The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely The row about EU funding takes center stage today as leaders hold a conference call to iron out their differences; UK CBI November industrial trends survey came in weak; Turkey delivered the consensus 475 bp rate hike; SARB is expected to keep rates steady at 3.5% Record levels of infections in Japan led officials to raise its virus alert to the highest level; Australia reported strong October jobs data; Indonesia and Philippines both surprised

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade

- Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely

- The row about EU funding takes center stage today as leaders hold a conference call to iron out their differences; UK CBI November industrial trends survey came in weak; Turkey delivered the consensus 475 bp rate hike; SARB is expected to keep rates steady at 3.5%

- Record levels of infections in Japan led officials to raise its virus alert to the highest level; Australia reported strong October jobs data; Indonesia and Philippines both surprised markets with 25 bp rate cuts

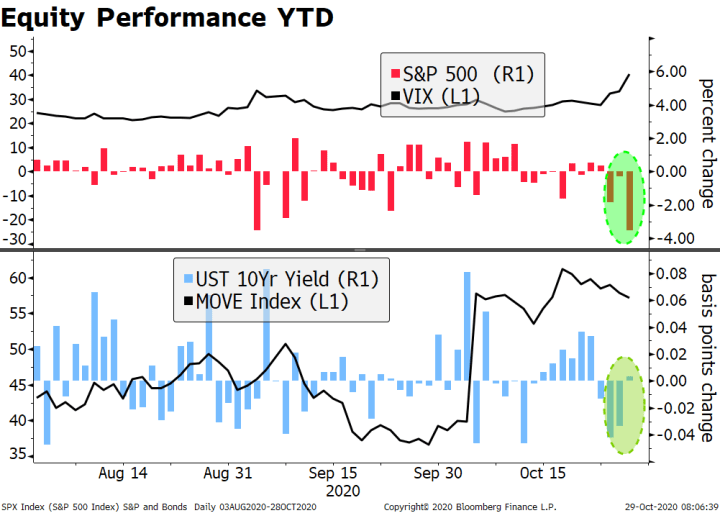

The negative virus news stream is taking a toll on market sentiment. Yesterday, New York City announced public schools would move to all remote as infections rise, and the MTA warned of 40-50% cuts in subway, bus, and commuter rail services if it does not receive aid from the federal government. Global equity markets are largely in the red today, while core bond yields are falling.

