The FOMC begins its two-day meeting today with a decision out tomorrow afternoon; Senate Minority Leader McConnell has finally agreed to a power-sharing deal based on the 2001 model; President Biden signaled willingness to negotiate his stimulus proposal in order to get a bipartisan deal; Fed manufacturing surveys for January will continue to roll out; Brazil reports mid-January IPCA inflation Italian Prime Minister Conte will reportedly resign today; Italian Treasury’s models suggest the budget deficit could blow out to -9.2% of GDP this year; UK reported labor market data; Hungary is expected to keep the base rate steady at 0.60%. BOJ minutes suggest it is looking for ways to strengthen the nation’s economic potential as part of its policy review; we are

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The FOMC begins its two-day meeting today with a decision out tomorrow afternoon; Senate Minority Leader McConnell has finally agreed to a power-sharing deal based on the 2001 model; President Biden signaled willingness to negotiate his stimulus proposal in order to get a bipartisan deal; Fed manufacturing surveys for January will continue to roll out; Brazil reports mid-January IPCA inflation

- Italian Prime Minister Conte will reportedly resign today; Italian Treasury’s models suggest the budget deficit could blow out to -9.2% of GDP this year; UK reported labor market data; Hungary is expected to keep the base rate steady at 0.60%.

- BOJ minutes suggest it is looking for ways to strengthen the nation’s economic potential as part of its policy review; we are growing concerned that the policy review was not very well thought out; interbank rates in China spiked after a large overnight capital drain by the PBOC and a warning about asset price bubbles; Korea reported firm Q4 GDP data

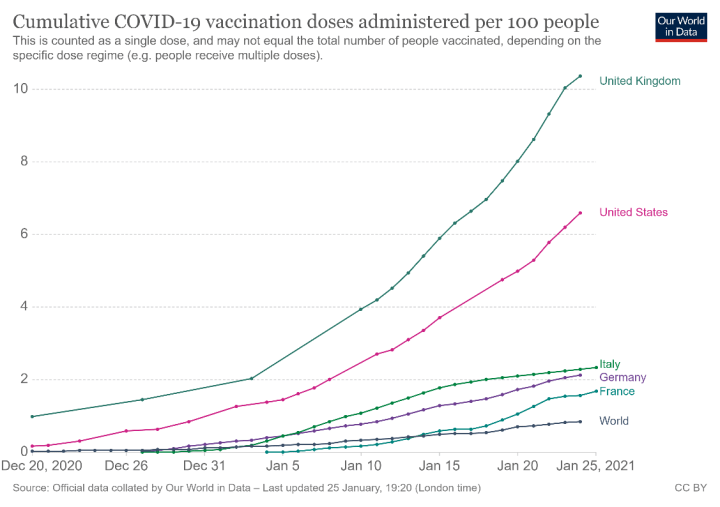

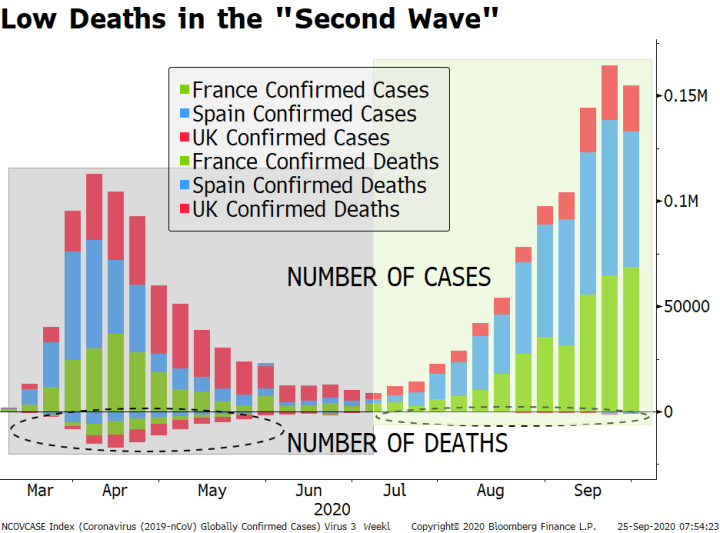

| The battle between vaccine rollouts and virus mutations continues with vastly different progress across countries. The UK and the US are moving well ahead of G10 countries. Government figures claim that three quarters of Britain’s over-80-year-old population have received the first dose. In the US, President Biden upped his vaccination goal to 1.5 mln shots a day. The EU, meanwhile, is falling behind its vaccination effort, plagued by logistical challenges and production delays from AstraZeneca.

