So, is that it? Have rates peaked? Is the long bear market finally over? The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by more than a rounding error over that time. The culprit, the reason stocks and bonds did so poorly over that time, is pretty simple – interest rates. The 10-year Treasury note yield roughly tripled during that time and all assets have been affected by those higher rates. Since January 1. 2021, the consumer price index

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, bonds, commodities, currencies, economy, Featured, Federal Reserve, Gold, Housing Market, Interest rates, Jerome Powell, Markets, Monetary Policy, newsletter, Real estate, REITs, stocks, US dollar

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

So, is that it? Have rates peaked? Is the long bear market finally over?

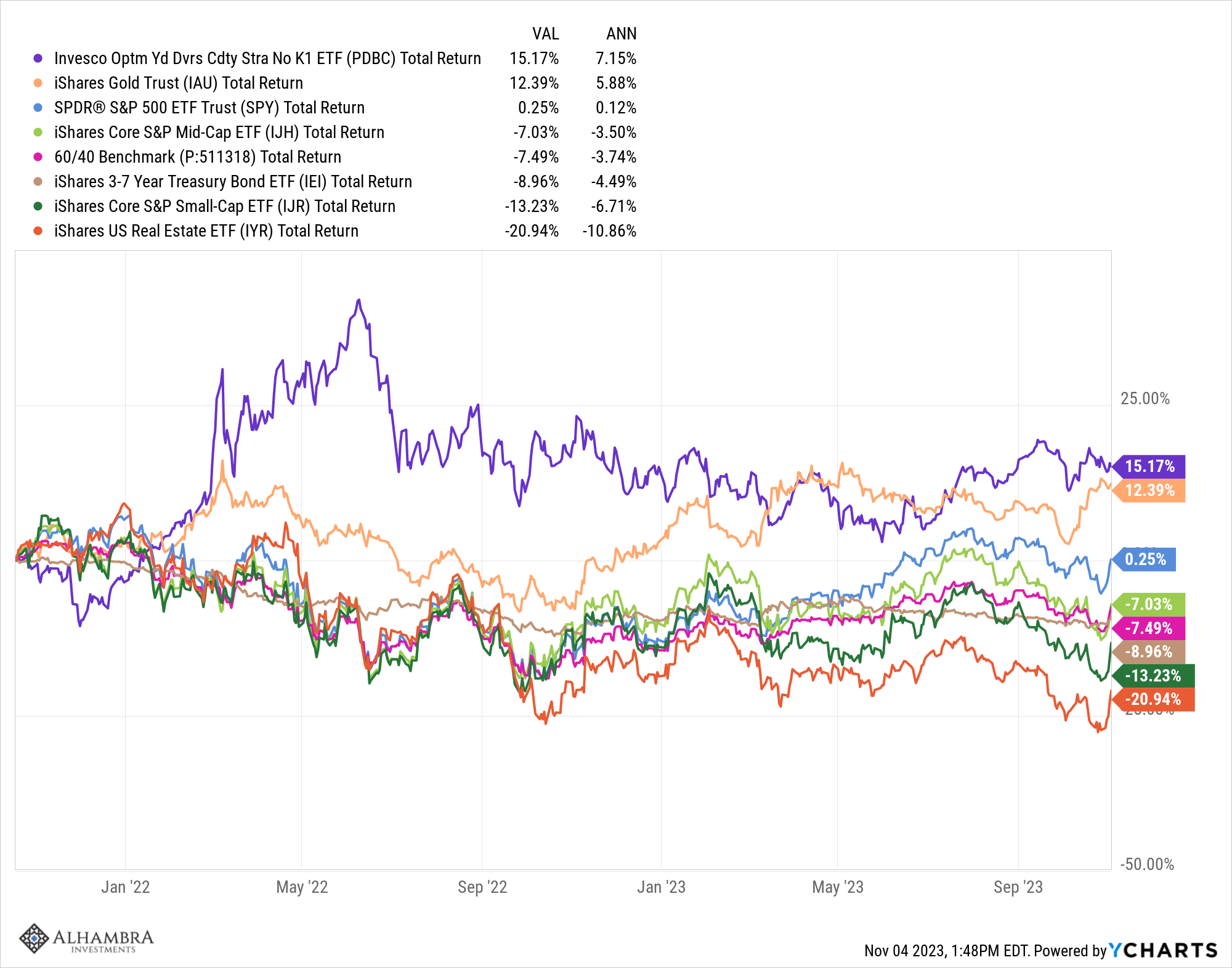

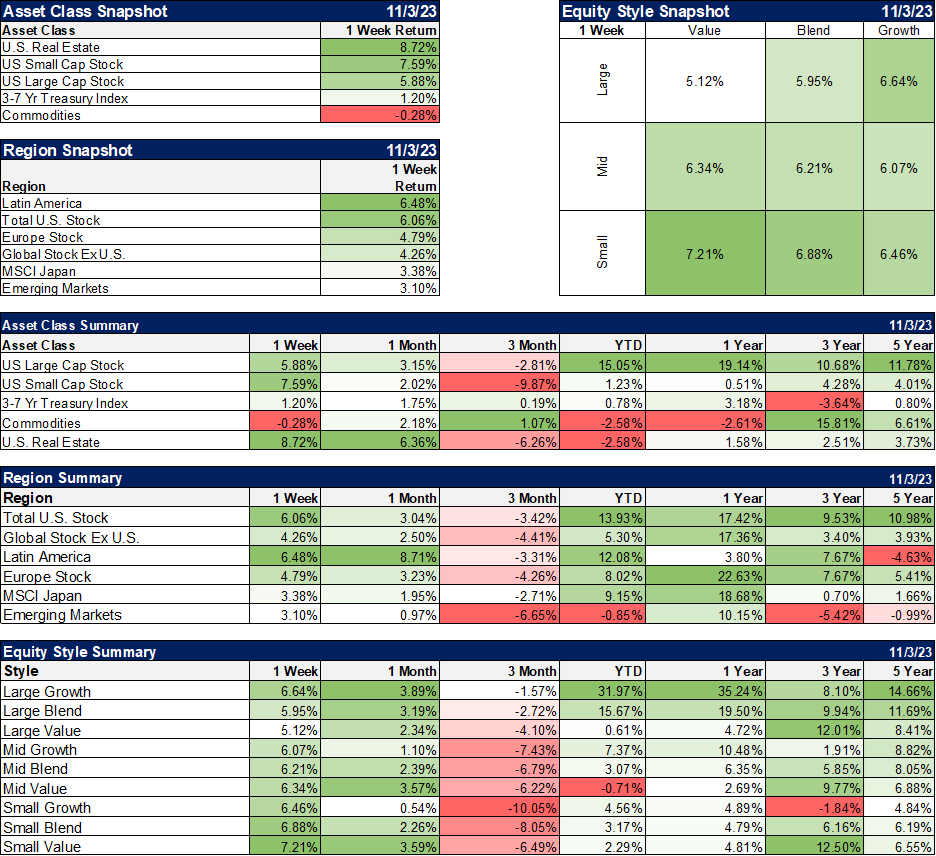

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by more than a rounding error over that time.

