Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal. But with case counts sharply rising once more, the whole thing was going to get shutdown instead. The government declared a holiday starting April 1 (no fooling) last year,...

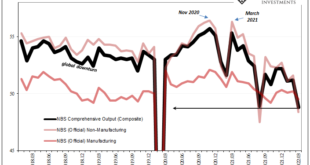

Read More »China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious. Why? For one thing, she noted how Europe produces a lot of stuff that, at the margins of its economy, make the whole system go. Or don’t go, as each periodic case may be: Europe in...

Read More »Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes...

Read More »The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1). Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury...

Read More »Tapering Or Calibrating, The Lady’s Not Inflating

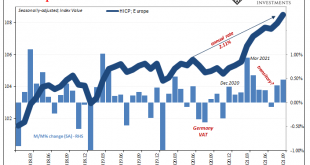

We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6. On the other side of the Atlantic, Europe’s central bank will be technically be doing the same thing likely at the same time. Except,...

Read More »Meanwhile, Outside Today’s DC

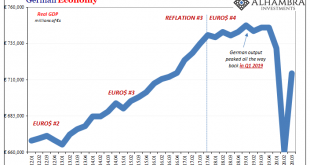

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage. Either way, Europe gets at it first. In 2018, what had been...

Read More »ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

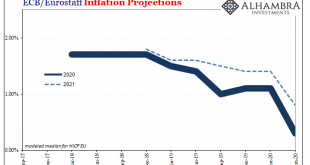

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press. It never ends. If you...

Read More »Miracles Aren’t Shovel-Ready

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.” They did it – and it didn’t take. Lagarde’s outreach was simply an act of admitting reality. Having forecast an undercurrent of worldwide inflationary breakout (how...

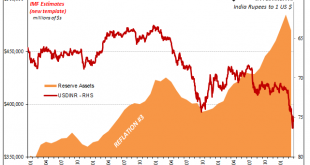

Read More »(No) Dollars And (No) Sense: Eighty Argentinas

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark. Over the last several crisis-filled weeks, officials in India have been fighting against a...

Read More »Christine Lagarde’s New Vision for the ECB

On December 12, Christine Lagarde introduced her goals and vision in her first rate-setting meeting as the new president of the European Central Bank (ECB). On the actual policy front, there were no surprises. She remained committed to the path set by her predecessor, Mario Draghi, and kept the current monetary stimulus unchanged. The central bank kept its deposit rate at the present record-low –0.5 percent and pledged to continue its €20 billion bond purchases every...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org