President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon; he will hit the ground running by announcing a raft of executive orders upon taking office; Janet Yellen’s confirmation hearing was revealing; Canada and Brazil are expected to keep rates unchanged Italian political tensions appear to have calmed; German government announced a hardening of mobility restrictions; UK reported December CPI BOJ began its two-day meeting; PBOC left policy rates on hold, as expected; Malaysia kept rates steady at 1.75%, as expected; Taiwan December export orders surged The dollar continues to edge lower. After trading at the highest level since December 21 near 91 Monday, DXY has fallen three straight days. Retracement objectives from

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon; he will hit the ground running by announcing a raft of executive orders upon taking office; Janet Yellen’s confirmation hearing was revealing; Canada and Brazil are expected to keep rates unchanged

- Italian political tensions appear to have calmed; German government announced a hardening of mobility restrictions; UK reported December CPI

- BOJ began its two-day meeting; PBOC left policy rates on hold, as expected; Malaysia kept rates steady at 1.75%, as expected; Taiwan December export orders surged

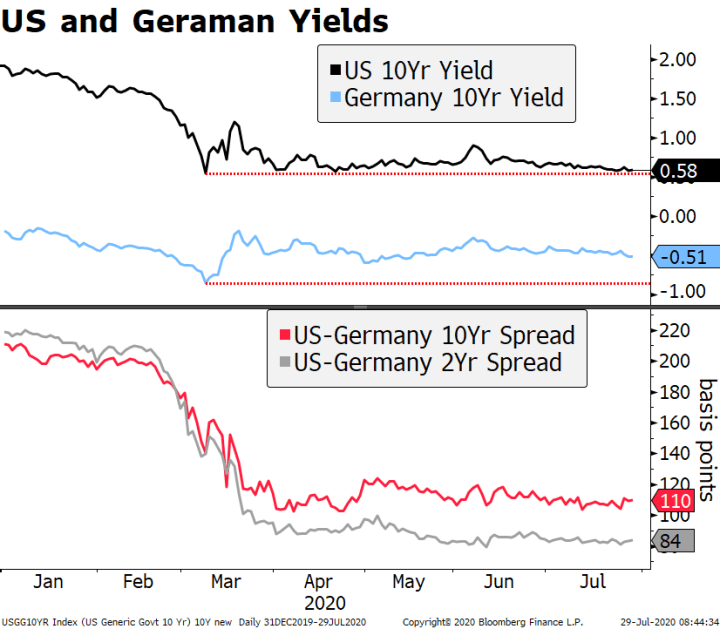

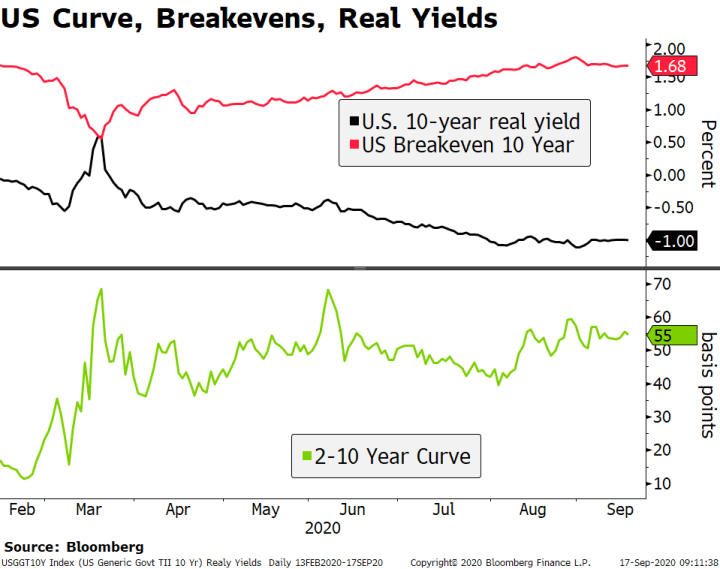

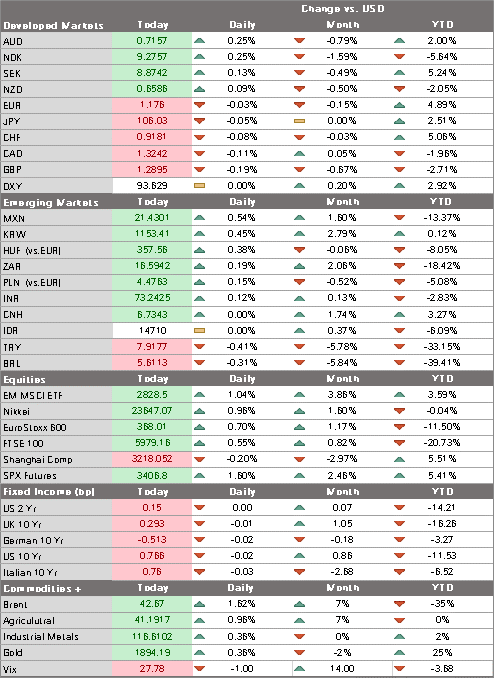

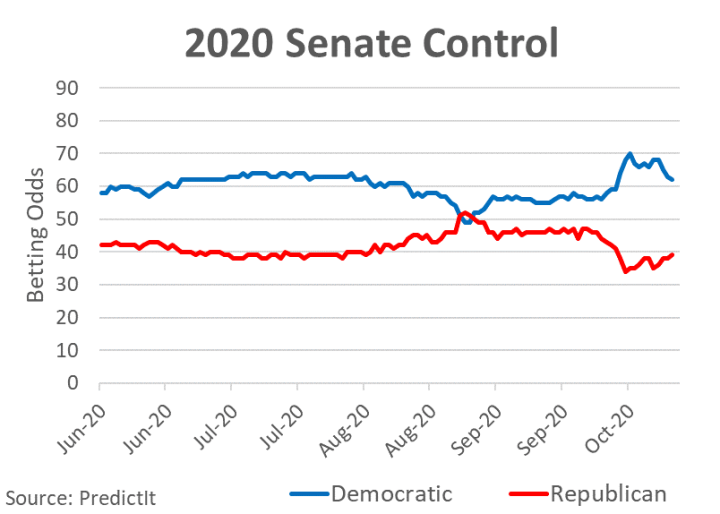

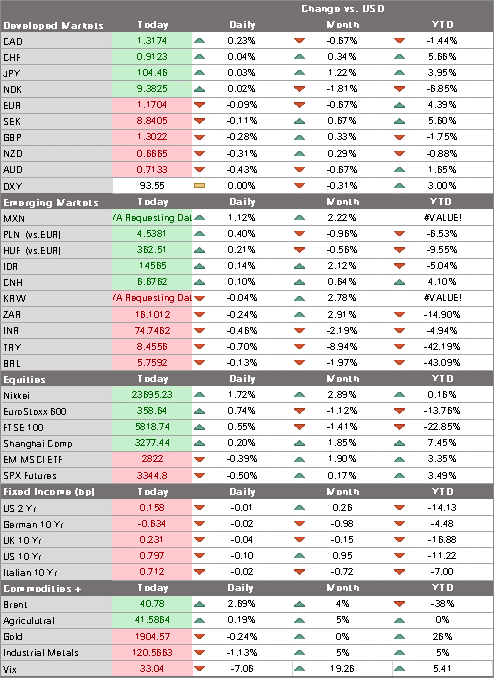

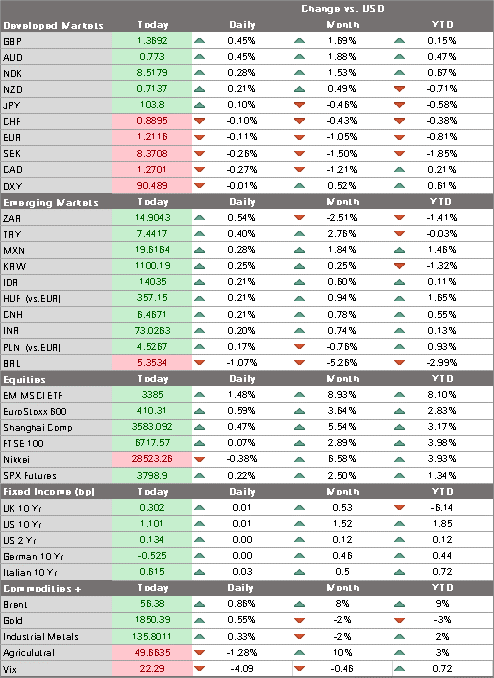

The dollar continues to edge lower. After trading at the highest level since December 21 near 91 Monday, DXY has fallen three straight days. Retracement objectives from the January rally come in near 90.286 (38%), 90.08 (50%), and 89.874 (62%). Sterling is leading the move today and has broken above last week’s cycle high near $1.3710 to trade at the highest level since April 2018. Charts suggest a test of that month’s high near $1.4375. The euro is lagging and so the EUR/GBP cross is trading at the lowest level since last May. USD/JPY continues to feel heavy and so we view any moves above the 104 area as temporary. We viewed the recent risk-off dollar bounce with skepticism and fully expect the Blue Wave trades to resume in force after the inauguration.

