Senate Democrats are setting the table for passage of President Biden’s proposed .9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI German data is showing further signs of weakness; BOE delivered a less dovish than expected hold; Deputy Governor Ramsden said he envisions slowing the pace of QE later this year Japan reported December household spending; RBA released its quarterly Statement on Monetary Policy; Indonesia Q4 GDP data came in around expectations; India kept rates on hold at 4.00% as mostly expected; Chinese tech giant Alibaba placed bln in international bonds in maturities of up to 40 years The dollar is

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI

- German data is showing further signs of weakness; BOE delivered a less dovish than expected hold; Deputy Governor Ramsden said he envisions slowing the pace of QE later this year

- Japan reported December household spending; RBA released its quarterly Statement on Monetary Policy; Indonesia Q4 GDP data came in around expectations; India kept rates on hold at 4.00% as mostly expected; Chinese tech giant Alibaba placed $5 bln in international bonds in maturities of up to 40 years

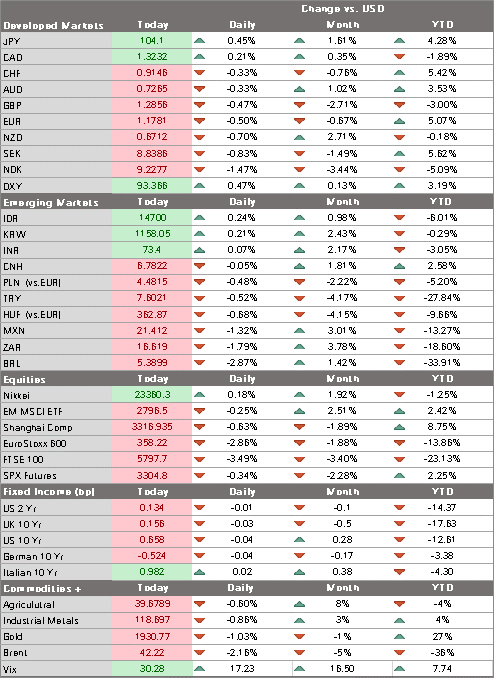

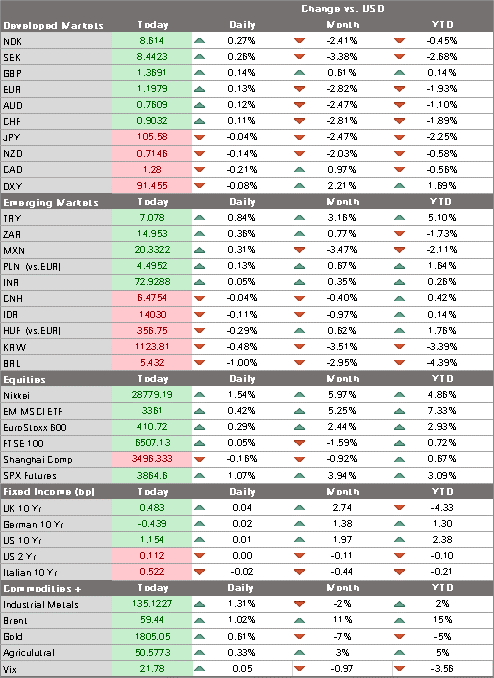

The dollar is consolidating its gains ahead of the jobs data. DXY traded today at the highest level since December 1 near 91.602 and the clean break above 91.428 yesterday sets up a test of the November 23 high near 92.80. The euro traded today at a new cycle low near $1.1950 but has since recovered a bit. It is on track to test its November 23 low near $1.18 but the break below $1.1975 signals deeper losses to $1.1745. Sterling is outperforming after the BOE yesterday delivered a less dovish than expected hold (see below). It traded back above $1.37 but may have trouble making further headway if the dollar continues to gain. USD/JPY is trading at the highest level since November 11 and is testing that day’s high near 105.70. After that is the October high near 106.10 and then the September high near 106.55.