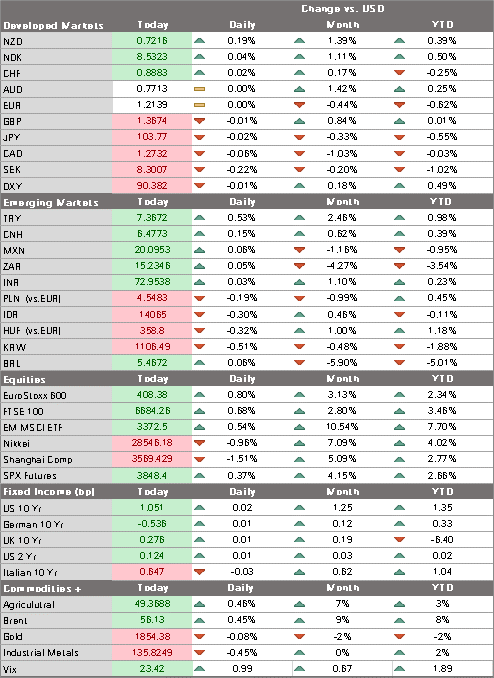

The dollar continues to trade sideways as markets await fresh drivers. That driver may be an ultra-dovish hold from the Fed tomorrow after it begins its two-day meeting today. DXY have given up earlier gains and appears likely to again test the 50% retracement objective of the January rally near 90.08. Break below that and then the 62% retracement objective near 89.874 is needed to set up a test of the January 6 low near 89.209. The euro remains a bit heavy as Italian politics remain unsettled but is likely to see support near $1.21. Sterling rebounded sharply after seeing support near $1.36, keeping EUR/GBP below the .89 level. USD/JPY continues to hover around 104 but remains heavy and is likely to continue probing the downside. |

Cumulative Covid-19 vaccination doses administered per 100 people |

AMERICAS

The FOMC begins its two-day meeting today with a decision out tomorrow afternoon. No change in policy is expected. Nor will new forecasts and Dot Plots be released. Those come in March. Yet this meeting will give the Fed an important opportunity to better frame its policy outlook. Recently, several regional Fed presidents started talking about tapering. This helped push long yields higher and the Fed leadership quickly pushed back, with Powell, Clarida, and Brainard all saying it was too early to talk about tapering. We expect the Fed to codify this stance once and for all at this meeting. At the same time, the Fed will surely acknowledge recent weakness in the US economic data in justifying its ultra-dovish stance. After Powell’s post-decision press conference, Kaplan will be the next Fed speaker Friday.

Senate Minority Leader McConnell has finally agreed to a power-sharing deal based on the 2001 model. He had refused to do so unless Majority Leader Schumer agreed to maintain the filibuster rule. Schumer refused but comments from two Democratic Senators supporting the filibuster were apparently enough for McConnell. Under the 2001 model, both parties will have an equal number of committee seats, equal budgets for committees, as well as the ability of both leaders to advance legislation out of committees that are deadlocked. However, Democrats will hold the chairmanships and Schumer will set the agenda for the floor, which may well be the most important aspect of the deal. Of note, Janet Yellen was confirmed by the Senate and becomes the first female Treasury Secretary.

President Biden signaled willingness to negotiate his stimulus proposal in order to get a bipartisan deal. Some have been calling for Biden to push through as much as possible through so-called budget reconciliation that requires a simple majority. However, Biden’s openness to negotiate suggests he will take a more cooperative approach. Senate Majority Leader Schumer said yesterday that he aims to pass a relief bill by mid-March, when jobless benefits from the last package in December will be expiring. However, other reports suggest that this timeline reflects passage of the bill via budget reconciliation. This process has its limits, however, as discretionary spending on health and education as well as the $15 minimum wage would likely be ineligible.

Fed manufacturing surveys for January will continue to roll out. Richmond Fed is expected at 17 vs. 19 in December. Yesterday, Dallas Fed came in at vs. 12.0 expected and in December. Kansas City reports Thursday and is expected at 12 vs. 14 in December. November S&P CoreLogic house prices and January Conference Board consumer confidence (89.0 expected) will also be reported.