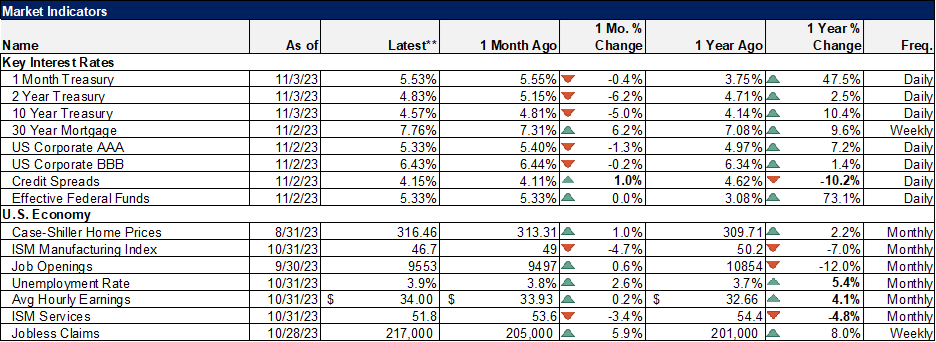

The culprit, the reason stocks and bonds did so poorly over that time, is pretty simple – interest rates. The 10-year Treasury note yield roughly tripled during that time and all assets have been affected by those higher rates. Since January 1. 2021, the consumer price index has risen by 17.5%, a 6% annualized rate, so the reason for the rise in rates is not a mystery either. It’s also pretty obvious, at least to me, that inflation peaked over a year ago, so interest rates peaking seems, if anything, a little late.

The Federal Reserve has been hiking rates since March of 2022 and most people, I think, give them credit for bringing down the inflation rate. But if that is true, why did the inflation rate peak after just 3 months and 1.5% in hikes? One can’t help but think that maybe there were other forces at work here. What did raising rates from 1.5% to 5.5% actually accomplish?

Jerome Powell did a bit of a victory lap at last week’s FOMC meeting but it is striking, at least to me, that it is hard – damned hard – to trace the drop in the inflation rate to the Fed’s rate hikes. It is hard, in my opinion, to see any effect from the Fed’s rate hikes other than a drop in stock and bond prices. That could have an impact on the economy but mostly through psychology; I would venture to say that today’s weak consumer sentiment has more to do with the stock market than the inflation rate. In any case, all the available research shows that wealth effects on the economy are small.

Rate hikes have certainly had an impact on the housing market in terms of activity but they haven’t had much impact on prices. We just got a Case-Shiller report last week that showed housing prices are still on the rise. Prices fell back for a while last year but they bottomed in March of this year and are now up 4% year-over-year. Here’s something to consider: maybe the bigger impact on housing from raising interest rates was on the supply side rather than the intended demand side. Just a crazy thought as I sit here in my house with a 2.25% mortgage.

When I look through the details of the year-over-year change in prices, the items that have brought the index back to earth are not really affected by Fed policy. Energy prices are down 0.5% over the last year with fuel oil and natural gas prices down 5.1% and 19.9% respectively. Used car prices are down 8% and airfares are down 13.4%. Eggs are down 14.5% and butter by 4%. Maybe I’m just not imaginative enough but I don’t think any of those things were affected by monetary policy. There are some items like Furniture (-5.4%) and Major Appliances (-7.7%) that have probably been impacted by reduced housing activity but these are not a big part of the index. And by the way, NGDP was up at an 8.5% annual rate last quarter which seems a curious time for the Fed to declare victory. Jerome Powell has been saying for over a year that reducing inflation would require some period of below-trend growth which we obviously haven’t had.

Whether the Fed’s rate hikes really caused the moderation of the official inflation rate is irrelevant in the short term. What matters for right now is whether the Fed believes it caused the inflation rate to moderate and Jerome Powell made it pretty clear last week that he does. So, the Fed is on hold, and absent a renewed surge in prices – which I’d say is far from certain – interest rates have likely peaked.

