The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over; the dollar continues to soften There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary; Fed manufacturing surveys for November will start to roll out; Peru’s interim President Merino resigned under pressure from more demonstrations Several UK MPs and Prime Minister Johnson were forced to isolate due to a Covid outbreak; contrary to the peak globalization narrative, 15 Asian nations managed to sign a major trade deal; Japan reported strong Q3 GDP data The week starts off with mostly upbeat data from China; PBOC delivered a net injection of funds through its 1-year MLF but left the rate unchanged at

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over; the dollar continues to soften

- There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary; Fed manufacturing surveys for November will start to roll out; Peru’s interim President Merino resigned under pressure from more demonstrations

- Several UK MPs and Prime Minister Johnson were forced to isolate due to a Covid outbreak; contrary to the peak globalization narrative, 15 Asian nations managed to sign a major trade deal; Japan reported strong Q3 GDP data

- The week starts off with mostly upbeat data from China; PBOC delivered a net injection of funds through its 1-year MLF but left the rate unchanged at 2.95%; Indonesia October trade figures showed a huge decline in imports (-27% y/y)

The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over. At least two of Biden’s advisers in the matter said they favored targeted measures, to avoid exacerbating “the pandemic fatigue people are feeling.” That said, several states have tightened restrictions as the virus numbers in the US show no sign of slowing. The US has never fully controlled it and the continued lack of a federal plan under Trump coupled with Trump’s reluctance to help with the transition to the Biden administration suggests things will get much worse before they get better.

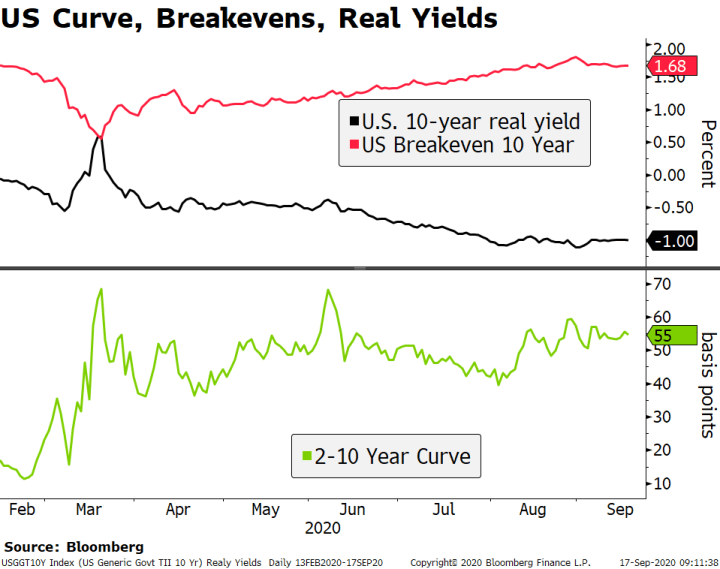

The dollar continues to soften. After peaking near 93.208 last week, DXY is down for the third straight day. A break below the 92.542 area would set up a test of the November 9 low near 92.13. Likewise, a clean break above the $1.1855 area for the euro would set up a test of its recent high near $1.1920. Sterling remains bid near $1.32 but remains subject to swings in Brexit talks (see below), while USD/JPY remains heavy. The pair traded today at the lowest level since November 9 and a break below 104.15 would set up a test of that day’s low near 103.20.

