House Democrats will move ahead with impeachment proceedings today; December CPI data will be the US highlight; heavy UST supply this week wraps up with a bln sale of 30-year bonds; December monthly budget statement will be of interest the Fed releases its Beige Book report; several Fed officials pushed back against notions of tapering anytime soon Italian political noise continues; UK and Germany warned of more restrictive measures; Russia will restart its reserve accumulation policy; Poland is expected to keep rates steady at 0.10% Japan’s government extended a state of emergency to seven more prefectures; BOJ may downgrade its economic assessment at next week’s meeting; PBOC may be getting uncomfortable with yuan strength The dollar is getting some limited

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- House Democrats will move ahead with impeachment proceedings today; December CPI data will be the US highlight; heavy UST supply this week wraps up with a $24 bln sale of 30-year bonds; December monthly budget statement will be of interest the Fed releases its Beige Book report; several Fed officials pushed back against notions of tapering anytime soon

- Italian political noise continues; UK and Germany warned of more restrictive measures; Russia will restart its reserve accumulation policy; Poland is expected to keep rates steady at 0.10%

- Japan’s government extended a state of emergency to seven more prefectures; BOJ may downgrade its economic assessment at next week’s meeting; PBOC may be getting uncomfortable with yuan strength

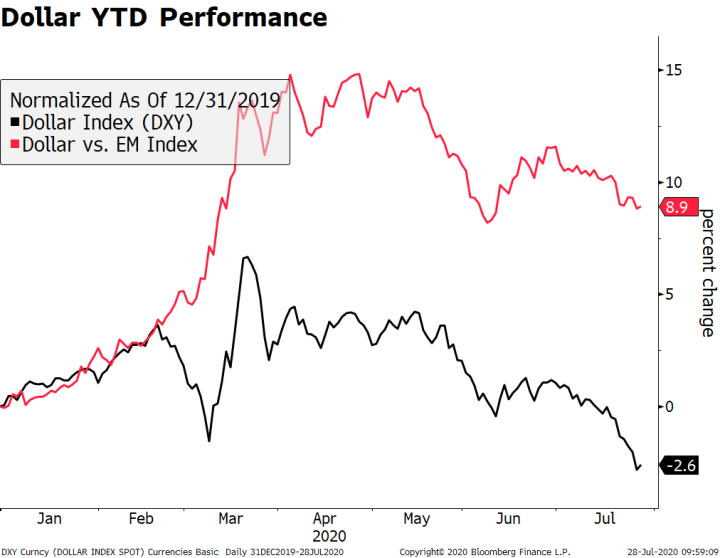

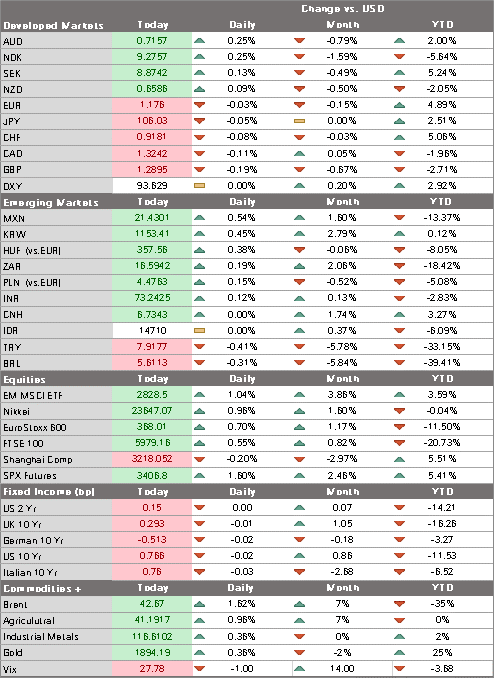

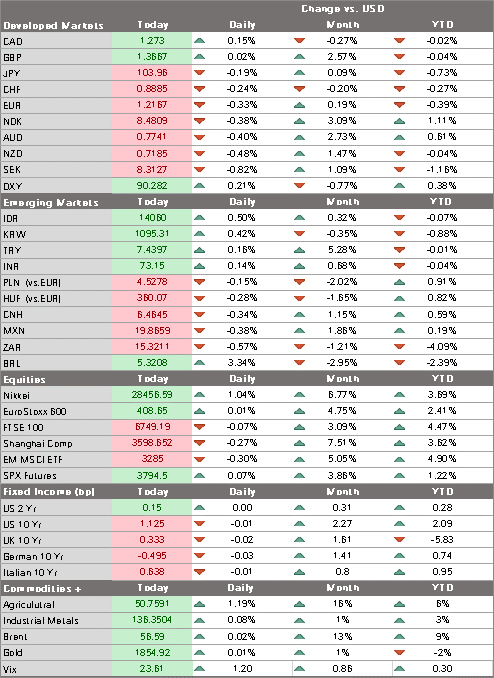

The dollar is getting some limited traction. DXY is trading higher after finding some support near the 90 area. We continue to view this bounce as a correction and still target the February 2018 low near 88.25. The euro is trading back below $1.12 but is likely to find continued support around the December 21 low near $1.2130. Sterling has managed to hang on to yesterday’s big gains and tested the $1.37 area before edging lower. USD/JPY remains choppy and is back testing 104 after trading as low 103.55 earlier today.

| AMERICAS

House Democrats will move ahead with impeachment proceedings today. A vote is expected by late afternoon. An important twist here is that more Republican lawmakers have said they will vote to impeach President Trump, including number three House Republican Liz Cheney. Elsewhere, reports suggest Republican Senate Majority Leader McConnell is happy with these developments, as they will help purge Trump from the Republican party. That said, it’s not clear when or if a Senate trial will be held before Biden’s inauguration January 20, as the Senate is on recess until the day before. As we have said before, impeachment is a largely symbolic gesture at this point. December CPI data