The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the 28-day). These are being characterized as always as rate hikes when in fact they are at most window dressing. The moves are the third time so far this year the PBOC has acted, and they haven’t in total really changed the policy rates all that much. The 7-day reverse repo rate is up a total of 25 bps in

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, China Fixed Asset Investment, China Industrial Production, China Retail Sales, currencies, Dollar, economy, EuroDollar, fai, Featured, Federal Reserve, Federal Reserve/Monetary Policy, fixed asset investment, industrial production, Markets, Monetary Policy, newslettersent, PBOC, rate hikes, Retail sales, RMB, shibor, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the 28-day).

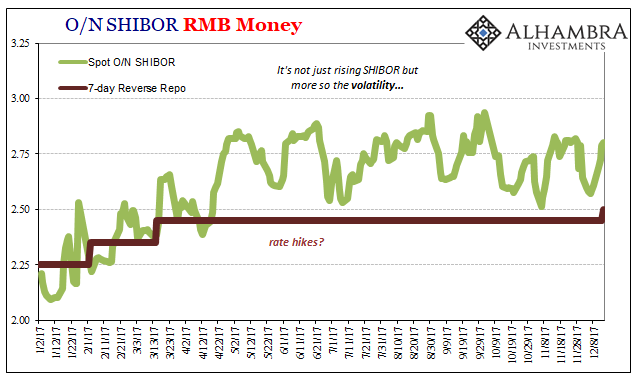

These are being characterized as always as rate hikes when in fact they are at most window dressing. The moves are the third time so far this year the PBOC has acted, and they haven’t in total really changed the policy rates all that much. The 7-day reverse repo rate is up a total of 25 bps in 2017, whereas O/N SHIBOR, a measure of private RMB costs, has moved by a lot more. The policy rate rather than pushing the private money rate is instead following it. |

RMB Money, Jan - Dec 2017 |

| It is mere symbolism, which from the Western perspective might seem a bit silly in a “why bother” kind of way, but on that side of the Pacific it is viewed officially as worth the charade so little margin is left in China. For one, PBOC officials know all-too-well that the media will characterize Chinese monetary policy as shifting to, or going further toward, “tightening.” As with both prior “hikes”, the mainstream has dutifully done just that.

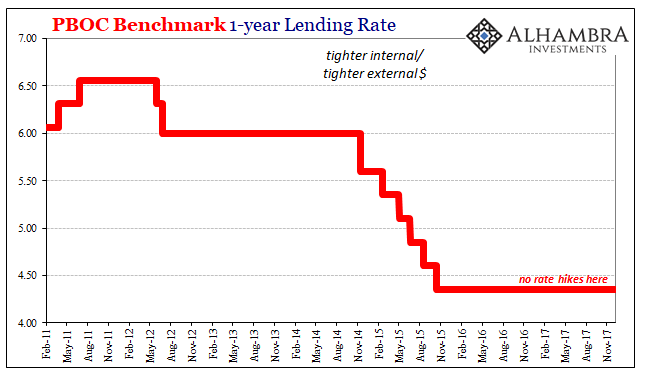

The timing of the second and third coincide with Fed “rate hikes” which gives the real target for the symbolic gestures. China’s central bank aims not on tightening RMB money markets but to ensure a stable CNY. Economists believe that speculators in particular will seek arbitrage in currency exchanges through interest rate differentials, both real and perceived. Therefore, by getting the media to claim the Chinese are tightening policymakers clearly think it will offset any rate bias the Fed might have made with its 25 bps “rate hike” yesterday. The currency policy has become paramount because stable CNY is China’s only hope. The Chinese economy is described in any number of extremely positive ways by the compliant, uncritical mainstream East and West; the PBOC’s “tightening” seemingly in line with that. But if that was really the case, the MLF and set of reverse repo rates would have been moved by more than the minimum 5 bps (symbolic) and more than that the central bank would have raised or have been raising its main policy rates – the benchmark 1-year lending rate. It is this latter that formed the basis of “accommodation” in 2014-15, along with cuts to the RRR forming several of the PBOC’s so-called “double shots.” Both the benchmark rate and the RRR remain where they have been since late 2015/early 2016. If economic and financial conditions were really improving, this is where monetary policy would respond (you know, like every other time in the past). |

PBOC Benchmark, Feb 2011 - Nov 2017 |

| They want everyone to think they are tightening so there doesn’t seem to be too much difference US to China, but not to actually tighten because China’s economy remains stuck in the lowest state of possible growth. The latest economic statistics continue to show that despite all the prior “stimulus” momentum and meaningful improvement still elude the Chinese system. |

