L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains.

La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis. Cette théorie adopte une approche expérimentale de l’économie, basée sur la conviction fondamentale que la monnaie est créée par le gouvernement à travers les dépenses budgétaires, et non par les banques centrales et privées, comme l’affirme la théorie traditionnelle.

Pour les promoteurs de la MMT aux Etats-Unis, l’actuelle faiblesse de l’inflation est signe d’une insuffisance de monnaie au sein du système et, par conséquent, d’un déficit des dépenses budgétaires. Leur

Articles by Team Asset Allocation and Macro Research

MMT, la nouvelle théorie en vogue à Washington

September 19, 2019L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains.La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis. Cette théorie adopte une approche expérimentale de l’économie, basée sur la conviction fondamentale que la monnaie est créée par le gouvernement à travers les dépenses budgétaires, et non par les banques centrales et privées, comme l’affirme la théorie traditionnelle.Pour les promoteurs de la MMT aux Etats-Unis, l’actuelle faiblesse de l’inflation est signe d’une insuffisance de monnaie au sein du système et, par conséquent, d’un déficit des dépenses budgétaires. Leur argument central est que la

Read More »Modern Monetary Theory

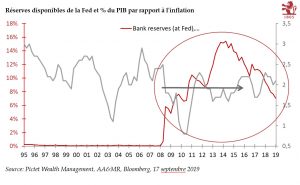

September 18, 2019This new theory is now in vogue in Washington DC, and its influence could grow.Modern Monetary Theory (MMT), a macroeconomic theory advocated by heterodox economists, is gaining traction in the US. The theory adopts an experimental approach to economics, underscored by the fundamental belief that money is created by the government via budget spending – and not via money creation by central and private banks, as per traditional theory.Proponents of MMT in the US interpret current low inflation levels as an indication of not enough money in the system, and as a result, insufficient budget spending. Central to their view is that the Federal Reserve should be merged with the US Treasury department and interest rates brought to zero in conjunction with increased fiscal spending.Investment

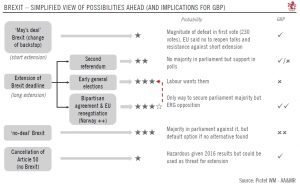

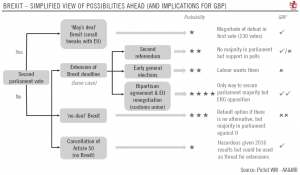

Read More »What if we have a ‘no deal’ Brexit ?

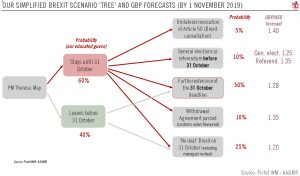

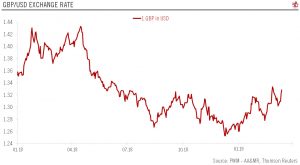

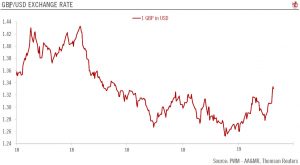

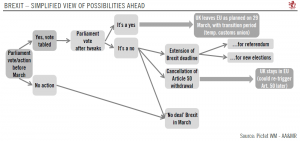

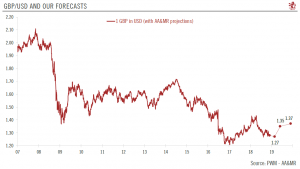

August 29, 2019Although still not our central scenario, a no-deal Brexit is a distinct possibility on the 31 October, with distinct implications for the UK economy and financial assets.Prime Minister Boris Johnson has chosen a more aggressive negotiation technique than predecessor Theresa May, flagging the UK’s readiness to exit the European Union without a transition deal (current deadline is 31 October) if the withdrawal agreement that May reached with Brussels is not improved to match his demands. Furthermore, Johnson has curtailed parliamentary time to reinforce his ‘no deal’ threat and muffle opposition.Our base case is still an extension of the 31 October deadline, but the ‘no deal’ risk remains high. While undoubtedly negative for growth, the cost of ‘no deal’ is probably not as dire as the

