Joe Biden became the 46th President of the US; three Democratic Senators were also sworn in; weekly jobless claims data will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; Brazil kept rates on hold at 2.0%, as expected ECB is expected to keep policy unchanged; Norges Bank kept rates steady at 0%, as expected; Chancellor Sunak is reportedly drawing up plans to extend support for the UK labor market in the coming months; South Africa is expected to keep rates steady at 3.5%; Turkey central bank kept rates steady at 17%, as expected BOJ kept policy unchanged, as expected; Australia reported solid December jobs data; Korea is posting strong export figures at the start of the year; Indonesia kept the

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The dollar continues to edge lower. After trading at the highest level since December 21 near 91 Monday, DXY has now fallen four straight days and retraced over a third of its recent bounce. The next major retracement objectives from the January rally come in near 90.08 (50%) and 89.874 (62%). The euro is edging higher ahead of the ECB decision and should continue to gain afterwards, while sterling is making new highs for this move near $1.3750, the highest level since April 2018. Charts suggest a test of that month’s high near $1.4375. USD/JPY remains heavy and is trading at the lowest level since January 7 near 103.35. |

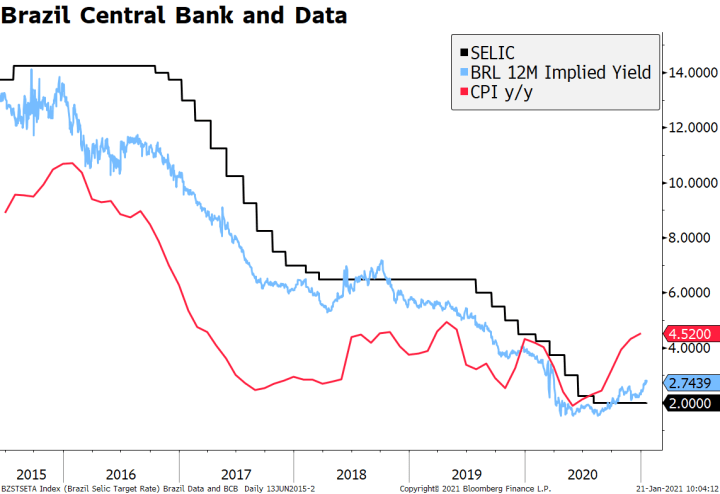

Brazil Central Bank and Data, 2015 - 2020 |

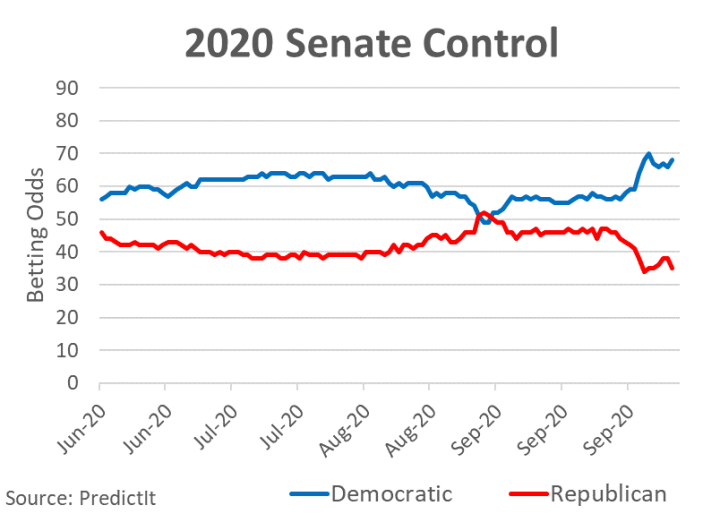

| As we expected, the Blue Wave trades have resumed now that inauguration has passed with no new violence.