will be the US highlight. Headline inflation expected to pick up a tick to 1.3% y/y and core inflation expected to remain steady at 1.6% y/y. PPI will be reported Thursday, with headline inflation expected to fall a tick to 0.7% y/y and core inflation expected to fall a tick to 1.3% y/y. The inflation debate has picked up with the unexpected return of the Blue Wave and so this data has taken on more significance. The US curve steepening is taking a breather today but at 105 bp, the 3-month to 10-year curve is still quite near the year’s high from March 18 near 120 bp. |

US Nominal Interest Rates, 2020 |

| Heavy UST supply wraps up today with a $24 bln sale of 30-year bonds. The previous 30-year auction saw a bid to cover ratio of 2.48 and 65.9% going to indirect bidders (foreign demand), and the yield came in at 1.665%. Yesterday’s $38 bln sale of 10-year notes went smoothly. The bid to cover ratio rose to 2.47 from 2.33 previously, while the share going to indirect bidders (foreign demand) fell a tick to a still high 62.2%. This follows a strong $58 bln sale of 3-year notes Monday, where the bid to cover ratio rose to 2.52 vs. 2.28 previously and 52.2% went to indirect bidders (foreign demand) vs. 49.3% previously.

This is a lot of paper for the market to digest but so far, so good. In fact, the 10-year yield traded as high at 1.18% yesterday before reversing sharply, suggesting investors (for now) will snap up US debt when rates go higher. Looking ahead, the next round of stimulus will have to be funded by increased debt issuance. While it’s not too surprising that curve steepening continues, we need to see whether it picks up and see how the Fed reacts. Speaking of bond supply, the December monthly budget statement will be of interest. A deficit of -$143.5 bln is expected. If so, the 12-month total would rise to a record high -$3.35 trln. As the economy continues to suffer, receipts are falling y/y while upward pressure remains on outlays. With another slug of fiscal stimulus likely in the early days of the Biden administration, these deficit numbers will only get worse this year. For now, the market has been able to absorb the supply without much dislocation, but this will surely be tested in the coming months. If the market cannot absorb this increased issuance, the Fed will have to start thinking about increasing its asset purchases, not tapering them. The Fed releases its Beige Book report. It is being prepared for the upcoming January 26-27 FOMC meeting. Since the last meeting December 15-16, the US outlook has clearly darkened and so the Beige Book should reflect this. The labor market has clearly softened as the economy lost momentum amidst rising virus numbers. While we expect some divergence between the manufacturing and service sectors may be highlighted, the overall tone of the report is likely to be fairly cautious and perhaps even downbeat. |

