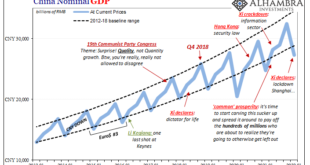

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing. So long as other places around the world wanted...

Read More »Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

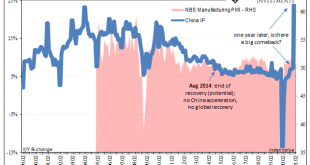

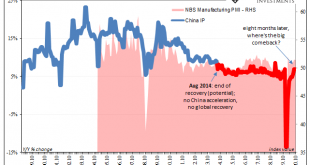

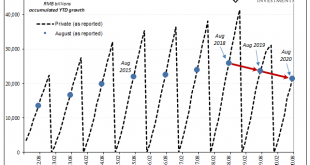

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult. What we want to know is how the current data fits with the overall idea of recovery: is it on track, perhaps going better than thought, or falling short. Another set of huge positives...

Read More »This Global Growth Stuff, China Still Wants A Word

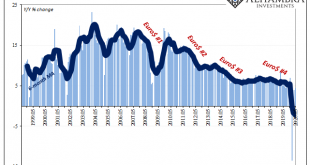

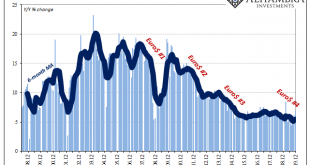

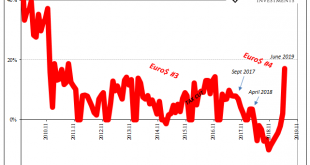

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality. Oddly the same for 2017’s update heading into 2018 and 2019. If currency wars are the...

Read More »Six Point Nine Times Two Equals What It Had In Twenty Fourteen

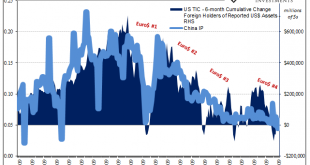

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.” In 2014, the clock was ticking but expectations were extremely high nonetheless. In September 2014, however, massive setback. Though it had been building all year by...

Read More »China’s Hole Puzzle

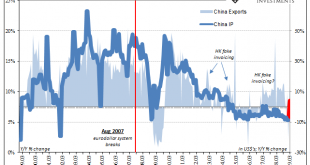

One day short of one year ago, on September 16, 2019, China’s National Bureau of Statistics (NBS) reported its updated monthly estimates for the Big 3 accounts. Industrial Production (IP) is a closely-watched indicator as it is relatively decent proxy for the entire goods economy around the world. Retail Sales in the post-Euro$ #2 context give us a sense of the Chinese economy’s persistent struggle to try to “rebalance” without the pre-2008 boost China had obtained...

Read More »A Chinese Outbreak (of Li v. Xi, Round 2)

Here they are again, seemingly at odds over how to proceed. Reminiscent of prior battles over whether to revive the economy or just let it go where it will, it appears as if China is in for Xi vs. Li Round 2. Or is it all just clever politics? Li Keqiang may be nominally the Chinese Premier but he’s a very distant second on every list of power players. Xi Jinping holds all the top spots, including a 2017-18 consolidation of power that left Xi rivaling only Mao in...

Read More »China Enters 2020 Still (Intent On) Managing Its Decline

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it. Rather than suggest the global economy is picking up, or ended last year in a “good...

Read More »China Data: Something New, or Just The Latest Scheduled Acceleration?

The Chinese government was serious about imposing pollution controls on its vast stock of automobiles. The largest market in the world for cars and trucks, the net result of China’s “miracle” years of eurodollar-financed modernization, for the Chinese people living in its huge cities the non-economic costs are, unlike the air, immediately clear each and every day. A new set of relatively strict pollution controls was added in the second half of this year. As is...

Read More »The Dollar-driven Cage Match: Xi vs Li in China With Nowhere Else To Go

China’s growing troubles go way back long before trade wars ever showed up. It was Euro$ #2 that set this course in motion, and then Euro$ #3 which proved the country’s helplessness. It proved it not just to anyone willing to honestly evaluate the situation, it also established the danger to one key faction of Chinese officials. The entire world slowed in 2012 following #2, but until the bottom of #3 it wasn’t really clear what that might mean. For a very long time,...

Read More »China’s Blowout IP, Frugal Stimulus, and Sinking Capex

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org