The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as bln of 10-year notes will be sold today; Brazil reports December IPCA inflation Yields in Europe and UK are following the trend higher in the US markets, but not as fast; Italy is facing another bout of political instability; BOE Governor Bailey pushed back against negative rates Japan’s government will declare a state of emergency for Osaka, Kyoto, and Hyogo prefectures as soon as tomorrow; Malaysia assets are underperforming on further lockdowns The dollar bounce may be running out of steam. Market sentiment has improved, with equity markets higher and bond prices lower. DXY is down today after four straight days higher. Given the position skew,

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

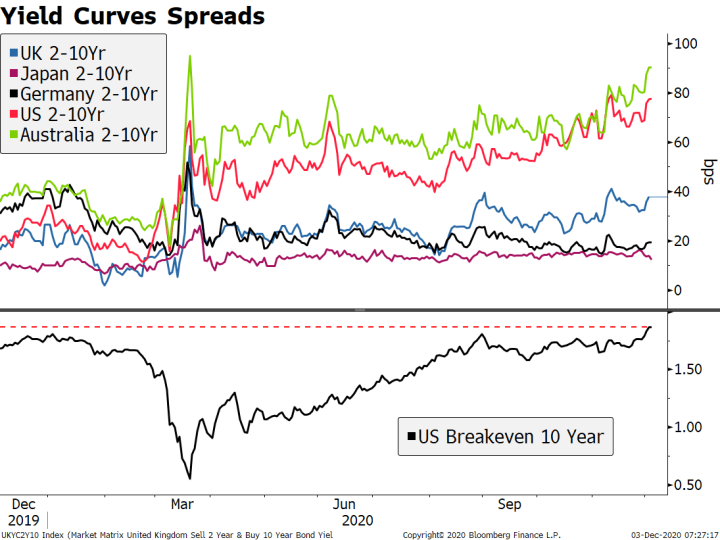

- The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation

- Yields in Europe and UK are following the trend higher in the US markets, but not as fast; Italy is facing another bout of political instability; BOE Governor Bailey pushed back against negative rates

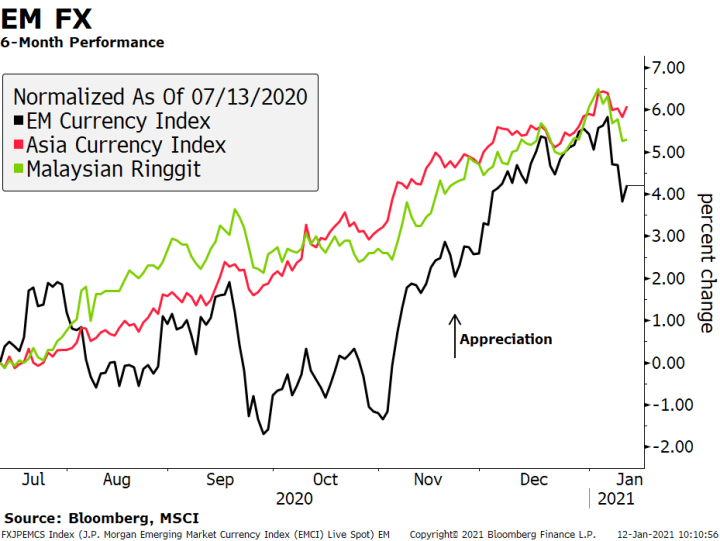

- Japan’s government will declare a state of emergency for Osaka, Kyoto, and Hyogo prefectures as soon as tomorrow; Malaysia assets are underperforming on further lockdowns

