Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat The noise level around Brexit continues to rise are we approach the finish line; eurozone and UK data came in firmer than expected; Turkey November CPI came in well above expectations BOJ is likely to extend its emergency measures at the December 17-18 meeting; Australia reported mixed October trade data; Caixin reported strong November services and composite PMI readings Dollar weakness continues. DXY traded at the lowest level

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields

- ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat

- The noise level around Brexit continues to rise are we approach the finish line; eurozone and UK data came in firmer than expected; Turkey November CPI came in well above expectations

- BOJ is likely to extend its emergency measures at the December 17-18 meeting; Australia reported mixed October trade data; Caixin reported strong November services and composite PMI readings

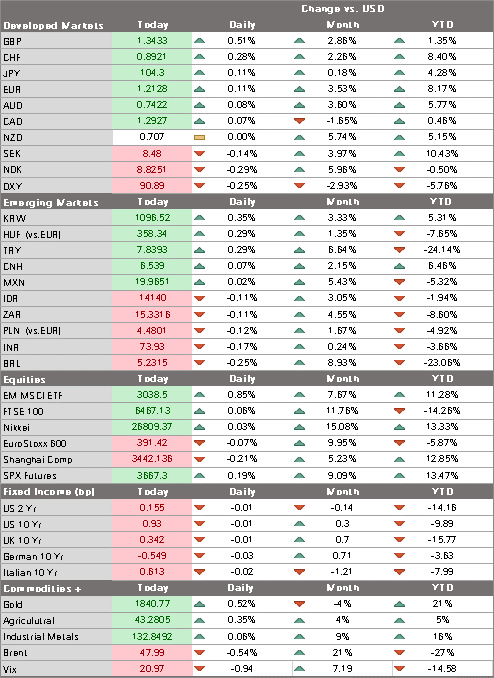

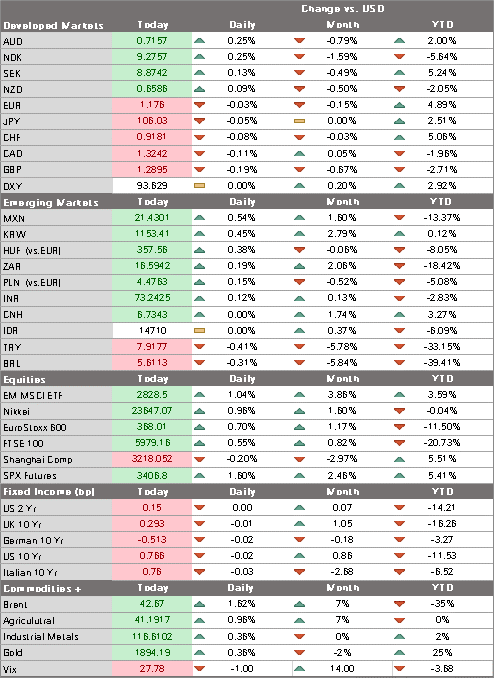

Dollar weakness continues. DXY traded at the lowest level since April 2018 near 90.838 earlier today. This weakness should persist and so we are left looking for the February 2018 low near 88.253. After finally breaking above the September 1 high near $1.2010, the euro hasn’t looked back and traded at a new cycle high near $1.2140 today. We maintain our medium-term target of $1.2555. Sterling continues to underperform, though it has taken part in this broad dollar weakness and is trading back above $1.3400. We still look for a near-term test of the $1.3480 high from September. USD/JPY remains stuck in its recent 104-105 trading range but is trading heavy and so we still look for an eventual break below 104 that would set up a test of the November low near 103.20.

AMERICAS

Stimulus talks continue but the goalposts have indeed been moved. Democratic leaders Pelosi and Schumer threw their support behind using the $908 bln bipartisan compromise proposal as a foundation for a new round of talks. This is quite a comedown from the $2.4 trln previously demanded and the $1.8 trln offer from the White House that was rejected before the elections. Under this proposal, small businesses would get $300 bln under a version of the Paycheck Protection Program, while state and local governments would get $240 bln, including money for schools. $180 billion would go to an extension of emergency unemployment benefits that would provide an added $300 per week for four months. This plan would not include direct payments to individuals.

