Discussions on President Biden’s proposed .9 trln fiscal package are getting off to a rocky start; Fed manufacturing surveys for January will continue to roll out ECB Governing Council member Olli Rehn viewed yield curve control for the region as “not sensible”; on the virus front, Norway tightened mobility restrictions, France looks set to impose another lockdown, and the UK considering closing borders; Germany IFO survey for January came in slightly lower than expected Japan will sell JPY500 bln of 40-year JGBs tomorrow; polls suggest Suga’s government continues to lose support; the border dispute between India and China is flaring up again The dollar is flat as markets await fresh drivers. However, technical indicators suggest the dollar will resume weakening

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Discussions on President Biden’s proposed $1.9 trln fiscal package are getting off to a rocky start; Fed manufacturing surveys for January will continue to roll out

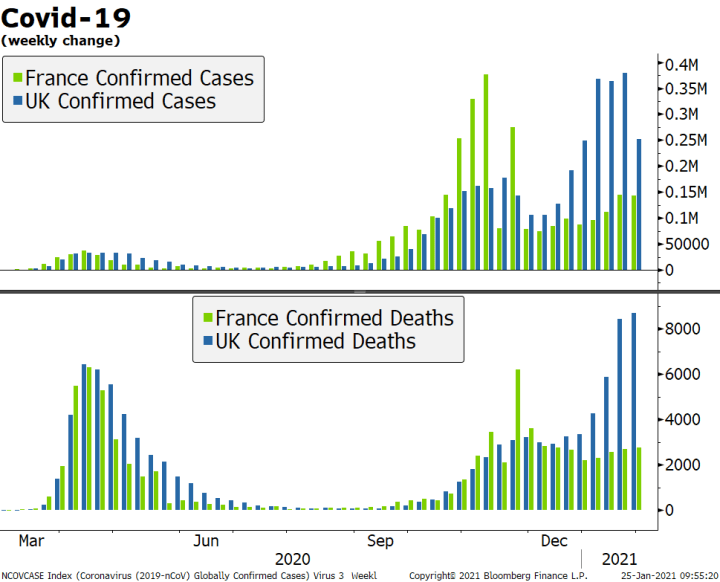

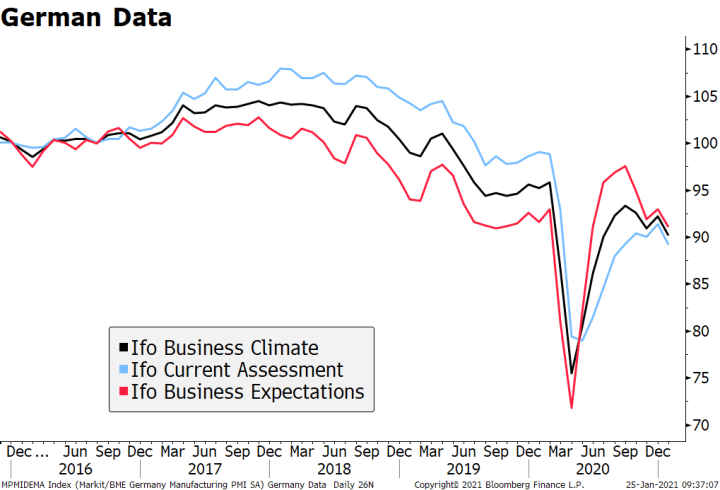

- ECB Governing Council member Olli Rehn viewed yield curve control for the region as “not sensible”; on the virus front, Norway tightened mobility restrictions, France looks set to impose another lockdown, and the UK considering closing borders; Germany IFO survey for January came in slightly lower than expected

- Japan will sell JPY500 bln of 40-year JGBs tomorrow; polls suggest Suga’s government continues to lose support; the border dispute between India and China is flaring up again

