Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI

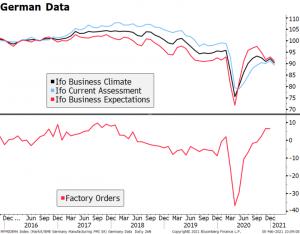

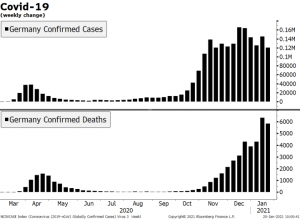

German data is showing further signs of weakness; BOE delivered a less dovish than expected hold; Deputy Governor Ramsden said he envisions slowing the pace of QE later this year

Japan reported December household spending; RBA released its quarterly Statement on Monetary Policy; Indonesia Q4 GDP data came in around expectations; India kept rates on hold at 4.00% as mostly expected; Chinese tech giant Alibaba placed $5 bln in international bonds in maturities of up to 40 years

The dollar is

Articles by Win Thin

Dollar Remains Firm Despite Dovish Fed Hold

January 28, 2021The FOMC delivered a dovish hold, as we expected; we get our first look at Q4 GDP; Fed manufacturing surveys for January will continue to roll out; weekly jobless claims data will be closely watched

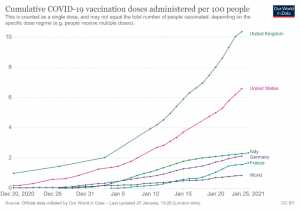

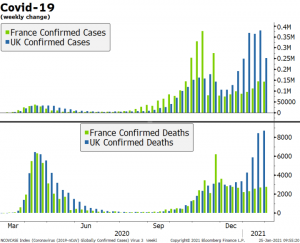

The vaccination gap between the UK and the US vs. Europe continues to wide, and grievances against suppliers are getting worse; Germany January CPI will be reported; if inflation risks were rising , ECB officials wouldn’t be so concerned about the strong euro and its disinflationary impact

In a clear signal that relations with China will remain frosty, the US reaffirmed its military support of Japan; Japan reported December retail and department store and supermarket sales; Philippines GDP growth continues but still disappointed in Q4

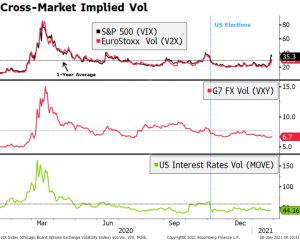

Equity markets implied volatility

Dollar Trading Sideways as FOMC Meeting Begins

January 26, 2021The FOMC begins its two-day meeting today with a decision out tomorrow afternoon; Senate Minority Leader McConnell has finally agreed to a power-sharing deal based on the 2001 model; President Biden signaled willingness to negotiate his stimulus proposal in order to get a bipartisan deal; Fed manufacturing surveys for January will continue to roll out; Brazil reports mid-January IPCA inflation

Italian Prime Minister Conte will reportedly resign today; Italian Treasury’s models suggest the budget deficit could blow out to -9.2% of GDP this year; UK reported labor market data; Hungary is expected to keep the base rate steady at 0.60%.

BOJ minutes suggest it is looking for ways to strengthen the nation’s economic potential as part of its policy review; we are

Dollar Flat as Markets Await Fresh Drivers

January 25, 2021Discussions on President Biden’s proposed $1.9 trln fiscal package are getting off to a rocky start; Fed manufacturing surveys for January will continue to roll out

ECB Governing Council member Olli Rehn viewed yield curve control for the region as “not sensible”; on the virus front, Norway tightened mobility restrictions, France looks set to impose another lockdown, and the UK considering closing borders; Germany IFO survey for January came in slightly lower than expected

Japan will sell JPY500 bln of 40-year JGBs tomorrow; polls suggest Suga’s government continues to lose support; the border dispute between India and China is flaring up again

The dollar is flat as markets await fresh drivers. However, technical indicators suggest the dollar will resume weakening