The good news is that a package before year-end is looking more likely. The bad news is that it’s going to be smaller than anticipated. However, many on the Democratic side are stressing that this is not the last package. Much will depend on the two Georgia Senate seats that go to a runoff January 5. Stimulus talks are ongoing even as Congress works on a wider spending bill that would prevent a government shutdown next week. For a deeper look at what to expect from Capitol Hill over the next week, please see “Some Thoughts on a Potential US Government Shutdown.”

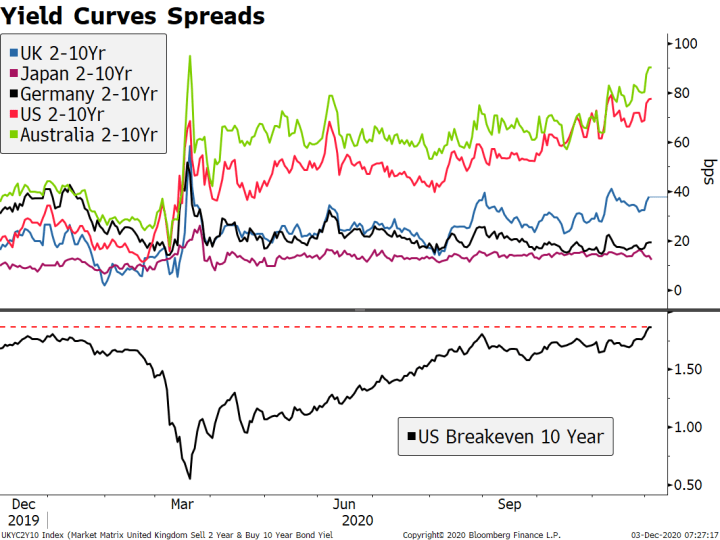

| Optimism regarding stimulus continues to buoy US yields. The 10-year yield rose some 10 bp this week and is now around 0.94%, the US curve continues to steepen well ahead of other major economies (bar Australia), and inflation breakeven rates are climbing past pre-pandemic levels. Yet rising yields have given the dollar no support whatsoever, as the US economic continues to worsen. Regardless of the economic impact of the stimulus package, we believe that continued steepening of the curve would imply a greater chance of some sort of Fed action to contain longer dated yields. That said, the 1.0% level for the 10-year yield is so far proving hard to crack and so the markets are for now doing the heavy lifting for the Fed. We think a significant break above that 1.0% would likely be the trigger for potential action by the Fed.

ISM services PMI is expected at 55.8 vs. 56.6 in October. Particular attention will be paid to the employment component, which fell to 50.1 in October. Earlier this week, the employment component in ISM manufacturing PMI fell to 48.4 from 53.2 in October, back below 50 after spending one month above it. That drop in the employment component is the first time since April and at 48.4 is the lowest since August. November Challenger job cuts will also be reported. Weekly jobless claims data will be reported. Regular weekly initial jobless claims are expected at 775k vs. 778k the previous week. Regular initial claims have risen two straight weeks now and stand at the highest level since mid-October. With lockdowns widening, we think this is just the start of renewed stress in the labor market. Regular continuing claims are expected at 5.8 mln vs. 6.071 mln the previous week. Adding in the combined 13.5 mln PUA and PEUC continuing claims means that nearly 20 mln are currently receiving some form of unemployment benefits. Yesterday, ADP reported 307k private sector jobs added in November vs. 440k expected. Between this, the weekly claims, and ISM employment, all the clues support our view that the US labor market continues to soften. This will impact consumption, as will the potential loss of unemployment benefits at year-end as well as widening lockdowns. We remain pessimistic on the US economy in Q4 and early Q1. Of note, consensus for NFP tomorrow is 478k, while inflation is expected to fall a tick to 6.8%. The Fed Beige Book report was suitably downbeat. It was prepared for the December 15-16 FOMC meeting and was conducted up to November 20. Since the last FOMC meeting November 4-5, the US outlook has clearly darkened. The report said most Fed regions are characterizing growth as “modest or moderate.” It added that “Four districts described little or no growth, and five narratives noted that activity remained below pre-pandemic levels for at least some sectors.” Furthermore, most Fed districts saw a slowdown in the pace of job gains. On the bright side, many Fed districts reported robust manufacturing activity, homebuilding, and home sales. However, rising bankruptcies and loan delinquencies were a concern, especially in the hospitality and retail industries. There are no Fed speakers today. After Bowman and Kashkari speak tomorrow, the media embargo goes into effect and there will be no speakers then until Powell’s post-decision press conference December 16. |