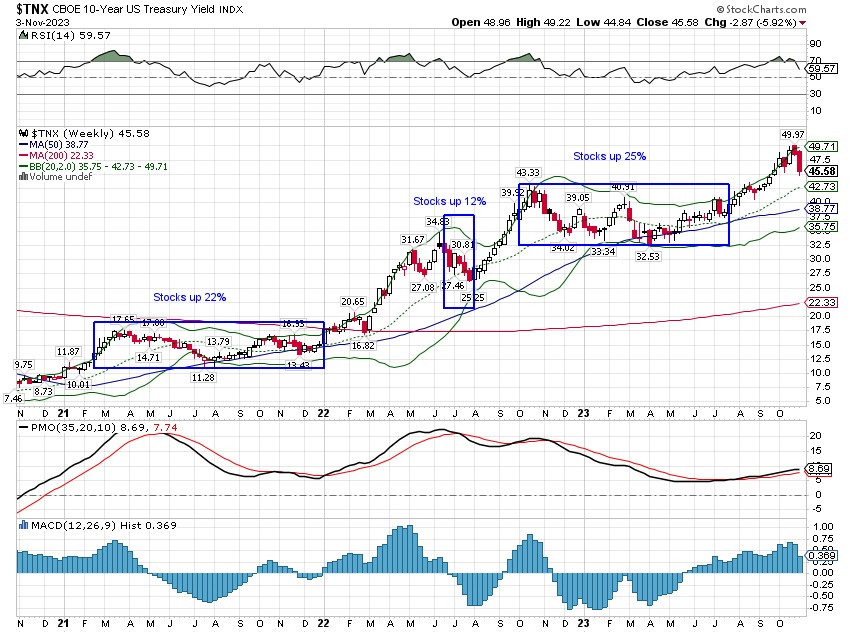

Interest rates have been rising since the summer of 2020 but there have been three periods of flat or falling rates. During each one, stocks surged:

And last week we got more of the same with stocks and REITs both coming off the October lows. The S&P 500 was up nearly 6%, small-cap stocks up 7.5%, and REITs up nearly 9%. Can that continue? Well, at that pace, no; that was just a relief rally, but if rates stabilize or fall some then stocks and REITs can continue to climb. How much? That likely now depends mostly on earnings.

S&P 500 earnings bottomed at the same time inflation peaked, the second quarter of 2022, and quarterly earnings are up 18% since then. But for Q3 2023 vs Q3 2022, so far, the growth rate is looking more like 10%. Guidance hasn’t been great either with 48 companies issuing a negative outlook and only 27 offering a positive one. As a result, earnings estimates for Q4 are down 3.9% since the end of Q3 although 2024 estimates have barely budged. On the other hand, of the 405 companies in the S&P 500 that have already reported this quarter, 82% of them have reported better-than-expected earnings and 62% have reported better-than-expected revenue. And the estimates they’re beating were based on previous company guidance, so maybe take their current outlook with a huge grain of salt. I would just say that with a forward P/E of nearly 18 already, the S&P 500 isn’t exactly on sale.

But that isn’t true of all stocks. Small and mid-cap stocks are outright cheap at roughly 12 times next year’s earnings and a higher expected earnings growth rate than the S&P 500. They are more volatile so it isn’t a free lunch but I do think if rates have peaked, these areas of the market can produce better returns. The same is true of REITs, which are posting trailing 12-month FFO growth of 11%. Of the major asset classes, REITs have taken the rise in rates the hardest but the fundamentals of the industry are actually pretty healthy.

Outside of office (which is only about 5% of the REIT index), occupancy rates are all over 95%. Average debt maturities are nearly 7 years and 85% of that debt is fixed rate. The office sector still faces some headwinds but we think the problems will be resolved sooner than most expect. The idea that work-from-home is going to be the norm going forward is, in our opinion, wrong. Companies don’t want it and increasingly neither do employees, at least not all the time.

The office sector will adjust over time to the changes just as other sectors have in the past. A few years ago, everyone thought retail real estate was a huge problem and now it has vacancy rates of less than 5 %. I would also suggest that it is when things are bad, as they are today, that one might find a bargain or two. Here’s a video I did last week about REITs: Why Do We Hold REITs in Our Portfolios?

