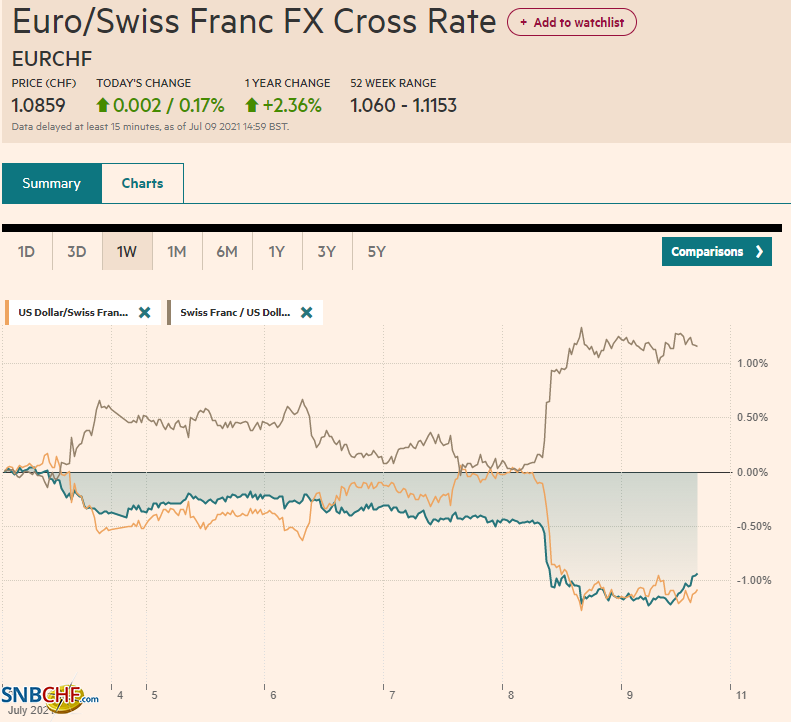

Swiss Franc The Euro has risen by 0.17% to 1.0859 EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are winding down what has been a challenging week that has seen equity markets slide and the dollar and bonds rally. The MSCI Asia Pacific fell for the fourth consecutive session, but the more interesting story may be the intrasession recovery that could set the stage for a better performance next week. The Nikkei gapped lower and rallied by around 2%, though still closed (0.65%) lower. Similarly, the Shanghai Composite recovered to new session highs after dropping over 1.1% at the open and closed less than 0.1% lower. South Korea and Taiwan indices fell a little

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Canada, China, Currency Movement, EUR/CHF, Featured, inflation, newsletter, PBOC, USD, USD/CHF

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss FrancThe Euro has risen by 0.17% to 1.0859 |

EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

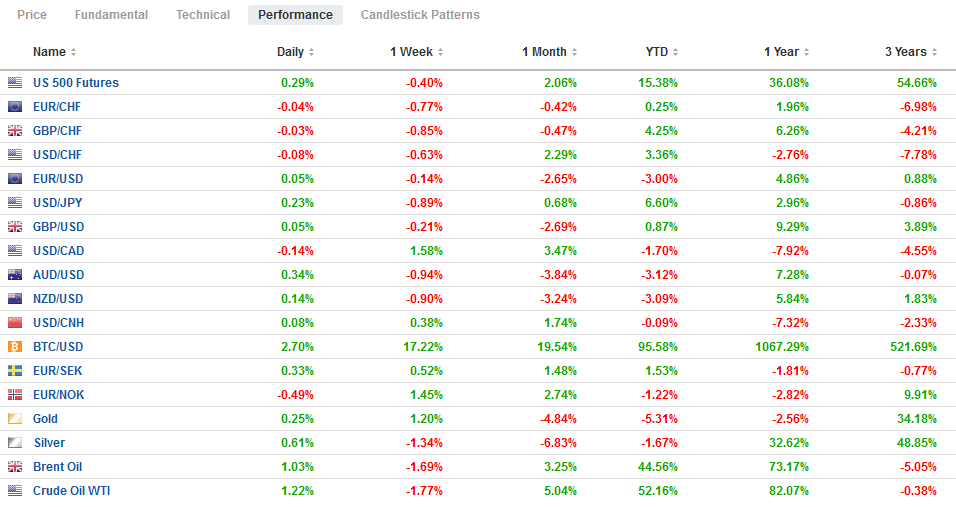

FX RatesOverview: The capital markets are winding down what has been a challenging week that has seen equity markets slide and the dollar and bonds rally. The MSCI Asia Pacific fell for the fourth consecutive session, but the more interesting story may be the intrasession recovery that could set the stage for a better performance next week. The Nikkei gapped lower and rallied by around 2%, though still closed (0.65%) lower. Similarly, the Shanghai Composite recovered to new session highs after dropping over 1.1% at the open and closed less than 0.1% lower. South Korea and Taiwan indices fell a little more than 1% and still closed near session highs. Europe’s Dow Jones Stoxx 600 is up about 0.8% near midday in Europe to pare this week’s decline to about 0.25%. That said, it is the first back-to-back weekly loss since April. US futures are pointing to a modestly higher opening. The US 10-year benchmark yield is up about four basis points to 1.34%. If sustained, it would be the first yield increase since June 25, when it settled slightly less than 1.53%. European bond yields are edging higher, though not before Germany’s 10-year yield slipped to a new three-month low (minus 31 bp). The dollar is mostly softer against the major currencies today. The Norwegian krone and the Australian dollar are leading the move. The yen is the weakest major currency today, slipping by about 0.3% to pare this week’s gain to around 0.9%, which leads the majors. The krone and dollar-bloc currencies are the poorest performers this week, all off more than 1%. Among the emerging markets, the freely accessible currencies are doing best, led by South Africa, Hungary, and Russia. On the week, the three Latam currencies (Brazil, Colombia, and Chile) have been the weakest performers, losing 2.3%-3.8% coming into today. The JP Morgan Emerging Market Currency Index is posting a small gain today to snap a four-day slide. It is off about 1.2% so far this week, and it is the fourth losing week in the past five. Gold is firm a little above $1800 after snapping a six-day advance yesterday. Oil is finding better footing. August WTI is near $74 after recovering yesterday from a three-week low near $$70.75. |

FX Performance, July 09 |

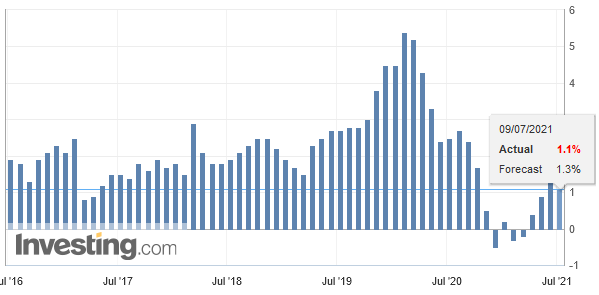

ChinaChina’s consumer prices rose 1.1% in June, slightly less than expected, and follows a 1.3% year-over-year rise in May. Pork prices, off 36.5% year-over-year, took almost one percentage point off its CPI measures. There appears to have been a small rebound in pork prices late last month, and officials expect prices to stabilize in H2. Food prices more generally fell by 1.7% (+0.3% in May), and non-food prices rose by a similar magnitude (1.6% in May). Fuel prices are higher, but the core CPI, stripped of food and energy, rose 0.9% year-over-year (0.9% in May). Producer prices rose 8.8% year-over-year (9.0% in May). There is some expectation that producer prices increases may have peaked, and officials have signaled further sales of some industrial metals from its strategic stockpiles. |

China Consumer Price Index (CPI) YoY, June 2021(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The softer inflation readings, coupled with the slippage in the PMI reports, give impetus to the signal from officials that it is prepared to provide more monetary support. After mainland markets closed, the PBOC announced a 50 bp cut in the required reserve ratio. It is seen freeing up about CNY1 trillion.

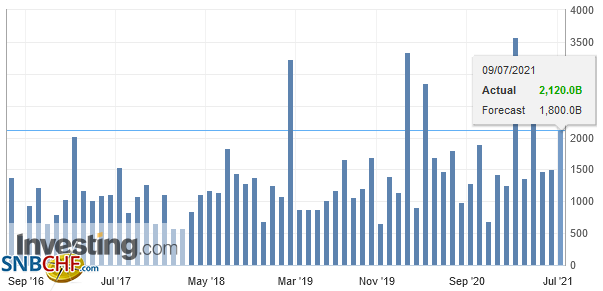

China also reported a surge in lending in June, led by shadow banking. Consider new yuan bank loans rose by CNY2.12 trillion, more than a third increase from the CNY1.5 trillion in May. Aggregate financing, which includes non-banking loans and wealth management arms of banks, jumped to CNY3.67 trillion from CNY1.92 trillion in May. While the new yuan loans exceeded expectations by CNY270 bln, the increase in aggregate financing was CNY780 bln above the median forecast in Bloomberg’s survey. |

China New Loans, June 2021(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

Asia Pacific

The BOJ meets next week. With Tokyo in yet another formal state of emergency, it would not be surprising to see it lower its growth forecasts. The BOJ is also expected to provide the broad details of a new lending facility to encourage more environmentally friendly investment. The BOJ is not expected to take any fresh initiatives to boost the economy, which likely contracted in the quarter that just ended. Talk emerged this week of a new supplemental budget after the Olympics.