Read More »Brexit – Boris Johnson vs parliament

July 22, 2019With Boris Johnson likely to become prime minster this week, our base case is for another extension to the 31 October Brexit deadline, probably for several months.Boris Johnson looks likely to be succeed Theresa May as prime minister, after the internal Tory party contest. Johnson prominently waves the no-deal Brexit flag (the possibility of exiting the EU without a deal) by the 31 October deadline, in order to get more concessions from the EU – a relatively perilous negotiation strategy.Uncertainty around what Johnson will ultimately do remains very high, as does how events around Brexit will take shape. Our view is that parliament will step up to the plate and resist a slide to ‘no deal’ by default, despite its own lack of cohesion. Our base case is for another extension to the 31

Read More »Trade and disinflation keep central banks dovish

July 5, 2019Global central banks are in dovish, if not outright easing, mode, as they seek to maintain easy monetary conditions to counteract an uncertain trade outlook and disinflationary forces.Global central bank rhetoric has turned even more dovish lately, encapsulated by the latest Federal Reserve (Fed) meeting and the European Central Bank (ECB) policy forum in Sintra, both in June. With global manufacturing slowing and inflation failing to pick up much, the Fed has signalled clearly that its next move might be a rate cut, ending a period of neutral ‘wait and see’. ECB President Mario Draghi has put further easing on the table for September unless the euro area economy improves in the meantime.Here, we present a summary of our near-term forecasts for various central banks.US Federal Reserve.

Read More »A spanner in the works

May 8, 2019While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed.

At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its trade delegation would still go to Washington DC this week for another round of talks.

We have long expected the path to a US-China trade deal to be bumpy, but we still think some sort of short-term agreement can be found. However, it is bound to be fragile, leaving a lot of deep-rooted issues

A spanner in the works

May 7, 2019While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed.At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its trade delegation would still go to Washington DC this week for another round of talks. We have long expected the path to a US-China trade deal to be bumpy, but we still think some sort of short-term agreement can be found. However, it is bound to be fragile, leaving a lot of deep-rooted issues unresolved. Indeed, we believe US-China trade will remain a key issue beyond the

Read More »Brexit update: a very British fudge

April 12, 2019The EU has granted a Brexit deadline extension to 31 October of this year. The next step after this extension could be another extension.Following the EU Council summit, 31 October 2019 is the new Brexit deadline. Given that we see limited probability of a sudden unknotting of the current UK parliamentary gridlock, our core scenario is that the deadline will be extended again. The current timeframe is too short to really work on an alternative to the current ‘Withdrawal Agreement’, which has already been rejected three times by parliament.This creates a bizarre situation, in which the UK is obliged to participate in the EU Parliament elections this May and subsequently send MEPs to Brussels. The question is how restive the Tory party becomes. While technically it is difficult to topple

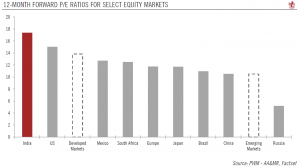

Read More »Indian elections start today

April 11, 2019Understanding what is at stake and what it means for markets as the world’s largest elections commence.Today, India’s 2019 general elections to determine the next Lok Sabha (the lower house) kick off. India is divided into 543 constituencies, each represented by one member of the Lok Sabha. The party or the coalition that wins a simple majority (272 seats) will form the government. Nearly 900 million voters across the nation will head to election booths to cast their votes over the next five weeks until 19 May. The final results will be counted on 23 May.Current poll results, which tend not to be a highly reliable indicator for a variety of reasons, point to Prime Minister Modi’s BJP as the front runner, but short of obtaining a majority. As things stand, the most likely scenario seems to

Read More »Brazil pension reform: Bolsonaro’s moment of truth

March 19, 2019In a context of financial and demographic pressure, the pension reform in Brazil may be the single most important source of long-term fiscal savings for the country, and necessary to restore fiscal balance.The sharp deterioration of Brazil’s public debt in recent years, triggered by a deep recession in 2014-2016, now requires the imminent restoration of fiscal balance in order to bring public finances back onto a more sustainable path.In this regard, pension reform is widely seen as the single largest source of long-term fiscal savings, given the generosity of Brazil’s current pension system and outsized related spending compared to its demographics.An ambitious draft reform was sent by the Bolsonaro administration to Congress at the end of February as a basis for parliamentary

Read More »Brexit update: UK parliament opts for an extension

March 18, 2019After an eventful week in parliament, the Brexit ball is set to keep rolling as MPs move to extend the 29 March deadline.