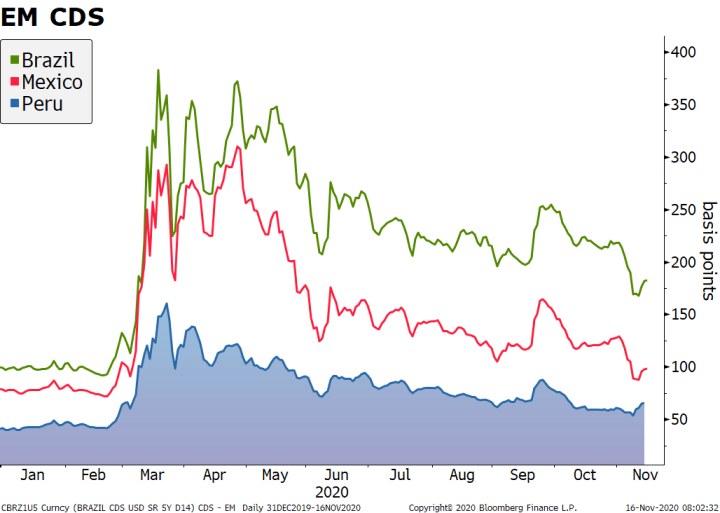

AMERICAS Joe Biden became the 46th President of the United States of America. Contrary to some fears, there was no violence or acts of terrorism aimed at the incoming administration. As expected, he signed a raft of executive orders yesterday that sought to reverse many of President Trump’s initiatives and to help limit the damage from the pandemic. Three Democratic Senators were also sworn in. The 50-50 tie gives the Democrats effective control of the Senate, as Vice President Harris will now cast the tie-breaking vote. Senator Schumer becomes Senate Majority Leader for the first time and Senator McConnell becomes Minority Leader for the first time since the 2014 elections. Weekly jobless claims data will be the highlight of an otherwise quiet week. Regular initial claims are expected at 935k vs. 965k the previous week. That reading was the highest since mid-August and was even worse unadjusted (1.15 mln). PUA initial claims (unadjusted) rose to a 284k and so together with regular (unadjusted) claims totaled 1.435 mln, the highest since mid-September. This week’s initial claims data are for the BLS survey week containing the 12th of the month. If last week’s deterioration is sustained, we can expect another negative NFP number for January. Elsewhere, regular continuing claims are expected at 5.30 ln vs. 5.271 mln the previous week. Here too the unadjusted number was even worse at 5.856 mln. The weak labor market was directly responsible for the terrible December retail sales data and weakness is set to continue this month. Fed manufacturing surveys for January will continue to roll out. Philly Fed survey is expected at 11.8 vs. a revised 9.1 (was 11.1) in December. Last week, Empire survey started the ball rolling with a 3.5 reading vs. 6.0 expected and 4.9 in December. Markit reports preliminary January PMI readings Friday, with manufacturing expected at 56.5 vs. 57.1 in December and services expected at 53.4 vs. 54.8 in December. These are the first snapshots for January and will help set the tone for other data to come. December building permits (-1.7% m/m expected) and housing starts (0.8% m/m expected) will also be reported. The Bank of Canada delivered another dovish hold. The bank noted considerable slack remains in the economy that will continue to require “extraordinary” support. More importantly, Governor Macklem admitted that the bank spent a “good bit” of time discussing the amount of stimulus needed, adding that a so-called “micro-cut” is one option available. Macklem also pushed back a bit against the strong Loonie, noting that it poses some risks to the outlook. He said more appreciation would create additional headwinds but noted that most of the move is due to USD weakness. Prior to the decision, December headline CPI came in at 0.7% y/y vs. 1.0% expected and common core at 1.3% y/y vs. 1.5% expected. The bank said inflation is unlikely to return “sustainably” to the 2% target until 2023, with excess supply expected to keep a lid on inflation over the horizon. USD/CAD is making new lows for this move near 1.26 and as long as the weak dollar backdrop is in play, not much can be done about Loonie strength. Brazil’s central bank (BCB) kept rates on hold at 2.0%, as expected, but adjusted the language to incorporate higher pipeline inflation pressures. The statement said that “forward guidance no longer holds” but that “the removal of the forwards guidance does not mechanically imply interest rates increases.” The bank is in a difficult position, no doubt. Inflation is rising and the pandemic outlook still looks grim, especially given the diplomatic challenges in securing the vaccine. On top of this, the fiscal situation is very challenging, holding back any hope of fundamental improvement for the country. All that said, we remain optimistic – from a markets point of view – towards Brazil in the near term given the commodity tailwinds that will help local assets, a more completive currency with the prospect of higher carry coming, and plenty of space to catch up compared to other EMs. |

|

| EUROPE/MIDDLE EAST/AFRICA

The European Central Bank is expected to keep policy unchanged. It just boosted its PEPP program by EUR500 bln and updated its macro forecasts at its last meeting in December and so it is likely to remain on hold for several meetings. Many analysts believe the ECB is done easing but we are not convinced. Madame Lagarde will surely get some questions about the strong euro but its recent losses suggest the exchange rate may not be as much of a concern now. Ahead of the decision, reports emerged that the ECB is informally targeting some yields by adjusting its asset purchases as needed amongst the different eurozone issuers. We expect Lagarde to get some questions about this. |

IMF Growth Outlook, 2018 - 2020 |

| We are surprised the euro isn’t trading higher after Italy dodged a bullet, but it may be lagging due to concerns that the ECB will do some more jawboning today. Once the meeting is out of the way, we think euro buying will pick up.

