The FOMC delivered a dovish hold, as we expected; we get our first look at Q4 GDP; Fed manufacturing surveys for January will continue to roll out; weekly jobless claims data will be closely watched The vaccination gap between the UK and the US vs. Europe continues to wide, and grievances against suppliers are getting worse; Germany January CPI will be reported; if inflation risks were rising , ECB officials wouldn’t be so concerned about the strong euro and its disinflationary impact In a clear signal that relations with China will remain frosty, the US reaffirmed its military support of Japan; Japan reported December retail and department store and supermarket sales; Philippines GDP growth continues but still disappointed in Q4 Equity markets implied volatility

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The FOMC delivered a dovish hold, as we expected; we get our first look at Q4 GDP; Fed manufacturing surveys for January will continue to roll out; weekly jobless claims data will be closely watched

- The vaccination gap between the UK and the US vs. Europe continues to wide, and grievances against suppliers are getting worse; Germany January CPI will be reported; if inflation risks were rising , ECB officials wouldn’t be so concerned about the strong euro and its disinflationary impact

- In a clear signal that relations with China will remain frosty, the US reaffirmed its military support of Japan; Japan reported December retail and department store and supermarket sales; Philippines GDP growth continues but still disappointed in Q4

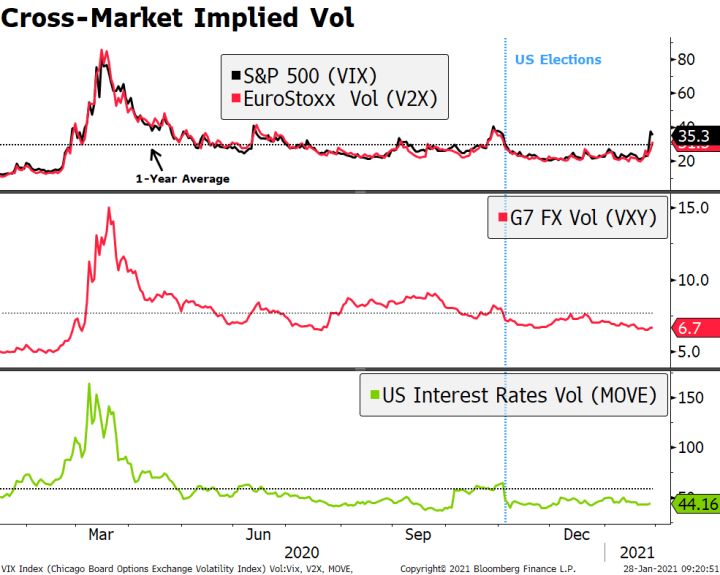

| Equity markets implied volatility are waking up from their slumber, but aggregate measures in FX and fixed income have barely budged. The VIX traded as high as 36 today compared to the high 20s just a few weeks ago, and is above its 1-year average. The de-risking stems from a combination of disappointing earnings, the prospect of delays in vaccine distribution, and the unusual (to say the least) events surrounding single name US stocks such as GameStop and AMC. Despite the change in direction of the broad dollar index, implied vol in the G7 FX space remains below 7. In fixed income markets, the MOVE index for US Treasuries has remained essentially flat since the elections. |