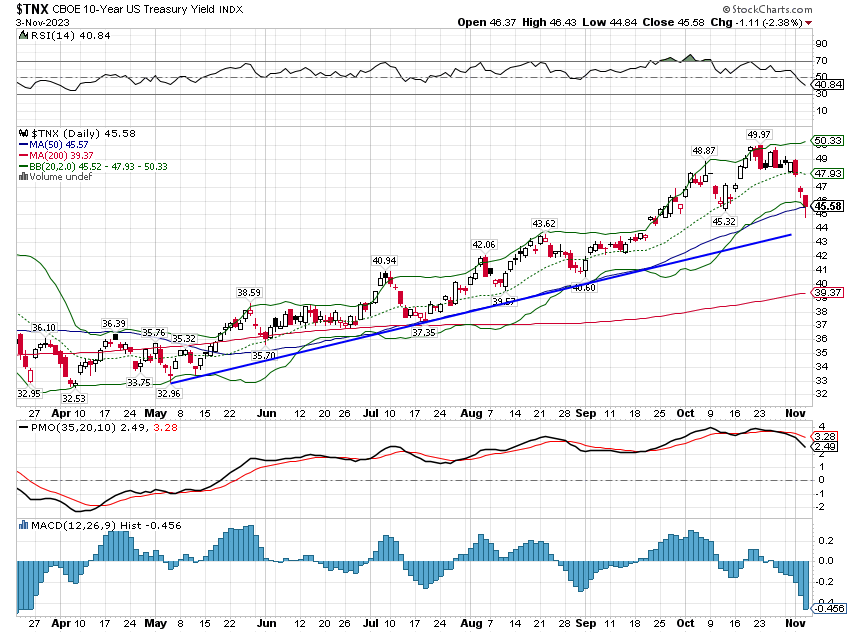

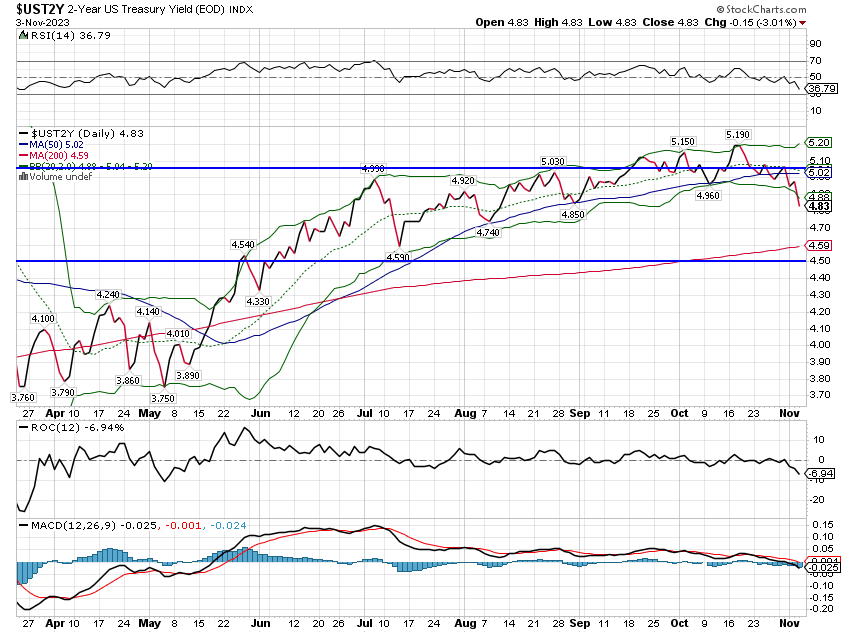

There is one caveat to the idea that rates have peaked and it is a pretty big one; what if they haven’t? The fact is that long-term interest rates are still in an uptrend (as I detail below). Bonds were very oversold and with large short positions, any move up (in price, not yield) was going to get exaggerated. From a technical perspective, the 10-year Treasury note yield could drop all the way to 4% and still be in an intermediate-term uptrend.