Norges Bank kept rates steady at 0%, as expected. The bank kept the rate path steady, showing a likely lift-off in H1 2022 and the policy rate near 1.0% by end-2023. However, the bank sounded upbeat as it noted that “vaccination is well under way, and it appears that the vaccination rollout will be somewhat faster than assumed earlier. Vaccination and the winding down of containment measures will boost growth further out in 2021.” There was no press conference or updated macro forecasts, which will instead be seen at the next meeting . Chancellor Sunak is reportedly drawing up plans to extend support for the UK labor market in the coming months. The government’s existing GBP60 bln ($82 bln) job furlough program that pays as much as 80% of wages is due to expire at the end of April. Reports suggest Sunak is weighing various options to support jobs into the summer and the measures are expected to be announced in the March 3 budget. UK CBI said recently that it would be a mistake to wait on announcing aid until the budget. In related news, CBI released the results of its January industrial trends survey. Total orders came in at -38 vs. -35 expected and -25 in December , while business optimism plunged to -22 from 0 in December. Yet BOE Governor Baily sounded relatively optimistic about the economic consequences of the latest lockdowns in the UK. He said that its impact “is diminishing somewhat.” He said the bank continues to study the possibility of negative interest rates, but again we think this is just to establish optionality. We very much doubt we will see the UK (or any country, for that matter) embark in negative rates at this stage in cycle. Fiscal policy is in the driver’s seat. |

|

| South African Reserve Bank is expected to keep rates steady at 3.5%. Yesterday. December headline CPI was reported at 3.1% y/y, moving a tick closer to the bottom of the 3-6% target range. Earlier today, November retail sales fell -4.0% y/y vs. -2.6% expected and a revised -2.3% (was -1.8%) in October. With the economy remaining weak and price pressures low, we do not believe SARB will follow through on its plans to start a tightening cycle next year. The fact that the last vote in November was 3-2 with two dissents in favor of a 25 bp cut suggest the bar to a hike remains high. If anything, risks are tiled more towards a restart of the easing cycle this year.

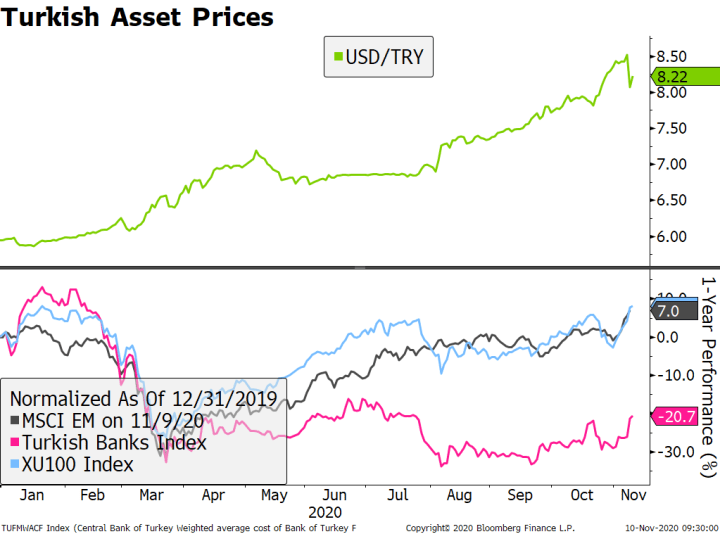

Turkey central bank kept rates steady at 17%, as expected. A few analysts look for 50 and 100 bp hikes, which would be the right thing to do given accelerating inflation. A hike would have locked in the credibility gained from the recent turn towards orthodoxy. |

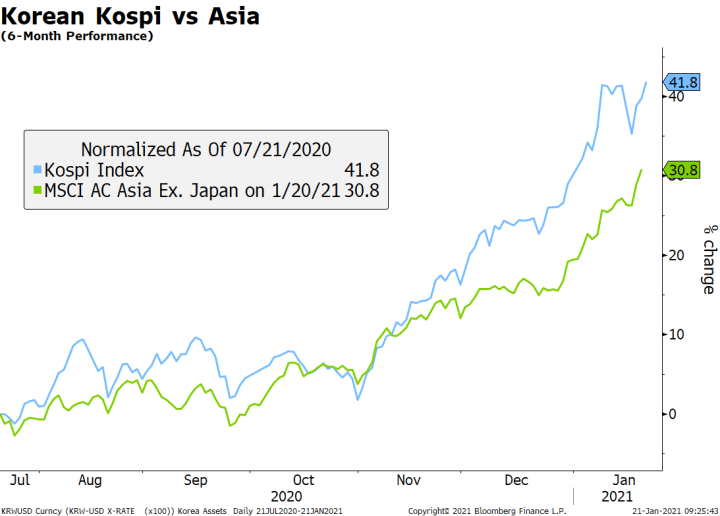

Korean Kospi vs Asia, Jul 2020 - Jan 2021 |

| At this point, we think markets will give Turkey a pass, at least until we get any signs that their commitment is weakening. Last week, President Erdogan said he was against high interest rates, adding that cutting rates would lower inflation.