Cross-Market Implied Vol, 2020-2021 |

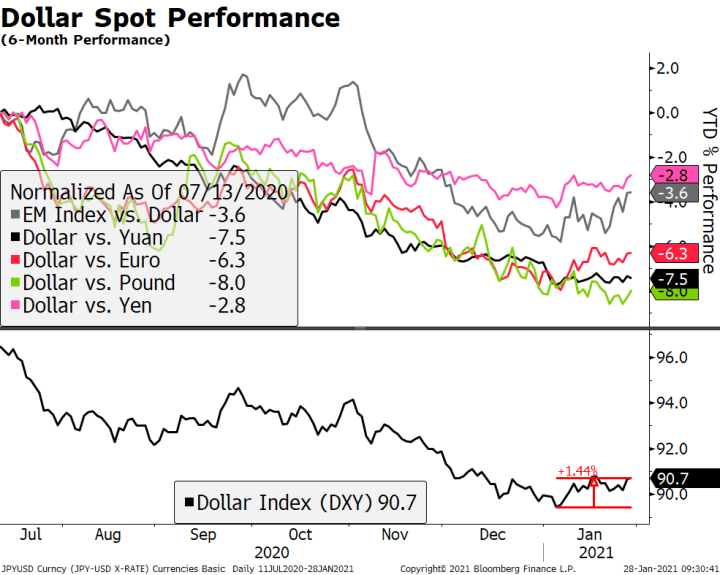

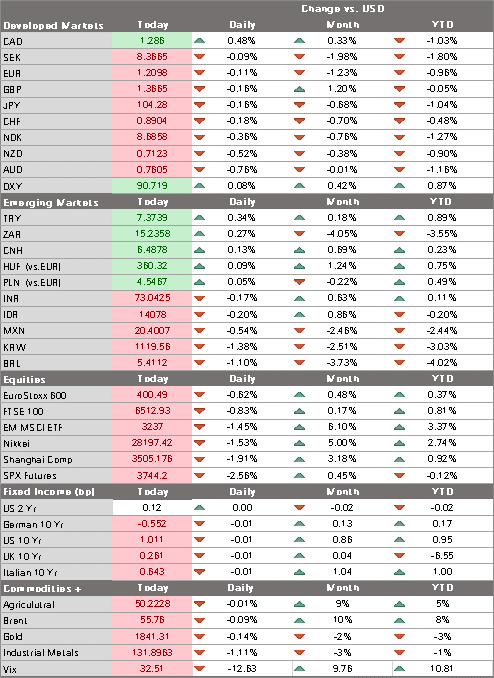

| The dollar continues to benefit from a confluence of factors. DXY is up 1.5% from the January lows, rising for four of the past five days. We think there are several factors at play here. First, a general reversal of trend started with the virus mutation news and new lockdowns that has led to a fast positioning adjustment for a market that started the year very short dollars. The risk-off mode has also led to the usual bid for dollar, especially as the vaccine progress in Europe ex-UK is doing significantly worse than in the US. Lastly, and probably the least impactful, the ECB continues to jawbone the euro (see below). The euro is holding above $1.21 for now but feels heavy, while sterling is back near $1.3650 after trading at new highs for this move yesterday near $1.3760. The yen is not trading as a haven asset during this current risk-off episode and USD/JPY is trading at the highest level since January 11 near 104.40. |

