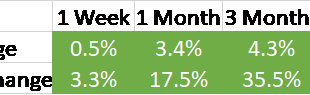

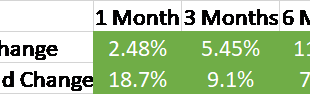

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market. In the short run, all that matters is what the majority believes is the truth. What they believed last week was that inflation isn’t falling fast enough and the Fed will not be cutting rates anytime soon. That was enough to send the bond market into a...

Read More »US Treasury Yields Come Back Softer After Moody’s Cut Outlook, and the Dollar Rises to New Highs Against the Yen

Overview: The dollar is beginning the new week narrowly mixed against the G10 currencies. Sterling seems largely unaffected by the cabinet reshuffle that has seen former Prime Minister Camron return as the foreign minister, replacing Cleverly who replaces Home Secretary Braverman. The dollar rose to new highs for the year against the Japanese yen (~JPY151.85). The market has shown little reaction to the pre-weekend news that Moody's cut the outlook for US credit to...

Read More »The Dollar Posts Corrective Upticks, while the Market Digests China’s Initiatives

Overview: China’s new initiatives to support the property sector helped lift the Hang Seng. And while the China’s CSI 300 edged higher both the Shanghai and Shenzhen composites fell. Most Asia Pacific markets fell, while Europe’s Stoxx 600 is posting a small gain. US futures are sporting modest losses. European benchmark 10-year yields are 3-5 bp lower, including UK Gilts ahead of Thursday’s budget that is expected to confirm new borrowing (Office for Budget...

Read More »Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and...

Read More »Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a...

Read More »US Dollar Offered but Stretched Intraday

Overview: The US dollar is trading heavily against all the major currencies, led by the Norwegian krone and euro. Emerging market currencies are also firmer. However, risk-appetites seem subdued. Even though most large bourses in Asia Pacific advanced but Japan and Hong Kong, European markets are nursing small losses and US futures are little changed. Benchmark 10-year yields are firmer with European yields 3 bp firmer and Italy’s premium over Germany slightly...

Read More »Weekly Market Pulse: Things That Need To Happen

Perspective: per·spec·tive | pər-ˈspek-tiv b: the capacity to view things in their true relations or relative importance Merriam-Webster Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view. Things that seemed so important at the time, years ago, turned out to be nothing more than bumps along the road of life. That is as...

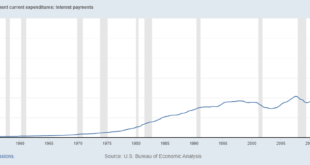

Read More »Weekly Market Pulse: TANSTAAFL

TANSTAAFL is an acronym for “There ain’t no such thing as a free lunch”. It has been around a long time – Rudyard Kipling used it in an essay in 1891 – but it was popularized by Robert Heinlein’s 1966 book, “The Moon is a Harsh Mistress”. In economics it most often refers to tradeoffs or opportunity costs; resources are scarce and if you choose to use them in one way they aren’t available for an alternate use. The other way the phrase is often used is to describe a...

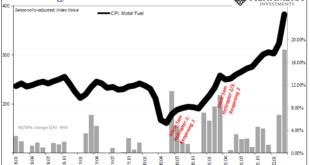

Read More »You Know What They Say About The Light At The End Of The Tunnel

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen. After August 2017 up to and including August 2018, the BLS’s CPI registered a seasonally-adjusted 20.5% year-over-year gain in its motor fuel component. Economic pain followed thereafter, though not entirely the fault of...

Read More »Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end. We shouldn’t care much about the Fed. Live look at Jay Powell’s press conference.#ratehikeshttps://t.co/leCyV8Wak4...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org