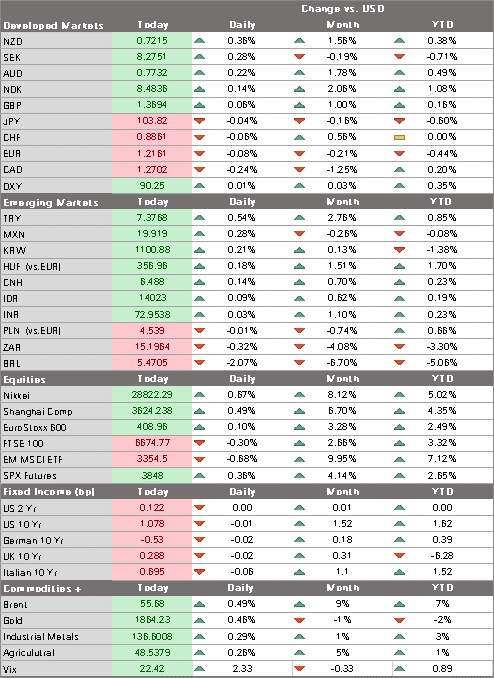

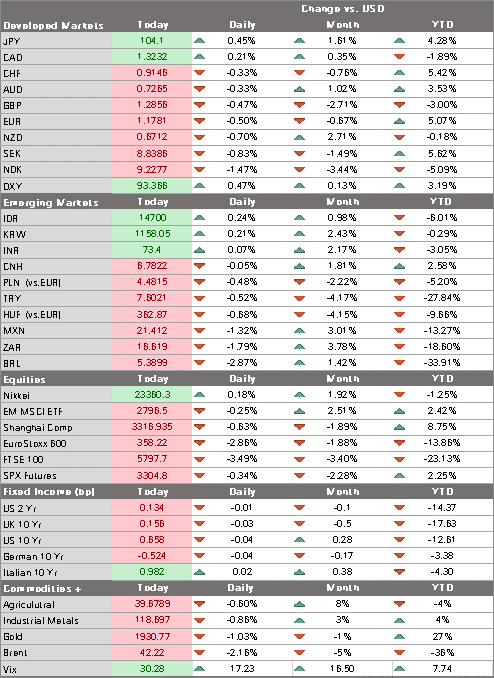

The dollar is flat as markets await fresh drivers. However, technical indicators suggest the dollar will resume weakening and this could be triggered by the Fed delivering another dovish hold this week as we expect. DXY continues to test the 50% retracement objective of the January rally near 90.08. Break below that and then the 62% retracement objective near 89.874 is needed to set up a test of the January 6 low near 89.209. The euro edged higher after the ECB decision but is having trouble breaking above $1.22. Sterling remains buoyant despite weak economic data and is testing the $1.37 area, pushing the EUR/GBP back below the .89 level. USD/JPY continues to hover around 104 but remains heavy and is likely to continue probing the downside.

AMERICAS

Discussions on President Biden’s proposed $1.9 trln fiscal package are getting off to a rocky start. Director of the National Economic Council Brian Deese held virtual talks Sunday with a 16-member bipartisan group of Senators about key elements of the proposal. Reports suggest independent Senator Kong and Republican Senator Collins (both from Maine) pushed for a more targeted package. It appears Senators from both parties favored a smaller bill that focuses on funding and distributing vaccines, something the White House does not want to do. King wants the Senate to approve a package before the Senate takes up the impeachment trial of former President Trump, which means by February 8. King also noted that the mid-March expiration of some aid included in the $900 bln package passed last month also serves as another potential deadline. Bottom line: the $1.9 trln amount was always seen as a marker. Now the hard work and horse-trading needed to reach a deal has begun.

Fed manufacturing surveys for January will continue to roll out. Dallas Fed is expected at 12.0 vs. 9.7 in December. Richmond Fed reports Tuesday and is expected at 17 vs. 19 in December. Kansas City reports Thursday and is expected at 12 vs. 14 in December. So far, Philly Fed came in at vs. a revised 9.1 (was 11.1) in December and Empire survey came in at 3.5 vs. 6.0 expected and 4.9 in December. Chicago Fed National Activity Index for December (0.10 expected) will be reported today. Because of the media embargo, there will be no Fed speakers this week until Chair Powell’s post-decision press conference Wednesday afternoon.