Dollar Spot Performance, 2020-2021 |

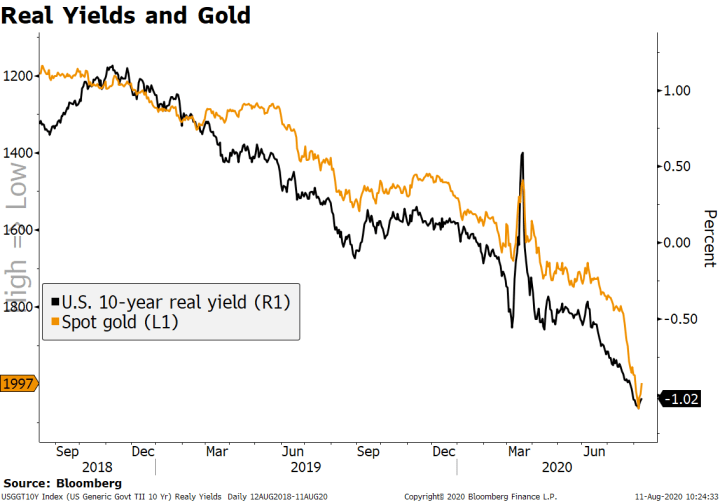

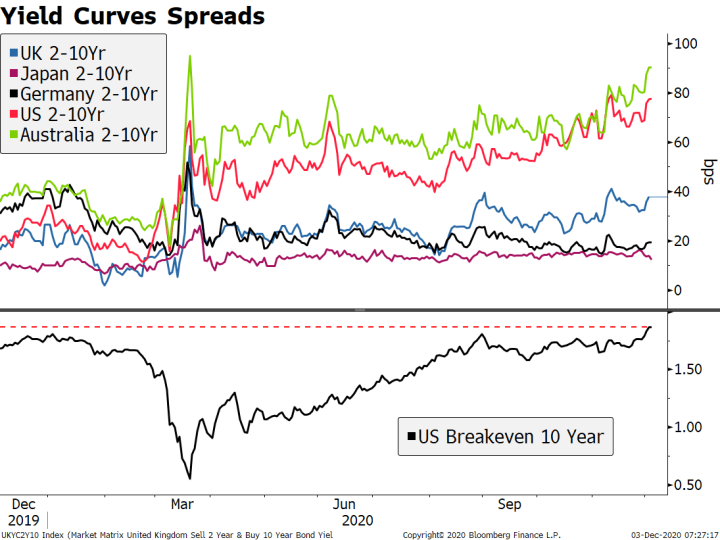

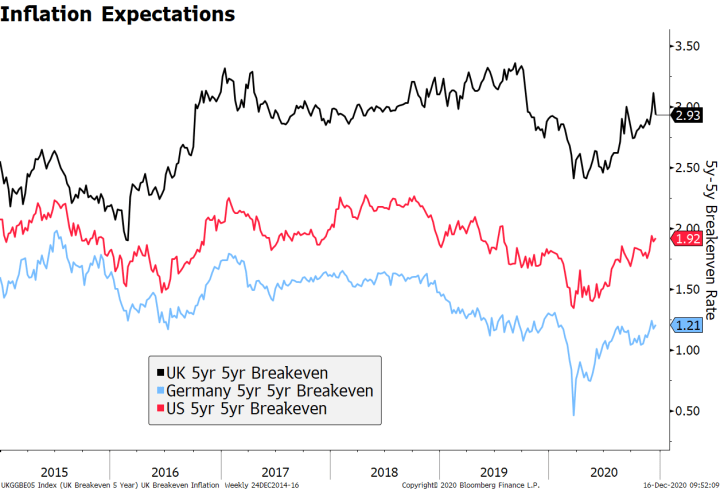

| AMERICAS

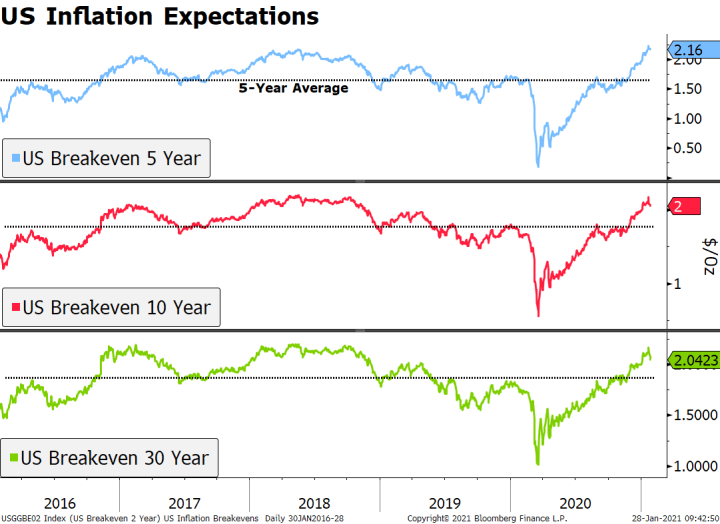

The FOMC delivered a dovish hold, as we expected. In keeping rates, asset purchases, and forward guidance unchanged, the statement noted that the pace of economic recovery and employment has moderated. Chair Powell said the path ahead remains uncertain and the Fed remains committed to its dual mandate. He noted that the US is a long way from full recovery and that policy will remain accommodative until the Fed’s goals are reached. Most importantly, he stressed that the whole focus on an exit strategy is premature and that it’s too early to talk about tapering. Powell said it’s very unlikely that we’ll see “troubling” inflation and that the upcoming rise will be transient. Powell really couldn’t be clearer: the Fed is not thinking about changing its policy settings anytime soon. Inflation expectations ticked lower yesterday but remain relatively elevated – as least as measured by TIPS breakeven rates. Of note, the two of the first three questions at the press conference dealt with Bitcoin and GameStop. Powell would not comment on either . However, a later question about asset bubbles general financial stability elicited a response. Powell said financial vulnerabilities were “moderate” but added that the link between interest rates and asset prices was not so strong. Powell added that asset prices of late have been driven largely by positive vaccine news and fiscal stimulus. While Powell has a point, we think the Fed should own up to the fact that zero rates and QE (not just in the US but globally) are a major factor behind asset price inflation. With the media embargo over, Kaplan and Daly are the next scheduled Fed speakers Friday. We get our first look at Q4 GDP. The economy is expected to have grown 4.2% SAAR vs. 33.4% in Q3. The Atlanta Fed’s GDPNow model suggests Q4 growth was 7.2% SAAR, while the New York Fed’s Nowcast model suggests Q4 growth was 2.58% SAAR. Of note, the New York Fed’s separate Weekly Economic Index suggests