The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday; optimism on a stimulus deal appears to be picking up; the two-day FOMC meeting ending with a decision Wednesday will be important November retail sales Wednesday will be the US data highlight for the week; Fed manufacturing surveys for December will start to roll out; weekly jobless claims Thursday will be important; Canada has a busy data week Brexit talks have been extended; BOE, Norges Bank, and SNB decisions come Thursday and no changes are expected; UK reports some key data; eurozone has a fairly quiet week Japan has an eventful data week; BOJ wraps up its two-day meeting Friday; Australia has a fairly busy week Optimism on Brexit and US stimulus is

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday; optimism on a stimulus deal appears to be picking up; the two-day FOMC meeting ending with a decision Wednesday will be important

- November retail sales Wednesday will be the US data highlight for the week; Fed manufacturing surveys for December will start to roll out; weekly jobless claims Thursday will be important; Canada has a busy data week

- Brexit talks have been extended; BOE, Norges Bank, and SNB decisions come Thursday and no changes are expected; UK reports some key data; eurozone has a fairly quiet week

- Japan has an eventful data week; BOJ wraps up its two-day meeting Friday; Australia has a fairly busy week

![]() Optimism on Brexit and US stimulus is weighing on the dollar as the new week begins. DXY has opened lower as event risk seems to have ebbed. The 91 area provided stiff resistance even in the midst of last week’s safe haven bid and now that the event risk is clearing up, dollar weakness has resumed and we continue to target the February 2018 low near 88.253 for DXY. The euro is holding above $1.21, while sterling has recovered to trade above $1.33 on some renewed Brexit optimism. USD/JPY is probing below 104 and we still look for a clean break below that suggests an eventual test of the November low near 103.20.

Optimism on Brexit and US stimulus is weighing on the dollar as the new week begins. DXY has opened lower as event risk seems to have ebbed. The 91 area provided stiff resistance even in the midst of last week’s safe haven bid and now that the event risk is clearing up, dollar weakness has resumed and we continue to target the February 2018 low near 88.253 for DXY. The euro is holding above $1.21, while sterling has recovered to trade above $1.33 on some renewed Brexit optimism. USD/JPY is probing below 104 and we still look for a clean break below that suggests an eventual test of the November low near 103.20.

AMERICAS

The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday. This will allow talks to continue on the spending bills as well as the pandemic relief package. Of note, the Senate passed the defense bill by a veto-proof margin of 84-13 and comes after the House did the same 335-78. Eleven other spending bills need to be passed and then wrapped together into an omnibus spending bill, but the strong showing for the defense bill sends a signal to President Trump not to try to derail the process at this late hour.

Optimism on a stimulus deal appears to be picking up. The bipartisan group of lawmakers will unveil full details of its $908 bln package Monday. Democratic Senator Manchin, one of those behind the $908 bln proposal, said “The plan is alive and well and there’s no way, no way that we are going to leave Washington without taking care of the emergency needs of our people.” Manchin wouldn’t specify how the liability protections would be addressed in proposal even as he suggested it might include both liability and aid to state and local governments. However, Manchin said mailing stimulus checks to individuals was “a bad idea.” In terms of a compromise, President Trump said he is “pushing it very hard.”

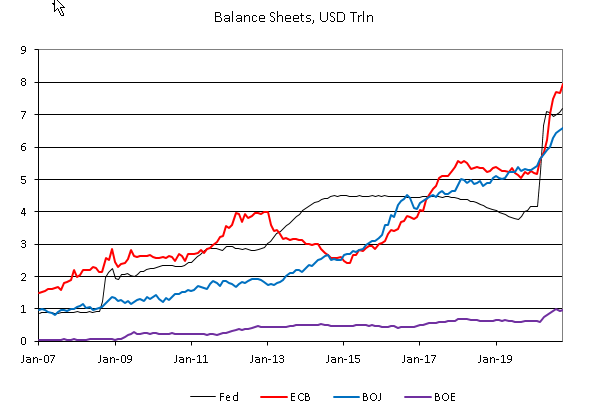

The two-day FOMC meeting ending with a decision Wednesday will be important. While no action is expected, the Fed may provide some clues about what plans to do in 2021. It may also pledge to do whatever is needed to keep markets functioning properly after some of its emergency programs lapse this month. The Fed could try to put markets at ease by laying out the conditions needed and steps that could be taken to reinstate those expiring emergency programs. With year-end looming, the last thing the Fed wants to see is disrupting funding problems.