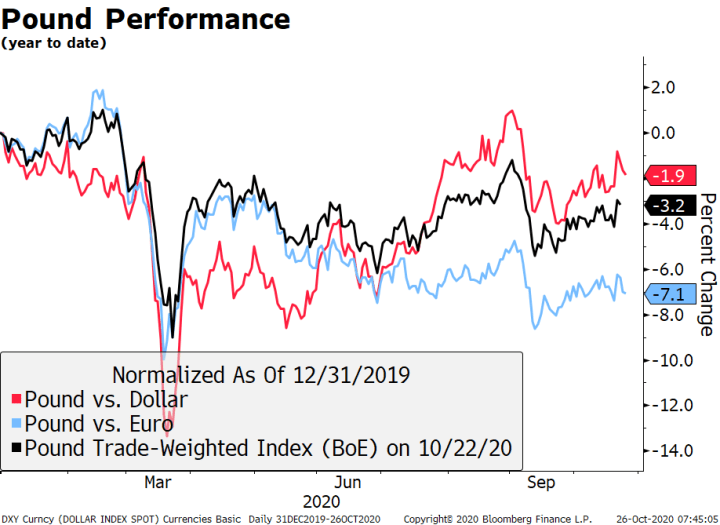

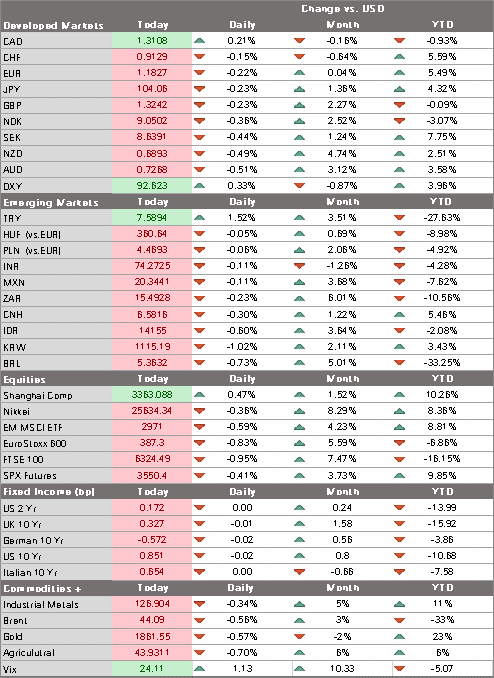

The dollar is benefiting from the risk-off price action but is likely to fade. DXY is up today after five straight down days. Like past bouts of haven buying, this dollar bounce is unlikely to last given the worsening US economic outlook, and so we still look for a test of the November 9 low near 92.13 when weakness resumes. Likewise, the euro should test its recent high near $1.1920 and sterling should retest its recent high near $1.3310. USD/JPY is trying to find a toehold above the 104 area, but the pair remains heavy and should test its November 6 low near 103.20.

AMERICAS

Weekly jobless claims data will be of interest. Regular weekly initial jobless claims are expected at 700k vs. 709k the previous week. OF note, this week’s reading is for the BLS survey week containing the 12th of the month and will be the first clue for November NFP. PUA weekly initial jobless claims have been running around 300k and so the two together have been running close to 1 mln since early October. Regular continuing claims are expected at 6.4 mln vs. 6.786 mln the previous week. Adding in the combined 13.5 mln PUA and PEUC continuing claims means that around 20 mln are currently receiving some form of unemployment benefits. Please see our recent piece “Benefits Cliff” Warns of Downside US Risks for a deeper look at the US labor market.

Fed manufacturing surveys for November will continue to roll out. Philly Fed is expected at 23.0 vs. 32.3 in October, while Kansas City Fed is expected at 11 vs. 13 in October. Earlier this week, Empire survey came in at 6.3 vs. 13.5 expected and 10.5 in October. These are the first snapshots for November and will help set the tone for other manufacturing data to come. October leading index (0.7% m/m expected) and existing home sales (-1.1% m/m expected) will also be reported today.

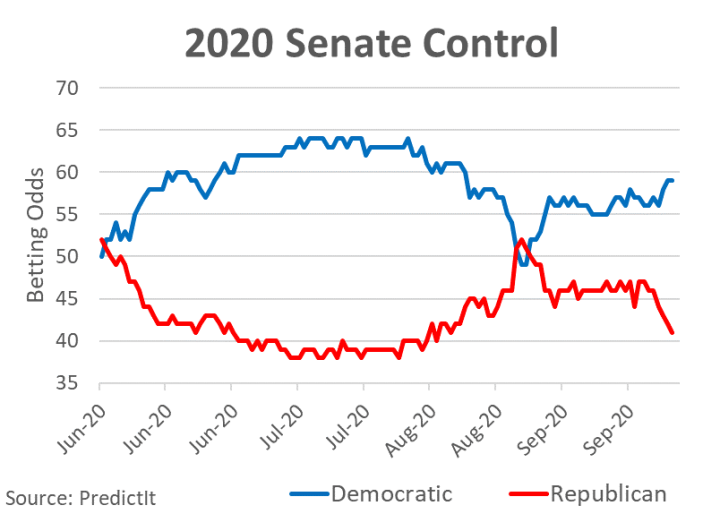

Judy Shelton’s Fed confirmation is looking less and less likely. With several Republican colleagues unable to vote and the Senate leaving Washington a day early today for the Thanksgiving recess, Majority Leader McConnell has not scheduled any more votes for the rest of this week. The Senate returns on November 30, the same day that Arizona Republican McSally will likely be replaced by Democrat Kelly due to the special election. This would tilt the party line vote 52-48 but with three Republicans opposed to Shelton, the vote swings to 51-49 against and should basically kill Shelton’s nomination beyond all doubt.

EUROPE/MIDDLE EAST/AFRICA

The row about EU funding takes center stage today as leaders hold a conference call to iron out their differences. Hungary and Poland are still playing hardball with the budget and pandemic recovery fund (worth a total of €1.8 trln) over the so-called rule of law considerations. At stake here is more than just a huge sum of money; the bloc’s decision making credibility will suffer a huge hit should this not go through, adding to the arsenal of Eurosceptic arguments. ECB President Lagarde said the EU plan “must become operational without delay” but an EU official warned that a solution will take time and unlikely to be reached in today’s call.