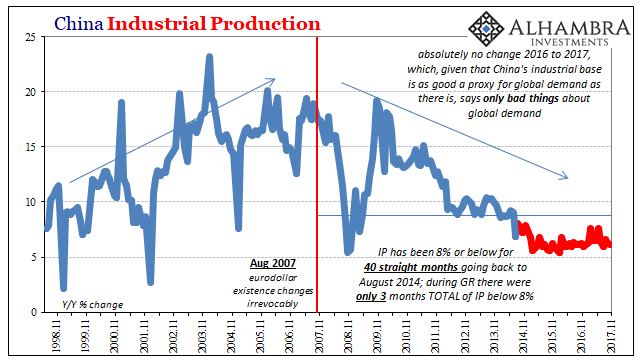

China Industrial Production, Nov 1998 - 2017(see more posts on China Industrial Production, ) |

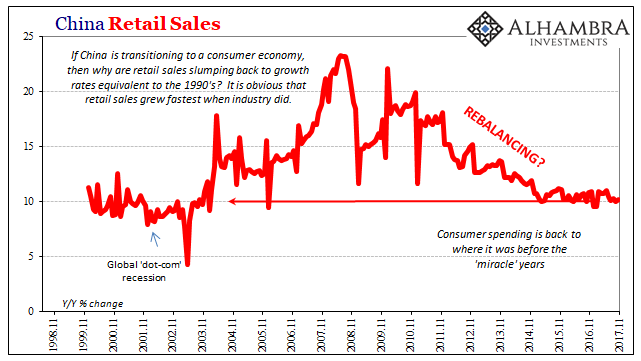

| Industrial Production was once again barely above 6% in November 2017, just as it has been almost in every single month since the start of 2015 (which actually raises more questions than assures of economic stability). Relatedly, Chinese retail sales grew by barely more than 10%, no acceleration or improvement indicated there, either. |

China Retail Sales, Nov 1988 - 2017(see more posts on China Retail Sales, ) |

| Without any actual momentum, China’s economic baseline (the supply side) suffers from lack of confidence about how the country, and global economy, is going to fare for the foreseeable future. |

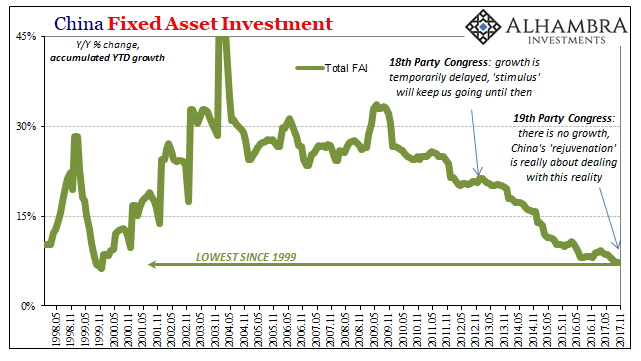

China Fixed Asset Investment, May 1998 - Nov 2017(see more posts on China Fixed Asset Investment, ) |

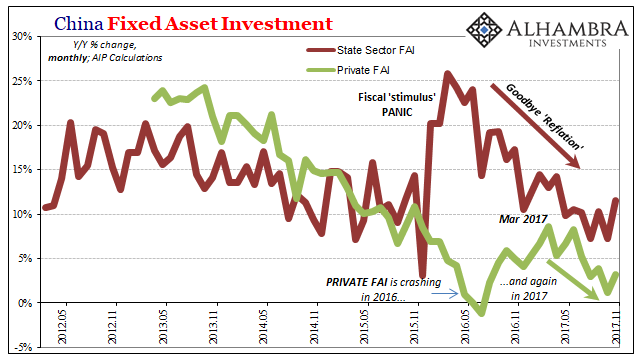

| Fixed Asset Investment (FAI) overall reached another multi-decade low last month on an accumulated basis, while private FAI was for a fourth straight month nearly flat at less than 5% growth year-over-year (single month). |

China Fixed Asset Investment, May 2012 - Nov 2017(see more posts on China Fixed Asset Investment, ) |

From this perspective you can really appreciate the bind Chinese officials find for themselves. To actually tighten (more than private money markets already have, Hong Kong, too) into an economy losing rather than gaining momentum would be monumentally stupid. Only by calling China’s economy robust when it’s not does the idea of “rate hikes” make sense.

Thus, the policy conflict really isn’t one. The PBOC wishes to remain as inwardly accommodative as possible while nurturing CNY (Hong Kong a big part of that, too) as best as it can, reacting only figuratively to outside influences like the Fed’s similar symbolism. It’s a very small needle to be threaded, and in that respect the MLF and reverse repo farce is quite revealing.

Tags: $CNY,China,China Fixed Asset Investment,China Industrial Production,China Retail Sales,currencies,dollar,economy,EuroDollar,fai,Featured,Federal Reserve,Federal Reserve/Monetary Policy,fixed asset investment,industrial production,Markets,Monetary Policy,newslettersent,PBOC,rate hikes,Retail sales,RMB,shibor