The virus numbers in the US show no signs of slowing; the dollar should continue to soften October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors Canada has an important data week; Brexit talks will (hopefully) wind up soon; UK reports key data Japan and Australia have busy data weeks The virus numbers in the US show no signs of slowing. The US has never fully controlled it and the continued lack of a federal plan under Trump coupled with Trump’s reluctance to help with the transition to the Biden administration suggests things will get much worse before they get

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The virus numbers in the US show no signs of slowing; the dollar should continue to soften

- October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors

- Canada has an important data week; Brexit talks will (hopefully) wind up soon; UK reports key data

- Japan and Australia have busy data weeks

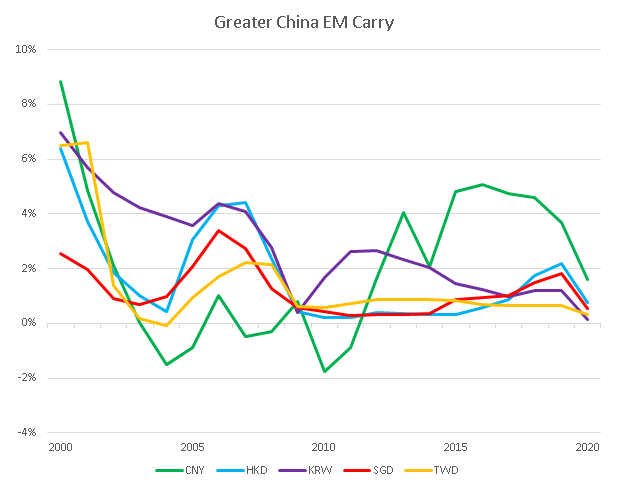

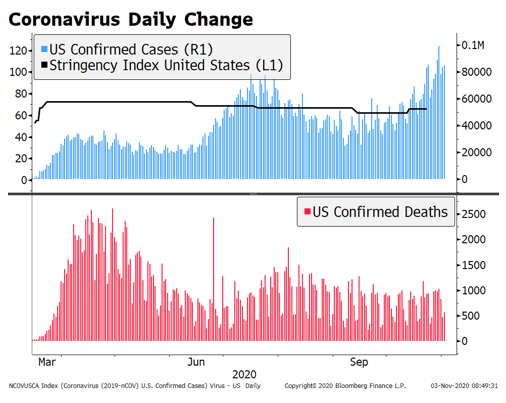

![]() The virus numbers in the US show no signs of slowing. The US has never fully controlled it and the continued lack of a federal plan under Trump coupled with Trump’s reluctance to help with the transition to the Biden administration suggests things will get much worse before they get better. Yes, the US economy has been resilient in recent months but this simply cannot continue. The renewed surge in virus numbers and growing state lockdowns underscore our weak dollar call. Until we can control it here, the short-term economic gains will eventually give way to greater medium-term pain.

The virus numbers in the US show no signs of slowing. The US has never fully controlled it and the continued lack of a federal plan under Trump coupled with Trump’s reluctance to help with the transition to the Biden administration suggests things will get much worse before they get better. Yes, the US economy has been resilient in recent months but this simply cannot continue. The renewed surge in virus numbers and growing state lockdowns underscore our weak dollar call. Until we can control it here, the short-term economic gains will eventually give way to greater medium-term pain.

The dollar should continue to soften. After peaking near 93.208 last week, DXY is down for the third straight day. A break below the 92.542 area would set up a test of the November 9 low near 92.13. Likewise, a break above the $1.1855 area for the euro would set up a test of its recent high near $1.1920. Sterling remains bid above $1.32 but remains subject to swings in Brexit talks (see below), while USD/JPY remains heavy. A break below 104.15 would set up a test of the November 9 low near 103.20.

AMERICAS

October retail sales Tuesday will be the US data highlight for the week. Headline sales are expected to rise 0.5% m/m vs. 1.9% in September, while sales ex-autos are expected to rise 0.6% m/m vs. 1.5% in September. The so-called control group used for GDP calculations is expected to rise 0.5% m/m vs. 1.4% in September. Whatever the October readings are, we know that November will be worse in light of widening lockdowns across the country. Credit card data from a major US bank suggests consumption is contracting in early November.

