As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday All eyes remain on Brexit; things are getting very tricky now in terms of timing; with the UK going into stricter lockdown, we believe the pressure is building on Prime Minister Johnson to strike a deal Japan has a busy week; the BOJ will keep markets guessing after it unexpectedly announced a policy framework review; Australia begins reporting November data Brexit concerns are weighing on market sentiment as the new week gets under way. This is giving the

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday

- All eyes remain on Brexit; things are getting very tricky now in terms of timing; with the UK going into stricter lockdown, we believe the pressure is building on Prime Minister Johnson to strike a deal

- Japan has a busy week; the BOJ will keep markets guessing after it unexpectedly announced a policy framework review; Australia begins reporting November data

![]() Brexit concerns are weighing on market sentiment as the new week gets under way. This is giving the dollar a little bit of a bid, with DXY trying to find some traction above 90. As we’ve seen with other bouts of risk-off activity, this dollar bounce is also likely to prove temporary and so we continue to target the February 2018 low near 88.253 for DXY. The euro is trading just above $1.22, while sterling has dropped over two cents from its new cycle high last week near $1.3625 to trade near $1.34 now due to a return of Brexit pessimism (see below). USD/JPY has recovered to trade back above 103 but remains heavy. We continue to look for a test of the March low near 101.20.

Brexit concerns are weighing on market sentiment as the new week gets under way. This is giving the dollar a little bit of a bid, with DXY trying to find some traction above 90. As we’ve seen with other bouts of risk-off activity, this dollar bounce is also likely to prove temporary and so we continue to target the February 2018 low near 88.253 for DXY. The euro is trading just above $1.22, while sterling has dropped over two cents from its new cycle high last week near $1.3625 to trade near $1.34 now due to a return of Brexit pessimism (see below). USD/JPY has recovered to trade back above 103 but remains heavy. We continue to look for a test of the March low near 101.20.

AMERICAS

As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided. Congress passed a 48-hour continuing resolution Friday to keep the government funded through the weekend. That time was spent hammering out a compromise on the Fed’s emergency lending powers, which had emerged as a last-minute obstacle. If all goes well tonight, Congress will pass a skinny stimulus bill for $900 bln that includes extended unemployment benefits with a supplemental $300 per week through March and a $600 per person one-time payment. Emergency PUA and PEUC benefits will also be extended. Liability protections and aid for state and local governments were left out of this bill.

With an agreement in principle at hand, it’s still possible for a very brief government shutdown. The stimulus bill will be attached to the omnibus spending bill that keep the government funded through FY21. Both houses of Congress must vote on all the measures will very little time to study them and so there simply may not be enough time to do so Sunday night. Another short-term continuing resolution could be passed to give everyone more time. If that CR isn’t passed, then the government would enter shutdown at midnight Sunday. However, barring any last minute disaster, the measures will most likely be approved Monday morning at the latest.

What about the Fed? The revised language in the compromise reportedly prohibits the Fed from creating exact copies of the emergency lending programs as those from the CARES Act. All those programs will shut down as of year-end and the $429 bln in unspent funds will be redirected to other programs in the new $900 bln bill. Republicans reportedly believe the language will prevent the Fed from pursuing new emergency lending programs on its own without Congressional permission and appropriations. However, the Democrats reportedly believe that the language still gives the incoming Biden administration leeway to introduce new emergency programs in conjunction with the Fed if needed. We hope we never have to find out who’s right here.

The Fed gave US banks the go-ahead to resume stock buybacks Friday. However, banks are still barred from boosting dividends at least through March. The Fed also revealed that US banks performed well in a second round of stress tests this year that show resilience to the pandemic. Fed Vice Chair Quarles noted “The banking system has been a source of strength during the past year, and today’s stress test results confirm that large banks could continue to lend to households and businesses even during a sharply adverse future turn in the economy.” Even though the media embargo is over, there are no Fed speakers scheduled the next two weeks due to the holidays.

Fed manufacturing surveys for November will continue to roll out. Richmond Fed reports Tuesday and is expected at 12 vs. 15 in November. Last week, Empire survey came in at 4.9 vs. 6.3 previously, Philly Fed came in at 11.1 vs. 26.3 previously, and Kansas City Fed came in at 14 vs. 11 previously. These are the first snapshots for December and suggest some softening in manufacturing.

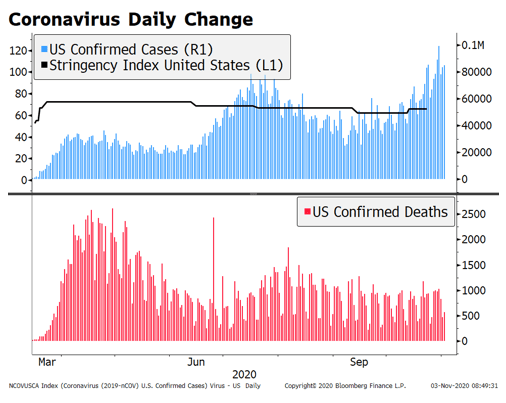

Weekly jobless claims will be reported on Wednesday due to the holiday. Regular initial jobless claims are expected at 875k vs. 885k the previous week. Last week’s reading was the highest since the first week of September. PUA initial claims rose to 455k last week, the highest since late September. Together, initial claims total 1.34 mln, also the highest since late September. Of note, last week’s initial claims data was for the BLS survey week containing the 12th of the month and so this sets us up for a very weak NFP. Meanwhile, regular continuing claims are expected at 5.56 mln vs. vs. 5.51 mln the previous week. Both PUA and PEUC continuing claims rose for the week prior to that and so the signs all point to a weakening labor market. Early consensus sees +100k for December NFP vs. +245k in November but we see downside risks.