AMERICAS

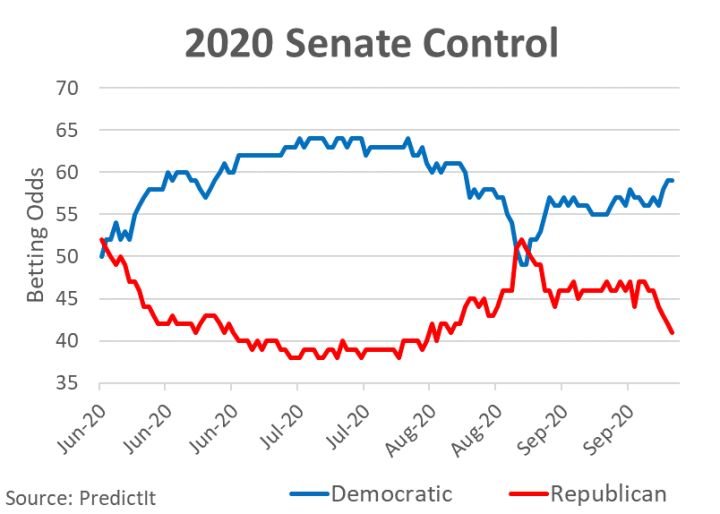

Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill. With Vice President Harris casting the tie-breaking vote, the 51-50 vote straight down party lines starts the process that would allow the bill to pass by a simple majority rather than by 60 votes. Democrats say they are still hoping for a bipartisan bill but they are clearly positioning for the possibility that no Republicans will support it. Republicans expressed dismay that their $618 bln offer was being ignored. We believe Biden is serious about a bipartisan solution but he and Democratic Senators are flexing their muscles to show that they won’t allow stimulus efforts to be slowed or derailed.

There were glimmers of possible bipartisanship in some of the votes. For instance, an amendment seeking to prevent $1400 stimulus checks from going to wealthier families passed by an overwhelming 99-1 vote, though it did not specify any threshold income level for receiving aid. Elsewhere, 60 senators blocked a proposal from Senator Cruz that opposed an expansion of work-related visas until the economy fully recovers. That vote suggests a possible compromise on an immigration deal later this year.

US January jobs data is the highlight. Bloomberg consensus for NFP started out at 100k, fell to 75k, fell again to 50k now, and then rose to 105k today. We suspect the whisper number is closer to 200k after the stronger than expected ADP reading of 174k. The unemployment rate and average weekly hours are seen steady at 6.7% and 34.7, respectively. December trade (-$65.7 bln expected) and consumer credit ($12 bln expected)will also be reported.

One final word on yesterday’s weekly claims. Regular initial and continuing claims came in lower than expected, with initial claims of 779k the lowest since late November and continuing claims of 4.59 mln the lowest since March. Elsewhere, emergency PUA and PEUC continuing claims fell by around 400k total for the BLS survey week, which is another supportive sign for today’s jobs data. Signs point to some modest healing is being seen in the labor market as 2021 gets under way and hopefully that will be reflected in NFP.

Canada also reports January jobs data. A drop of -40.0k is expected vs. a revised -52.7k (was -62.6k) in December. Of note, the December drop was due largely to part-time jobs (-95.4k), which offset a 42.7k gain in full-time jobs. Unemployment is expected to rise to 8.9% from a revised 8.8% (was 8.6%) in December. If so, this would be the second monthly rise from the cycle trough of 8.6% in November and would move further above the pre-pandemic rate of 5.7% from last February. For now, fiscal policy will bear the load of stimulus as the Bank of Canada is likely to remain on hold for now. December trade and January Ivey PMI will also be reported.

Colombia reports January CPI. Headline inflation is expected at 1.65% y/y vs. 1.61% in December. If so, inflation would accelerate for the second straight month while remaining well below the 2-4% target range. Last week, the bank delivered a hold at Governor Villar’s first meeting. The vote was 5-2, the same as it was back in December. That means Governor Villar voted with the hawks this time. The bar for another cut looks high but we can’t rule it out entirely as the recovery is limited by new restrictions in the major cities.