UK CBI November industrial trends survey came in weak. Total orders fell as expected to -40 vs. -34 in October, while export orders plunged to -51 from -46 in October. Expectations of the next three months for output and average selling prices both moved back into negative territory at -10 and -8, respectively. The CBI will reports its distributive trades survey Monday, which is also likely to show deterioration as the lockdowns start to bite.

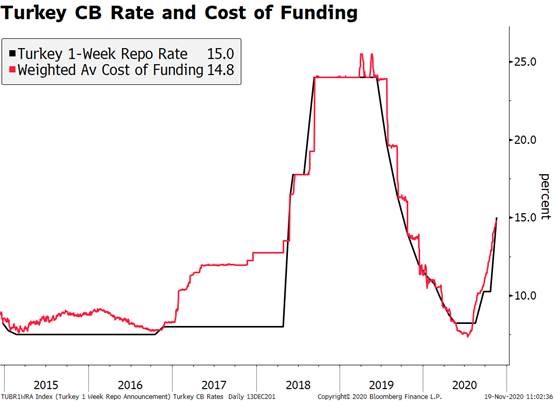

| The Turkish central bank delivered the consensus 475 bp rate hike but a bit more than we had expected. The bank said that it will now provide all funding through the benchmark 1-week repo rate that now stands at 15%, validating what the average cost of funding had suggested. Hopefully, this ends the unnecessarily complicated interest rate framework that had been used before. This is a very good first credibility building step for the new central bank Governor Agbal. Consistently, the lira has spiked higher by over 2%. |

Turkey CB Rate and Cost of Funding, 2015-2020 |

| South African Reserve Bank is expected to keep rates steady at 3.5%. However, a handful of analysts see a 25 bp cut to 3.25%. Governor Kganyago will begin his monetary policy statement at 8 AM ET (1300 GMT) and after 10-15 minutes, the decision will be revealed. The economy remains sluggish, while unemployment rose to 30.8% in Q3 from 23.2% in Q2. Inflation was 3.0% y/y in September, right at the bottom of the 3-6% target range. With the rand trading relatively firm, we see risks of a dovish surprise.

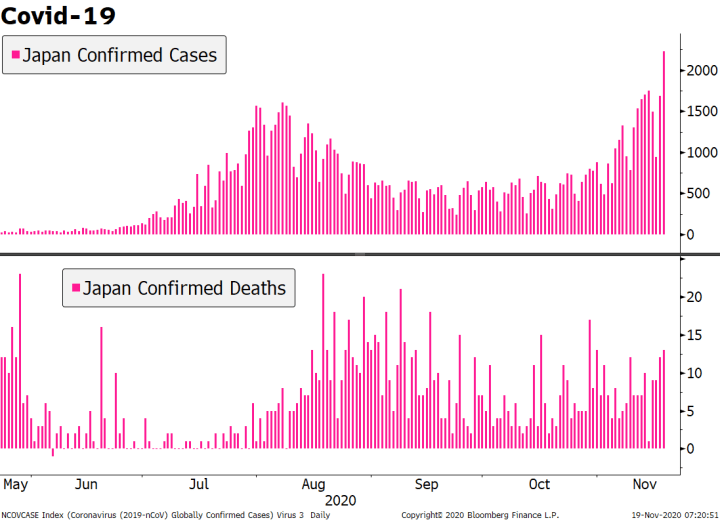

ASIA Record levels of infections in Japan led officials to raise its virus alert to the highest level. Confirmed infection rates rose above 2,000 yesterday, a daily record, with Tokyo seeing 500 new cases. Local wires suggest that authorities are not about to reimpose restrictions on services, even though Prime Minister Suga said the country was on “maximum alert.” He asked citizens to “engage in quiet, masked, dining.” The Nikkei closed 0.4% lower on the day, in line with the downdraft in global equities. |

Covid - 19 Japan, 2020 |

| Australia reported strong October jobs data. Employment rose a whopping 178.8k vs. -27.5k expected and a revised -42.5k (was -29.5k) in September. The mix was good, with 97.0k full time jobs and 81.8k part time jobs added. The unemployment rate rose a tick to 7.0% vs. 7.1% expected, while the participation rate jumped to 65.8% from a revised 64.9% (was 64.8%) in September. Policymakers will be happy with readings and should keep the RBA on hold for the time being after easing earlier this month.

