A Starbucks coffee shop in Lucerne, Switzerland (Keystone) - Click to enlarge The Swiss food giant Nestlé is set to pay Starbucks $7.1 billion (CHF7.1 billion) to market the American firm’s products outside Starbucks’ coffee shops. Under the alliance deal, announced on Monday, Starbucks and Nestlé have agreed to work together on marketing strategies and innovation. “This transaction is a significant step for...

Read More »FX Daily, May 07: Greenback Starts Week on Firm Note

Swiss Franc The Euro has risen by 0.08% to 1.1959 CHF. EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar recovered from a softer tone in early Asia and is higher against nearly all the major and emerging market currencies as North American market prepare to start the new week. The news stream is light and investors remain on edge...

Read More »FX Weekly Preview: Geopolitics Becomes More Salient as Monetary Policy Plays for Time

Say what one will, US President Trump is vigorously projecting what he believes are American interests. There is virtually no sign of the isolationism that many observers had anticipated. Indeed, as we have argued, the America First rejection of the League of Nations that Trump harkens back to was not isolationist as much as unilateralist. And the same is true of the Trump Administration. He is trying to get North Korea...

Read More »Emerging Markets: What Changed

Summary Bank Indonesia is taking measures to stabilize the local bond market. The Philippine central bank is tilting more hawkish. Czech National Bank cut its inflation forecasts. The Turkish government is loosening fiscal policy to drum up popular support. S&P downgraded Turkey to BB- with stable outlook. Argentina officials are taking significant measures to support the peso. Brazil central bank made a subtle...

Read More »Own Some Gold and Avoid Overvalued Assets

We could be heading for a golden age – or a return to the 1970s The cost to the US government of borrowing money for a decade came within sniffing distance of 3% yesterday. The US ten-year Treasury yield is sitting at 2.96% as I write this morning, having got to 2.99% yesterday. Does this really matter? After all, 3% is just another number. On the one hand, you’d be right to think that. On the other, it’s not so much...

Read More »Europe chart of the week – Corporate Sector Soft Patch

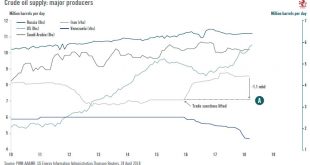

Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bonds purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of...

Read More »Results of the Annual General Meeting 2018 of UBS Group AG

- Click to enlarge UBS shareholders approved all the Board of Directors’ proposals at today’s Annual General Meeting in Basel. Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Jeremy Anderson and Fred Hu as new members of the Board. They approved the payment of an ordinary dividend of CHF 0.65 per share, an increase compared with the previous year. They...

Read More »“Blood In The Streets” Of U.S. Gold Bullion Coin Market

U.S. Mint American Eagle gold coin sales collapse to weakest April since 2007 giving contrarian value buyers another buy signal Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday. The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25...

Read More »House View, May 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in...

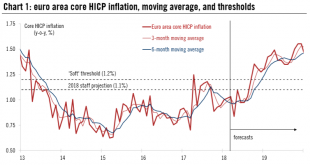

Read More »Policy normalisation may be delayed in Europe

Communication from European central banks over the last few weeks has been consistent with a more cautious stance and, in some cases, is likely to lead to delays in their monetary policy normalisation plans. Each situation is different, with a loss in economic momentum, subdued underlying inflation, and political risks playing a role to varying degrees in the euro area, the UK, Switzerland and Sweden. At the same time,...

Read More » SNB & CHF

SNB & CHF