And frankly, it wouldn’t surprise me if it did as the economy does seem to be slowing. We may well get a growth slowdown (recession or not is irrelevant) that brings rates down to that level. But that is a cyclical argument, that rates have peaked for this cycle. FYI, we don’t know where we are in this cycle. It could be near its end – a recession – or not. Even if it is – we get a slowdown or recession soon and then start to recover – there is still a possibility that inflation is a secular problem, one that will persist across multiple cycles. And based on the impact of Fed rate hikes to date, I’m not at all sure that monetary policy can do anything about it, at least not without causing a severe recession.

Environment

Interest rates fell last week with both the nominal 10-year rate and the 10-year TIPS rate down over 25 basis points. With inflation breakevens essentially unchanged (-3 bps), the change in rates was driven by a change in real growth expectations. There was a lot going on last week with the Treasury refunding announcement, the FOMC meeting, and Jerome Powell’s press conference.

I’m sure all of those things had an impact on rates, but the biggest moves came in the wake of economic reports. The Treasury refunding was announced Wednesday morning at 8:30 and yields did drop by about 6 basis points but at the end of the day, rates were only down about 5 basis points from the day before. The biggest drop in rates came on Thursday (unit labor costs) and Friday morning (employment report).

I’m not sure either of those reports were deserving of the attention they received but with large short positions in the market it didn’t take much to spark a rally. And while it was a good week for bonds, rates are still in an uptrend and just back to where they were at the beginning of October.

Short-term rates were also down but not as much as the long end. 2-year Treasury yields are unchanged since July. The yield curve flattened slightly on the week and is still inverted.

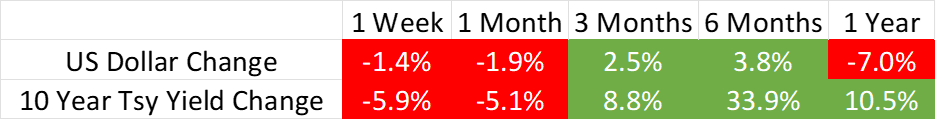

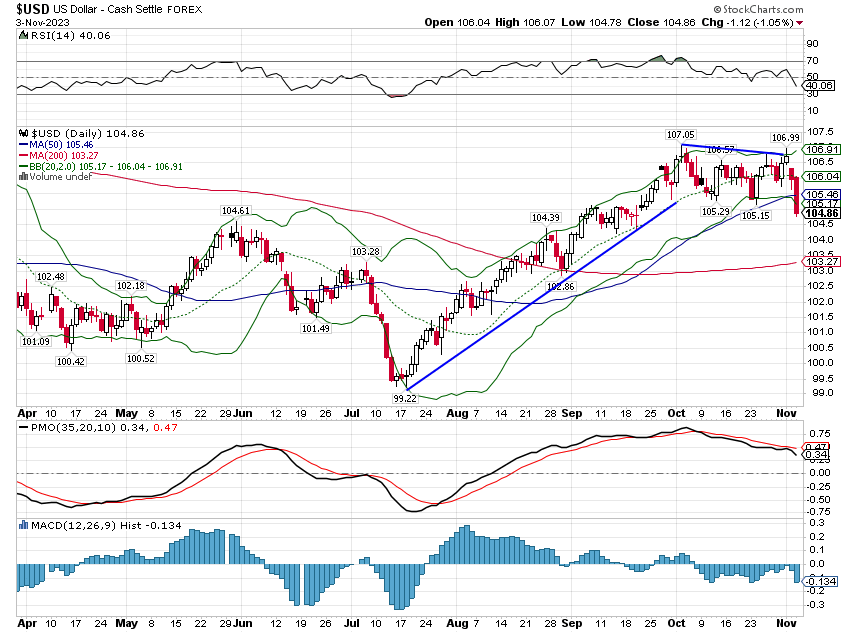

The dollar was also weak as real yields fell. While the really short-term trend could be called down, the dollar remains in an uptrend over longer periods. I believe the dollar will ultimately get in a more sustained downtrend but I can’t make that call yet.