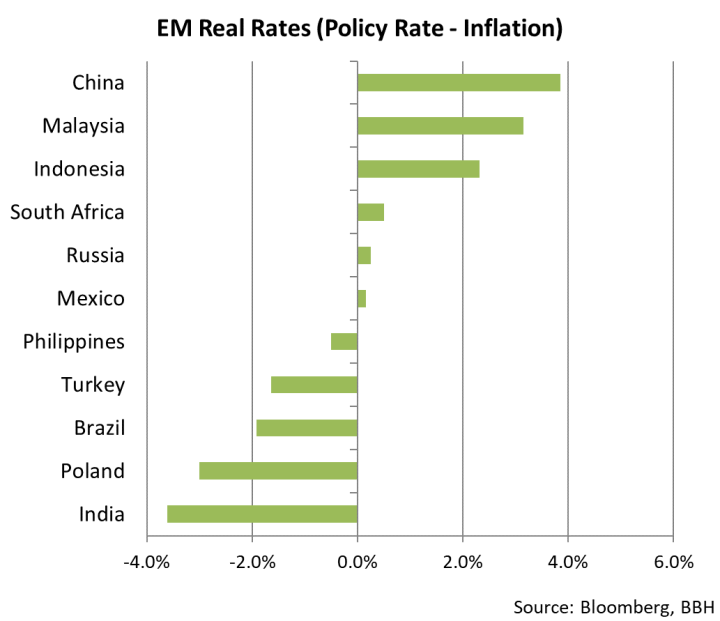

Bank Indonesia surprised markets with a 25 bp rate cut to a record low 3.75%. This was the first move since the last 25 bp cut back in July. Like the Philippines, Indonesia saw a larger-than-expected growth contraction in Q3 (-3.4% y/y), and some of the impact of their extended lockdowns are still to come. But unlike the Philippines, Indonesia’s CPI inflation is running well below the policy rate. The country’s real rate is considerably higher than in most major EMs, which helps alleviate some of the country’s concerns about central bank credibility and budget financing. The rupiah is underperforming on the day (-0.6% against the dollar), but roughly in line with the broad trend in EM. |

EM Real Rates |

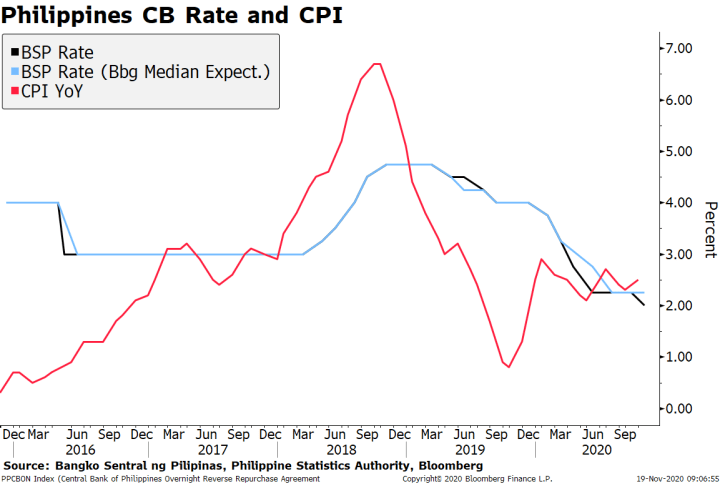

| The Philippine central bank surprised markets with a 25 bp cut to 2.0%. This was the first cut since the last 50 bp cut back in June, driving real rates deeper into negative territory. Recall that the bank also surprised markets on the dovish side on two other occasions this year (April and June) and once last year during the course of its 275 bp easing cycle that started in early 2019. Interestingly, officials increased their 2020 CPI forecast by a tick to 2.4%. Of course, the bank is reacting to the huge drop in growth (-11.5% y/y in Q3), and the relatively limited fiscal support so far. There has been no sustained reaction in FX markets, as the peso’s performance remains in the middle of the pack against its Asian peers over the last several months. |

Philippines CB Rate and CPI, 2016-2020 |

|

Tags: Articles,Daily News,Featured,newsletter