Dollar Weakness Continues Ahead of ECB Decision

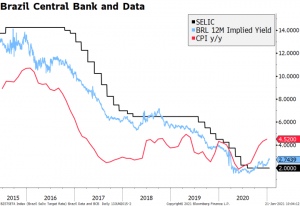

January 22, 2021Joe Biden became the 46th President of the US; three Democratic Senators were also sworn in; weekly jobless claims data will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; Brazil kept rates on hold at 2.0%, as expected

ECB is expected to keep policy unchanged; Norges Bank kept rates steady at 0%, as expected; Chancellor Sunak is reportedly drawing up plans to extend support for the UK labor market in the coming months; South Africa is expected to keep rates steady at 3.5%; Turkey central bank kept rates steady at 17%, as expected

BOJ kept policy unchanged, as expected; Australia reported solid December jobs data; Korea is posting strong export figures at the start of the year; Indonesia kept the

Dollar Continues to Soften Ahead of Inauguration

January 21, 2021President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon; he will hit the ground running by announcing a raft of executive orders upon taking office; Janet Yellen’s confirmation hearing was revealing; Canada and Brazil are expected to keep rates unchanged

Italian political tensions appear to have calmed; German government announced a hardening of mobility restrictions; UK reported December CPI

BOJ began its two-day meeting; PBOC left policy rates on hold, as expected; Malaysia kept rates steady at 1.75%, as expected; Taiwan December export orders surged

The dollar continues to edge lower. After trading at the highest level since December 21 near 91 Monday, DXY has fallen three straight days. Retracement objectives from

Drivers for the Week Ahead

January 19, 2021President-elect Biden will be inaugurated Wednesday; security in Washington DC and many state capitols has been beefed up due to concerns of violence; the Senate reconvenes Tuesday and will immediately begin work on confirming Biden’s cabinet choices; reports suggest that if asked, Yellen will disavow a weak dollar policy whilst affirming commitment to a market-determined exchange rate

Weekly jobless claims data Thursday will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; BOC meets Wednesday and is expected to keep policy unchanged

ECB meets Thursday and is expected to keep policy unchanged; Italian political intrigue will continue this week; Norges Bank meets Thursday and is expected to keep policy

Dollar Regains Some Traction as Markets Search for Direction

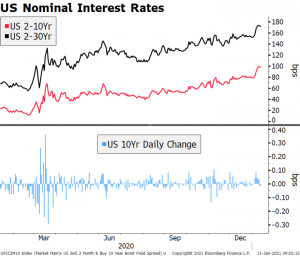

January 14, 2021House Democrats will move ahead with impeachment proceedings today; December CPI data will be the US highlight; heavy UST supply this week wraps up with a $24 bln sale of 30-year bonds; December monthly budget statement will be of interest the Fed releases its Beige Book report; several Fed officials pushed back against notions of tapering anytime soon

Italian political noise continues; UK and Germany warned of more restrictive measures; Russia will restart its reserve accumulation policy; Poland is expected to keep rates steady at 0.10%

Japan’s government extended a state of emergency to seven more prefectures; BOJ may downgrade its economic assessment at next week’s meeting; PBOC may be getting uncomfortable with yuan strength

The dollar is getting some limited

Dollar Runs Out of Steam as Sterling Leads the Way

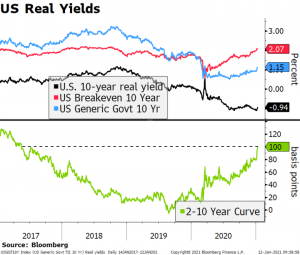

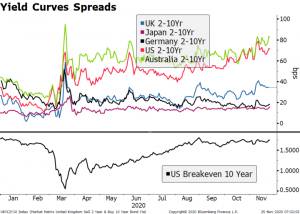

January 12, 2021The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation

Yields in Europe and UK are following the trend higher in the US markets, but not as fast; Italy is facing another bout of political instability; BOE Governor Bailey pushed back against negative rates