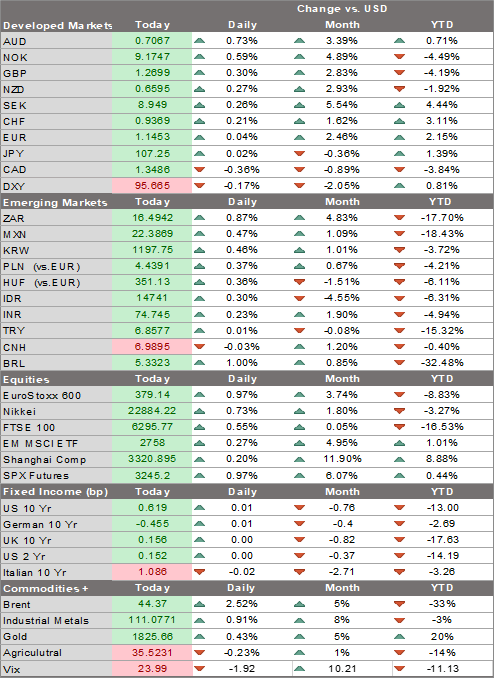

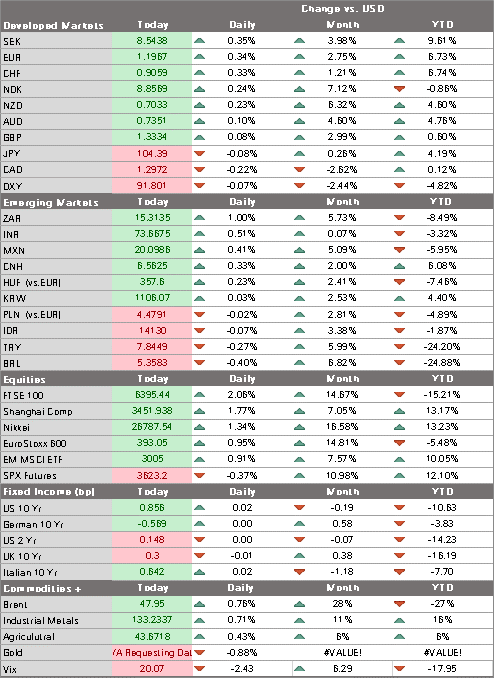

The dollar bounce may be running out of steam. Market sentiment has improved, with equity markets higher and bond prices lower. DXY is down today after four straight days higher. Given the position skew, we see potential for a test of the December 21 high near 91. That said, we view this bounce as temporary and continue to target the February 2018 low near 88.25. The euro found support around the December 21 low near $1.2130 but its bounce has been limited. Sterling is the big mover today on BOE comments (see below), bouncing off support around the December 28 low near $1.3430 and testing the $1.36 area now. USD/JPY ran out of steam around 104.40 and now feels heavy and is likely to retest the 104 area.

| AMERICAS

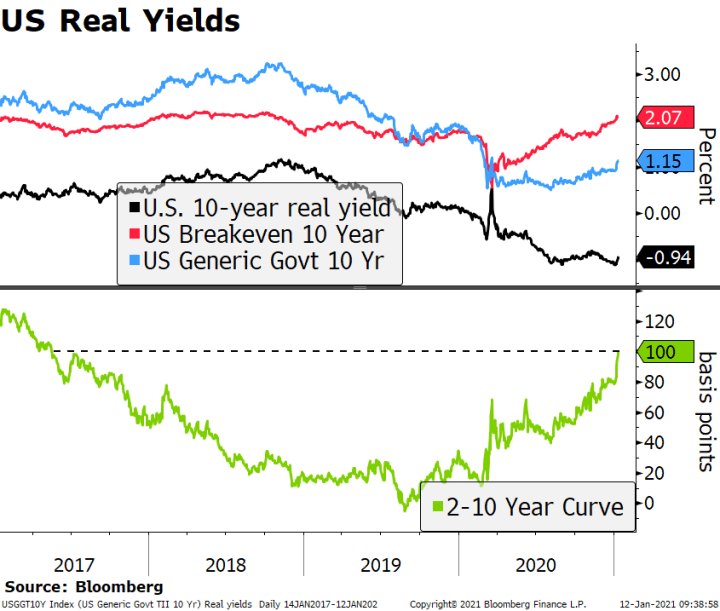

Vice President Pence will not invoke the 25th Amendment, leaving impeachment as the only path left for Democrats to remove President Trump. House Speaker Pelosi will reportedly give Pence a deadline today. Since he won’t invoke it, the House will move ahead with impeachment proceedings tomorrow. As we’ve note before, impeachment is a largely symbolic move that will not impact policy in the final days of President Trump’s administration. Of note, the Senate is currently in recess until January 19 and so it would have to convene a special session to hold the impeachment trial. The US curve continues to steepen. At 108 bp, the 3-month to 10-year curve is the steepest since late March and the year’s high from March 18 comes in near 120 bp. This is helping US bank stocks outperform and one of the forces putting downward pressure on gold, though there are plenty of other supportive factors for precious metals. The 10-year yield of 1.16% is the highest since March 19, while 10-year TIPS inflation breakeven inflation rate of 2.08% is just below the multi-year high of 2.11% from last week. The rise in the long end is driven in part by rising inflation expectations here in the US as markets contemplate another slug of fiscal stimulus ahead. It’s worth noting that real US yields have become less negative. That is, the increase in nominal yields has been faster than the increase in inflation expectations. This may be one of the factors helping the dollar stabilize. December inflation data will be closely watched, with CPI out tomorrow and PPI out Friday. |

US Real Yields, 2017-2020 |

| UST supply will remain an issue as $38 bln of 10-year notes will be sold today. The previous 10-year auction saw a bid to cover ratio of 2.33 and 62.3% going to indirect bidders (foreign demand), and the yield came in at 0.951%. Of note, the $58 bln sale of 3-year notes yesterday saw strong demand. The bid to cover ratio was 2.52 vs. 2.28 previously and 52.2% went to indirect bidders (foreign demand) vs. 49.3% previously. The yield came in at 0.234% vs. 0.211% previously. This is a lot of paper for the market to digest and looking ahead, the next round of stimulus will have to be funded by increased debt issuance. While it’s not too surprising that curve steepening continues, we need to see how the Fed reacts.