| EUROPE/MIDDLE EAST/AFRICA

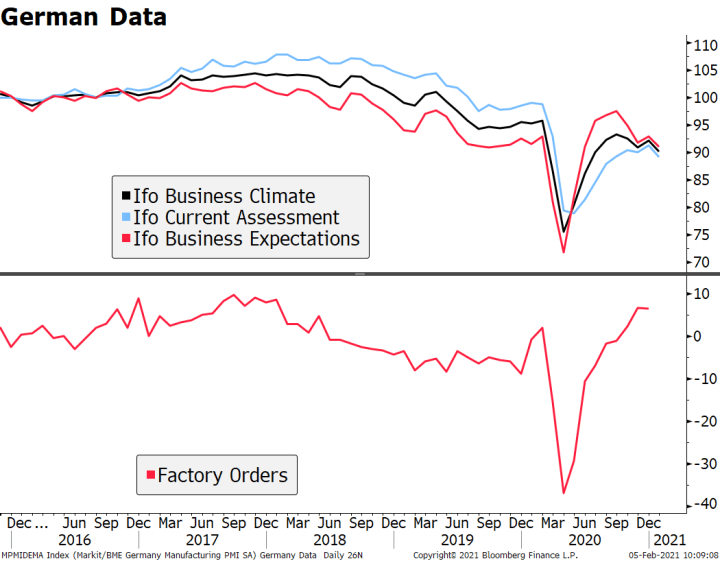

German data is showing further signs of weakness. December factory orders came in at -1.9% m/m vs. -1.0% expected and a revised 2.7% (was 2.3%) gain in November. Data are showing the impact of the latest lowdown, especially retail sales plunging -9.6% m/m in December. What’s worse, forward looking indicators such as the IFO surveys are already pointing towards a deeper deceleration, which we fear will be extended by the vaccine delays. We see downside risks to the German IP and trade data next week. And as the largest economy in the eurozone, the entire region is facing downside risks going forward. Bank of England delivered a less dovish than expected hold. Of note, it said it was appropriate to prepare for negative rates but said it did not intend to signal that negative rates are coming. It presented an upbeat growth outlook of 5% growth this year vs. 7.25% previously and 7.25% next year vs. 6.25% previously. These are much more bullish than consensus of 4.7% and 5.6%, respectively, as well as the IMF at 4.5% and 5.0%, respectively. The same goes for the inflation forecasts and so bottom line is that the BOE is probably excessively optimistic. We are less optimistic and believe another increase in asset purchases is likely later this year, probably a month or two after Chancellor Sunak’s March budget statement as he will give the BOE an indication of how much support will be needed. Deputy Governor Ramsden went even further and said he envisions slowing the pace of QE later this year. Didn’t the BOE learn its lesson? The Fed just had to do some major damage control on tapering talk. It’s way too early for any major central bank to talk about tapering. We try not to be too critical of policymakers but we really think the BOE misread the room. The threat of negative rates had helped keep the UK curve flat and now the market perceives that as being off the table. Now it’s stuck with a steeper yield curve and firmer sterling and that’s going to be a headwind for the economy. Let’s see if there’s any pushback from BOE officials in the coming days. |