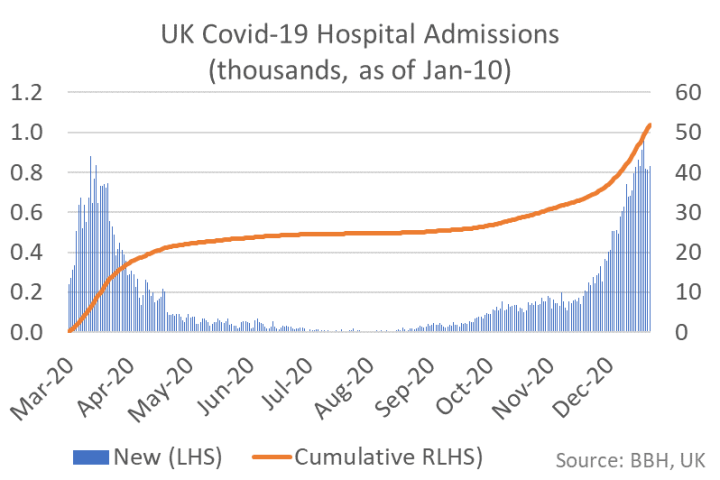

UK Covid-19 Hospital Admissions, 2020 |

| Several Fed officials pushed back against notions of tapering anytime soon. George and Bullard both indicated yesterday that it’s too soon to discuss, with George saying ” It is too soon to speculate about the timing of any change in this stance.” Bullard added that “it’s just too much uncertainty sitting right here today” to make a prediction on when tapering might begin. While neither are FOMC voters in 2021, we do not think these two are alone and we should be prepared for even more pushback if yields rise too fast. Bullard, Kashkari, Brainard, Harker, and Clarida all speak today.

