Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose 0 million? In a trillion economy? Give me a break. There was the kerfuffle of the S&P US Services PMI versus the ISM Services PMI. The former fell all the way to 43.7 (50 is the dividing line between expansion and contraction) while the latter, supposedly measuring the same thing, rose to 56.9. Which one is right?

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, bonds, commodities, CPI, credit spreads, currencies, ECB, economy, Featured, Federal Reserve/Monetary Policy, Gold, growth stocks, inflation, inflation expectations, Interest rates, Jerome Powell, Market Sentiment, Markets, newsletter, PPI, Real estate, stocks, TIPS, Ukraine, value stocks, Vladimir Putin

This could be interesting, too:

RIA Team writes The Benefits of Starting Retirement Planning Early in Your Career

Swissinfo writes Swiss residential real estate to remain in demand in 2025

Thomas J. DiLorenzo writes Stakeholder Capitalism and the Corporate KPI Cult

Swissinfo writes Parliament stalemate on abolishing Swiss homeowner tax

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a $24 trillion economy? Give me a break.

There was the kerfuffle of the S&P US Services PMI versus the ISM Services PMI. The former fell all the way to 43.7 (50 is the dividing line between expansion and contraction) while the latter, supposedly measuring the same thing, rose to 56.9.

Which one is right? The major difference between the two is that S&P surveys more small businesses, so maybe there’s a divide in the outlook between large and small companies. Or maybe, like the NFIB and U of Michigan sentiment surveys the S&P report has been tainted by politics somehow. All I can say is that the S&P data isn’t confirmed by any other metric. The two reports were nothing more than a gift to the permas; bulls flogged the ISM report and the bears reveled in the S&P report. No one else cared.

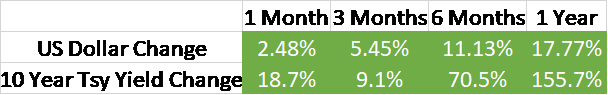

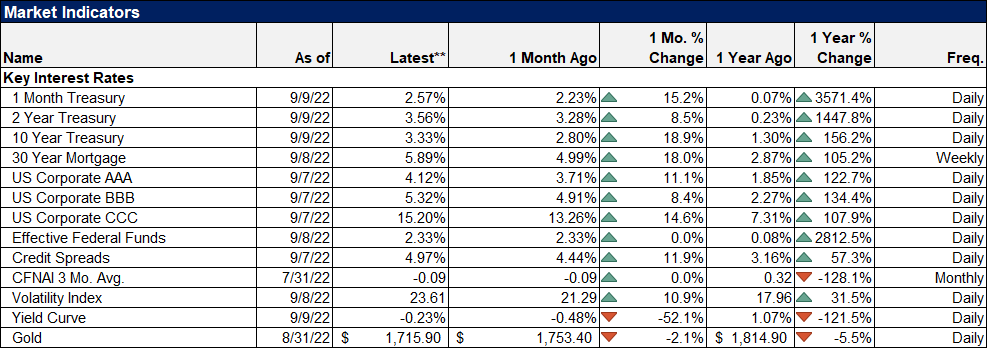

A couple of weeks ago when Jerome Powell spoke at the Jackson Hole retreat, his speech was taken as a forceful warning to markets that he and his merry band of rate setters were going to keep hiking until, well, you just wait and see. Last week he said basically the same thing at the Cato monetary conference and stocks went up just to confuse everyone. Bonds were down as interest rates rose – as they have been doing all year or to be more accurate, as they’ve been doing for 2 1/2 years.

The ECB did raise rates by 75 basis points last week despite everyone on the planet knowing that Europe is on the verge of recession and likely to, at a minimum, freeze their buns off this winter because Vlad won’t turn the gas back on. So European stocks rose more than US stocks and the Euro moved back above parity with the dollar because, well…maybe because Vlad’s army was about to get its butt kicked over the weekend? Hey, I’m all on board with markets discounting the future but that’s a little farfetched…maybe.

We will be getting some new inflation information this week that seems likely to be positive. The BLS will report CPI on Tuesday and PPI on Wednesday both of which are expected to be down 0.1%. There were some obvious price declines in August from gasoline to used cars to clothing so everyone knows that everyone knows that inflation has moderated. Could the report show an even steeper drop than expected? Maybe but the Fed speakers last week made it pretty clear they intend to hike 75 basis points in September and with it already priced into the market they’ll probably go ahead.

Most of what passes for news, the things people credit with moving markets on a day to day or week to week basis, is nothing more than noise. And sometimes we don’t even get any noise.

Environment

The trend for the 10 year Treasury note yield and the dollar are still up. The dollar did pull back ever so slightly last week but it doesn’t mean a thing yet. Could positive developments in Ukraine change that? Sure, but only if Putin gets replaced by someone sane. I certainly want to see Putin ousted but I am also cognizant of the old saying to be careful what you wish for. A win for Ukraine should be a win for Europe and the world but victory and positive results are far from assured.

The rise in rates has not been confined to nominal rates. 10 year TIPS yields hit 0.91% last week, the highest since 2018. Fear of inflation in the market peaked late last year when this yield fell to -1.15%. Except for a brief fall in TIPS yields in the immediate aftermath of the Ukraine invasion, investors have been selling inflation protection persistently since then.

| A suggestion that the Fed will be successful in their inflation fight? Maybe. Markets aren’t always right but they are better at predicting the future than the Fed or any other forecaster, so I’ll go with markets. The Fed may well be behind the curve, just not in the way most of the pundits think.