German Data, 2016-2021 |

| ASIA

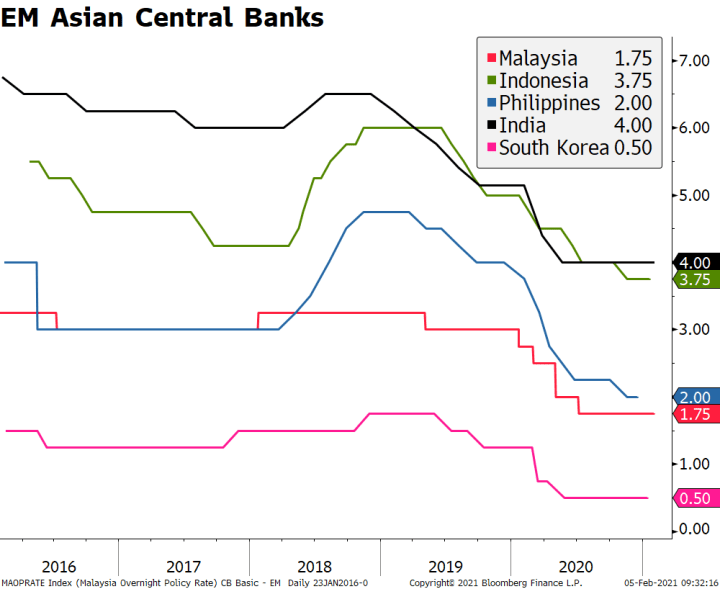

Japan reported December household spending. Spending fell -0.6% y/y vs. -1.8% expected and a 1.1% gain in November. Lower spending on transportation and eating out were the major factors. This was the first drop after two straight months of gains, though those gains were flattered by the impact of the consumption tax hike a year earlier. While spending is likely to remain weak at the start of this year due to the lockdowns, low base effects due to the start of the pandemic last year will help limit the worsening of y/y comparisons in the coming months. Reserve Bank of Australia released its quarterly Statement on Monetary Policy. It contained updated macro forecasts, with GDP seen growing 8% at mid-year before easing to 3.5% at year-end and remaining there through end-2022. Inflation is seen accelerating to 3% at mid-year before easing to 1.5% at year-end and remaining there until end-2022. Looking further out, unemployment is seen falling from 6.5% at mid-year and falling steadily to 5.25% by mid-2023, while inflation is seen rising slightly to 1.75% by mid-2023, below the 2-3% target range. Governor Lowe testified to parliament and said he didn’t expect to hike rates until at least 2024 since employment and inflation are expected to remain well below target for an extended period. The dovish message was expected after the RBA surprised markets with an extension of its QE program earlier this week. Retail sales were reported. Indonesia’s Q4 GDP data came in around expectations, falling -0.4% q/q and -2.2% y/y. GDP fell -2.1% for the full year, the first annual contraction since the Asian financial crisis in the late 1990s. The country looks on the way to recovery, with tentative signs of improvement in private consumption. Moreover, the economy will benefit from the latest fiscal support package and likely more rate cuts by the Bank Indonesia, assuming the rupiah remains stable. BI’s policy rate of 3.75% remains one of the highest in the region. |

EM Asian Central Banks, 2016-2020 |

| The Reserve Bank of India kept rates on hold at 4.00% as mostly expected. This makes sense after the upside budget surprise, though some analysts were looking for a dovish surprise. The forward guidance indicated that officials will continue to rely on liquidity support measures. The RBI also increased the cash reserve ratio by 50 bp, which had been temporarily lowered to 3%, allowing it to lean on other liquidity measures. CPI rose 4.6% y/y in December, the lowest since September 2019 and back within the 2-6% target range for the first time since March 2020. As such, we see ongoing risks of a rate cut later this year.

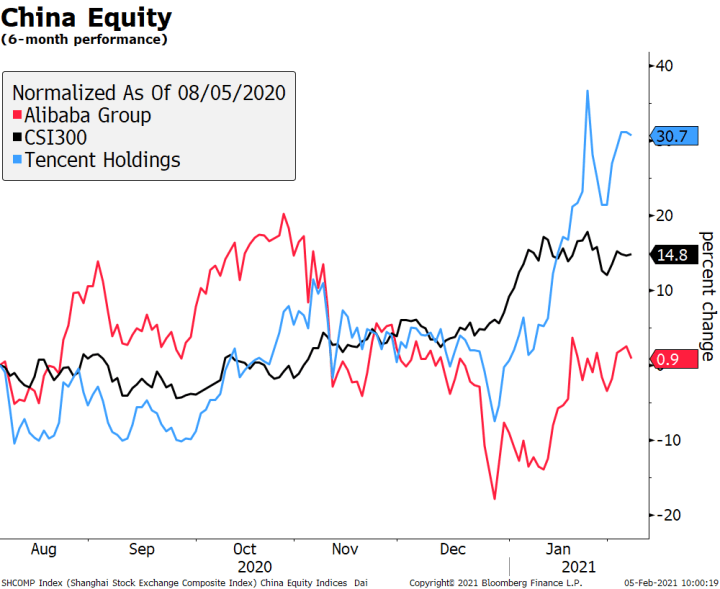

The Chinese tech giant Alibaba placed $5 bln in international bonds in maturities of up to 40 years. This was the largest issuance in Asia in eight months, according to Bloomberg. The 40-year bonds came in at 130 bp over US Treasuries, lower than the 160 bp guidance. With its relatively high yields, China continues to be a favor destination for foreign investment. The issue was well over subscribed with reports of nearly $40 bln in demand, suggesting little concern over the recent regulatory crackdowns relating to antitrust. In fact, yesterday regulators supposedly reached a restructuring agreement with Jack Ma’s Ant Group that will make it look more regular bank. Alibaba’s stock price has recovered sharply from the December swoon. |

China Equity, 2020-2021 |

|

Tags: Articles,Daily News,Featured,newsletter