Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal. But with case counts sharply rising once more, the whole thing was going to get shutdown instead. The government declared a holiday starting April 1 (no fooling) last year, lasting three days while totally banning any large public gatherings (except those by and for government officials, obviously) for nearly a week. Other restrictions were either applied or kept in place. You know the drill. As a consequence of these draconian measures, retail sales in Germany crashed. Of

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Christine Lagarde, CPI, currencies, economy, Featured, Federal Reserve/Monetary Policy, Germany, HICP, inflation, Markets, newsletter, Recession, Retail sales

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

| Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal. But with case counts sharply rising once more, the whole thing was going to get shutdown instead.

The government declared a holiday starting April 1 (no fooling) last year, lasting three days while totally banning any large public gatherings (except those by and for government officials, obviously) for nearly a week. Other restrictions were either applied or kept in place. You know the drill. As a consequence of these draconian measures, retail sales in Germany crashed. Of course they did give how pretty much every German was stuck at home with little commerce available outside of it for a sizable chunk of that month. |

|

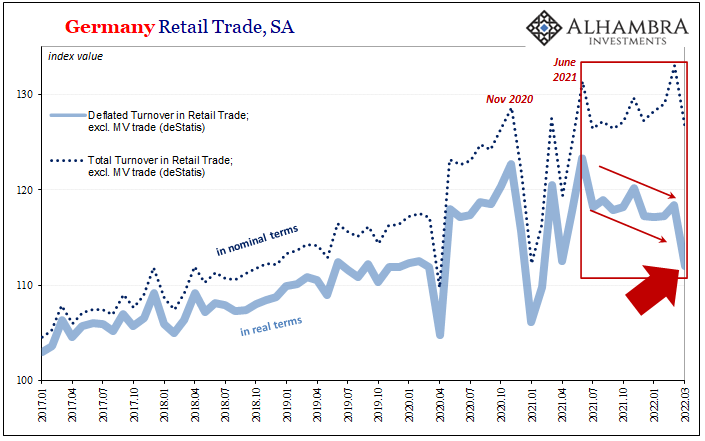

| According to deStatis, the government’s bean counting agency, accounting for price changes (which weren’t changing all that quickly early last year) retail trade collapsed by 6.6% in April 2021 when compared to the month before. Shut the whole country down, get nearly minus seven m/m.

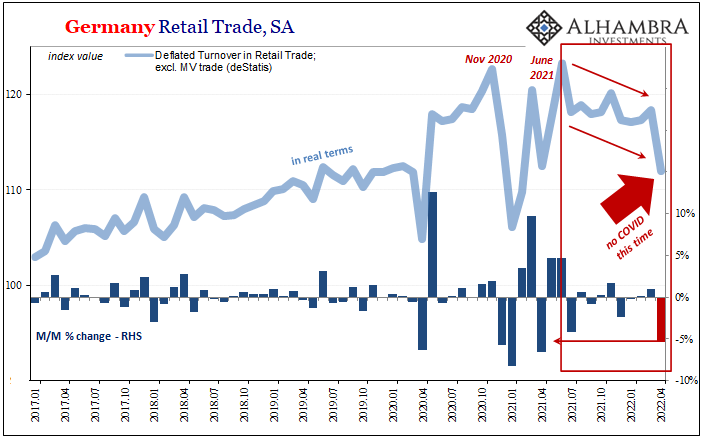

Dismissed as the inevitable non-economic consequences of government COVID-fighting, the same process was repeated a couple more times over the year since then with similar though less extreme retail sales results. The government acts, commerce falls substantially, everyone presumes the economy goes right back to good or awesome when the acts are lifted. But in April 2022, there was no COVID panic. Going by German retail trade numbers, however, you’d be forgiven for thinking there had been. According to the latest estimates from deStatis, retail sales crashed by 5.4% in April 2022 when compared to March; nearly identical m/m results from the prior April. Only this time, no case count conundrum or overstimulated government in sight. No one can blame the pandemic for this one. |

This is all economics (small “e”).

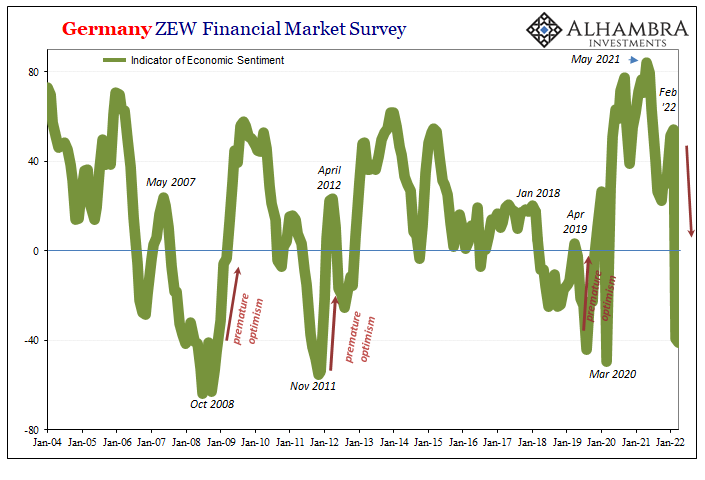

They will and already have fingered Russia, of course, but even when doing so mainstream commentary is rightly fixed on the bigger issue – the emerging downside to last year’s supply shock (sales in real terms have been falling since last June, coincident to Euro$ #5). Paying more and getting less (shown above) has a particularly insidious way of eroding economic fundamentals, especially when what you’re paying more for is the basics like gasoline and energy.

No one is, or will be, doing that quite like the Germans. Even nominal retail sales in April went down sharply, a warning that demand destruction isn’t just a real possibility, it can turn up (meaning down) just that quickly and severely when the conditions are right.

This is no geographic outlier, either. What’s going on over there is happening everywhere to a similar enough degree. And, it has to be stated, this has nothing to do with rate hikes (which haven’t even begun in Europe, and this is one key reason why).

Recessions aren’t just oversized downturns or slowdowns, they are a step beyond those, made so by an unusually bad set of circumstances producing unusually awful results. Speaking of and for not just Germany but globally, you have to consider these retail sales estimates as highly unusual in that sense.

What a difference a year makes, or, in the growing case of globally synchronized, doesn’t for retailers. Out of the frying pan of non-economic government interference and into the fire of not inflation but something looking worse.

Tags: Christine Lagarde,CPI,currencies,economy,Featured,Federal Reserve/Monetary Policy,Germany,hicp,inflation,Markets,newsletter,recession,Retail sales