Dieser Artikel erschient erstmalig im Nebelspalter am 23. März 2022. Es gehört zum Wesen von Prinzipien, dass sie auf Dauer angelegt sind und sich gegenüber dem Wandel des Zeitgeists als resistent erweisen müssen. Was die Schweiz zum Frieden beitragen könnte – und wie dieser aussehen müsste. Robert Nef Wer Prinzipien beharrlich vertritt, muss damit rechnen, dass er immer wieder als «jemand von gestern» und als Feind des Fortschritts hingestellt wird. Gegenwärtig haben die...

Read More »The slow, stealthy but steady spread of absolutism

Part I of II by Claudio Grass, Switzerland The struggle and rivalry between the “West and the rest” might be grabbing news headlines due to the Ukraine war these days, but in truth, it is anything but newsworthy. This antagonism, this battle for geopolitical, physical dominance, for moral supremacy, and this clash of ideas and fundamental values has been raging for much longer than that, perhaps longer than most of us can recall. It sowed the seeds of bloody and even genocidal...

Read More »The slow, stealthy but steady spread of absolutism

Part I of II by Claudio Grass, Switzerland The struggle and rivalry between the “West and the rest” might be grabbing news headlines due to the Ukraine war these days, but in truth, it is anything but newsworthy. This antagonism, this battle for geopolitical, physical dominance, for moral supremacy, and this clash of ideas and fundamental values has been raging for much longer than that, perhaps longer than most of us can recall. It sowed the seeds of...

Read More »Dollar Comes Back Bid

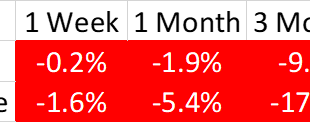

Overview: The US dollar is recovering today after it was sold following the jobs report before the weekend. It is enjoying a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring best, while the Scandis are off close to 0.5%. Most emerging market currencies are also softer, with only a few Asian currencies edging higher today, including the South Korean won, Indian rupee, and Taiwanese dollar. With a stronger dollar and firmer interest rates,...

Read More »Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months. Real disposable income is up 0.8% in the last six months but was down...

Read More »A grateful goodbye to 2022, a hopeful hello to 2023

Even though what we saw during the height of the pandemic was shocking enough for most people, what we saw during 2022 was arguably even more astonishing. During the lockdowns and quarantines and the forced business shutdowns, the sheer number of all the rights and freedoms that were coercively “suspended”, as though that’s a thing one can do with true liberty, left so many fellow citizens in disbelief. However, what many people found even more horrifying was the way it was seemingly...

Read More »A grateful goodbye to 2022, a hopeful hello to 2023

Even though what we saw during the height of the pandemic was shocking enough for most people, what we saw during 2022 was arguably even more astonishing. During the lockdowns and quarantines and the forced business shutdowns, the sheer number of all the rights and freedoms that were coercively “suspended”, as though that’s a thing one can do with true liberty, left so many fellow citizens in disbelief. However, what many people found even more horrifying...

Read More »Failures in Russia’s War Against Ukraine

The New York Times collects background information about failures in Russia’s war against Ukraine.

Read More »Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure...

Read More »Weekly Market Pulse: Good News, Bad News

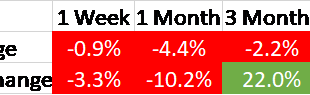

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday. The same could be said of bonds which also had a good week, with the aggregate index up 2.3%. The stock market rally probably says...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org