Other minor data will be seen. November Chicago Fed National Activity Index will be reported Monday. Tuesday brings another Q3 GDP revision (33.1% SAAR expected), December Conference Board consumer confidence (97.0 expected), and November existing home sales (-2.2% m/m expected). November personal income and spending will be reported Wednesday. Income is expected at -0.2% m/m vs. -0.7% in October, while spending is expected at -0.2% vs. +0.5% in October. November durable goods orders (0.6% m/m expected), new homes sales (-0.9% m/m expected), and final Michigan consumer sentiment (81.0 expected) will also be reported Wednesday.

EUROPE/MIDDLE EAST/AFRICA

All eyes remain on Brexit. Talks were extended into Monday after weekend talks yielded no breakthroughs. The sticking points remain fisheries and, to a lesser extent, the level playing field. EU chief Brexit negotiator Barnier said Sunday that the talks are at a “crucial moment.” He stressed that he is still working hard for an agreement but said an accord will depend on how much of its domestic catch Britain is prepared to give up in return for access to the EU market.

Things are getting very tricky now in terms of timing. The European Parliament has warned it won’t be able to ratify any deal in time for the end of the transition period December 31 unless it is presented with one by midnight on Sunday. That’s not happening and so the EU may have to take the unusual step of applying Brexit on a provisional basis before putting it to a full vote early next year. However, we may be getting ahead of ourselves as a deal has yet to be struck.

With the UK going into stricter lockdown, we believe the pressure is building on Prime Minister Johnson to strike a deal. The last thing the UK economy needs now is a hard Brexit in the middle of an intensifying pandemic. Johnson is also coming under fire for this handling of the lockdowns, reversing his position on allowing travel just days ahead of Christmas. The knives are out, with critics accusing Johnson of canceling Christmas. Further complicating matters, France and Germany have suspended travel to and from the UK due to the mutating virus, with others sure to follow.

UK reports limited data. The CBI releases its December distributive trades survey Monday. Last week, CBI released its manufacturing survey, where total orders index improved to -25 vs. -40 expected and actual in November. UK also reports November public sector net borrowing and final Q3 GDP data Tuesday.

ASIA

Japan has a busy week. Japan’s cabinet meets Monday to approve the FY21 budget and release the government’s borrowing plans. November department store sales will be reported Tuesday. December Tokyo CPI, November unemployment, retail sales , and housing starts will be reported Friday. Both Tokyo headline and core (ex-fresh food) CPI is expected to fall -0.8% y/y, while retail sales are expected to fall -0.8% m/m. The unemployment rate and job-to-applicant ratio are both seen steady at 3.1% and 1.04, respectively.

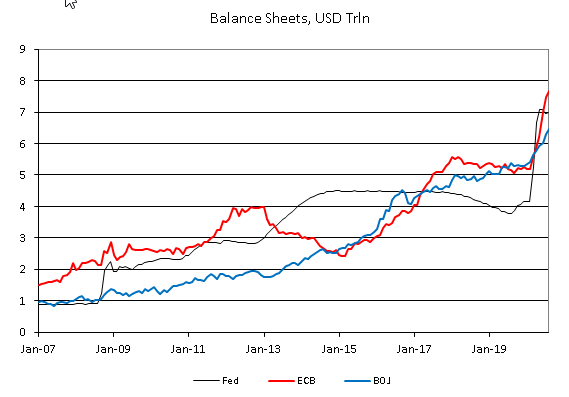

The Bank of Japan will keep markets guessing after it unexpectedly announced a policy framework review. Last week, it extended its emergency lending and liquidity programs for six months whilst keeping rates and asset purchases unchanged. However, it pledged to review the sustainability of its policy framework. The bank stressed that there was no need to scrap its yield curve control as part of the review, but the announcement does suggest there will be tweaks coming that will seek maintain its accommodative stance for even longer. The BOJ said it would likely announce the findings in March.

Australia begins reporting November data. Preliminary retail sales will be reported Tuesday. Preliminary trade data will be reported Thursday. The economic data have been coming in firm recently, which should keep the RBA in wait and see mode for the time being. Indeed, the outlook keeps getting brighter. The government just boosted its forecast for export earnings from mining and energy in FY21 due to booming prices. Export are now seen at AUD279 bln ($212 bln) in FY to June 30, 2021, up 9% from the previous forecast in September.

Tags: Articles,developed markets,Featured,newsletter