies’ Over-Reach?

The last time the U.S. Congress pushed back against the Imperial Presidency and the over-reach of the nation’s Security Agencies was 43 years ago, in 1975. The last time the U.S. Congress pushed back against the Imperial Presidency and the over-reach of the nation’s Security Agencies was 43 years ago, in 1975. In response to the criminal over-reach of the Imperial Presidency (Watergate) and to the criminal over-reach of...

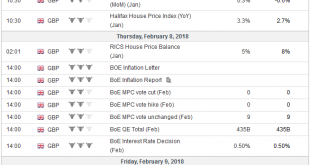

Read More »FX Weekly Preview: Changing Fortunes in the Capital Markets or Long Overdue Correction?

The chief development in the capital markets has been the sharp drop in equities after a significant rally since late last year and the rise in yields. The dollar had fallen alongside the exuberant appetite for risk assets. Anecdotal evidence supports the idea that the greenback was used as a funding currency to purchase those risk assets. The Dollar Index’s first weekly advance since the middle of last December amid...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended Friday on a weak note and capped off a week of softness. We felt that more and more EM policymakers were getting uncomfortable with FX strength and are likely welcome this recent weakening. However, that’s only if their stock and bond markets hold up, which they are (for now). Friday was clearly the dollar’s day to shine. What’s more important is how the markets trade Monday. Do they sell...

Read More »Motorway stickers set to bring in CHF350 million

Anyone wanting to drive on Swiss motorways from Thursday will need the new 2018 vignette, a charge sticker which is placed inside one’s windscreen, costing CHF40 ($42.90). The Federal Customs Administration said on Wednesday it expected to sell around 9.6 million vignettes, resulting in a net income of some CHF347 million. The authorities estimated a third of the vignettes would be bought by foreign drivers. They added...

Read More » SNB & CHF

SNB & CHF