Japan’s government will declare a state of emergency for Osaka, Kyoto, and Hyogo prefectures as soon as tomorrow; Malaysia assets are underperforming on further lockdowns

The dollar bounce may be running out of steam. Market sentiment has improved, with equity markets higher and bond prices lower. DXY is down today after four straight days higher. Given the position skew,

Drivers for the Week Ahead

December 21, 2020As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday

All eyes remain on Brexit; things are getting very tricky now in terms of timing; with the UK going into stricter lockdown, we believe the pressure is building on Prime Minister Johnson to strike a deal

Japan has a busy week; the BOJ will keep markets guessing after it unexpectedly announced a policy framework review; Australia begins reporting November data

Brexit concerns are weighing on market sentiment as the new week gets under way. This is giving the

Dollar Continues to Soften Ahead of FOMC Decision

December 20, 2020Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI

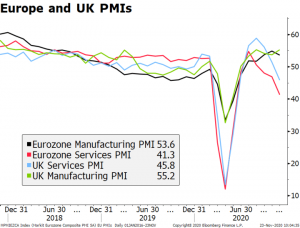

The latest Brexit headlines are sounding optimistic; UK November CPI came in weaker than expected; eurozone December preliminary PMI provided an upside surprise; EU regulators lifted their curb on bank dividends

Japan reported weak November trade and mixed preliminary December PMI readings; Australia will challenge China at the WTO

Improved market sentiment continues to weigh on the dollar. DXY is down for the third straight day and four of the past five, and traded today at a new low for this cycle near

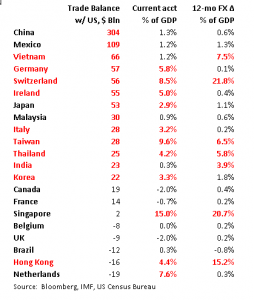

Some Thoughts on the Latest Treasury FX Report

December 18, 2020The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report named Switzerland and Vietnam as currency manipulators. Both countries came under scrutiny in the last report and so this week’s announcement was only surprising in that it was made by a lame duck administration that will be gone in a month.

RECENT DEVELOPMENTS

This is the first Treasury FX report since January. In previous administrations, the semi-annual reports were typically released in April and October. However, the trade war disrupted this cycle. In 2019, only one report was issued and that was in May. Under President Trump, the report has become highly politicized but that is likely to change under President Biden. Please see A Brief

FOMC Preview

December 15, 2020The two-day FOMC meeting starts tomorrow and wraps up Wednesday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in the coming months.

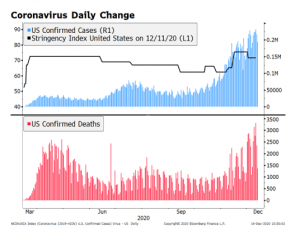

RECENT DEVELOPMENTS

The US outlook has worsened since the November FOMC meeting. Infection numbers are making new highs with no sign of abating. There is no national strategy to contain the virus, so we are getting a hodgepodge of state level responses. With the pandemic stretching on, markets are realizing that the current phase of the recovery is stalling out right now, and that the full recovery will be pushed out further into next year with the likelihood of tighter restrictions

Drivers for the Week Ahead

December 13, 2020The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday; optimism on a stimulus deal appears to be picking up; the two-day FOMC meeting ending with a decision Wednesday will be important

November retail sales Wednesday will be the US data highlight for the week; Fed manufacturing surveys for December will start to roll out; weekly jobless claims Thursday will be important; Canada has a busy data week

Brexit talks have been extended; BOE, Norges Bank, and SNB decisions come Thursday and no changes are expected; UK reports some key data; eurozone has a fairly quiet week

Japan has an eventful data week; BOJ wraps up its two-day meeting Friday; Australia has a fairly busy week