I am skeptical of the quick move in rates because the economic data released last week was affected by the UAW strike although it is hard to say how much. We know that it affected the employment report directly as motor vehicles and parts dropped 33,000 jobs; without that drop, the payroll report would have been better than expected. Expect to see a make up next month. I think it is also likely the ISM reports were affected but that is harder to quantify. Transportation was one of the few sectors in the ISM that was positive but other sectors reported weakness from the strikes.

Over the last year, interest rates are higher and the dollar is lower by 7%. Historically, that environment favors EM, International Value, gold, and commodities and that has mostly been true over the last year (commodities are down modestly). It is not usually a good environment for US stocks and outside the S&P 500 that has proven true as well. If rates have peaked and fall over the next year, history says US equity performance should improve but if the dollar is also in a downtrend, international stocks would still be the better choice. Absent a working crystal ball, diversification is the best option.

Markets

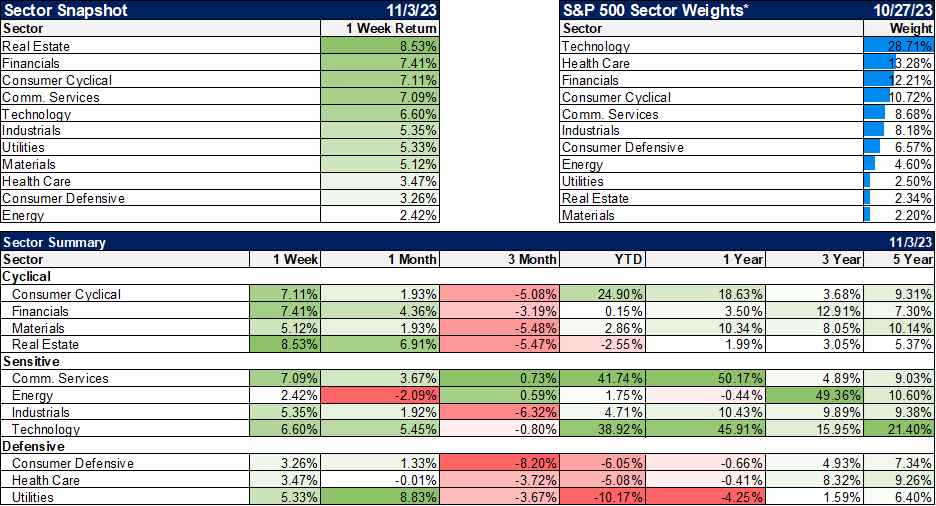

REITs were the best-performing asset class last week which isn’t surprising given the drop in rates. This is consistent with history that says that REITs outperform large-cap stocks by a wide margin when rates peak and start falling. The size of the move last week was a function of how oversold REITs were, and how unloved the sector had become. As I said above, the fundamentals of REITs are actually pretty good outside the office sector. And the cloud over office is probably not as dark as everyone assumes. Yes, COVID and work from home may have changed working arrangements but I suspect when we look back a couple of years from now the change won’t be as big as we thought. Here’s a short video on REITs I did last Thursday: Why Do We Have REITs in our Portfolios?

Value outperformed in mid- and small cap but lagged slightly in large cap. Growth still has a wide lead YTD and over the last year but value still holds the lead over the last 3 years.

International stocks performed well but lagged the US for the week. The one exception was Latin America which was really more about currencies with the Brazilian Real up over 2% and the Chilean Peso up over 5% versus the US dollar.

Real estate was the best-performing sector but was followed closely by financials and cyclicals. Within financials, it was the regional banks making the biggest moves, up over 12% for the week. The problems faced by regional banks are well-known and mostly relieved by lower rates. The biggest fear with the regional banks is commercial real estate and specifically office, but lower rates make that an easier problem to solve. There have been some high-profile instances of owners ceding properties to lenders but it does not appear to be a widespread problem, at least not yet. Could it be a problem in the future? Sure, if rates stay high for several years or go higher. But right now, lower rates are properly seen as a positive for real estate and their lenders.

