© Ocskay Mark | Dreamstime.com Every three months the rate of interest used to benchmark Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time the reference rate fell from 1.50% to 1.25%. The last time it dropped was 2 June 2017 when it fell to 1.5%. The rate is based on the average Swiss mortgage rate over three months. This rate is then rounded to the nearest 0.25%. On 31 December 2019 that rate was 1.37%,...

Read More »SNB Profit in 2019: 48.9 billion (2018: loss of CHF 14.9 billion, 2020 Does not Look Good)

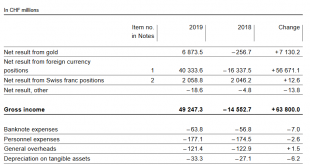

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »USD/CHF Price Analysis: 17-week-old falling trendline, 61.8 percent Fibonacci on bears’ radar

USD/CHF remains on the back foot near the multi-week low. Bearish MACD signals further downside, key support question the sellers. 200-week SMA acts as the key upside barrier. Despite bouncing off September 2018 lows, USD/CHF stays 0.11% down while trading around 0.9640 during early Monday. Also portraying the pair’s weakness are bearish conditions of MACD. That said, a downward sloping trend line since early October 2019, at 0.9600 now, acts as the immediate...

Read More »Drivers for the Week Ahead

The dollar has softened as Fed easing expectations have picked up Late Friday, Chair Powell issued an unscheduled statement saying the Fed is monitoring the virus and will act as appropriate This is a big data week for the US; the Fed releases its Beige Book report Wednesday Super Tuesday comes this week; Bank of Canada meets Wednesday Final eurozone and UK February PMI readings will be reported this week Reserve Bank of Australia meets Tuesday; BOJ Governor Kuroda...

Read More »Swiss price watchdog calls for reduction in train ticket prices

The price watchdog wants to see a 2% reduction in ticket prices once track fees for rail companies drop starting next year. (© Keystone / Walter Bieri) With track fees for rail companies set to drop, savings should be passed on to customers, Stefan Meierhans told the weekly NZZ am Sonntag. The call comes on the heels of revelations that two state-owned rail firms wrongly claimed millions in subsidies. Switzerland’s official price watchdog said that prices for train...

Read More »The Limits of Force: A Bayonet in the Back Will Not Restore China’s Economy

Force cannot restore legitimacy, trust or confidence, nor can it magically erase the consequences of a still-unfolding national trauma. The Chinese authorities threatening to punish workers who refuse to return to work are getting a lesson in the limits of force in an unprecedented national trauma: a bayonet in the back will not restore the legitimacy and confidence that have been lost. There are two enormous blind spots in conventional media coverage of the...

Read More »Mises: To Adopt Keynesian Terminology Is to Legitimize It

Some years ago, there was published a book in the German language with the title L.T.I. These three letters stood for three Latin words, lingua Tertii Imperii, the language of the Third Reich. And the author, a former professor of Romance languages at one of the German universities, described in this book his adventures during the Nazi regime. And his thesis was that all people, without any exception, in Germany of course, were Nazis—not because they had accepted...

Read More »Transport operators told to pay back millions in state subsidies

BLS must pay back CHF43.6 million is wrongly claimed state subsidies. (© Keystone / Christian Beutler) Two more Swiss state-owned transport companies have been ordered to pay back more than CHF50 million ($51 million) in wrongly claimed subsidies. The authorities are also looking into the possibility of criminal prosecutions in connection with the worsening subsidies scandal. Government auditors have targeted Swiss Federal Railways and a transport operator in canton...

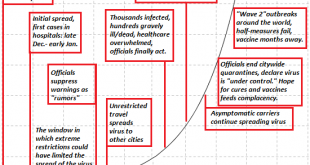

Read More »Could the Covid-19 Pandemic Collapse the U.S. Healthcare System?

Disregard these second-order effects at your own peril. A great many systems that are assumed to be robust are actually fragile. Exhibit #1 is the global financial system, of course, but Exhibit #2 may well be the healthcare system globally and in the U.S. Observers have noted that the number of available beds in U.S. hospitals is modest compared to the potential demands of a pandemic, and others have wondered who will pay the astronomical bills that will be...

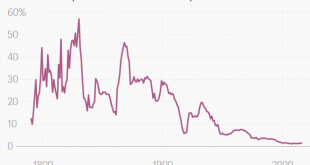

Read More »The US’s “Free Trade” Isn’t Very Free

The false notion that the US has eliminated virtually all of its barriers to foreign imports has been repeated more and more in recent years. The claim is made both by advocates for free trade and by critics of free trade. For instance, Patrick Buchanan has claimed only American elites “are beneficiaries to free trade” while implying the US either has free trade, or something close to it. Rather than insulate US companies from global competition, Buchanan insists,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org