President-elect Biden will be inaugurated Wednesday; security in Washington DC and many state capitols has been beefed up due to concerns of violence; the Senate reconvenes Tuesday and will immediately begin work on confirming Biden’s cabinet choices; reports suggest that if asked, Yellen will disavow a weak dollar policy whilst affirming commitment to a market-determined exchange rate Weekly jobless claims data Thursday will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; BOC meets Wednesday and is expected to keep policy unchanged ECB meets Thursday and is expected to keep policy unchanged; Italian political intrigue will continue this week; Norges Bank meets Thursday and is expected to keep policy

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- President-elect Biden will be inaugurated Wednesday; security in Washington DC and many state capitols has been beefed up due to concerns of violence; the Senate reconvenes Tuesday and will immediately begin work on confirming Biden’s cabinet choices; reports suggest that if asked, Yellen will disavow a weak dollar policy whilst affirming commitment to a market-determined exchange rate

- Weekly jobless claims data Thursday will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; BOC meets Wednesday and is expected to keep policy unchanged

- ECB meets Thursday and is expected to keep policy unchanged; Italian political intrigue will continue this week; Norges Bank meets Thursday and is expected to keep policy unchanged; UK has another busy data week

- BOJ meets Thursday and is expected to keep policy unchanged; Japan and Australia have busy weeks

![]() The dollar continues to gain traction as risk-off impulses carry over into this week. DXY is trading at the highest level since December 21 and is on track to test the 91 area. The euro is testing the December 9 low near $1.2060 and appears likely to test the $1.20 area. Sterling has held up well but is back trading below $1.36. A break below $1.3550 would set up a test of the January 11 low near $1.3450. USD/JPY is also seeing a series of lower highs and feels heavy and so we continue to view any moves above the 104 area as temporary. We expect the Blue Wave trades to resume after the inauguration.

The dollar continues to gain traction as risk-off impulses carry over into this week. DXY is trading at the highest level since December 21 and is on track to test the 91 area. The euro is testing the December 9 low near $1.2060 and appears likely to test the $1.20 area. Sterling has held up well but is back trading below $1.36. A break below $1.3550 would set up a test of the January 11 low near $1.3450. USD/JPY is also seeing a series of lower highs and feels heavy and so we continue to view any moves above the 104 area as temporary. We expect the Blue Wave trades to resume after the inauguration.

AMERICAS

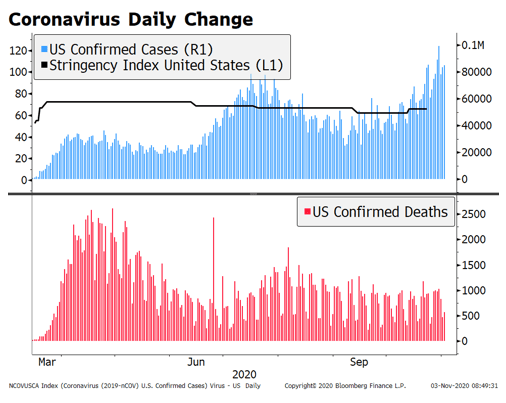

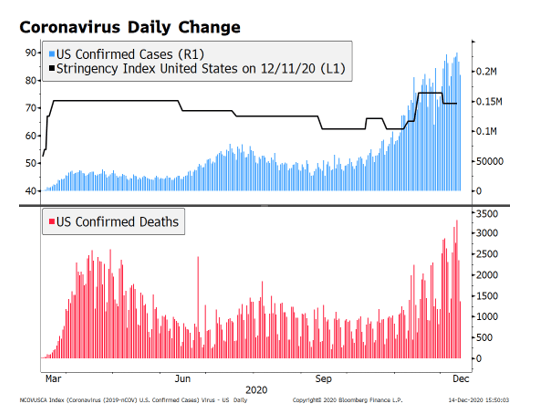

President-elect Biden will be inaugurated Wednesday to become the 46th President of the United States. He inherits a raging pandemic that continues to take a toll on the US economy. Recent economic data support our widely held view that until the virus is under control, the economy cannot mount a sustainable recovery. The good news is that Biden has made virus control and vaccination priorities and that should set the table for stronger growth later this year.

Security in Washington DC and many state capitols has been beefed up due to concerns of violence centered around the inauguration. As we saw earlier this month, such an event would likely feed into risk-off impulses that disrupt the financial markets. Yet any disruptions should be viewed as transitory. To us, the Blue Wave trades remain alive and well and should eventually resume once we get past the inauguration.

The Senate reconvenes Tuesday and will immediately begin work on confirming Biden’s cabinet choices. The most important hearing will be Janet Yellen’s, who has been nominated to be Secretary of the Treasury. Recall that she was President of the San Francisco Fed from 2004 to 2010, Fed Vice Chair from 2010 to 2014, and Fed Chair from 2014 to 2018. We bring this up to show that Yellen has been a policymaker during a boom, a bust, and a recovery. These experiences will no doubt be invaluable as she takes the helm of the world’s largest economy.