With the economy slowing and job losses mounting, why not take action now? We believe the Fed views fiscal policy to be the most effective option right now. Sure, the Fed can take action to impact liquidity and interest rates but that is not the problem. The failure to control the virus and the lack of fiscal stimulus are the main headwinds on the economy. The Fed will surely maintain the current framework of loose monetary policy and abundant liquidity for as far as the eye can see, but is unlikely to take any further actions now. We believe the Fed will keep its powder dry in case further action is needed in 2021.

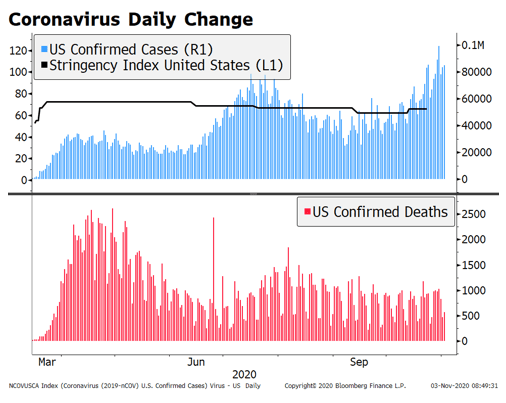

November retail sales Wednesday will be the US data highlight for the week. Headline sales are expected to fall -0.3% m/m vs. a 0.3% gain in October, while sales ex-autos are expected to rise 0.1% m/m vs. 0.2% in October. The so-called control group used for GDP calculations is expected to rise 0.2% m/m vs. 0.1% in October. It’s clear that the economy is slowing but whatever the November readings are, we know that December will likely be worse in light of widening lockdowns across the country. Consumption will be impossible to maintain with layoffs rising and jobless benefits waning.

Fed manufacturing surveys for December will start to roll out. Empire survey starts the ball rolling Tuesday and is expected at 6.9 vs. 6.3 in November. Philly Fed follows up Thursday and is expected at 20.0 vs. 26.3 in November. Kansas City Fed also reports Thursday and is expected at 10 vs. 11 in November. In between, Markit reports preliminary PMI readings Wednesday, with manufacturing expected at 55.8 vs. 56.7 in November and services expected at 56.0 vs. 58.4 in November. These are the first snapshots for December and will help set the tone for other data to come. November IP will be reported Tuesday and is expected to rise 0.3% m/m vs. 1.1% in October.

Weekly jobless claims Thursday will be important. Regular initial jobless claims are expected at 823k vs. 853k the previous week, while regular continuing claims are expected at 5.7 mln vs. 5.757 mln the previous week. There’s no consensus yet for December NFP but we suspect it will be well below the 245k in November. In fact, if claims continue to rise, we may get a negative jobs number. Stay tuned.

Other minor data round out the week. November import/export prices and TIC data will be reported Tuesday, followed by October business inventories (0.6% m/m expected) Wednesday. November building permits (0.9% m/m expected) and housing starts (0.2% m/m expected) will be reported Thursday, while October leading index (0.4% m/m expected) will be reported Thursday.

Canada has a busy data week. Highlights will be November CPI Wednesday and October retail sales Friday. Headline inflation is expected to rise a tick to 0.8% y/y, while common core is expected to remain steady at 1.6% y/y. Headline sales are expected to rise 0.1% m/m vs. 1.1% in September, while ex-auto sales are expected to rise 0.1% m/m vs. 1.0% in September. November housing starts, existing home sales, and October manufacturing sales will be reported Tuesday, followed by October wholesale trade sales Wednesday. The Bank of Canada is taking a wait and see approach even as the Trudeau government pursues aggressively expansive fiscal policy.

EUROPE/MIDDLE EAST/AFRICA

Brexit talks have been extended. No, really. UK Prime Minister Johnson and EC President von der Leyen agreed over the weekend to go the “extra mile” past the Sunday deadline and keep talking this week. The closer December 31 gets, the skinnier the deal. A trade agreement of such complexity simply cannot be implemented in less three weeks and so the details will likely have to be hammered out in 2021. Given that sterling continued to trade just below $1.34, the currency markets are telling us that a skinny deal is still the most likely outcome. That said, risk reversals show investors are paying the most for downside sterling protection since March.

The Bank of England decision comes Thursday. Since the bank just increased asset purchases and updated its forecasts at the November 5 meeting, no action is needed so soon. That said, it’s worth noting that the possibility of negative rates has crept back into market pricing. At the start of December, negative rates had been virtually priced out. Currently, WIRP suggests odds of negative rates as soon as the next meeting February 4 and rising with each successive meeting up until August 5. We continue to downplay risks of negative rates, even in the case of a hard Brexit. Sterling tends to strengthen on BOE decision days. Of the nine so far in 2020, cable has gained on six of them.