The British Parliament concluded a series of votes on Brexit this week with an intention to extend the 29 March Brexit deadline. What remains unclear at this point is whether the UK will seek a short (two months) or a longer extension (two years). It is also not clear what this extension would be used for. A longer extension would help to fundamentally rethink and rejig the Brexit strategy, including potentially leading to a softer Brexit than the one sought by May in her initial deal with the EU. That said, we remain in flux about what exactly will happen during a long extension, and

Brexit update: UK parliament opts for an extension

March 15, 2019After an eventful week in parliament, the Brexit ball is set to keep rolling as MPs move to extend the 29 March deadline.The British Parliament concluded a series of votes on Brexit this week with an intention to extend the 29 March Brexit deadline. What remains unclear at this point is whether the UK will seek a short (two months) or a longer extension (two years). It is also not clear what this extension would be used for. A longer extension would help to fundamentally rethink and rejig the Brexit strategy, including potentially leading to a softer Brexit than the one sought by Theresa May in her initial deal with the EU. That said, we remain in flux about what exactly will happen during a long extension, and particularly what would help break the logjam (new elections? a

Read More »ECB: to LTRO, or not LTRO, what is the question?

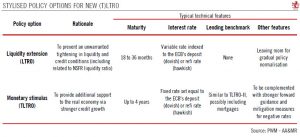

March 6, 2019The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs.

Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions.

We expect the ECB to send out a strong signal at its March meeting that it will soon offer a new (T)LTRO, with details likely to be announced in April or June.

The ECB’s decision on (T)LTRO will, of course, matter to euro area banks, mostly for the periphery’s banks who have been the biggest consumers of

ECB: to LTRO, or not LTRO, what is the question?

March 5, 2019The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs.Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions.We expect the ECB to send out a strong signal at its March meeting that it will soon offer a new (T)LTRO, with details likely to be announced in April or June.The ECB’s decision on (T)LTRO will, of course, matter to euro area banks, mostly for the periphery’s banks who have been the biggest consumers of current TLTROs.Read full report here

Read More »Brexit update

March 1, 2019An extension of the Brexit deadline looks likely, but for what?Recent political developments in the UK and the increased focus on an extension to the current Brexit deadline in particular, have reduced the risk of a ‘no deal’ Brexit on 29 March. Prime Minster Theresa May will put her divorce deal to another Parliament vote on 12 March. While the vote will likely be much narrower than the initial vote in January, we assume that it will also be rejected.This will open the door for another vote on 14 March, when Parliament will vote on an extension – possibly until end June – of the Brexit deadline, although this would also require the consent of all EU member states. We now assume an extension as our central scenario.An extension would keep a lot of uncertainties on the table, however.

Read More »Brexit update – UK Parliament spins its wheels

January 30, 2019‘Wake up call’ yet to happen as the clock ticks on.A series of votes in the British parliament resulted in little new progress on the Brexit front; the outcome being that Theresa May will return to Brussels to attempt to improve her ‘deal’, which a new parliamentary vote scheduled for mid-February.However, Brussels has rejected the idea of reopening negotiations and it is not clear that mere tweaks will be enough to overcome the intense opposition in parliament to May’s initial deal.Bottom line is that there is still no sign of a meaningful ‘wake-up call’ happening in parliament, which is disappointing. A crucial amendment that would have banned a ‘no-deal’ Brexit and constrained May’s cabinet was voted down; and parliament remains hesitant to expand its powers and spearhead

Read More »Brexit update – PM May seeks new direction

January 17, 2019Theresa May reaches out to find all-party agreement on Brexit.This week, the British Parliament rejected Theresa May’s divorce deal en masse. At the same time, she has kept enough support to stay in power, as a motion of no confidence was rejected.How the Brexit process unfolds from now remains highly uncertain. The recent turn of events means there is an increasing probability of the UK seeking an extension of the 29 March deadline (now our base case) as May reaches out to opposition members of parliament (MPs) to find an agreement. Possibly revolving around a customs union with the EU, interparty agreement could lead to a ‘softer’ version of Brexit than May’s initial divorce deal.Complicating matters, however, is the insistence by the Labour Party’s leadership on pushing for new