Economics/Market Indicators

Credit spreads narrowed last week as stocks rallied. I am still concerned that spreads have widened recently but they are still below the long-term average and way below levels that would cause us to shift our portfolios. The weakest report of the week in my opinion was the ISM report which had been improving and is now back closer to the lows. Maybe that was due to the UAW strike but if not, it shows more weakness in manufacturing than I expected and more than we see in other reports.

I don’t know if interest rates have peaked. Neither does anyone else, least of all the Federal Reserve. I’m not sure at all that the Fed even knows how their rate hikes affect the economy at this point. The evidence that they have any kind of control over prices is thin at best. And if they don’t know how their rate hikes to date have impacted the economy and the inflation rate, what makes anyone think they know how a pause in the rate hikes will impact things?

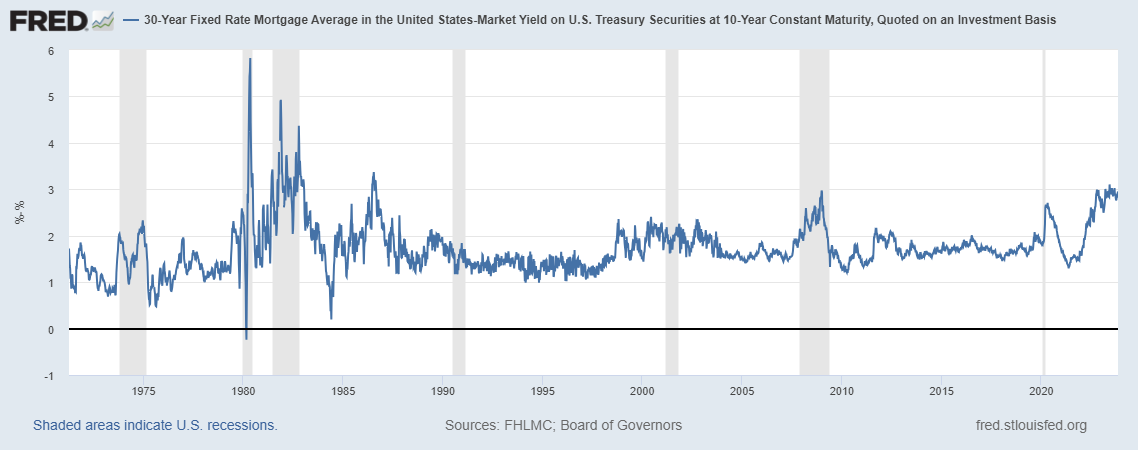

For example, now that the Fed has signaled a pause in their rate hikes -and that is certainly how the market interpreted Powell last week – how will that impact mortgage rates? Right now, mortgage rates are elevated not just because the 10-year yield is higher but because the spread is wider too:

30-year fixed mortgage rate minus the 10-year Treasury note yield

I suspect that one of the reasons for the wider spread is that banks have been anticipating further rate hikes. There are other reasons too, for sure, but anticipation of more rate hikes seems a likely factor. So if the 10-year rate steadies here because the Fed is on hold, what will happen to this spread? Will it narrow back to more normal levels? If that happens, mortgage rates could drop a full percentage point. What happens to the housing market in that scenario?

The impact on activity seems obvious – you’d get more since more people could afford a house with lower mortgage rates. But what about prices? Would a drop in mortgage rates free up more supply? Would lower rates cause homebuilders to build more or raise prices back to where they were (new home prices are down 12% year-over-year)? I don’t know the answers to those questions and neither, by the way, does the Fed.

Monetary policy is hard.

Joe Calhoun

Tags: Alhambra Portfolios,Alhambra Research,Bonds,commodities,currencies,economy,Featured,federal-reserve,Gold,Housing market,Interest rates,Jerome Powell,Markets,Monetary Policy,newsletter,Real Estate,REITs,stocks,US dollar