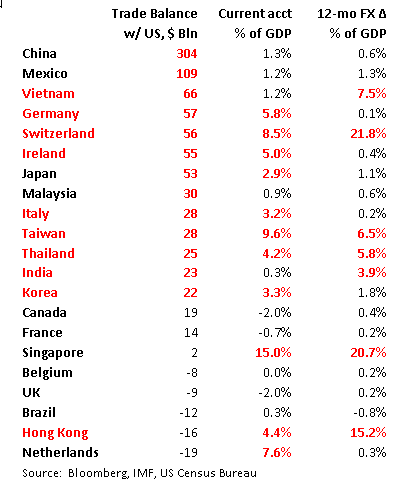

Reports suggest that if asked, Yellen will disavow a weak dollar policy whilst affirming commitment to a market-determined exchange rate. She is prepared to say “The United States doesn’t seek a weaker currency to gain competitive advantage. We should oppose attempts by other countries to do so.” Furthermore, officials stress that no one other than Yellen will talk about the dollar. All of these efforts are meant to signal a broad shift in policy from the outgoing Trump administration. If nothing else, markets will no longer be subject to tweet-related volatility and that’s a good thing.

Biden is already getting pushback to his proposed $1.9 bln fiscal package. A proposed hike in the federal minimum wage to $15 per hour is being met with skepticism from Republican lawmakers. Negotiations will take place but overall, we think enough moderate Republicans will support much of this first package. What about the planned package after this one? While climate change is a hot button issue, we think both parties can easily get behind a long-overdue infrastructure plan worth upwards of $1 trln.

Weekly jobless claims data Thursday will be the highlight of an otherwise quiet week. Regular initial claims are expected at 923k vs. 965k the previous week. That reading was the highest since mid-August and was even worse unadjusted (1.15 mln). PUA initial claims (unadjusted) rose to a 284k and so together with regular (unadjusted) claims totaled 1.435 mln, the highest since mid-September. This week’s initial claims data are for the BLS survey week containing the 12th of the month. If last week’s deterioration is sustained, we can expect another negative NFP number for January. Elsewhere, regular continuing claims are expected at 5.25 ln vs. 5.271 mln the previous week. Here too the unadjusted number was even worse at 5.856 mln. The weak labor market was directly responsible for the terrible December retail sales data and weakness is set to continue this month.

Fed manufacturing surveys for January will continue to roll out. Philly Fed survey is out Thursday and expected at 11.3 vs. a revised 9.1 (was 11.1) in December. Last week, Empire survey started the ball rolling with a 3.5 reading vs. 6.0 expected and 4.9 in December. Markit reports preliminary January PMI readings Friday, with manufacturing expected at 56.5 vs. 57.1 in December and services expected at 53.4 vs. 54.8 in December. These are the first snapshots for January and will help set the tone for other data to come.

Other minor data round out the week. November TIC data will be reported Tuesday, followed by December building permits (-2.0% m/m expected) and housing starts (0.8% m/m expected) Thursday and existing home sales (-2.1% m/m expected) Friday.

Bank of Canada meets Wednesday and is expected to keep policy unchanged. At its last meeting December 9, it delivered a dovish hold by pledging to keep rates steady until 2023 and to continue buying bonds at the current pace. Like other policymakers, the BOC is balancing optimism regarding the vaccine with downside risks from a renewed spike in virus numbers. We expect the bank to take a similar stance at this meeting.

This will also be a busy data week for Canada. Highlights are December CPI Wednesday ahead of the BOC decision and November retail sales Friday. Headline inflation is expected to remain steady at 1.0% y/y, while common core is expected to remain steady at 1.5% y/y. Headline sales are expected to rise 0.1% m/m vs. 0.4% in October, while sales ex-auto are expected to rise 0.4% m/m vs. flat in October. Canada also reports December housing starts Monday followed by November wholesale trade and manufacturing sales Tuesday.

EUROPE/MIDDLE EAST/AFRICA

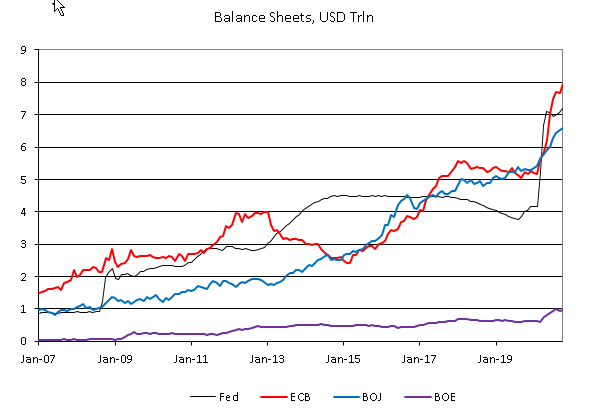

The European Central Bank meets Thursday and is expected to keep policy unchanged. It just boosted its PEPP program by EUR500 bln and updated its macro forecasts at its last meeting in December and so it is likely to remain on hold for several meetings. Many analysts believe the ECB is done easing but we are not convinced. Madame Lagarde will surely get some questions about the strong euro but its recent losses suggest the exchange rate may not be as much of a concern now.