Brazil reports mid-January IPCA inflation. It is expected at 4.34% y/y vs. 4.23% in mid-December. COPOM minutes will also be released that day. The bank delivered a hawkish hold then as the statement said that “forward guidance no longer holds” but that “the removal of the forwards guidance does not mechanically imply interest rates increases.” Bloomberg consensus sees a tightening cycle this year that takes the SELIC rate to 3.25% by year-end from 2.0% currently. Next COPOM meeting is March 17 and a 25 bp hike to 2.25% is likely then.

| EUROPE/MIDDLE EAST/AFRICA

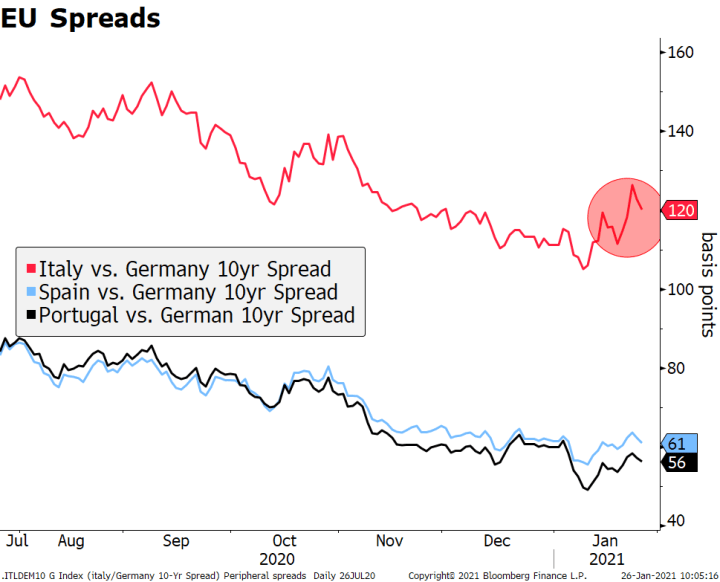

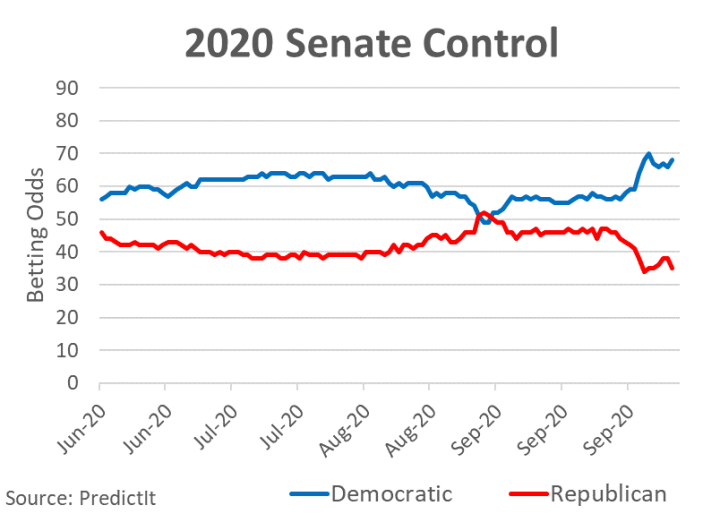

Italian Prime Minister Conte will reportedly resign today. After offering his resignation to President Mattarella, Conte will be asked to make another attempt to forge a coalition without Renzi’s Italia Viva party. The existing one now has 148 seats in the Senate after Italia Viva’s 18 lawmakers pulled out. Officials say anything is possible, including a coalition that brings in centrists, unaffiliated lawmakers, Berlusconi’s Forza Italia, or even disgruntled members of Italia Viva. Conte would need to add a minimum of 13 lawmakers to his coalition to hold a majority in the 321-seat Senate. As things stand, Conte won the confidence vote in the lower house. Markets seem fine with this outcome, as seen by today’s narrowing of Italian spreads to equivalent German bunds. Elsewhere, the Italian Treasury’s models suggest the budget deficit could blow out to -9.2% of GDP this year as the economy suffers. Growth may come in at the low end of estimates near 4.5% as lockdowns extend and expand. These compare to previous forecasts of -8.8% for the deficit and 6% for growth. As a result, the debt to GDP ratio would likely come in at 158.5% of GDP vs. 155.6% previously forecast. |

EU Spreads, 2020 - 2021 |

UK reported labor market data. Employment for the three months ending in November fell -88k vs. -104k expected and -144k previously, pushing the unemployment rate up a tick to 5.0%, the highest since 2016. Jobless claims rose 7.0k in December vs. a revised 38.1k (was 64.3k) in November. Despite the slightly better than expected readings, Chancellor Sunak will remain under great pressure to deliver more relief for labor and small businesses in his March budget and the data is likely to prove supportive. Elsewhere, CBI distributive trades survey for January was reported, with retailing reported sales coming in at -50 vs. -33 expected and -3 in December. Obviously, this bodes ill for retail sales and the economy in Q1.

