Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record. In this case, it is demand that drives supply rather than the other way around. The constant demand for...

Read More »No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. . In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which...

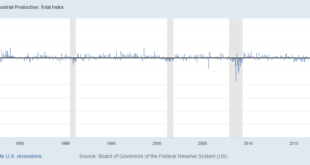

Read More »Industrial Synchronized Demand

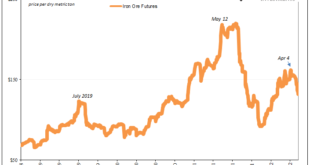

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April. This despite supply bottlenecks and production shortfalls which continue to plague each. Copper has now fallen to its lowest since last...

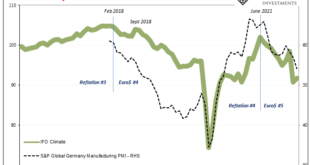

Read More »Euro$ #5 in Goods

Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand. Wait, what was that last one? The S&P Global Flash Germany Manufacturing PMI fell to 54.1...

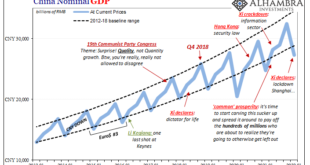

Read More »Shanghai’s Current Plight Began in 2017

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing. So long as other places around the world wanted...

Read More »I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape. The 2022 FOMC has made itself plain, incredibly hawkish to an...

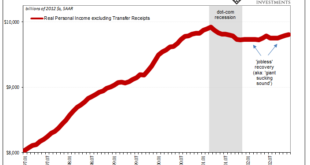

Read More »White-Hot Cycles of Silence

We’re only ever given the two options: the economy is either in recession, or it isn’t. And if “not”, then we’re led to believe it must be in recovery if not outright booming already. These are what Economics says is the business cycle. A full absence of unit roots. No gray areas to explore the sudden arrival of only deeply unsatisfactory “booms.” Every once in a while, however, even the mainstream media meanders closer to the actual economics (small “e”) of the...

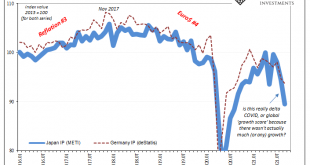

Read More »The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since...

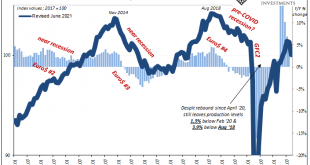

Read More »The Enormously Important Reasons To Revisit The Revisions Already Several Times Revisited

Extraordinary times call for extraordinary commitment. I never set out nor imagined that a quarter century after embarking on what I thought would be a career managing portfolios, researching markets, and picking investments, I’d instead have to spend a good amount of my time in the future taking apart how raw economic data is collected, tabulated, and then disseminated. Yet here we are. I’m not saying, nor have I ever alleged, the government is cheating, cooking the...

Read More »Far Longer And Deeper Than Just The Past Few Months

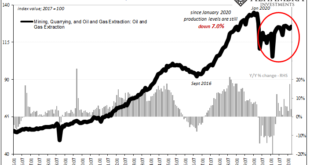

Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States. While absolutely tragic for those who suffered its blow, in economic terms this means that any weakness exhibited by whichever economic account during both August and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org