AMERICAS

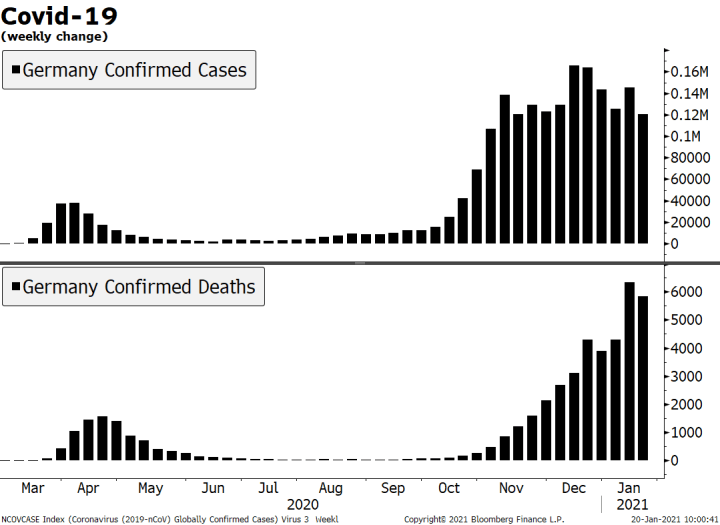

President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon today. He inherits a raging pandemic that continues to take a toll on the US economy. Recent economic data support our widely held view that until the virus is under control, the economy cannot mount a sustainable recovery. The good news is that Biden has made virus control and vaccination priorities for his first hundred days and that should set the table for stronger growth later this year.

Biden will hit the ground running by announcing a raft of executive orders upon taking office. These include, but are not limited to, rejoining the World Health Organization and Paris climate accords, setting a mask mandate on federal properties, extending the moratorium on evictions and foreclosures until at least March 31, pausing student loan payments on federal loans, revoking the Keystone XL pipeline, reviewing President Trump’s regulatory changes, halting construction of the border wall, and ending the Muslim travel ban.

Security in Washington DC and many state capitols has been beefed up due to concerns of violence centered around the inauguration. As we saw earlier this month, such an event would likely feed into risk-off impulses that disrupt the financial markets. Yet any disruptions should be viewed as transitory. To us, the Blue Wave trades remain alive and well and should eventually resume once we get past the inauguration.

Janet Yellen’s confirmation hearing was revealing. Not in terms of Yellen’s economic views, which are well known, but in terms of current Senate Republican views. Senator Grassley said in his opening remarks that “Now is not the time to enact a laundry list of liberal structural economic reforms.” Senator Thune asked Yellen “when is it too much” in terms of issuing more debt to finance increased government spending. Senator Portman warned that “we shouldn’t get too comfortable” with low borrowing costs, adding that debt/GDP is now “frightening.” In contrast, the incoming chair of the Finance Committee Senator Wyden said his top priority is “avoiding the mistake the Congress made in the last recession — taking a foot off the gas pedal before a recovery took hold.”

As expected, Yellen disavowed a weak dollar policy whilst affirming commitment to a market-determined exchange rate. While not calling for a stronger dollar, Yellen wants to signal a broad shift in FX policy from the outgoing Trump administration. It’s worth noting that the nebulous “strong dollar” policy that began under Rubin came after his predecessor Bentsen used the strong yen as a cudgel to get Japan to open up its markets more. Similarly, Yellen’s comments are meant to emphasize a departure from the Trump administration. It’s more a statement of what Biden’s FX policy won’t be rather than what it will be. If nothing else, markets will no longer be subject to tweet-related volatility and that’s a good thing.

Bank of Canada is expected to keep policy unchanged. At its last meeting December 9, it delivered a dovish hold by pledging to keep rates steady until 2023 and to continue buying bonds at the current pace. Like other policymakers, the BOC is balancing optimism regarding the vaccine with downside risks from a renewed spike in virus numbers. We expect the bank to take a similar stance at this meeting. Ahead of the decision, Canada reports December CPI. Headline inflation is expected to remain steady at 1.0% y/y, while common core is expected to remain steady at 1.5% y/y.