Optimism on Brexit and US stimulus is

Dollar Rally Running Out of Steam Ahead of ECB Decision

December 10, 2020Stimulus talks drag on; US November CPI will be today’s data highlight; US Treasury wraps up a big week of auctions today with $24 bln of 30-year bonds on offer

The November budget statement will hold some interest; weekly jobless claims will be closely watched; Brazil left rates unchanged at 2.0% but made some important hawkish changes to its forward guidance; Peru is expected to keep rates steady at 0.5%

Brexit negotiations have been extended again; two-day EU summit begins; ECB is widely expected to add more stimulus; UK data was mostly weaker in October

Japan estimates the latest stimulus package will boost GDP by JPY20.1 trln; China will start collecting extra duties on Australian wine starting tomorrow; default risk in the Chinese corporate sector remains a

Jittery Markets Keep the Dollar Afloat (For Now)

December 9, 2020US fiscal negotiations are taking longer than expected; US Treasury auctions $56 bln of 3-year notes; we believe the Fed is watching the yield curve closely; Brazil reports November IPCA inflation; Chile kept rates on hold at 0.50% and tweaked its asset purchase program

UK Prime Minister Johnson is going to Brussels for high-level Brexit negotiations with EC President von der Leyen; there are no signs of progress in the EU budget and recovery fund negotiations; Germany reported a firm December ZEW survey

Japan reported October household spending, real cash earnings, current account, and final Q3 GDP; stimulus efforts continue in Japan

The dollar is stabilizing a bit. Given all the event risk this week, it’s not that surprising that markets on the defensive.

Some Thoughts on a Potential US Government Shutdown

December 6, 2020The US Congress has returned from recess with a lot on its plate. Priority must be given to passing an omnibus spending bill that prevents a government shutdown after December 11. The next round of fiscal stimulus has taken on greater urgency and may be attached to the wider spending bill.

RECENT DEVELOPMENTS

The Senate returned from recess Monday and the House returns today. Much of the work ahead will be done behind the scenes as lawmakers negotiate passage of an omnibus spending bill by December 11 in order to avert a government shutdown. While we expect a deal to be struck, it is possible that Congress will be forced to pass another continuing resolution that would keep the government temporarily funded as negotiations continue.

We are in this current

Dollar Stabilizes but Weakness to Resume

December 5, 2020There are new efforts to pass another round of stimulus sooner rather than later; we warn against getting too optimistic; US bond yields rose in anticipation of stimulus; Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US

The Fed releases its Beige Book report for the December FOMC meeting; ADP releases its private sector jobs estimate, with consensus at 430k; Brazil outperformed yesterday on positive fiscal comments from President Bolsonaro

The UK became the first country to approve a Covid-19 vaccine; on the Brexit front, headlines have been mixed but that’s nothing unusual

Reports suggest the EU is likely to delay previously agreed funding to Poland and Hungary as punishment for their veto threats; Germany reported

Dollar Plumbs New Depths With No Relief In Sight

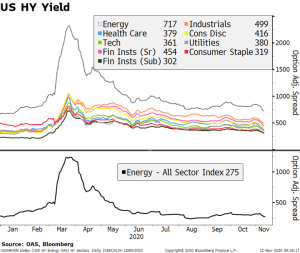

December 3, 2020Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields

ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat

The noise level around Brexit continues to rise are we approach the finish line; eurozone and UK data came in firmer than expected; Turkey November CPI came in well above expectations

BOJ is likely to extend its emergency measures at the December 17-18 meeting; Australia reported mixed October trade data; Caixin reported strong November services and composite PMI readings

Dollar weakness continues. DXY traded at the lowest level

Dollar Consolidates Ahead of Thanksgiving Holiday

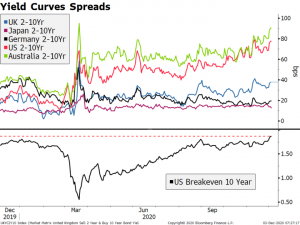

November 28, 2020The divergence in developed markets yield curves continues; the dollar is consolidating ahead of the US holiday