| EUROPE/MIDDLE EAST/AFRICA

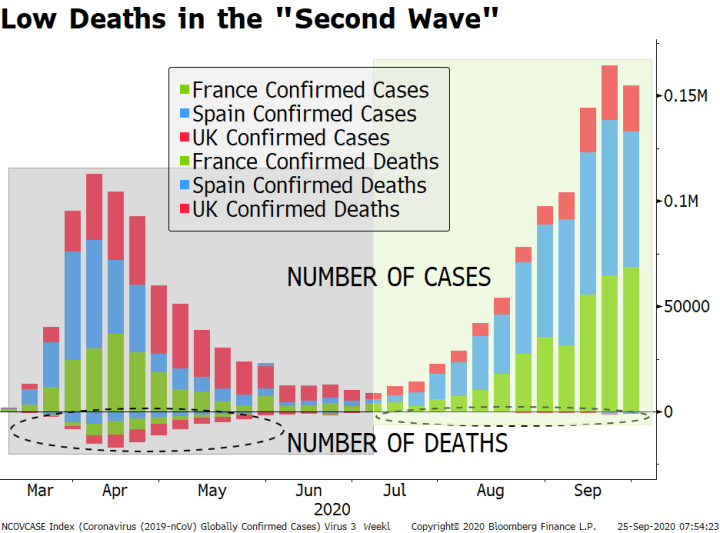

ECB Governing Council member Olli Rehn viewed yield curve control for the region as “not sensible.” He noted that the eurozone has at least nineteen different yields curves that reflect vast economic and financial differences between the countries, and that YCC was not the best way to maintain favorable financing conditions. As part of its strategy review, Rehn said that the ECB is assessing how to define “favorable” financing conditions as well as the best to determine how to maintain those conditions. That said, reports have emerged that the ECB is engaged in YCC-lite, adjusting its asset purchases to maintain spreads for key bond markets at what it views as “appropriate” levels. Despite the dire outlook for the pandemic in Western countries, we think the bar is very high for most central banks to embark on new unconventional politics, be it yield curve control or negative rates. Fiscal policy is in the driver’s seat now. On the virus front, Norway tightened mobility restrictions, France looks set to impose another lockdown, and the UK considering closing borders. In Norway, the government announced on Saturday that the “outbreak of the English virus mutation” requires that 10 municipalities (including Oslo) come under strict measures. In France, the government may announce a third lockdown on Wednesday, but no firm decision has yet been made. In the UK, aside from discussion about closing borders, the government changed the tone and now seems to be managing expectations lower by suggesting that the lockdown may last until the summer. Prime Minister Johnson said that his government will examine options for relaxing lockdown measures before the February 15 review but warned that he doesn’t want to risk another surge of infections by reopening too early. |

Covid-19 Weekly Change |

| Germany IFO survey for January came in slightly lower than expected. The headline reading fell to 90.1 vs. 91.4 expected and a revised 92.2 (was 92.1) in December. The expectations component declined to 91.1 vs. 93.6 expected and a revised 93.0 (was 92.8) in December, while the current assessment fell to 89.2 vs. 90.6 expected and 91.3 in December. We think these figures probably present a more realistic picture than the recent ZEW and PMI figures, which were still holding up well. It’s very difficult to have an optimistic outlook of the Germany and the euro area for the near-term. The good news is that this is probably already priced in and does not represent new incremental information. GfK consumer confidence for February will be reported Wednesday and is expected at -7.9 vs. -7.3 in January. |

German Data, 2016-2020 |

| ASIA

Japan will sell JPY500 bln of 40-year JGBs tomorrow. The sale comes after reports suggest that the BOJ may allow the 10-year yield to trade in a wider band than the current 20 bp on either side of 0%. It’s worth noting that the JGB curve has steepened a bit at the ultra-long end over the past month. However, increased debt issuance and a wider YCC range would likely lead to an even steeper yield curve and we are skeptical that the bank would allow this right now. Indeed, a steeper curve would also tend to strengthen the yen and that is also undesirable for policymakers. While USD/JPY continues to hover around the 104 level, technical suggest the pair is setting up for another stab at the downside. Polls suggest Suga’s government continues to lose support. Latest Asahi poll shows cabinet approval dropping to 33% from 39% last month and disapproval rising to 45% from 35% last month. The poll also showed that about 63% disapproved of the government’s handling of the pandemic, 80% thought the government was too slow to declare a state of emergency in response to the pandemic, and 54% thought that measures introduced under the emergency were insufficient. The poll was carried out over the weekend. We continue to believe that Prime Minister Suga will deliver another slug of fiscal stimulus near mid-year as he girds for elections this autumn, which will put further upward pressure on JGB yields. The border dispute between India and China is flaring up again. Local media reported more clashes between the two sides and several injuries. While the news does re-open a risk for the region that has been dormant for several months, we don’t anticipate any severe escalation or market impact. |

Tags: Articles,Daily News,Featured,newsletter