Summary:

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in the bond market once again. We have been taking measures to calibrate our risk exposures accordingly. Our most recent tactical move saw us reduce credit risk in our portfolios in favour of short-term US bonds for US investors and absolute return bond funds for other investors. The latter offer more

Topics:

Perspectives Pictet considers the following as important: 7) Markets, asset allocation, Featured, Macroview, market stance, newsletter, Pictet positioning, Pictet Strate, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in the bond market once again. We have been taking measures to calibrate our risk exposures accordingly. Our most recent tactical move saw us reduce credit risk in our portfolios in favour of short-term US bonds for US investors and absolute return bond funds for other investors. The latter offer more

Topics:

Perspectives Pictet considers the following as important: 7) Markets, asset allocation, Featured, Macroview, market stance, newsletter, Pictet positioning, Pictet Strate, Pictet strategy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Pictet Wealth Management’s latest positioning across asset classes and investment themes.

- In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration.

- Volatility is still higher than last year, and has increased noticeably in the bond market once again. We have been taking measures to calibrate our risk exposures accordingly.

- Our most recent tactical move saw us reduce credit risk in our portfolios in favour of short-term US bonds for US investors and absolute return bond funds for other investors. The latter offer more flexibility and greater return potential than corporate credit at a time of heightened volatility.

- With volatility still higher than in 2017, we remain attuned to the possibilities offered by alternative investments (such as private equity), which offer low correlations with traditional assets.

Commodities

|

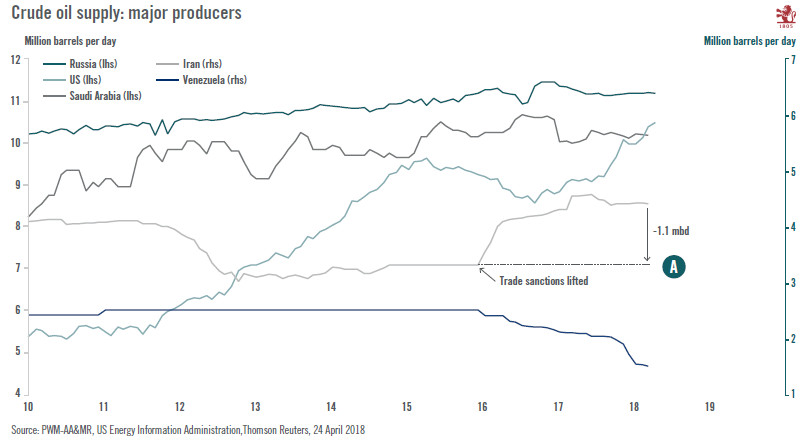

Crude Oil Supply: Major Producers, 2010 - 2018 |

Currencies

- Driven by signs of moderating growth momentum elsewhere and expectations of US interest rate rises, the US dollar strengthened and emerging market currencies weakened in April. However, our baseline scenario is that the dollar’s strength will fizzle out in the medium term.

- After a further limited decline against the dollar in the short term, we believe the euro could rebound to USD1.25 by the end of the year.

Equities

- April proved moderately positive for equities after a good earnings season. Cyclicals, which we favour given strong business momentum, outperformed in the US and Europe, while defensive sectors such as real estate and consumer staples lagged.

- Equity volatility remains higher than last year, helping lower valuations. But a possible fall in trade tensions and an extra push from buoyant M&A activity should boost stock markets.

- The ten-year US Treasury yield touched 3% towards the end of April. Our baseline scenario remains that the 10-year yield will peak at 3.1% this year, although we are paying attention to inflation.

- We remain neutral on US and euro investment-grade credit, with the relatively attractive coupon it provides compensating for the slight widening in spreads we expect over the remainder of the year.

Alternatives

- Most hedge fund strategies rose in value in Q1, proving resilient in the face of market turbulence. We remain overweight tactical trading and relative strategies that stand to benefit from arbitrage trades.

- We are also overweight long/ short equity strategies, believing price dispersion is likely to help stock pickers and that opportunities to short equities may become more prevalent.

- While private equity fundraising eased in Q1, competition and valuations remain high, with managers ever-more pressed to add value. A disciplined selection process continues to be vital for private-equity portfolio managers.

Tags: Asset allocation,Featured,Macroview,market stance,newsletter,Pictet positioning,Pictet Strate,Pictet strategy