Q4 growth was 4.6% SAAR, which is very close to Bloomberg consensus. That said, this is old news and markets are braced for an extremely weak Q1 despite the fact that the New York Fed’s Nowcast model is currently tracking Q1 growth at 6.65% SAAR and Bloomberg consensus is currently at 2.3% SAAR. Fed manufacturing surveys for January will continue to roll out. Kansas City Fed is expected at 13 vs. 14 in December. So far this week, Dallas Fed came in at 7.0 vs. 9.7 in December and Richmond Fed came in at 14 vs. 19 in December. Previously, Philly Fed came in at 26.6 vs. a revised 9.1 (was 11.1) in December and Empire survey came in at 3.5 vs. 4.9 in December. So far, the manufacturing sector is holding up well as 2021 gets under way. Of note, Chicago PMI will be reported tomorrow and is expected at 58.5 vs. a revised 58.7 (was 59.5) in December. Weekly jobless claims data will be closely watched. Regular initial claims are expected at 875k vs. 900k the previous week. PUA claims were 424k last week and so together with regular (unadjusted) claims totaled 1.4 mln, still quite high and nearly unchanged from the previous week. Last week’s readings were for the BLS survey week containing the 12th of the month. Clearly, recent deterioration in the labor market is persisting and likely to generate another weak (and possibly negative) NFP for this month. We know it’s still early yet but Bloomberg consensus now sees +75k for January NFP, down from +100k previously. A lot can still happen and continuing claims data will be another piece of the puzzle since they lag initial claims by a week and so will be for the BLS survey week. These are expected at 5.088 mln vs. 5.054 mln the previous week. Whether January NFP is +75k or -75k, the fact of the matter is that the US economy has lost momentum and needs further stimulus to tide it over until the virus is under control and vaccinations are more widely rolled out. Other minor data will be reported. Advance goods trade (-$84.0 bln expected), wholesale and retail inventories (0.5% and 0.6% m/m expected, respectively), leading index (0.3% m/m expected), and new home sales (3.0% m/m expected) all come out today. |