The account of the ECB’s last meeting showed policymakers differed over how much additional stimulus was needed then. The account shows eventual agreement on EUR500 bln was reached but only after hawkish officials secured an acknowledgment that the entire amount might not be deployed. Also of note, Chief Economist Lane’s plan to allow banks to borrow even more from the ECB at negative rates experienced pushback, leading to a smaller increase.

Eurozone has a fairly light data week. The highlight will be preliminary January PMI readings to be reported Friday. Headline manufacturing PMI is expected at 54.5 vs. 55.2 in December, services PMI is expected at 44.5 vs. 46.4 in December, and composite PMI is expected at 47.6 vs. 49.1 in December. French composite is seen falling to 49.0 from 49.5 in December, while the German composite is seen falling to 50.3 from 52.0 in December. January ZEW survey will be reported Tuesday.

Italian political intrigue will continue this week. Prime Minister Conte is trying to get a new working majority that will keep his coalition in power. He faces votes of confidence in the lower house Monday and the Senate Tuesday. Conte is likely to win the lower house vote, but the vote will be particularly close in the Senate, where the coalition had a razor-thin majority. Reports suggest Renzi’s party will abstain from the Senate vote, which would allow Conte’s government to survive in a weakened state. Indeed, Renzi said “Our goal was never to kick Conte out,” adding that he’s open to negotiations if Conte is willing to discuss Renzi’s demands to tap the European Stability Mechanism for healthcare spending. This may allow the euro to regain some lost ground.

Norges Bank meets Thursday and is expected to keep policy unchanged. At its last meeting December 17, the bank delivered a hawkish hold. It kept rates steady at 0.0%, as expected, but the rate path was shifted to show a likely lift-off in H1 2022 and the policy rate near 1.0% by end-2023. This compares to the previous forward guidance that rates would likely remain at current levels for “the next couple of years” and lift-off at end-2022 and a policy rate near 0.5% by end-2023. The bank cut its near-term growth outlook then, which was not surprising after it emphasized downside risks at the November 5 meeting. For now, we think the Norges Bank takes a wait and see approach.

UK has another busy data week. December CPI will be reported Wednesday, with headline expected to rise a couple of ticks to 0.5% y/y and CPIH expected to rise a tick to 0.7% y/y. CBI releases results of its January industrial trends survey Thursday, with total orders expected at -35 vs. -25 in December . Preliminary January PMI readings, December retail sales, and public sector net borrowing data will be reported Friday. Headline manufacturing PMI is expected at 53.3 vs. 57.5 in December, services PMI is expected at 45.0 vs. 49.4 in December, and composite PMI is expected at 45.7 vs. 50.4 in December. Headline sales are expected to rise 1.0% m/m vs. -3.8% in November, while sales ex-auto fuel are expected to rise 1.0% m/m vs. -2.6% in November.

This is in the rear view mirror as markets are already braced for even worse numbers in December and January as the lockdowns hit. The virus numbers continue to rise and so the impact is likely to carry over into February and perhaps even March. Bottom line is that Q1 is likely to see the UK economy contract and we fully expect further stimulus. Chancellor Sunak is coming under renewed pressure from within to step up fiscal stimulus. We also expect further monetary easing but downplay notions of negative rates by the BOE.

ASIA

Bank of Japan meets Thursday and is expected to keep policy unchanged. At its last meeting in December, the bank kept policy unchanged but unexpectedly announced a policy framework review on the sustainability of its policy framework. The bank stressed that there was no need to scrap its yield curve control as part of the review, but the announcement does suggest there will be tweaks coming that will seek maintain its accommodative stance for even longer. Indeed, it said it would likely announce the findings in March. Governor Kuroda said that “Our intent is to keep short and long term policy interest rates at their present or lower levels, and we won’t be reviewing negative interest rates.”

Japan also has a heavy data week. December convenience store sales Wednesday. December trade and supermarket sales will be reported Thursday. Preliminary January PMI readings and December national CPI will be reported Friday. The economy is likely to suffer from the current lockdowns and so many expect GDP to contract in Q1. While monetary policy is on hold, we fully expect another round of fiscal stimulus later this year.

Australia has a busy week. January Westpac consumer confidence will be reported Wednesday. December jobs data will be reported Thursday. Preliminary January PMI readings and December retail sales will be reported Friday. Elsewhere down under, New Zealand reports Q4 CPI Friday. For now, both RBA and RBNZ are on hold as both nations continue to make good headway containing the virus. Risks lie ahead and so policymakers remain in wait and see mode.

Tags: Articles,developed markets,Featured,newsletter