FOMC minutes will be released; weekly jobless claims data will be released a day early; October personal income and spending will be reported; Banco de Mexico releases its quarterly inflation report

UK Chancellor Sunak’s spending review will lay out his plans for next year; South Africa reported higher than expected October CPI

Japan’s Cabinet Office maintained its “severe” assessment of the economy; RBNZ gave an upbeat outlook in its FSR, further lowering odds of negative rates; cryptocurrencies remain in the spotlight as bitcoin trades at record highs above $19,000

The divergence in developed markets yield curves continues. The US and Australian

Dollar Weakness Resumes as Short-Covering Fades

November 25, 2020Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed

President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings

German IFO Business Climate survey for November was mixed; UK national lockdown will end next week; UK CBI reported its November distributive trades survey

Japan reported October department store sales; markets are reassessing RBNZ dovishness after reports that it may add house prices to its mandate

Sentiment is being buoyed by two incrementally positive stories. First, President Trump has

Dollar Weakness Resumes as Markets Start Another Week in Risk-On Mode

November 25, 2020Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar

Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising

President-elect Biden has reportedly picked his diplomatic team; it’s a quiet week in the US due to the Thanksgiving holiday

The latest Brexit headlines have been as optimistic as can be for this stage of the process; Eurozone preliminary November PMI readings were weaker than expected; UK preliminary November PMI readings were stronger than expected

Korea posted a strong

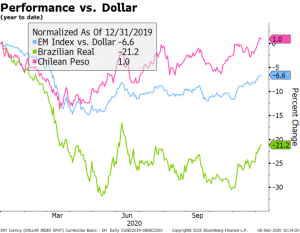

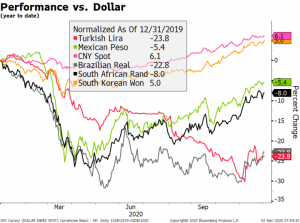

EM Preview for the Week Ahead

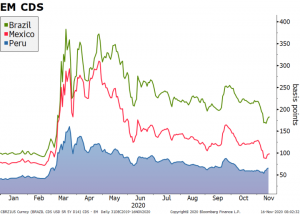

November 22, 2020Most EM currencies were up last week, once again taking advantage of broad dollar weakness. In addition, EM equities also performed well, with MSCI EM up for the third week in a row and for seven of the past eight. We expect EM assets to continue benefiting from the global liquidity story as well as the weak dollar trend.

AMERICAS

Brazil reports mid-November IPCA inflation Tuesday. Inflation is expected at 4.15% y/y vs. 3.52% in mid-October. If so, this would be the highest since mid-February and would move back into the top half of the 2.5-5.5% target range for the first time since that month. Next COPOM meeting is December 9 and rates are expected to remain steady at 2.0%. However, the CDI market is pricing in the first hike of the tightening cycle at the

Dollar Bounce Likely to Fade

November 21, 2020The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade

Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely

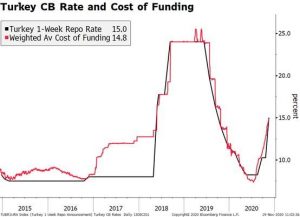

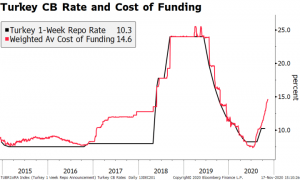

The row about EU funding takes center stage today as leaders hold a conference call to iron out their differences; UK CBI November industrial trends survey came in weak; Turkey delivered the consensus 475 bp rate hike; SARB is expected to keep rates steady at 3.5%

Record levels of infections in Japan led officials to raise its virus alert to the highest level; Australia reported strong October jobs data; Indonesia and Philippines both surprised