Brazil COPOM is expected to keep rates steady at 2.0%. However, the CDI market is pricing in a 25 bp hike to 2.25% at the March 17 meeting, followed by a series of 50 bp hike thereafter that take the policy rate to 5.25% at year-end. While this seems way too aggressive, we do believe steady tightening of a lesser degree will be seen this year. Bloomberg consensus sees a year-end rate of 3.25%, which seems much more reasonable and likely. December IPCA inflation came in at 4.52% y/y vs. 4.31% in November, the highest since May 2019. Of note, the inflation target and target range were both shifted 25 bp lower this year to 3.75% and 2.25-5.25%, respectively.

EUROPE/MIDDLE EAST/AFRICA

Italian political tensions appear to have calmed. Prime Minister Conte won votes of confidence in both houses of parliament. However, he fell short of winning an outright majority in the Senate. Of note, Renzi’s Italia Viva party abstained as promised in the Senate vote rather than voting against Conte and so fresh elections have been avoided for now. Conte now meets with President Mattarella to discuss his options going forward. The first and most attractive option is for Conte to broaden his coalition, and he will likely be given around two weeks to build a new majority in the Senate. Reports suggest a group of senators has indicated they’ll declare their support for Conte as soon as today

| The German government announced a hardening of mobility restrictions. The move was well telegraphed but still not a positive development. It includes an extension to the lockdown period until from the end of January to mid-February. Non-essential businesses will now be closed, and border closures may be next. All of this is a reaction to the risk imposed by the new variants of the virus, now being reported various countries around the globe.

UK reported December CPI. Both headline and CPIH came in a tick higher than expected at 0.6% y/y and 0.8% y/y, respectively. Both accelerated from November but we are nowhere near the 2% target. Indeed, inflation has been below the target since August 2019 and simply isn’t part of the policy discussions right now as the BOE focuses on providing stimulus to help offset the impact of the pandemic. The virus numbers continue to rise and so the negative impact is likely to carry over into February and perhaps even March. The bottom line is that Q1 is likely to see the UK economy contract and we fully expect further stimulus. Chancellor Sunak is coming under renewed pressure from within to step up fiscal stimulus. We also expect another increase in asset purchases but downplay notions of negative rates by the BOE. |

|

| ASIA

Bank of Japan began its two-day meeting. A decision will be announced tomorrow and no change is expected. t its last meeting in December, the bank kept policy unchanged but unexpectedly announced a policy framework review on the sustainability of its policy framework. Governor Kuroda said that “Our intent is to keep short and long term policy interest rates at their present or lower levels, and we won’t be reviewing negative interest rates.” The bank said it’s likely to announce the findings in March and so this week’s meeting is seen as a placeholder. That said, the bank is likely to downgrade its economic assessment in light of the widening lockdowns. Elsewhere, Japan December convenience store sales fell -4.0% y/y vs. -2.2% in November. The People’s Bank of China left policy rates on hold, as expected. The 1-year Loan Prime Rate (LPR) was kept at 3.85%, unchanged since April of last year, while the 5-year stayed at 4.65%. Expectations are rising that the PBOC could start to remove accommodation later this year. We don’t expect this to cause any major disruptions as it will be slow and well telegraphed. In fact, higher yields might end up being positive for local bond markets which are already seen strong foreign investor demand. The PBOC conducted another big liquidity injection today (largest in four months) but was intended to offset seasonal drains relating to tax payments. |

|

| Bank Negara Malaysia kept rates steady at 1.75%, as expected. However, the bank left the door open for further easing by noting that policy going forward “will be determined by new data and information, and their implications on the overall outlook for inflation and domestic growth.” December CPI will be reported Friday and is expected to fall -1.5% y/y vs. -1.7% in November. While the central bank does not have an explicit inflation target, ongoing deflation risks as well as widening lockdowns warn of an eventual rate cut this year. For now, fiscal policy will carry the load as the government just announced a MYR15 bln aid package Monday that aims to help households and businesses weather the lockdowns.

Taiwan December export orders surged. Orders rose 38.3% y/y vs. 30.4% expected and 29.7% in November. It was the strongest gain since March 2010 and is the tenth straight y/y gain, which should ensure strong export shipments through mid-year. Despite strong exports, policymakers remain concerned about the strong TWD. Latest reports suggest the central bank asked exporters to spread out their foreign currency sales to help ensure stability in the FX market. This comes after other reports that the bank has asked local custodial banks to encourage their customers to spread out their FX sales.

|

|

Tags: Articles,Daily News,Featured,newsletter