Ahead of the decision, the UK reports some key data. October unemployment and November jobless claims will be reported Tuesday, with the three-month unemployment rate expected to rise to 5.1% from 4.8% previously. November CPI will be reported Wednesday, with both headline and CPIH inflation expected to fall a tick to 0.6% y/y and 0.8% y/y, respectively. Preliminary December PMI readings will also be reported Wednesday, with manufacturing expected at 55.9 vs. 55.6 in November, services expected at 50.5 vs. 47.6 in November, and the composite expected at 51.4 vs. 49.0 in November. November retail sales and December CBI industrial trends survey Friday. Headline sales are expected to fall -4.2% m/m vs. +1.2% in October.

Eurozone has a fairly quiet week. It reports October IP Monday, which is expected to rise 2.0% m/m vs. -0.4% in September. Preliminary December PMI readings will be reported Wednesday with headline manufacturing expected at 53.0 vs. 53.8 in November, services expected at 41.9 vs. 41.7 in November, and the composite expected at 45.5 vs. 45.3 in November. Looking at the country breakdown, the French composite is expected to improve to 42.7 from 40.6, while the German composite is expected to worse to 50.6 from 51.7. German December IFO business climate survey will be reported Friday, with headline expected to fall to 90.0 from 90.7 in November.

The Swiss National Bank decision comes Thursday and no change in rates is expected. We do expect the bank to continue pushing back against ongoing Swiss franc strength. It is the second strongest major currency YTD behind only SEK. At the last meeting, the bank warned that it would intervene “more strongly” in the FX market and called the Swiss franc “highly valued.” The bank also said it would begin publishing quarterly FX intervention volumes instead of annually. This is likely meant to head off any criticism by the US, which has already put Switzerland on a watchlist of currency manipulators. New economic forecasts will be issued. At the last meeting, GDP was revised to -5% this year vs. -6% seen in June. Going forward, we still do not think the bank will go more negative and instead expect policymakers to continue focusing on the exchange rate with its ongoing intervention program. Swissie tends to strengthen on SNB decision days. Of the seven dating back to 2019, CHF has gained against EUR on five of them.

Norges Bank decision will be Thursday and is widely expected to keep rates steady at 0.0%. At the last meeting November 5, the communique emphasized the downside risks from the pandemic’s second wave. It maintained forward guidance that rates would likely remain at current levels for “the next couple of years” and still expects to start hiking rates in late 2022. The November statement also noted that the krone “is weaker than projected,” suggesting some concern about the currency. Nokkie tends to strengthen on Norges Bank decision days. Of the eight so far this year, NOK has gained against EUR on five of them.

ASIA

Japan has an eventful data week. The Bank of Japan releases its Q4 Tankan outlook Monday. Large manufacturing index is expected at -15 vs. -17 in Q3, while large manufacturing outlook is expected at -11 vs. -17 in Q3. All-industry capex is expected to rise only 0.1% vs. 1.4% in Q3. November trade and preliminary December PMI readings will be reported Wednesday, with exports expected to rise 0.5% y/y vs. -0.2% in October and imports expected to fall -9.3% y/y vs. -13.3% in October. November national CPI will be reported Friday. Headline inflation is expected at -0.8% y/y vs. -0.4% in October, while core (ex-fresh food) is expected at -0.9% y/y vs,. -0.7% in October. All in all, the data support our view that the economy continues to underperform even as deflation risks intensify.

Bank of Japan wraps up its two-day meeting Friday. Reports suggest the bank will extend its emergency lending and liquidity programs whilst keeping rates and asset purchases unchanged. For now, the bulk of stimulus is falling on fiscal policy and the BOJ will just maintain its supportive policies. The yen tends to strengthen on BOJ decision days. Of the eight so far this year, JPY has gained on five of them.

Australia has a busy week. Reserve Bank of Australia releases its minutes Tuesday. At the December 1, the RBA delivered a dovish hold. The bank warned that the economy will need “significant gains” in employment that leads to a tighter labor market and higher wages in order to see inflation move back to its 2-3% target range. Governor Lowe reiterated his forward guidance that “Given the outlook, the board is not expecting to increase the cash rate for at least 3 years.” He added that “The board will keep the size of the bond purchase program under review, particularly in light of the evolving outlook for jobs and inflation. The board is prepared to do more if necessary.” Preliminary December PMI readings will be reported Wednesday. November jobs data will be reported Thursday. Employment is expected to rise 40.0k vs. 178.8k in October, while the unemployment rate is expected to remain steady at 7.0%.

Tags: Articles,developed markets,Featured,newsletter