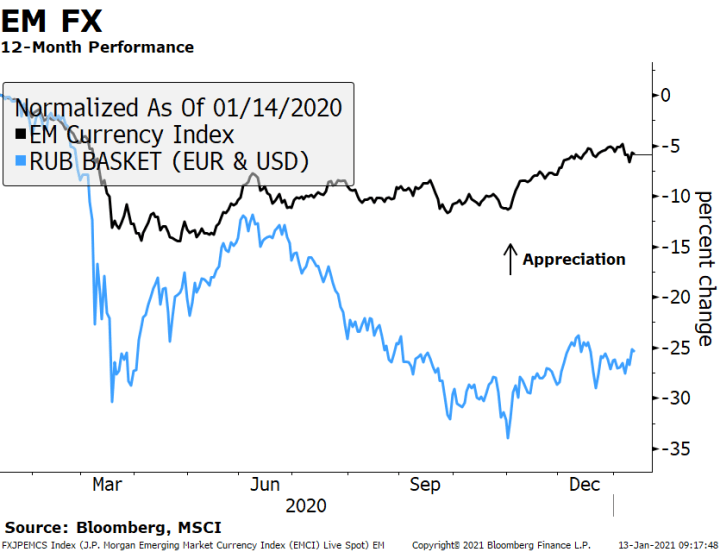

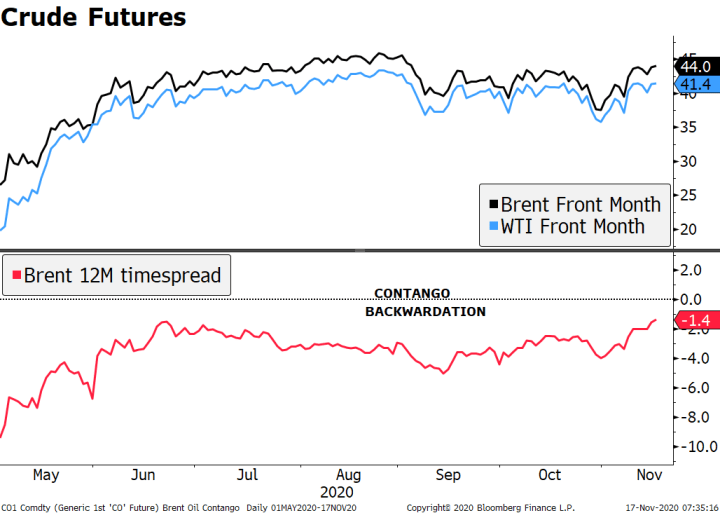

EUROPE/MIDDLE EAST/AFRICA Italian political noise continues. Former Prime Minister and current Italia Viva leader Renzi will hold a press conference today regarding a possible decision to pull his ministers from the ruling coalition. We believe this is largely posturing on the part of Renzi. His party has only 3% support in recent opinion polls and so we suspect Renzi will try to avoid triggering fresh elections. Also, no one wants to be known as the one that forced the populace to vote during a pandemic. Italian yields have been climbing recently, but this has been in large part due to the global bond sell-off as the reflation trade gets more traction. The UK and German governments warned of more restrictive measures. Chancellor Merkel said the lockdowns may have to be prolonged given the new virus strain. In the UK, PM Johnson is threatening harsher measures for those not respecting the rules. Hospital data show there are now more patients in ventilators in the UK than during the April peak. Elsewhere, eurozone reported firm November IP. It jumped 2.5% m/m vs. 0.2% expected, while the October gains was revised up to 2.3% from 2.1% previously. Of note, Italian IP surprised to the downside, falling -1.4% m/m vs. -0.4% expected. Russia will restart its reserve accumulation policy. This will keep the nascent ruble appreciation pressures under check and start raising FX reserves as oil prices continue to climb. The Finance Ministry will start buying the equivalent of $1.4 bln between January 15 and February 4. Russia has been a net reserve seller from its sovereign wealth fund since March. The ruble remains one of the weakest EM currencies since the pandemic, with the euro-dollar basket down some 25%. Despite the undeniable positive fundamental story for Russia and our positive outlook on commodities, we still think the risk-reward is better for other commodity plays (such as Brazil) in the near term, or at least until we get a more visibility on Biden approach towards Putin. |

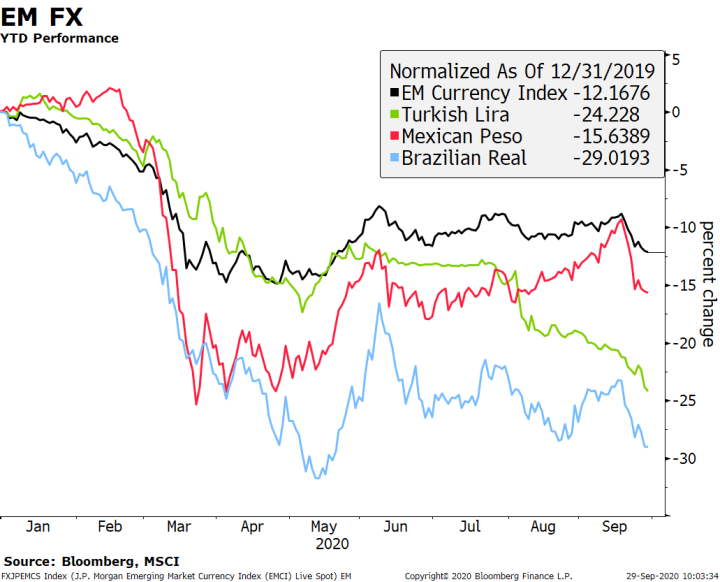

EM FX 12-Month Performance |

| National Bank of Poland is expected to keep rates steady at 0.10%. CPI rose 2.3% y/y in December, the lowest since April 2019 and in the bottom half of the 1.5-3.5% target range. No wonder Governor Glapinski recently started talking about resuming easing again. With rates close to zero, there’s not much room to cut and we think negative rates are unlikely. Rather, we suspect the bank will continue trying to weaken the zloty. November trade and current account data will also be reported today so keep an eye on exports. Central bank minutes will be released Friday.

ASIA Japan’s government extended a state of emergency to seven more prefectures. This brings the total number up to eleven, which means that prefectures that account for nearly 60% of the nation’s GDP are now under lockdown. Plans to end the state of emergency in a month have been roundly criticized as too optimistic, leading many to forecast potential economic contraction in Q1. Elsewhere, Japan reported December machine tool orders. Order rose 8.7% y/y vs. 8.6% in November, with base effects flattering the readings . The Bank of Japan meets January 20-21. While no change in policy is expected, reports suggest the BOJ may downgrade its economic assessment then. It may also mark down its GDP forecast for FY20 ending in March because of the emergency from the current -5.5%. With Suga’s popularity likely to continue falling as the economy weakens, we expect another fiscal stimulus package by mid-year to try and help shore up his support ahead of fall elections. PBOC may be getting uncomfortable with yuan strength. The central bank set its daily fix at its weakest level relative to market modeling since mid-2018. This follows several minor measures in recent weeks that were designed to encourage capital outflows and limit capital inflows. That said, the yuan is simply reflecting the weak dollar trend that has seen many EM currencies trade at multi-year highs. Similar to other EM central banks, the best that the PBOC can hope for is to slow the move, not reverse it. |

|

Tags: Articles,Daily News,Featured,newsletter