| AMERICAS

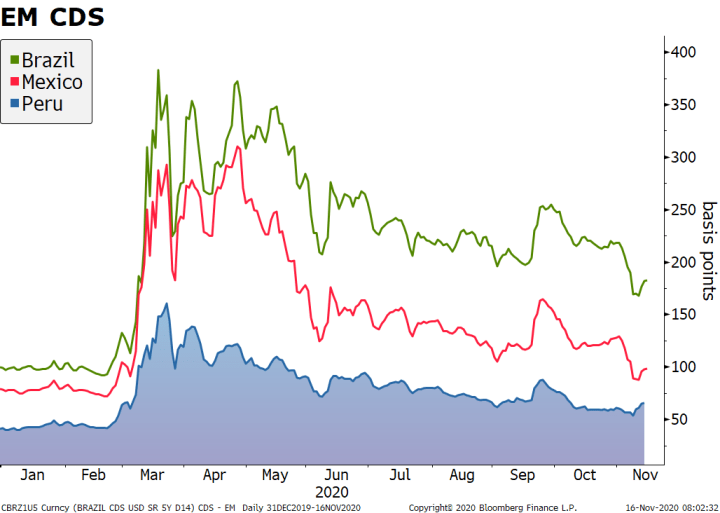

There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary. This seems very positive to us, but probably not hugely market moving. Markets were already discounting (rightly, in our view) the odds of a more controversial candidate (such as Elizabeth Warren) in part because of the challenge to get her approved in the Senate. We think odds for Yellen, along with other highly qualified female candidates such as Lael Brainard, also fits with Biden’s drive to build a more diverse cabinet. Fed manufacturing surveys for November will start to roll out. Empire survey starts the ball rolling today and is expected at 13.8 vs. 10.5 in October. Philly Fed follows up Thursday and is expected at 22.0 vs. 32.3 in October. Kansas City Fed then reports Friday and stood at 13 in October. These are the first snapshots for November and will help set the tone for other manufacturing data to come. Clarida and Daly speak, while Canada reports September manufacturing sales (1.5% m/m expected) and October existing home sales. Peru’s interim President Manuel merino resigned under pressure from more demonstrations. He lasted just five days after the successful impeachment brought down his predecessor. However, his tenure has been marred by protests and police crackdowns, leading to the deaths of two people and many injured. To make matters worse, lawmakers failed to agree on a new president on Sunday and will try again today. Peru is starting at a comparatively strong place from a sovereign risk point of view (rated BBB+ by S&P vs BB- for Brazil and BBB for Mexico), but the deterioration could be swift. |

EM CDS, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

The already complicated political situation in the UK has become even more complicated after several MPs and Prime Minister Johnson were forced to isolate due to a Covid outbreak. This will delay the revamp Johnson had planned in the wake of the latest cabinet resignations. Talks continue in Brussels ahead of the new mid-week deadline. Yet even that new deadline remains movable, as reports suggest the UK hinted that talks could be extended beyond this week as both sides struggle to close the remaining gaps. Irish Foreign Minister Coveney said there has to be a major breakthrough in the next 7-10 days, after which both sides would have to start preparations for a no-deal Brexit. We stick to our forecast of a face-saving skinny deal, with the UK likely forced to make more concessions as Johnson grows more isolated both domestically and internationally. ASIA Contrary to the peak globalization narrative, 15 Asian nations managed to sign a major trade deal. The Regional Comprehensive Economic Partnership (RCEP) was finalized after about a decade of negotiations (which originally included the US), bringing together China, Japan, and Korea along with ASEAN and the Antipodeans. India was notably absent from the deal. While this agreement furthers regional Asian integration (similar to the EU and NAFTA), indirect benefits of this agreement are expected to reach as far as the US and EU. Studies estimate this as potentially adding $200 bln to global GDP. While not extensive in terms of tariff reduction – and leaving agriculture largely untouched – it eliminates costly rules of origin requirements that had proliferated under the existing agreements. |

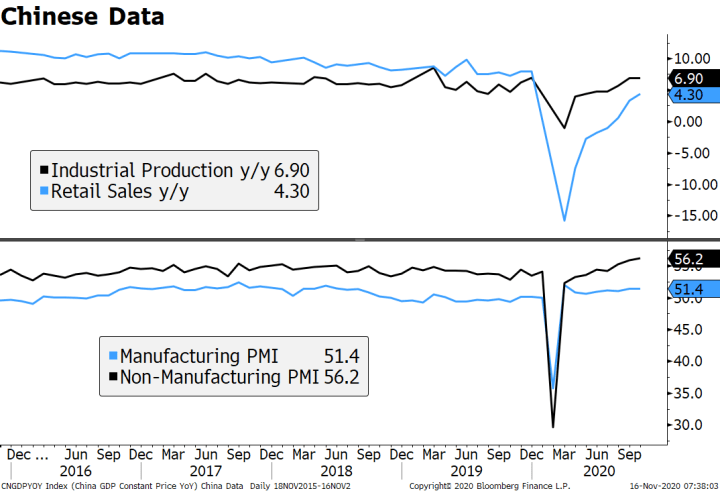

Chinese Data, 2016-2020 |

| Japan reported strong Q3 GDP data. GDP grew 21.4% SAAR vs. 18.9% expected and a revised -28.8% (was -28.1%) in Q2. Exports and consumption were the main drivers, with government stimulus efforts playing a large role. The recovery is welcome but risks to Q4 are rising along with the virus numbers. Furthermore, Japan has only clawed back about half the lost output from the pandemic, lagging most other developed economies. No wonder that Prime Minister Suga has already announced another round of fiscal stimulus before year-end.