National Bank of Hungary is expected to keep the base rate steady at 0.60%. CPI rose 2.7% y/y in both November and December, the lowest since May and in the bottom half of the 2-4% target range. For now, we believe policymakers are in wait and see mode. Of note, Hungary became the first EU country to buy Russia’s Sputnik V vaccine and cited the slow arrival of vaccines from the west for the decision. Prime Minister Orban warned that Hungary will probably need to extend virus curbs, including a curfew and closures of some businesses, until mass vaccination has been achieved. This is another reason why policy is likely to remain loose for now.

ASIA

Bank of Japan minutes suggest it is looking for ways to strengthen the nation’s economic potential as part of its policy review. There is a section in the minutes that focuses on the “considerable room” available for improving Japan’s productivity, especially at small and medium-sized firms. Yet this strikes us as a bit misguided. Monetary policy can do many things but improving productivity isn’t one of them. This really requires microeconomic solutions in the labor market, including improved training and education. Yes, monetary policy can help set the stage by keeping rates low and boosting investment, which tends to boost productivity. However, central banks have little direct impact on productivity.

We are growing concerned that the policy review was not very well thought out. Announced by surprise last month and with results due in March, the review seems rushed and these comments about productivity seem misguided. The Fed’s review took a year, while the ECB’s is ongoing and is taking more than a year due to the pandemic. Can the BOJ really come up with conclusive results in less than three months? Color us skeptical.

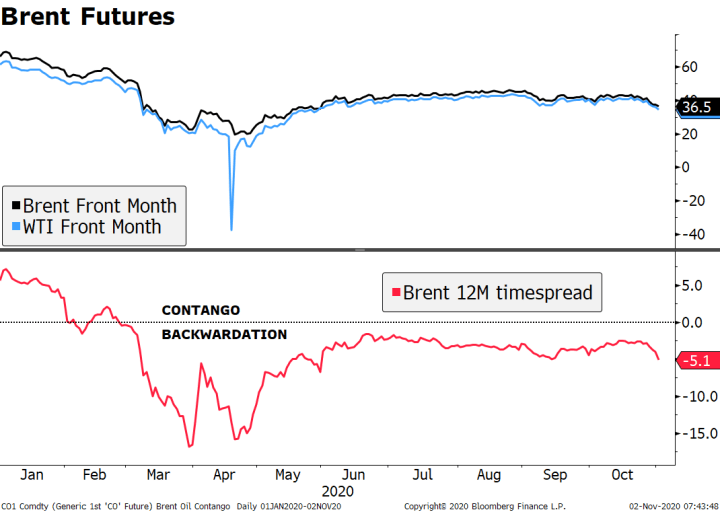

| Interbank rates in China spiked after a large overnight capital drain by the PBOC and a warning about asset price bubbles. The 7-day repo rate rose 36 bp while the overnight rates rose 28 bp, bouncing back from the lows in December which followed generous liquidity provisions by the PBOC. The drain is unusual coming ahead of the Lunar New Year holiday, when liquidity tightens up as cash is withdrawn. The warning about the recent increases in stock markets and property values came from the bank’s advisor Ma Jun, who is arguing for changes in the monetary policy stance but didn’t provide any details. Yet it’s clear the PBOC is walking a fine line. Governor Yi Gang stressed today that the bank won’t exit its accommodative stance “prematurely” and added that monetary policy will continue to “prop up the economy.” However, he added that the bank will be mindful of financial stability risks. |

PBOC's Rates, 2019-2021 |

| Korea reported firm Q4 GDP data. Growth came in at 1.1% q/q vs. 0.9% expected and 2.1% in Q3, while the y/y rate was -1.4% vs. -1.6% expected and -1.1% in Q3. For the entire year, GDP contracted only -1%, which is quite remarkable when compared to most other countries, both developed and emerging. The combination of successful virus control and aggressive fiscal stimulus were the textbook responses required, but Korea was also lucky to see strong export growth due to its ties to China. The recovery continues but policymakers are likely to remain accommodative this year. Bloomberg consensus sees a tightening cycle starting in H1 2022, which seems too soon to us. Next policy meeting is February 25 and rates are expected to be kept steady at 0.50%. |

Tags: Articles,Daily News,Featured,newsletter