US Inflation Expectations, 2016-2020 |

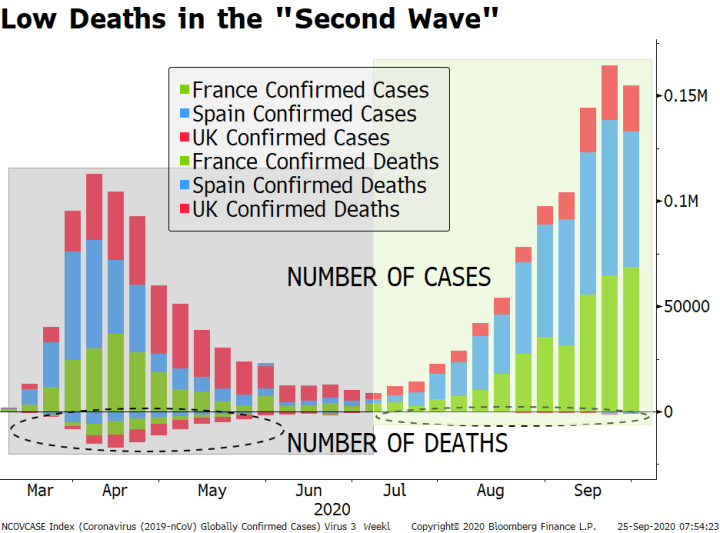

| EUROPE/MIDDLE EAST/AFRICA

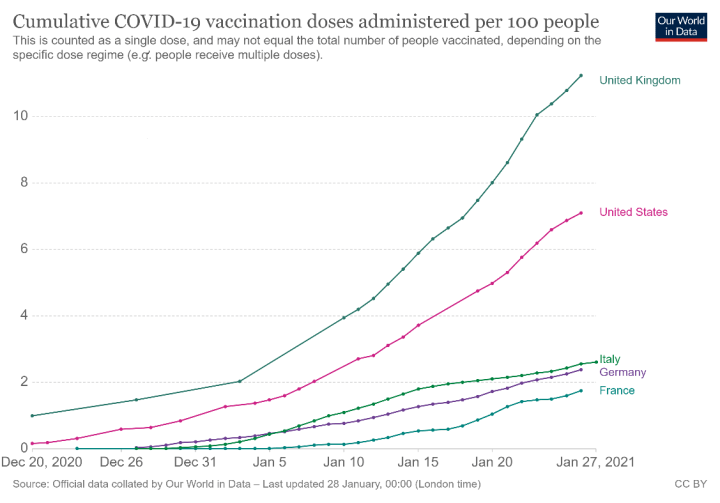

The vaccination gap between the UK and the US vs. Europe continues to widen, and grievances against suppliers are getting worse. The EU’s spat with AstraZeneca continues, with the company saying it would not shift supplies from the UK to the region. This means that delays in the vaccination program will continue for now after the production setback at its Belgian factory. German Health Minister Spahn predicted “at least another 10 tough weeks” of shortages and called for a meeting between the government and drug companies to address the problem. Some EU members have called for outright restrictions of vaccine shipments to the UK but so far, cooler heads have prevailed. In a potential gesture of good will, the UK offered some assistance to the EU but stopped short of pledging to divert any vaccines. Germany January CPI will be reported. Headline inflation (EU Harmonized) is expected to rise 0.5% y/y vs. -0.7% in December. State CPI data already reported suggest upside risks to the national reading. Still, we note that the expected acceleration is a statistical quirk due to low base effects from January 2020, when CPI fell -0.8% m/m. February will see the opposite, with a high base effect likely to dampen the y/y rate considerably. The bottom line is that inflation remains a distant possibility for the eurozone. If inflation risks were rising , ECB officials wouldn’t be so concerned about the strong euro and its disinflationary impact. Today, Governing Council member Rehn said “We are certainly ready to use and adjust all our instruments as appropriate. We are closely monitoring developments in the exchange rate, especially regarding the inflation outlook.” This echoes comments from Knot yesterday, who actually played up the risks of taking policy rates more negative. Reports suggest that other ECB officials want to push back on market skepticism regarding rate cuts. Rehn added that the inflation outlook is “too low for my taste, and more importantly, too low for our aim.” |

Cumulative Covid-19 vaccination doses administered per 100 people |

| ASIA

In a clear signal that relations with China will remain frosty, the US reaffirmed its military support of Japan. Japan officials said that in his first call to Prime Minister Suga, “President Biden expressed his unwavering commitment to the defense of Japan, including the application of Article 5 of the U.S.-Japan Security Treaty to the Senkaku islands.” US officials confirmed this. Elsewhere, Secretary of State Blinken rejected Chinese territorial claims in a call with Philippine officials and also emphasized existing US alliances in talks with top Australian and Thai officials. It’s a clear sign that the Biden administration will take a multilateral approach towards containing China rather than the bilateral one taken by the Trump administration. Japan reported December retail and department store and supermarket sales. Retail sales fell -0.8% m/m vs. -0.7% expected and a revised -2.1% (was -2.0%) in November, while department store and supermarket sales fell -3.5% y/y vs. -3.7% expected and -3.4% in November. The Economy Ministry cut its assessment of the trend in sales to “somewhat weak.” The biggest drops in spending were for food and drink, which have now declined for three straight months. Given the increased measures to restrict dining out during the state of emergency, January is also likely to show weakness. |

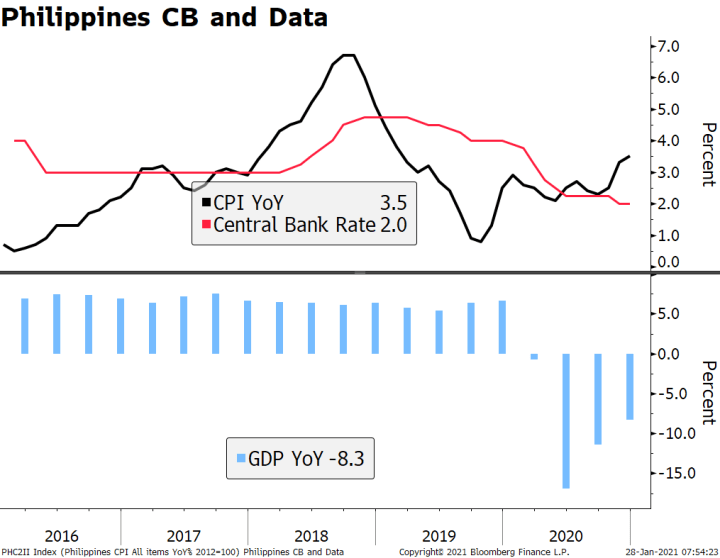

Philippines CB and Data, 2016-2020 |

| Philippines GDP growth continues but still disappointed in Q4. GDP grew 5.6% q/q vs. 6.0% expected and 8.0% in Q3. In y/y terms, GDP fell -8.3% compared to -7.9% expected and -11.5% in Q3. The 2020 full-year contraction came in at -9.5% vs. 6.0% growth in 2019. The slightly weaker than expected showing in Q4 was due in part to the comparatively restrained fiscal reaction to the pandemic, even though it was one of the few positive engines of growth (4.4% y/y) in the last quarter, in contrast to a 7.2% y/y decline in household consumption. The Philippine peso was little changed overnight, a relatively good performance compared to broader losses across the region. |

Tags: Articles,Daily News,Featured,newsletter