The week starts off with mostly upbeat data from China. October IP came at 6.9% y/y, slightly higher than expected, though retail sales came in at 4.3% y/y, slightly lower than forecast. Fixed asset investment picked up to 1.8% y/y, slightly stronger than expected. Of note, the IP data showed a stronger production impulse coming from the private sector, with public enterprise figures decelerating slightly, with a similar pattern seen in the investment side. Still, we think the broader trend towards a managed rebalancing of the economy away from exports and towards domestic engines is underway, even if at a gradual pace. Meanwhile, the PBOC delivered a net injection of funds through its 1-year MLF but left the rate unchanged at 2.95%. The bank has injected over CNY1 trln ($150 bln) through the facility since August, according to Bloomberg. The funds come as banks experience tighter liquidity conditions in part due to elevated government bond purchases. Note that the 1- and 5-year loan prime rates will be set Friday and are expected to be kept steady at 3.85% and 4.65%, respectively. Still, the PBOC is likely to maintain its dovish stance well into 2021. |

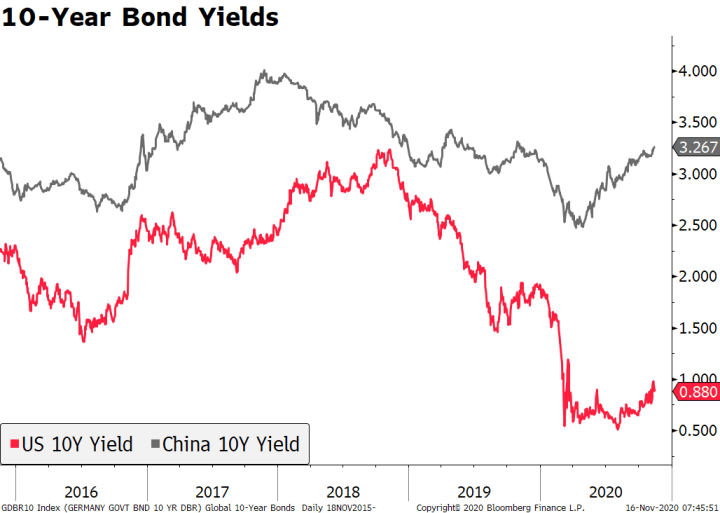

10-Year Bond Yields, 2016-2020(see more posts on 10-Year Bond Yields, ) |

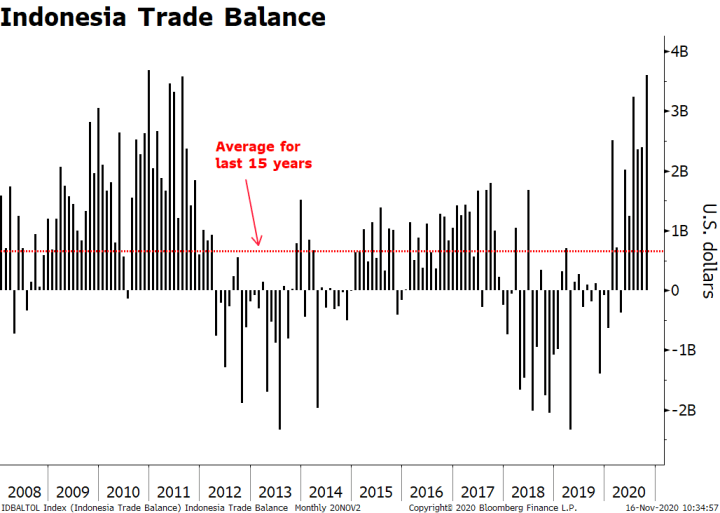

| Indonesia October trade figures showed a huge decline in imports (-27% y/y), far greater than expected. Exports came in at -3.3% y/y, contracting less than expected and leaving the trade surplus at $3.6 bln vs. $2.2 bln expected. The magnitude of the surplus should help the currency in the short term, but it makes us wary of Indonesia’s medium-term growth prospects as it suggests the downturn could be more severe than originally thought. For now, the rupiah is up 0.5%, about the average of major EM Asian countries. |

Indonesia Trade Balance, 2008-2020(see more posts on Indonesia Trade Balance, ) |

Tags: Articles,Daily News,Featured,newsletter