Swiss Franc The Euro has fallen by 0.04% to 1.0648 EUR/CHF and USD/CHF, March 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 4.2% rally in the S&P 500 yesterday helped lift Asia Pacific markets earlier today, and the five basis point backing up of the US 10-year yield pushed regional yields higher. However, the coattails proved short, and Europe’s Dow Jones Stoxx 600 is snapping a three-day advance...

Read More »Chinese economic disruption hits Swiss supply chains

Data published this week showed China’s factory activity contracted at its sharpest pace on record in February (Keystone / Xu Changliang) China’s sharp contraction in economic activity over the past month due to the coronavirus epidemic is sending shockwaves across the globe. Switzerland is one of the top ten countries exposed to Chinese supply disruptions, a United Nations report reveals. Over the past month China, which has a central role in global supply chains,...

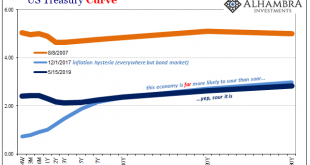

Read More »The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events. The short version: monetary authorities as well as the “experts” describe almost perfectly risk averse behavior among the central money dealing system in outbreaks like September’s repo – but...

Read More »Christine Lagarde’s New Vision for the ECB

On December 12, Christine Lagarde introduced her goals and vision in her first rate-setting meeting as the new president of the European Central Bank (ECB). On the actual policy front, there were no surprises. She remained committed to the path set by her predecessor, Mario Draghi, and kept the current monetary stimulus unchanged. The central bank kept its deposit rate at the present record-low –0.5 percent and pledged to continue its €20 billion bond purchases every...

Read More »Governments Are Using the Coronavirus to Distract From Their Own Failures

The Johns Hopkins University Coronavirus Global Cases Monitor shows that the mortality rate of the epidemic is very low. At the writing of this article,1 there have been 92,818 cases, 3,195 deaths, and 48,201 recoveries. It is normal for the media to focus on the first two figures, but I think that it is important to remember the last one. The recovered figure is more than ten times the deceased one. This should not make the reader ignore the epidemic, but it is...

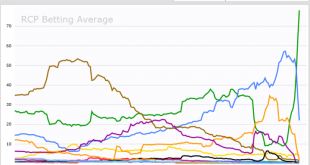

Read More »Updated Democratic Primary Timeline

Super Tuesday has come and gone. Bloomberg has suspended his campaign after an extremely poor showing, and Warren is expected to follow suit soon. Here is our updated take on the likely Democratic candidate. RECENT DEVELOPMENTS Biden exceeded expectations on Super Tuesday. He won Alabama, Arkansas, Massachusetts, Minnesota, North Carolina, Oklahoma, Tennessee, Texas, and Virginia and leads in Maine. Sander won Colorado, Utah, and Vermont and leads in California. As...

Read More »Ich kaufe Schnäppchen ein – Wenn andere Hamstern und in Panik verfallen ??

Wenn andere hamstern und Panik schieben, bewahren wir die Ruhe und halten an unserer Anlagestrategie fest. Für mich war es eigentlich nie ein Thema Markettiming zu betreiben, ich möchte regelmässig mein Geld an der Börse investieren. Reich durch einen Crash oder Korrektur Während andere gelähmt sind und stetig abwarten bis der Boden erreicht ist, gehen viele Gelegenheiten ungenutzt. Niemand kann genau wissen wann der Boden erreicht wird. Deshalb betreibe ich für...

Read More »FX Daily, March 4: Equities Trade Higher, While Yields Continue to Fall

Swiss Franc The Euro has fallen by 0.49% to 1.0627 EUR/CHF and USD/CHF, March 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The G7 delivered up a nothing burger than was shortly followed by a 50 bp Fed cut. The equity market seemed to enjoy it briefly and extended Monday’s dramatic gains, before falling out of bed. The S&P 500 lost about 2.2%, while the Dow Industrial slumped 3%, but shortly after the...

Read More »Socialism and Gold

Most people assume that the central bank prints money when it buys bonds. They further assume that this increase in the quantity of money causes an increase in the general price level. And, this leads them to assume that the value of the money is 1 / P (P is the general price level). Therefore, when the central bank prints money to buy bonds, it is diluting the value of the money held by everyone—in proportion to the amount printed divided by the total amount in...

Read More »Red Bull profits from Swiss sugar subsidies

Red Bull buys about 25% of the sugar produced in Switzerland, resulting in reported savings for the company of up to CHF10 million (© Keystone / Christian Beutler) The makers of sweet products benefit from the federal subsidies paid to sugar beet farmers in Switzerland. The price of sugar in Switzerland has been on the decline for years. As a result, 400 farmers have quit producing it in recent years. Sugar beet producers receive annual subsidies amounting to CHF36...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org