Brainard, Rosengren, Kaplan, Kashkari, and George all speak today. November JOLTS job openings (6400 expected) will be reported. Brazil reports December IPCA inflation. It is expected to accelerate to 4.37% y/y from 4.31% in November. If so, inflation would be the highest since May 2019. Of note, the inflation target and target range were both shifted 25 bp lower this year to 3.75% and 2.25-5.25%, respectively. Next COPOM meeting is January 20 and rates are expected to remain steady at 2.0%. However, the CDI market is pricing in a 25 bp hike to 2.25% at the March 17 meeting, followed by a series of 50 bp hike thereafter that take the policy rate to 5.25% at year-end. While this seems way too aggressive, we do believe steady tightening of a lesser degree will be seen this year. Bloomberg consensus sees a year-end rate of 3.25%, which seems much more reasonable and likely. |

Global Longer-Dated Yields |

| EUROPE/MIDDLE EAST/AFRICA

Yields in Europe and UK are following the trend higher in the US markets, but not as fast. In both cases, 10-year yields remain within recent rages , trading around 0.33% in the UK and -0.48% in Germany. The widening nominal interest rate differential in the US’s favor provides some support for the dollar, but we still think this is only one of many variables and the headwinds will prevail in the short term. Italy is facing another bout of political instability as a junior partner of the ruling coalition threatens to leave. Former Prime Minister Renzi may pull two ministers from his Italia Viva (Italy Alive) party out of the government tonight. After breaking away from the Democratic Party, Renzi’s party only holds 30 seats in the ruling coalition led by Prime Minister Conte, but it’s unclear if any other center-left parties will follow his lead. The two party leaders have clashed over the government’s plans for using the EU recovery fund. Italy Alive officials said the party will first study the government’s latest proposal for using the recovery fund that was just received Monday evening before making any decisions about leaving the coalition. Conte would first try to cobble together another working coalition and so talk of fresh elections is premature. Of note, the current parliamentary terms ends in May 2023. For now, markets have not reacted to these developments. Elsewhere, Italian retail sales plunged -6.9% m/m in November as lockdowns hit. |

EU Spreads, 2020 - 2021 |

| Bank of England Governor Bailey pushed back against negative rates. He noted that there are “lots of issues” with such a move, adding that it may hurt banks and impact their lending to companies. Bailey added that it isn’t easy to draw parallels with the experiences with negative rates in the euro zone. As we’ve noted before, the push for negative rates at the BOE is largely coming from the external members of the MPC, with internal members more resistant to the idea. We continue to believe that further stimulus will come from expanded QE and increased spending on the fiscal side.

WIRP suggests potential for negative rates as early as May. We see this as highly unlikely. |

|

| Next BOE meeting is February 4 and we expect more debate about negative rates to emerge. Since the BOE just increased QE in November, we believe more stimulus is unlikely until the March 18 or May 6 meetings. Bailey’s comments have helped sterling recover today. A break above the $1.3610 area would set up a test of the $1.3705 high from last week. With the euro holding steady, the EUR/GBP is trading back below .90 and is on track to test the November low near .8867.

ASIA Reports suggest Japan’s government will declare a state of emergency for Osaka, Kyoto, and Hyogo prefectures as soon as tomorrow. With Tokyo and its surrounding areas already in a state of emergency, this new move would put a huge chunk of the nation under lockdown. The economy was already weak going into this current wave of infections and the recovery will be further delayed. While the BOJ is on hold for now, we fully expect another round of fiscal stimulus later this year. Elsewhere, Japan reported November current account data. An adjusted JPY2.34 trln surplus was slightly larger than the expected JPY2.0 trln. Malaysia assets are underperforming on further lockdowns. The government announced a step-up of mobility restrictions for several states and the King declared a state of emergency until August 2021. The lockdown will last for two weeks, but will spare sectors of the economy deemed essential, such as agriculture and manufacturing. The Health Ministry also said they found a variant strain of the virus, similar to that found in the UK. The state of emergency means that parliament is suspended, a good thing for PM Muhyiddin Yassin since he was facing the risk of snap elections. Our initial reaction is that these events are net neutral for Malaysian assets, with the worsening economic outlook from the lockdowns offset by a period of political stability, at least for the near term. |

|

Tags: Articles,Daily News,Featured,newsletter