|

| EUROPE/MIDDLE EAST/AFRICA

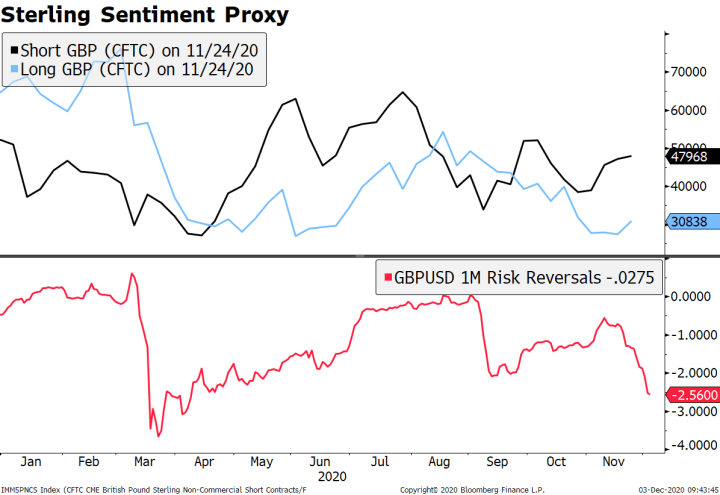

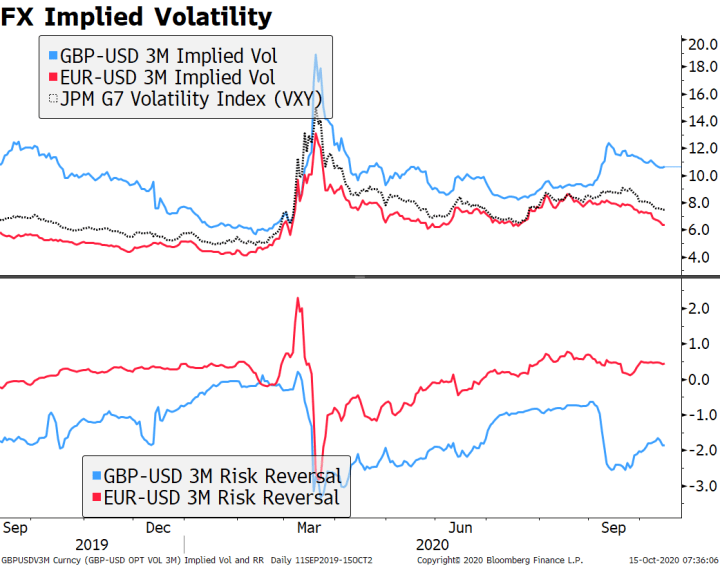

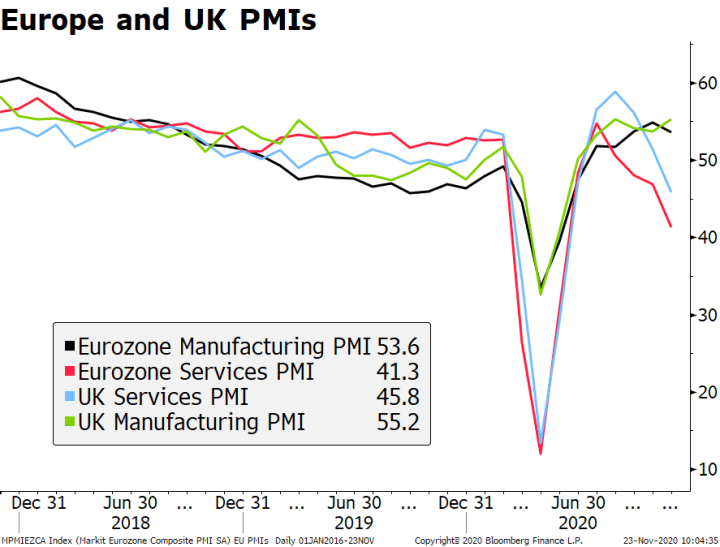

The noise level around Brexit continues to rise are we approach the finish line, but it’s best to ignore it. The latest news was the hardening of the French position over fisheries, with wires claiming President Macron may veto a deal in which he considers the terms to be unfavorable. Reports suggest a deal needs to be struck over the weekend as preparations for the December 10 EU summit pick up then. Markets are (understandably) becoming nervous about the outcome, as seen by positioning proxies such as CFTC futures data showing a build-up of short sterling positions. Risk reversals are also showing an increased demand for protection against sterling downside with the 1-month back to levels not seen since April. In the spot market, sterling has lagged most G10 currencies in as they rallied against the dollar over the last few sessions. Elsewhere, UK final services and composite PMIs improved sharply from the preliminary readings to 47.6 and 49.0, respectively. |

|

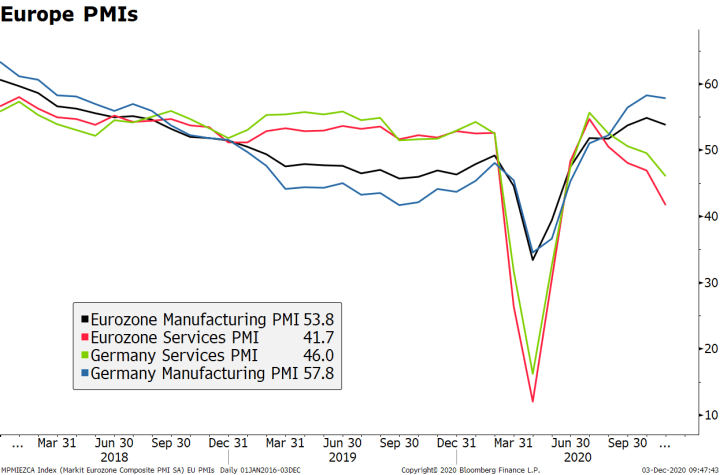

| Eurozone final services and composite PMIs came in firmer than expected. The headline services improved to 41.7 from 41.3 preliminary while the composite PMI improved to 45.3 from 45.1 preliminary. Germany’s final services PMI came at 46.0, slightly below flash estimates, while the survey’s manufacturing component stood well into expansionary territory at 57.8. French readings also improved from the preliminary readings. Germany is extending its lockdown until January 10. Recall that the currency restrictions apply mainly services and leisure, so it should serve to continue increasing the wedge between industrial and services sector data. Spain and Italy reported November for the first time and their composite readings fell sharply from October to 41.7 and 42.7, respectively. | |

| Eurozone retail sales came in stronger than expected. Sales rose 1.5% m/m, more than double the consensus 0.7% and nearly reversing the revised -1.7% (was -2.0%) drop in September. Country data has mostly come in stronger than expected and so we saw some upside risks for the eurozone reading. That said, activity is going to be depressed in November and December as lockdowns widen and deepen.

