Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and...

Read More »Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a...

Read More »Weekly Market Pulse: There Is No Certainty In Investing

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record. In this case, it is demand that drives supply rather than the other way around. The constant demand for...

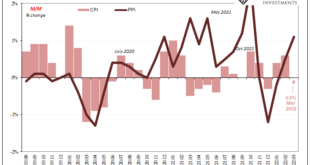

Read More »Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay. The short end of the yield curve (USTs and elsewhere) is plotting like FOMC dots, whenever oil and crude...

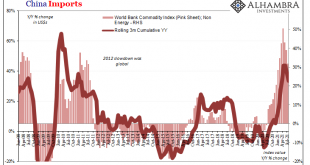

Read More »China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%. Balancing those were the prices for main food staples, especially pork, the latter having declined an rather large 9.3% last month from the month before. Keeping energy but removing...

Read More »US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

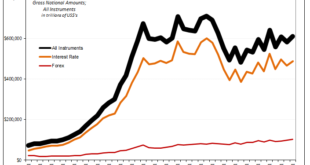

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation? The short end of the curve, as noted here, is being pressured by only the last of those things, rate hikes, and from them creating...

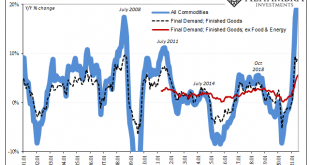

Read More »What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out. You see inflation around you; anyone can only tell deflation by hopefully noticing and...

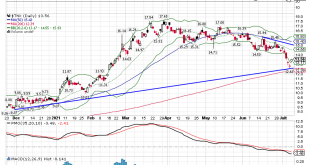

Read More »Weekly Market Pulse: As Clear As Mud

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs. Crude oil has recently joined in, falling 7% from its recent high. Energy stocks are in a full...

Read More »And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene. The BLS reports today that its main producer price index (PPI), the one for finished goods, was up 9.19% year-over-year in June 2021....

Read More »Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range. The bond rally since April has been of the stealth variety, the financial press and market strategists dismissing every tick down in rates as nothing. It was a lonely trade to put on and yes...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org