Turkey Central Bank Preview

November 20, 2020We expect the Turkish central bank (CBRT) to deliver a substantial rate hike at Thursday’s meeting but not as aggressive as consensus. Bloomberg’s median expectation is for a 475 bp hike. Our call is for a somewhat less aggressive move (perhaps around 400 bp) because the recent price action is likely to afford the new CBRT administration the confidence not to have to surprise on the upside. We think this makes sense. A large enough move to reaffirm the change of direction, along with a clear commitment to extend the tightening cycle, should be enough to satisfy investors while also keeping bullets for later. In this scenario, we might get a knee-jerk lira sell-off that soon stabilizes. The real concern comes if they deliver a hike of 200-250 bp or less which

Read More »Dollar Weakness Continues Ahead of US Retail Sales Data

November 19, 2020The dollar continues to soften

October retail sales will be the US data highlight; Fed manufacturing surveys for November have started to roll out; Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed

Newswires reported (again) that a Brexit deal is at hand; Hungary and Poland will veto the EU budget and recovery fund; ECB signaled that they are focused on asset purchases and long-term funding for the next round of stimulus; Hungary is expected to keep the base rate steady at 0.60%

RBA released its minutes; concerns over credit risk in China are weighing on local assets, but not the yuan; the Korean won remains unfazed by official verbal intervention

The dollar continues to soften. After peaking near 93.208 last week, DXY is down for the

Dollar Soft as Markets Start the Week in Risk-On Mode

November 18, 2020The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over; the dollar continues to soften

There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary; Fed manufacturing surveys for November will start to roll out; Peru’s interim President Merino resigned under pressure from more demonstrations

Several UK MPs and Prime Minister Johnson were forced to isolate due to a Covid outbreak; contrary to the peak globalization narrative, 15 Asian nations managed to sign a major trade deal; Japan reported strong Q3 GDP data

The week starts off with mostly upbeat data from China; PBOC delivered a net injection of funds through its 1-year MLF but left the rate unchanged at

Roadblocks and Opportunities for International Trade in 2021

November 18, 2020We see significant upside risk for global trade coming from “top down” forces (such as politics), but at the same time we expect the undercurrent reconfiguring many of the existing relationships to intensify. The “Peak Globalization” narrative (at least regarding trade) is being challenged by hopes of a revival of multilateral cooperation under Biden and the latest Asian trade agreement. But this doesn’t change our long-term view that the US and China are in an inexorable trajectory of decoupling. The backdrop is highly complex, involving: a leaderless WTO, changing trade patterns in Asia, the new UK-EU relationship, post-Covid supply chain restructuring, Trump’s final salvos against China, and Biden’s incoming administration, amongst others. We will tackle a few

Read More »Drivers for the Week Ahead

November 16, 2020The virus numbers in the US show no signs of slowing; the dollar should continue to soften

October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors

Canada has an important data week; Brexit talks will (hopefully) wind up soon; UK reports key data

Japan and Australia have busy data weeks

The virus numbers in the US show no signs of slowing. The US has never fully controlled it and the continued lack of a federal plan under Trump coupled with Trump’s reluctance to help with the transition to the Biden administration suggests things will get much worse before they get

Dollar Softens Ahead of CPI Data

November 13, 2020Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today

Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25%

UK Q3 GDP rebounded strongly but September data show a loss of momentum; Brexit talks remain unresolved; the domestic political outlook is getting (even more) turbulent; eurozone reported weak September IP

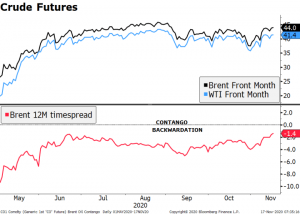

Crude prices remain well supported by the dual engines of positive vaccine news and continued OPEC output restraint; Japan reported soft September core machine orders and October PPI; India reports October CPI and