Fed manufacturing surveys for November will start to roll out. Empire survey starts the ball rolling Monday and is expected at 13.8 vs. 10.5 in October. Philly Fed follows up Thursday and is expected at 22.0 vs. 32.3 in October. Kansas City Fed then reports Friday and stood at 13 in October. These are the first snapshots for November and will help set the tone for other manufacturing data to come. In between, October IP will be reported Tuesday and is expected to rise 1.0% m/m vs. -0.6% in September.

Other minor data round out the week. October import/export prices, September business inventories (0.6% m/m expected), and TIC data will be reported Tuesday, followed by October building permits (1.4% m/m expected) and housing starts (2.8% m/m expected) Wednesday. October leading index (0.7% m/m expected) and existing home sales (1.4% m/m expected) will be reported Thursday.

The Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors. Two Republican Senators came out against her (Romney and Collins) and one (Murkowski) was on the fence but has now signaled her support. Unless two more oppose (for a total of four against), then Shelton will get a seat on the Board of Governors during this lame duck session. No word on the other nominee Christopher Waller, who is eminently more qualified for the post. The only saving grace is that President-elect Biden won’t elevate Shelton to the Chair when Powell’s term is up, as Trump had been rumored to be considering. If confirmed, Shelton will be just one of many voices on the Board of Governors.

The week has many Fed speakers. Clarida and Daly speak Monday. Tuesday, Barkin speaks while Bostic, Daly, Kaskhari, and Rosengren take part in a conference on racism and the economy. Williams, Bullard, Kaplan, and Bostic speak Wednesday, followed by Kaplan, Barkin, and George Friday. All are likely to echo Chair Powell’s concerns about rising virus numbers in the US, as well as the need for more fiscal stimulus.

Canada has an important data week. Key readings will be October CPI Wednesday and September retail sales Friday. Headline inflation is seen falling a tick to 0.4% y/y, while common core inflation is seen remaining steady at 1.5% y/y. Headline sales are expected to rise 0.1% m/m vs. 0.4% in August, while sales ex-autos are expected flat m/m vs. 0.5% in August. September manufacturing sales (1.5% m/m expected) and October existing home sales will be reported Monday. October housing starts and September wholesale trade sales (0.4.% m/m expected) will be reported Tuesday.

EUROPE/MIDDLE EAST/AFRICA

Brexit talks will (hopefully) wind up soon. Talks continue in Brussels ahead of a new mid-week deadline. Yet even that new deadline remains movable, as reports suggest the UK hinted that talks could be extended beyond this week as both sides struggle to close the remaining gaps. UK Environment Secretary Eustice said over the weekend that it would be possible to “squeeze out extra time” if the two sides were close to an agreement. However, Eustice stressed that “This needs to be a week when things move, when we break through some of these difficult issues, and get a resolution, and at least have some sort of headlines of an agreement.” Stay tuned.

UK reports some key data. October CPI will be reported Wednesday. Both headline and CPIH inflation are expected to remain steady at 0.5% y/y and 0.7% y/y, respectively. CBI releases its November industrial trends survey Thursday, with total orders expected at -40 vs. -34 in October. Retail sales and public sector borrowing data will be reported Friday. Headline sales are expected to fall -0.3% m/m vs. 1.5% in September, while sales ex-auto fuel are expected to fall -0.1% m/m vs. 1.6% in September.

ASIA

Japan has a busy data week. Q3 GDP grew 21.4% SAAR vs. 18.9% expected and a revised -28.8% (was -28.1%) in Q2. The recovery is welcome but risks to Q4 are rising along with the virus numbers. October trade data will be reported Wednesday, with exports expected to fall -4.5% y/y and imports by -8.6% y/y. October national CPI will be reported Friday. Headline inflation is seen falling to -0.4% y/y, while core (ex-fresh food) inflation is seen falling to -0.7% y/y. If so, headline deflation would be the worse since September 2016 and core deflation the worst since March 2011. Preliminary November PMI readings and October convenience store sales will also be reported Friday.

Australia has a busy week. October jobs data will be reported Thursday. Employment is expected to fall -27.5k vs. -29.5k in September, with the unemployment rate expected to rise a couple of ticks to 7.1%. Preliminary October retail sales will be reported Friday. Ahead of that, Reserve Bank of Australia releases its minutes Tuesday. At that meeting, the bank delivered a 15 bp cut to 0.10% in both the cash rate and the 3-year yield target. The bank raised the possibility of buying even longer-dated bonds at that meeting and so the minutes will be scrutinized. Westpac October leading index will be reported Wednesday.

Tags: Articles,developed markets,Featured,newsletter