Read More »Brexit logjam persists

December 14, 2018It’s always darkest before dawn, and dawn is not yet in sight.It was another eventful week in British politics, although there was still no meaningful progress on clearing the way for a smooth Brexit before the crucial deadline of March 2019. While a smooth exit remains our base-case scenario, uncertainty remains sizeable.PM Theresa May postponed the British Parliament vote on her Brexit divorce deal, and vowed to re-open discussions with European Union (EU) partners. However, things are not off to a great start as discussions so far have confirmed that her European counterparts remain reluctant to budge.May survived an internal party leadership contest by 200-117; but the vote also showed a significant minority in the Tory party could challenge May’s divorce deal, even with tweaks, when

Read More »Exit of central bank head adds to Indian market uncertainties

December 12, 2018The surprise resignation of governor of the Reserve Bank of India poses a question mark over its policies and independence ahead of next year’s election.Urjit R. Patel, the governor of the Reserve Bank of India (RBI), unexpectedly resigned on 10 December, just four days before a crucial board meeting on discuss internal governance issues.His resignation came amid a period of acute tension between the RBI and the Indian government over a range of issues, from banking regulations and the use of excess reserves to central bank governance—but in a nutshell it comes down to the question of the RBI’s independence.In the short term, the impact of Patel’s departure on the Indian economy and RBI policies may be fairly limited, but RBI’s monetary policy may turn more dovish from its current

Read More »Some good news despite likely defeat of Theresa May’s Brexit deal in parliament

December 7, 2018Risks of a “no deal” Brexit appear to be receding.Theresa May’s Brexit plan is likely to be defeated in the 11 December (unless postponed) UK parliament vote. The press is currently suggesting a defeat by a margin of around 100 MPs, but if it is higher, then it would seriously handicap the chances of a ‘yes’ in a second vote. A rejection of May’s deal would open the door to several scenarios, including the possibility of a second vote after possible tweaks to the current deal, although squeezing out concessions from the European Union could be tough.How Brexit will unfold remains highly uncertain. We still see a high likelihood of a second vote passing with tweaks made to the current deal, thereby avoiding a no-deal Brexit on 29 March next year. That said, the possibility of an extension

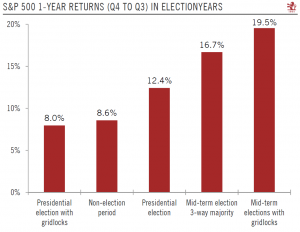

Read More »Gridlock in Washington and the markets

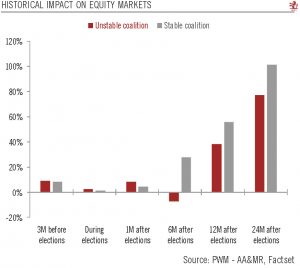

November 2, 2018Political gridlock has been good news for US stocks in the past, but Tuesday’s midterm elections come at a time of rising doubts about market prospects.The US midterm elections take place on Tuesday 6 November. Based on recent polls, the most likely outcome is that the Democrats will regain a small majority in the House of Representatives, while the Republicans keep a small majority in the Senate.Should the Democrats take control of the House, Washington D.C. could be back to ‘gridlock as usual’, with little new major legislation being passed over the next two years. But while Democrats may not want to work with Trump, there could be ‘passive compromise’ on trade policy, particularly with regard to China.The main alternative to this scenario is failure by the Democrats to mobilise

Read More »Contrasting Fortunes within the Euro Area

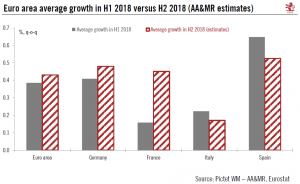

September 21, 2018While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes.

The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators show that Italy is the only of the four major euro area economies to face weaknesses both in export-led manufacturing and services, due domestic political uncertainties (including the upcoming state budget) as well as global trade tensions.

