The greater the excesses, speculative euphoria and moral hazard, the greater the reversal. A very convenient conviction is rising in the panicked financial netherworld that the Federal Reserve and its fellow dark lords will “save the market” from COVID-19 collapse. They won’t. I already explained why in The Fed Has Created a Monster Bubble It Can No Longer Control (February 16, 2020) but it bears repeating. Contrary to naive expectations, the Fed’s primary job isn’t inflating stock market and housing bubbles, though punters are forgiven for assuming that, given the Fed has inflated three gargantuan bubbles in a row, each of which burst (1999-2000, 2007-08 and now 2019-2020). The Fed’s real job is protecting the banking/financial sector from a richly deserved and

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The greater the excesses, speculative euphoria and moral hazard, the greater the reversal.

A very convenient conviction is rising in the panicked financial netherworld that the Federal Reserve and its fellow dark lords will “save the market” from COVID-19 collapse. They won’t. I already explained why in The Fed Has Created a Monster Bubble It Can No Longer Control (February 16, 2020) but it bears repeating.

Contrary to naive expectations, the Fed’s primary job isn’t inflating stock market and housing bubbles, though punters are forgiven for assuming that, given the Fed has inflated three gargantuan bubbles in a row, each of which burst (1999-2000, 2007-08 and now 2019-2020).

The Fed’s real job is protecting the banking/financial sector from a richly deserved and long overdue implosion. Blowing speculative asset bubbles is a two-fer, enabling rapacious, parasitic financiers and banks to profit from debt-serfs borrowing and gambling in rigged casinos (take your pick: student loan casino, housing casino, stock market casino, commodities casino, currency casino, etc.).

Blowing guaranteed-to-burst bubbles also generates a bogus PR cover, the Fed’s beloved “wealth effect,” an idiots’ delight belief that the greater the speculative bubble, the more tax donkeys and debt serfs will spend, spend, spend on defective junk and low-value services they don’t need–in essence, speeding up the global supply chain from China et al. to the local landfill, all in service of Corporate America profits.

The Fed’s secondary interest is maintaining some measure of control over the financial sector and the real-world economy it ruthlessly exploits. Just as the Fed gets panicky if interest rates start getting away from its control, the Fed also gets nervous when its speculative bubbles get away from it via infinite moral hazard:

When punters no longer care whether the Fed actually intervenes or not, so powerful is their faith in eventual Fed “saves,” the Fed has lost control and that’s not what the Fed wants.

The Covid-19 pandemic is a godsend to the world’s central bank, the Fed. Recall that the Fed has a dual mandate: protecting U.S. financiers and banks and global financiers and banks. The Fed thus has the equivalent of Triffin’s Paradox, the dual role of the U.S. dollar as a domestic currency and as a global reserve currency.

The two roles are not always compatible and conflicts may arise, requiring sacrifices to keep the entire overheated machine from coming apart.

To re-establish the essential linkage between punters’ speculative greed and its actual interventions, the Fed must let the current euphoric faith in its “guarantee” to rescue infinite greed crash to Earth. As noted earlier, the Fed lords are foolish but not stupid. They understand speculative bubbles always pop, and so the Covid-19 pandemic is just the excuse they needed to let the air out of the current grossly unsustainable bubble.

“Buy-the-dip” punters are placing bets on the belief the Fed can’t possibly let the current bubble pop. Oh yes they can and yes they will. All bubbles pop. That leaves the Fed with an unsavory choice: either be viewed as responsible for the bubble bursting or engineer some fall-guy to take the blame and give the Fed cover for its self-serving incompetence.

It’s also instructive to note, as many have, that the Fed enters this global recession with very little policy ammo. Interest rates are so near zero already that a couple of rate cuts will do very little good in the real economy. As for buying Treasury bonds, this is also overblown; at the rate U.S. Treasury debt is rising, all the Fed will be doing is sopping up fiscal-deficit debt nobody else wants.

|

For all the brave bleatings of Fed luminaries about negative-interest rates being the “cure” to all that ails the precarious global economy, Japan and Europe have effectively proven that negative interest rates only further cripple the banking sector while doing essentially nothing to boost spending in the landfill economy. All negative-interest rates accomplished was further boosting speculative bubbles and wealth inequality, which threatens to destabilize the social order–something the Fed cannot control. Panicky punters expect the Fed to blow its wad on saving their hides, but what would that leave the Fed for the real recession that’s just getting underway? Nothing. Would the Fed lords be so short-sighted and stupid to blow their last ammo just to save speculatively-insane punters from the inevitable bursting of a moral hazard-driven bubble? In a word, no. |

The Rising Wedge Model of Breakdown - Click to enlarge |

| As I suggested last week, When Bubbles Pop, Only the First Sellers Escape Being Bagholders (February 21, 2020). There is a great deal of recent history on how bubbles arise and burst that’s worth studying. The Covid-19 pandemic promises to be much more consequential than the run-of-the-mill financial excesses of the past 20 years, but we already know one important thing: All bubbles pop.

We also know this: the greater the excesses, speculative euphoria and moral hazard, the greater the reversal. |

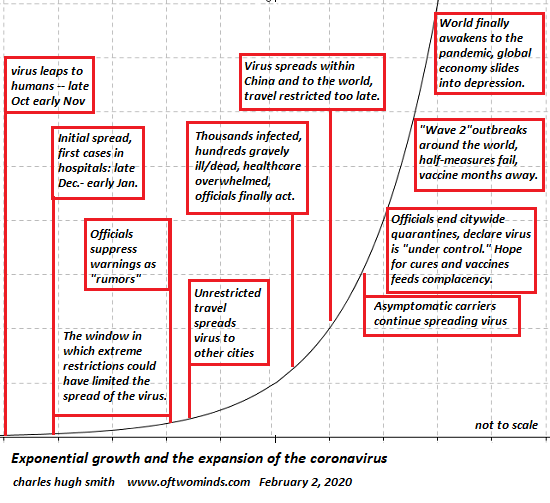

Exponential growth and the expansion of the coronavirus |

Tags: Featured,newsletter