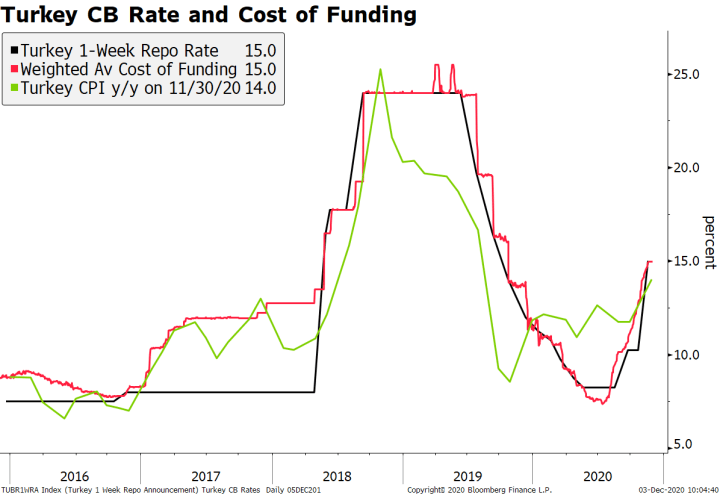

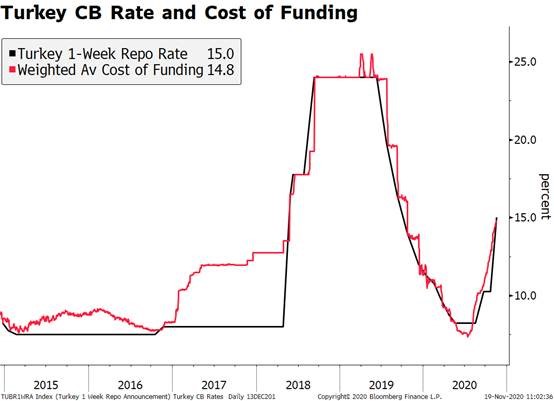

Turkey November CPI came in well above expectations. Thankfully the central bank got ahead of it with its recent 475 bp hike. The headline figure was 14.03% y/y, about 1.4 ppts above forecasts, while core came in at 13.26% y/y. Headline is the highest since August 2019 and moves further above the 3-7% target range. Unsurprisingly, FX pass-through is a big factor here since the lira depreciated nearly 30% against the dollar from the start of the year to end-October, and the 10% gain since the lows in November wouldn’t have any impact yet. In other words, the government and central bank’s credibility-building push will have to continue, including more rate hikes. Next policy meeting is December 24 and another hike seems likely then, especially is the lira continues to weaken. |

|

| ASIA

Reports suggest the Bank of Japan is likely to extend its emergency measures at the December 17-18 meeting. This includes purchases of commercial paper and the special funding program for banks to support firms hurt by the pandemic. These measures expire in March and the early extension may be timed to coincided with the next fiscal package that’s due this month too. With the economy facing greater headwinds, we think these moves make sense. Indeed, there are rumblings that this third extra budget won’t be the last. Stay tuned. Elsewhere, Japan final services and composite PMIs improved significantly. Services improved to 47.8 from 46.7 preliminary, dragging the composite up to 48.1 from 47.0 preliminary. Australia reported mixed October trade data. Exports rose 5% m/m vs. 4% expected, while imports rose only 1% m/m vs. 4.0% expected. The row with China should start to hit exports in the coming months. While mainland officials said the tariffs imposed on Australian goods were temporary and meant to last four months, though they could be extended for up to nine. Elsewhere , final November services and composite PMIs improved modestly. Services improved to 55.1 from 54.9 preliminary, nudging the composite up to 54.9 from 54.7 preliminary. Caixin reported strong November services and composite PMI readings. Services jumped to 57.8 vs. 56.4 expected and 56.8 in October, dragging the composite up to 57.5 from 55.7 in October. This follows strong manufacturing PMI readings earlier in the week. These are the first snapshots of the mainland economy for November and are expected to show continued recovery. That said, ex-PBOC official Sheng warned the bank not to change its stance too soon, noting “My opinion is that China is far from meeting the conditions for tightening monetary policy.” We concur.

|

Tags: Articles,Daily News,Featured,newsletter