We remain bearish on euro area peripheral bonds as Italian

Contrasting fortunes within the euro area

September 19, 2018While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes.The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators show that Italy is the only of the four major euro area economies to face weaknesses both in export-led manufacturing and services, due to domestic political uncertainties (including the upcoming state budget) as well as global trade tensions.We remain bearish on euro area peripheral bonds as Italian budget discussions could continue to stoke volatility. However, some

Read More »A modified approach for a low-return environment

June 26, 2018Download issue:English /Français /Deutsch /Español /ItalianoOur annual Horizon publication contains Pictet Wealth Management’s analysis of expected returns over a 10-year horizon. Simply put, major asset classes are expected to deliver lower returns. But alternatives offer greater potential — in exchange for a degree of illiquidity.This abridged edition of Horizon sets out our rationale behind our expected returns forecasts relative to risk for the next ten years across some 35 asset classes.This exercise forms the basis of our strategic asset allocation policy – our core decisions on asset class weightings over the long term. It also helps enormously with client expectations and transparent communications. We choose a 10-year time period because our client profile typically exhibits a

Read More »Pressure is rising in US-China trade

June 18, 2018We are not yet in a trade war, but US brinkmanship means the risk is rising.The US will hit USD34 billion (out of a total of USD500 billion) of imports from China with a 25% trade tariff, effective 6 July. The official reason is to sanction China’s intellectual property theft and to fire a warning shot against the ‘Made in China 2025’ industrial policy. This move has prompted retaliatory measures by the Chinese authorities on imports from the US of the same scale and intensity. For now, the tariffs on USD34 billion of imports about to be enacted will have a negligible impact on both the US and Chinese economies, in our view (less than 0.1% on both economies). But the risk of sliding into a full-blown trade war is increasing. We continue to see the tariffs as US brinkmanship (although of a

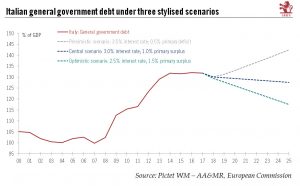

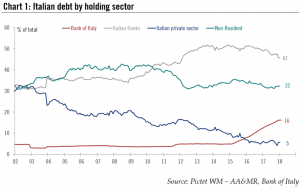

Read More »Different paths for Italian public debt

June 14, 2018The fiscal policies of the new Italian government will determine the trajectory for Italian debt. The high uncertainty means we are bearish on euro area peripheral bonds.At 132% of GDP, Italy has the second-highest public debt load in the euro area after Greece. Italy’s debt ratio has remained broadly stable over the past five years, but the sustainability of public debt remains highly vulnerable to shocks, let alone a recession or financial crisis.In addition, here are still lots of questions regarding the new coalition government’s real intentions on fiscal policy. Crucially, one needs to understand the extent to which the new government’s proposals will impact Italian debt sustainability.In our central scenario, we envisage the new government implementing only part of its fiscal

Read More »Eurosceptic Italian government faces a reality check

May 22, 2018More than two months after the general election, the Italian political impasse seems close to being broken, with the League and the Five Star Movement (M5S) likely to form a government. M5S and the League together have a majority in both the upper and lower houses. After several document leaks this week, a final common programme was published today. The document needs the approval of party members. The focus will shift to the designation of a prime minister (PM) and the distribution of key ministerial positions—a process in which the President of the Republic, Sergio Mattarella, will play a crucial role and likely act as a guarantor of stability. He will be able to use his power of veto if policies proposed by the

Read More »Eurosceptic Italian government faces a reality check

May 18, 2018With the putative M5S-League government publishing its final common programme, we take a look at the road ahead for the Italian economy and for Italian government debt.We expect negative noise surrounding the Italian budget to intensify initially, but believe that negotiations with Brussels will result in compromises eventually, including dilution of the incoming Italian government’s fiscal easing measures. The biggest risks lie with the proposed rolling-back of the pension reforms, in our view.Italian spreads are likely to remain under widening pressure in the near term. However, the new government has put at risk our central scenario of a slight widening of Italian spreads to 160 bp by year-end, with a higher risk of overshoot to 200 bp depending on the actual policy measures

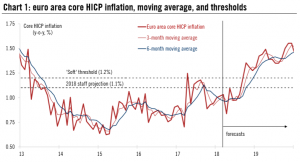

Read More »Policy normalisation may be delayed in Europe

May 5, 2018Communication from European central banks over the last few weeks has been consistent with a more cautious stance and, in some cases, is likely to lead to delays in their monetary policy normalisation plans. Each situation is different, with a loss in economic momentum, subdued underlying inflation, and political risks playing a role to varying degrees in the euro area, the UK, Switzerland and Sweden. At the same time, significant growth and FX spillovers from one region to the other suggest that there is always a limit to the degree of monetary policy divergence.

Although the next policy decisions by the ECB and SNB could be delayed, we have made no change to our policy normalisation scenario. We expect the ECB to