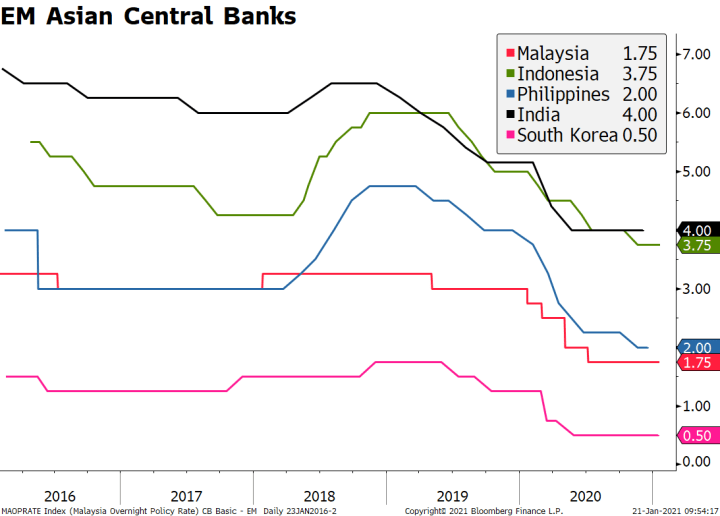

ASIA Bank of Japan kept policy unchanged, as expected. The communique brought no major surprises, as the bank reinforced its determination to keep the yield curve under tight control. The bank upgraded the growth outlook for FY2021 to 3.9% from 3.6% in October and for FY2022 to 1.8% from 1.6%. Inflation for FY2021 is seen a tick higher at 0.5% and steady at 0.7% for FY2022. Of note, FY2023 will be added to the macro forecasts at the April 26-27 meeting. Of course, all eyes are now on the March 18-19 meeting, when the BOJ will release the results of its framework review that was unexpectedly announced in December. Governor Kuroda said today that “Yield curve control has worked appropriately and I don’t think the framework itself needs to be changed. But from the standpoint of achieving more effective and sustainable monetary easing its operations are under review.” Much will depend on how the virus and the economy develop over the next two months. Elsewhere , Japan reported December trade and supermarket sales. Exports rose 2.0% y/y vs. 2.4% expected and -4.2% in November, while imports fell -11.6% y/y vs. -13.9% expected and -11.1% in November. Japan’s exports continue to lag those of its regional competitors Korea and Taiwan. Thus, it’s no surprise that policymakers remain concerned about the strong yen. The adjusted surplus came in at JPY477 bln vs. JPY719 bln expected. Sales rose 2.7% y/y vs. 1.2% in November Australia reported solid December jobs data. Total employment rose 50.0k, right at consensus and down from 90.0k in November. The breakdown remains favorable, with 35.7k full-time jobs added and 14.3k part-time jobs added. The unemployment rate fell a couple of ticks to 6.6%, the lowest since April. Preliminary January PMI readings and December retail sales will be reported tomorrow. For now, the RBA is on hold as the nation continues to make good headway in containing the virus. Risks lie ahead and so policymakers remain in wait and see mode. Next policy meeting is February 2, the first since December 1. No change is expected but we will get its Statement on Monetary Policy then with new macro forecasts. Korea is posting strong export figures at the start of the year, supporting the already positive view towards the region. Exports increased 10.6% y/y for the first 20 days of January vs. 12.6% in December, suggesting a strong underlying trend for tech products and semiconductors. Exports to China jumped 19%, exports to the US also jumped 19%, and exports to the EU rose 16%. Shipments to Japan fell -11%, while imports were up only 1.5%. Data for the full month will be reported February 1. The won is up slightly on the day, in line with the broad dollar trend but has appreciated 9% over the last six months, one of the top performing EM currencies. Over the same period, the Kospi index has posted over 40% returns, beating most global equity indices by a large margin. Bank of Korea just kept rates unchanged at 0.5% last week and stressed that it’s too soon to consider changing its policy stance as the pandemic continues and restrictions remain in place. |

|

| Bank Indonesia kept the 7-day target rate steady at 3.75%, as expected. Governor Warjiyo noted that inflation estimates are still low and expects the economy to grow between 4.8-5.8% this year. Recall that the Indonesian government was forced to step up mobility restrictions as the pandemic worsened. CPI rose 1.68% y/y in December, the highest since June but still below the 2-4% target range. The outlook suggests a considerable chance of further easing by the BI, but much will depend on external factors, the trajectory of the rupiah, and how the mass vaccination program goes. The good news is that the issue of central bank independence seems to have moved off the radar (at least for now), with BI ending its direct bond purchases from the government this year. |

EM Asian Central Banks, 2016 - 2020 |

Markets 202101

Tags: Articles,Daily News,Featured,newsletter