The dollar found support yesterday near JPY109.50 and has popped back above JPY110.00 today. An option there for $630 mln expires on Monday. Initial resistance is seen near JPY110.35. The dollar’s four-week advance is ending, and near JPY110.10, the greenback is off about 0.85%, which would be the largest weekly loss since early April.

The Australian dollar’s slump was extended to almost $0.7400 today, where the lower Bollinger Band is found. Recall that on Tuesday is tested $0.7600. A move now above $0.7460 would help stabilize the tone and provide a better footing for a recovery next week.

The Chinese yuan firmed slightly today before the reserve ratio was shaved. It alternated between gains and losses this week but net-net, fell for the sixth consecutive week. The PBOC set the dollar’s reference rate at CNY6.4755, tightly in line with expectations (CNY6.4760).

Europe

The UK’s May GDP rose by 0.8%, about half of what the median forecast in Bloomberg’s survey anticipated, and adding insult to injury, April’s growth was trimmed to 2.0% from 2.3%. Industrial output missed expectations, rising by only 0.8% (not 1.4% as projected), and manufacturing output actually fell (0.1%) though the April decline (0.3%) was revised away. Construction disappointed (-0.8% vs. 1.0% forecast). April’s 2.0% decline was revised to only -0.7%. Services were a big miss. Instead of expanding by 1.6%, they grew by a more modest 0.9%, and the April surge of 3.4% was slimmed to 2.8%.

A new front in the UK-EU post-Brexit tension has opened. The EU estimates that the UK owes it 47.5 bln euros for its ongoing commitments to the EU programs it continues to benefit from and other obligations, including pensions. In 2018, the UK had estimated the obligations would run closer to 41.4 bln euros. The EU expects a 6.8 bln euro payment this year.

Norway’s inflation is at elevated levels, and today’s report leaves the Norges Bank on course to hike rates later this quarter. The headline CPI is 2.9% above year-ago levels, up from 2.7% in May. The underlying measure, which adjusts for tax changes and excludes energy, slipped to 1.4% from 1.5%. Producer prices jumped 4.6% month-over-month for a 37.1% year-over-year increase, which notably includes oil prices.

The euro is a quarter-cent range below $1.1850, where an option for about 915 mln euros expires today. Another option is expiring at $1.1800 for 1.26 bln euros. The euro is struggling to sustain even modest upticks. It settled at $1.1845 yesterday and $1.1865 a week ago. Barring a stronger recovery in North America, it will be the fifth losing week in the past six.

Sterling is also in a narrow range below $1.38. Without new gains, it will be the first session since April 13 that sterling would not have traded above $1.38. Sterling settled last week near $1.3825. It has also declined in five of the past six weeks.

America

The US economic calendar features the final wholesale inventory report for May. It is not a market mover even in the best of times. Washington is expected to announce sanctions on ten new Chinese companies for human rights violations in Xinjiang. On another front, the G20 finance ministers are expected to endorse the global tax reform proposals, the full details of which have not been worked out. There are at least three hurdles that need to be overcome. First is how to redistribute the tax revenue from the largest companies, which seems likely to help other high-income countries more than developing economies. The second hurdle is the EU and Canadian digital tax, which the US objects to. Third, it is not clear that the tax reform can pass the US Senate.

Canada’s June employment data is front and center. Recall Canada lost jobs in April and May. A recovery is likely in June, and the median forecast is for 175k jobs, which would knock the unemployment rate to 7.8% from 8.2%. Today’s report is seen as a key to next week’s Bank of Canada meeting. In April, the Bank of Canada announced it was tapering its bond purchases and foresaw the output gap closing in H2 22, which in turn suggests it could deliver its first rate hike around then. A strong rebound in the labor market would likely allow the central bank to maintain its outlook and continue to taper in Q3.

The Canadian dollar is one of the worst-performing major currencies this week, falling about 1.5% against the dollar. The greenback settled last week slightly above CAD1.2320. Despite a slightly heavier tone today, the US dollar is holding above CAD1.2500, where an option for nearly $520 mln will roll off today. A break below CAD1.2475 today would leave the greenback vulnerable to a further pullback next week.

The US dollar is near a three-day low against the Mexican peso (~MXN19.92). Yesterday’s firm CPI reading keeps the market leaning toward a follow-up rate hike in August (after last month’s surprise 25 bp hike). The next area of dollar support is seen in the MXN19.70-MXN19.75 area. Brazil’s CPI edged up to 8.35% from 8.06%. It has signaled intentions to lift rates again. Coming into today, the Brazilian real has fallen for eight consecutive sessions for a cumulative drop of about 6.3% and pushes it to its lowest level since late May. The dollar will begin today above its upper Bollinger Band (~BRL5.24) and appears vulnerable to a pullback.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Canada,China,Currency Movement,EUR/CHF,Featured,inflation,newsletter,PBOC,USD/CHF