Long term real rates have been called the single most important price in an economy and for good reason. Real rates are a critical factor in almost every decision made by households, businesses and governments about whether to spend now or spend later. What’s amazing is that these decisions get made with the vast majority of people having no idea what the real rate is or how it is calculated. In simple terms, when real rates are negative fear of inflation is high and investors act to protect their purchasing power; they concentrate on capital preservation, inflation protection. They might buy gold – which is inversely correlated with real rates – or other commodities or TIPS. What they aren’t doing is making productive investments; the desire to protect the value of savings is greater than the desire to grow it. So, rising real rates, such as we have today, is a positive sign that people are more interested in investing for the future than protecting the gains of the past. That’s good news and we should hope it continues. |

|

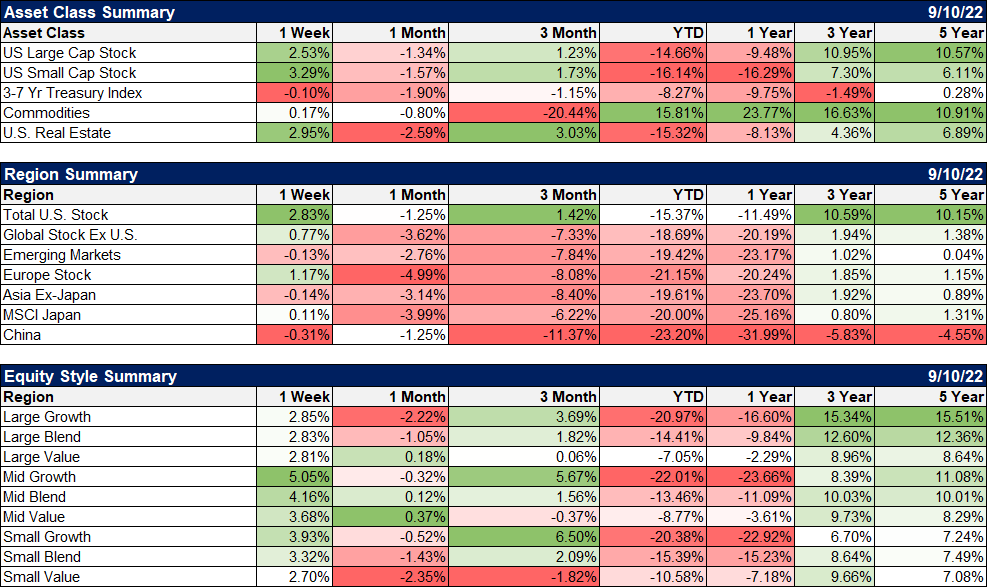

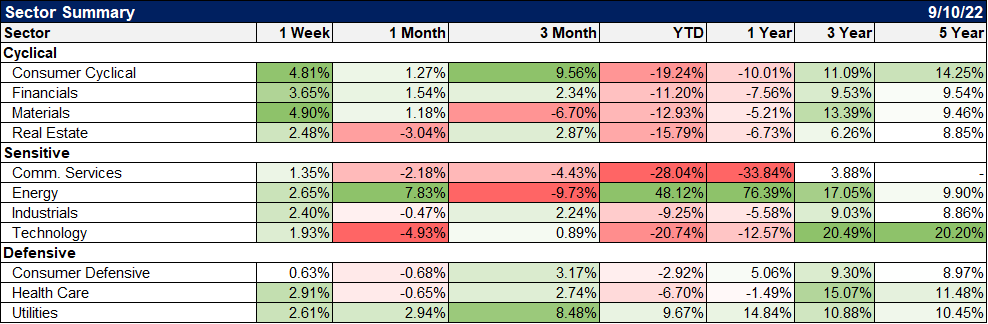

MarketsStocks, commodities and real estate were all up last week while bonds sold off again. There wasn’t, to my knowledge, any catalyst for the buying. The economic data was mostly benign and the Fed was out again talking tough about inflation. It is interesting that when Powell spoke at Jackson Hole a couple of weeks ago the Dow fell 1000 points but when he said almost exactly the same thing last week, the market went up. Growth stocks took the lead last week and there is some indication that a trend toward growth is developing. That is more than a little dismaying since we don’t think they are very cheap just yet. Quite the contrary actually. Mid and small cap growth stocks are reasonably priced but large cap is still on the expensive side for us. We’ll see how things progress but we are watching the growth vs value battle very closely. It may well depend on the course of the dollar. A lower dollar tends to favor value while a rising dollar tends to favor growth. Obviously, that hasn’t been the case this year but it is a tendency not a sure thing. |

|

| Economically sensitive sectors outperformed last week with cyclicals, financials and materials leading. Defensive stocks were up but less than the market. | |

| Credit spreads rose to almost 6% back in July but eased back to 4.25% in mid-August. They had been creeping back up but peaked just over 5% about 10 days ago. Spreads will widen at some point when the economy is closer to recession but current levels don’t indicate any big stress.

As I said above, there really wasn’t any news of note for the markets last week. Is it significant that, in the absence of news, stocks were bid higher? Maybe. Sentiment, as I’ve noted repeatedly over the last few months, is very negative. I am frankly dismayed at the defeatism, the feeling that things are bad and can only get worse that pervades the national mood. That isn’t the America I grew up in and it isn’t the one I want to leave to my daughter. But maybe some of that gloom is starting to lift. Maybe the fact that in a vacuum, people want to take risk, to invest for the future, is a sign of better things to come. I certainly hope so. |

Tags: Alhambra Portfolios,Alhambra Research,Bonds,commodities,CPI,credit spreads,currencies,ECB,economy,Featured,Federal Reserve/Monetary Policy,Gold,growth stocks,inflation,inflation expectations,Interest rates,Jerome Powell,Market Sentiment,Markets,newsletter,PPI,Real Estate,stocks,TIPS,Ukraine,value stocks,Vladimir Putin